From the same developer who brought you the High Probability Reversal Strat one of the very first and most popular automated strategies of the ProRealCode marketplace launched back in May 2021, FXAutomate is pleased to announce their latest product called Linear Reversion Trader (see below)

This strategy is based on a statistical advantage achieved through a combination of both mean reversion and linear regression. Mean reversion in financial terms assumes that price will tend to converge to an average price over time. Using mean reversion as a timing strategy involves both the identification of the trading range as well as the computation of the average price using quantitative methods. Linear regression on the other hand is one of the most basic and commonly used methods for predictive analysis. Together these methods provide a great statistical tool for identifying high probability mean reversion opportunities.

It was specifically developed with the idea of keeping things as simple and uncomplicated as possible. For this reason it features only 2 primary variable inputs which dictate the start of the trading hours and the maximum allowed loss. Further than this it has 2 secondary variable inputs that can be adjusted to suit a whole range of different instruments and markets. The strategy is also very suitable for clients looking for a lower risk strategy that can be traded with as little as 1000 euros.

In preparation for the public launch of the strategy the same strategy has been running in parallel on both the AUDUSD and AUDCHF markets since the 8th of April.

The advantages provided by the live testing period is that not only could the initial back tested results and edge of the strategy be tested in a Live environment but this also provided a better idea of the true spread involved. As an example adjusting the back test date to match the period for which the strategy was run live, it was possible to conclude that the true average spread on the AUDUSD market was in fact 2 points compared to the IG quoted value of 0.6. This ‘true’ average spread could then be used to run a more accurate back test for the strategy to see how it would have performed under more realistic conditions in the past. The back test attached to the gallery is therefore based on this ‘true spread’ and validates the robust nature of the strategy.

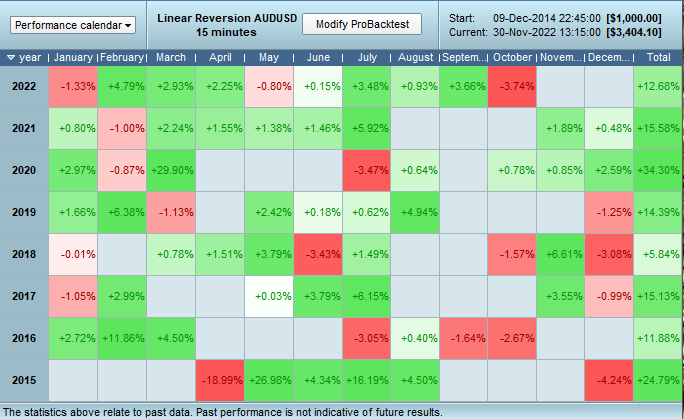

According to the performance calendar we see positive results each year for the past 8 years with an expected average annual return of 16.8%, this result is also achieved by maintaining a high winning rate of ~70% and a gain to loss ratio of 1.46. Other noteworthy aspects are that the average gain is 58% bigger than the average loss. And the largest win is 35% bigger than the worst loss.

In celebration of the launch the developer is currently running a promotion on the strategy valid until next week Sunday the 11th of December 2022.

For more info please visit the developers product page: Linear Reversion Trader