HOW TO TRADE WITH TrendDECODER AND TrendDECODER SCREENER?

But first things first: WHY trading with TrendDECODER?

Well, every trader has faced this situation: being too early or too late entering the Trend or worse getting stuck in a Range.

The reason? Because all the Trend indicators that you can find LAG A LOT!

Well this is the core-concept of TrendDecoder:

- identify the moments when the price is not trending!

- Innovate to create « the fastest indicator to detect trends and price ranges »

- Make it universal for all assets

What is it about and how to trade with TrendDECODER?

The TrendDecoder is a concentrate of multiple innovations to make Trend following simple and easy and here is how to trade thanks to them.

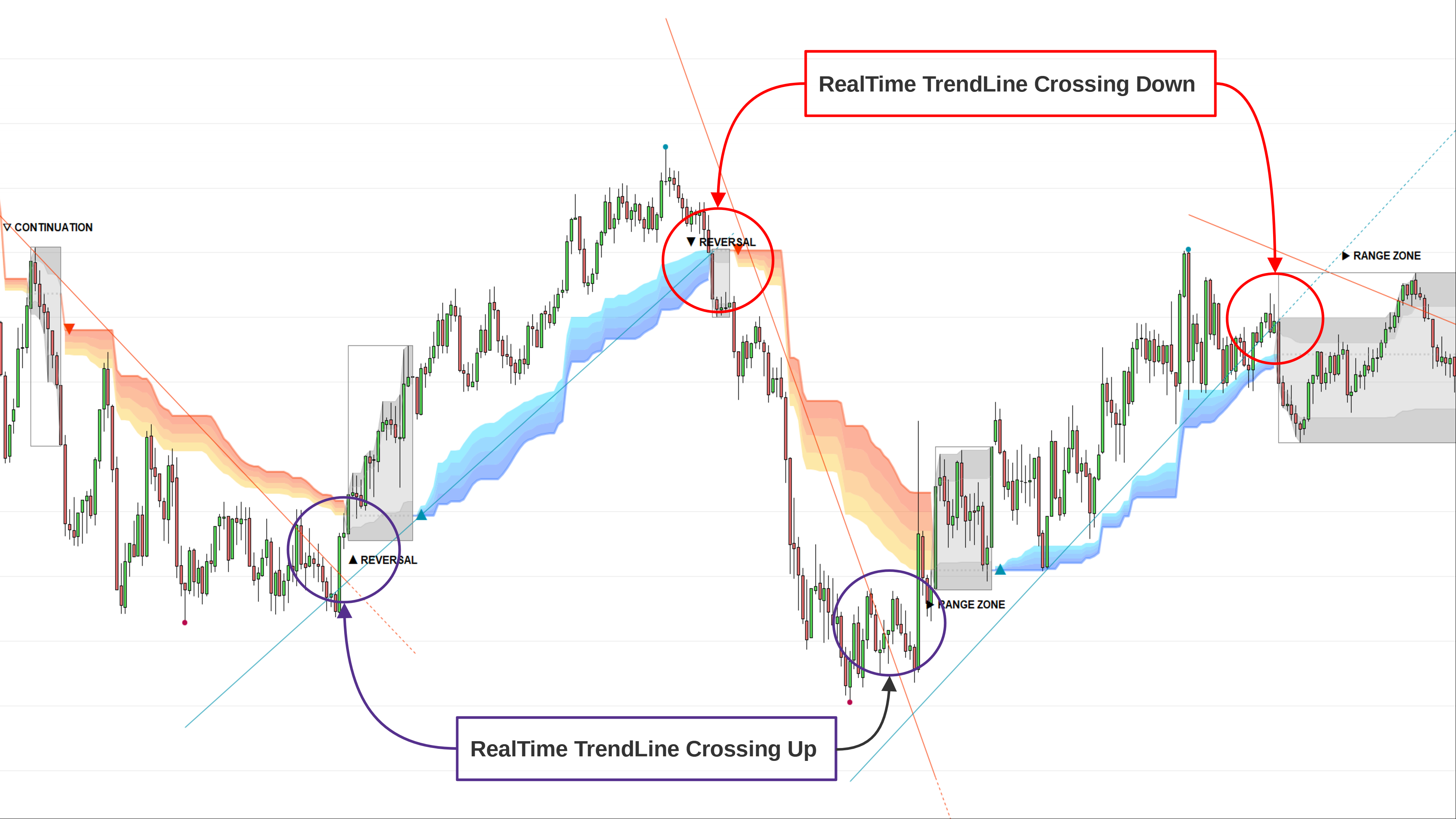

Strategy #1: « TrendLinesCrossing » – Early Trend Following

- With the Projective TrendLine© – you see before it happens the direction and the possible angle of the Trend with its probable range.

- With the RealTime TrendLine© vs the Projective TrendLine© – you can adjust immidiately if the market accelerates North or South.

- With the RealTime TrendLine Crossing© – you can detect at the earliest the moment the Trend gets out of track, to get in or out of the train. And this is where our first strategy can take place.

Strategy #1: Check List

- Set a Multi Time Frame environment

- Check that the Main Time Frame is aligned with the Upper Time Frame

- Entry:

- Main Time Frame: wait for a clear crossing over (future TrendUp) or under (future TrendDown) of the RealTime TrendLine

- Main Time Frame: wait for the opening of the GreyBox

- Lower Time Frame: place your entry when a « TrendUp Signal » / « TrendDown Signal » has appearerd

- First Stop Loss: place your SL under the last Low

- Trailing Stop:

- Option 1 (automatic): make your Stop Loss trail with for instance twice the ATR (Average True Range)

- Option 2 (manual): move your SL just under the lowest border of the Blue Cloud (TrendUp) or the highest border of the Red Cloud (TrendDown)

- Exits:

- Option 1 (late exit): let your Trailing Stop exit your trade

- Option 2 (early exit): exit when the price crosses over or under the RealTime TrendLine

- Entry:

Here is an example of such a strategy:

Strategy #2: « Trend Following »

- With the DecoderSignals© & Blue/Orange Clouds© – once the GreyBox has delivered its message, get the new direction of the Trend and see the probable zones of pull backs during the current direction.

Strategy #2: Checklist

- Set a Multi Time Frame environment

- Check that the Main Time Frame is aligned with the Upper Time Frame

- Main Time Frame:

- wait for the closing of the GreyBox and check its verdict, either « Range », « Continuation » or « Reversal »

- check the appearance of the « TrendUp Signal » or the « TrendDown Signal »

- Option 1: the previous GreyBox says « Range »

- Entry: buy « at Market » immediately at « TrendUp Signal » price

- Stop Loss: place your SL under the lower border of the GreyBox (for an expected TrendUp) or the higher border (for an expected TrendDown)

- Trailing Stop:

- Automatic: make your Stop Loss trail with twice the ATR (Average True Range) above or under the price

- Manual: move your SL just under the lowest border of the Blue Cloud (TrendUp) or the highest border of the Red Cloud (TrendDown)

- Option 2: the previous GreyBox says « Reversal »

- Entry: wait for the price to pull back near the Blue Cloud (TrendUp) or reverse up near the Red Cloud (TrendDown)

- Stop Loss: place your SL under the lower border of the previous GreyBox (for an expected TrendUp) or the higher border (for an expected TrendDown)

- Trailing Stop:

-

- Option 1 (automatic): make your Stop Loss trail with twice the ATR (Average True Range) above or under the price

- Option 2 (manual): move your SL just under the lowest border of the Blue Cloud (TrendUp) or the highest border of the Red Cloud (TrendDown)

-

- Option 3: the previous GreyBox « Continuation » = you try to catch the current Trend

- Entry: buy at the perfect timing when the Stochastic in the Grey Box is in “oversold” zone / sell when it is in “overbought”

- Stop Loss: place your SL under the lower border of the previous GreyBox (for an expected TrendUp) or the higher border (for an expected TrendDown)

- Trailing Stop:

- Option 1 (automatic): make your Stop Loss trail with for instance twice the ATR (Average True Range) above or under the price

- Option 2 (manual): move your SL just under the lowest border of the Blue Cloud (TrendUp) or the highest border of the Red Cloud (TrendDown)

- Exits:

- Automatic: let the Trailing Stop exit your position

- Manual: exit once the price crosses under the lower Blue Cloud border (to end a TrendUp move) or once the once the price crosses above the higher Red Cloud border (to end a TrendDown move)

Strategy #3: « Range Trading »

- With the GreyBox© – you can identify when the market gets out of the Trend with a new sequence of transition.Check if the market is in Range, Continuation or Reversal (Up or Down) and wait for the closing of the box to get the Trend signal.

Strategy #3: « Check List »

- Set a Multi Time Frame environment

- Entry:

- Main Time Frame: wait for the opening of the GreyBox

- Buy at the perfect timing when the Stochastic in the Grey Box is in “oversold” zone / sell when it is in “overbought”

- Lower Time Frame: place your entry when a « TrendUp Signal » / « TrendDown Signal » has appeared

- First Stop Loss: place your SL under the lower border of the GreyBox (for an expected TrendUp) or higher border (for an expected TrendDown)

- Exits / Take Profit:

- sell at the perfect timing when the Stochastic in the Grey Box is in “overbought” zone / exit short when it is in “oversold”

Check our TrendDecoder – Lifetime license to meet your needs.

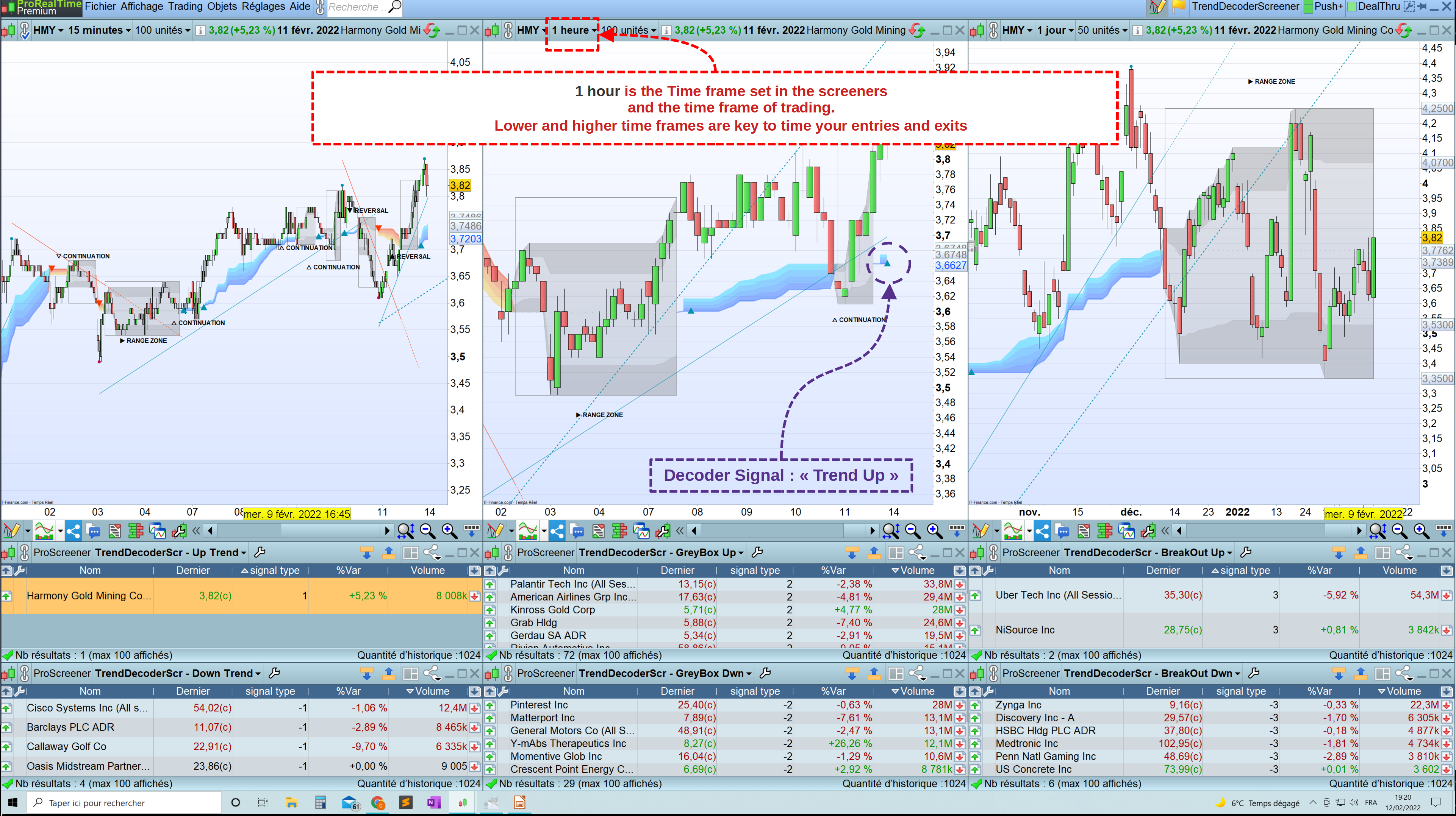

You can also trade with TrendDECODER Screener

Check also the TrendDecoder Screener to select the best assets in the exact configuration you want to trade: New bullish/bearish Trend, Breakout of a bullish/bearish RealTime TrendLine, GreyBox appearence during a bullish/bearish Trend.

This is a very good way to trade by selecting the assets in the proper configuration you want to trade.

This is an exemple of how you can configure your screener to see extensively all the opportunities the market offers depending on the moment the differents assets are.

TrendDECODER – Lifetime license > > > > > > > > > 🥇 N°1 Best-Reviewed