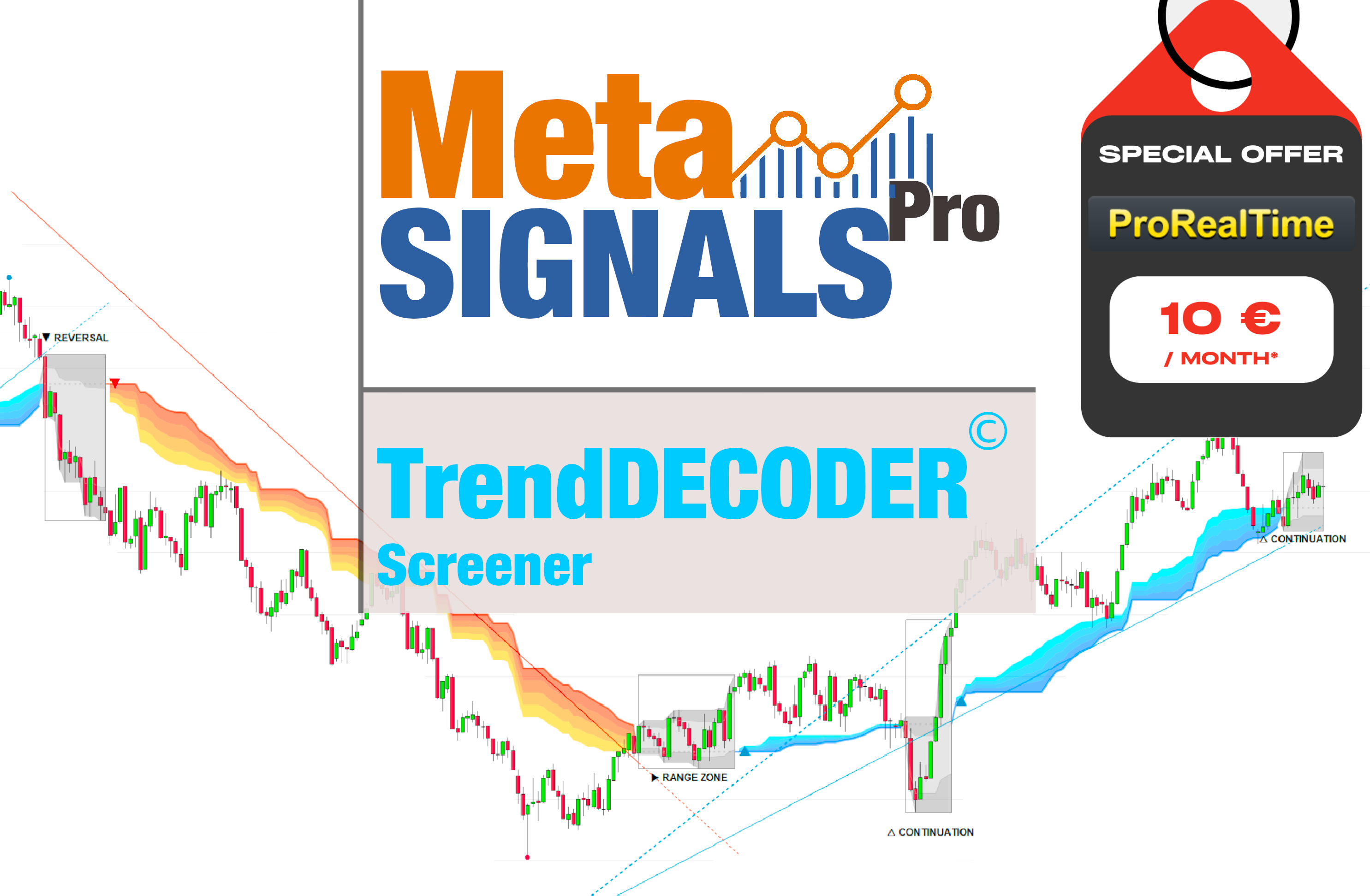

What you will get after set-up?

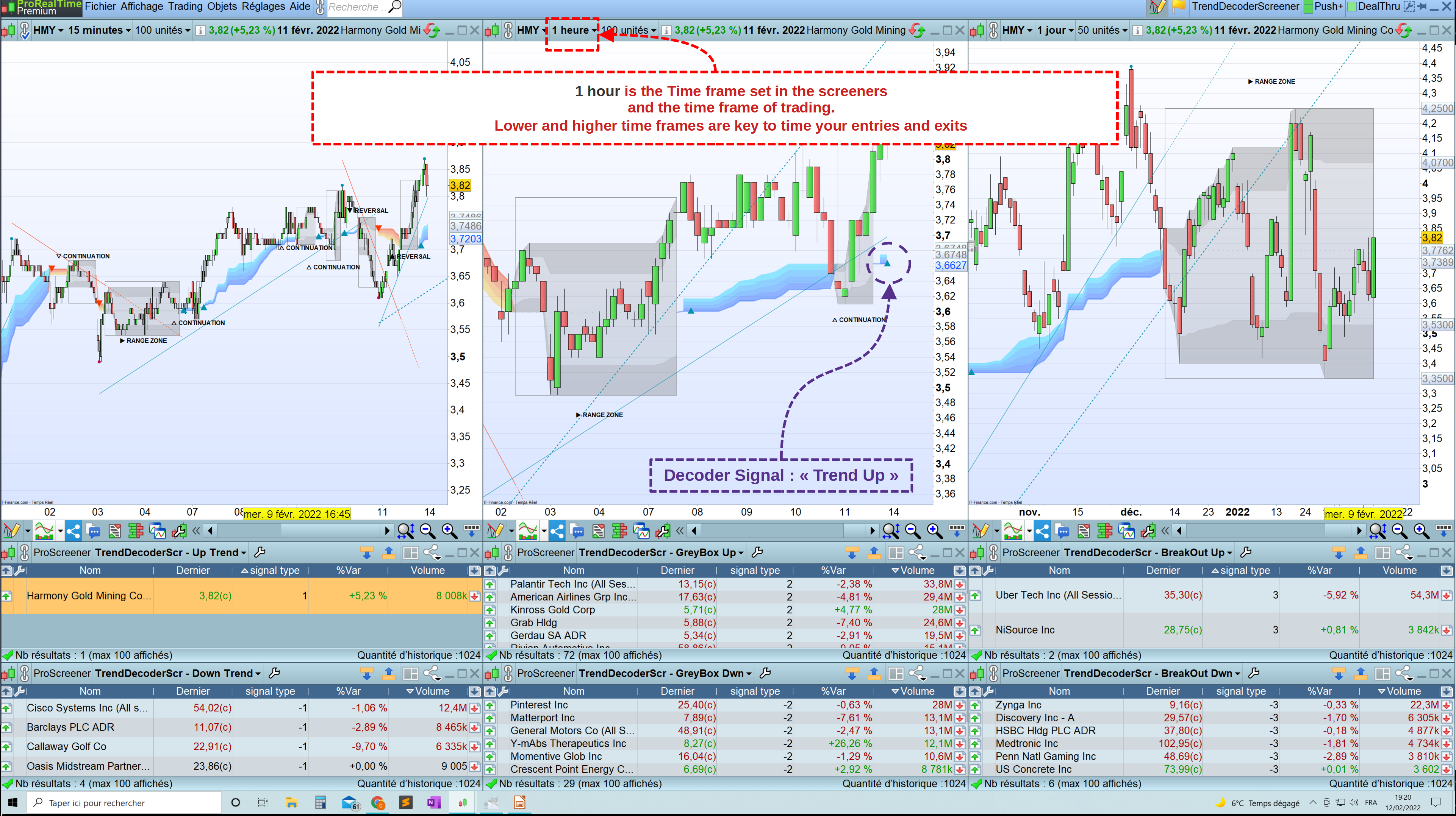

This is an exemple of how you can configure your screener to see extensively all the opportunities the market offers depending on the moment the differents assets are.

Please note that you need to have Prorealtime Premium to have multiple screeners in the same work space.

If you have the Prorealtime Complete version you will need to save as many workspaces as TrendDECODER screeners as you want.

What is it about ?

The TrendDECODER is a concentrate of multiple innovations to make Trend following simple and easy. We have decoded the specific moves behind its multiple configurations.

- With the Projective TrendLine© – see before it happens the direction and the possible angle of the Trend with its probable range.

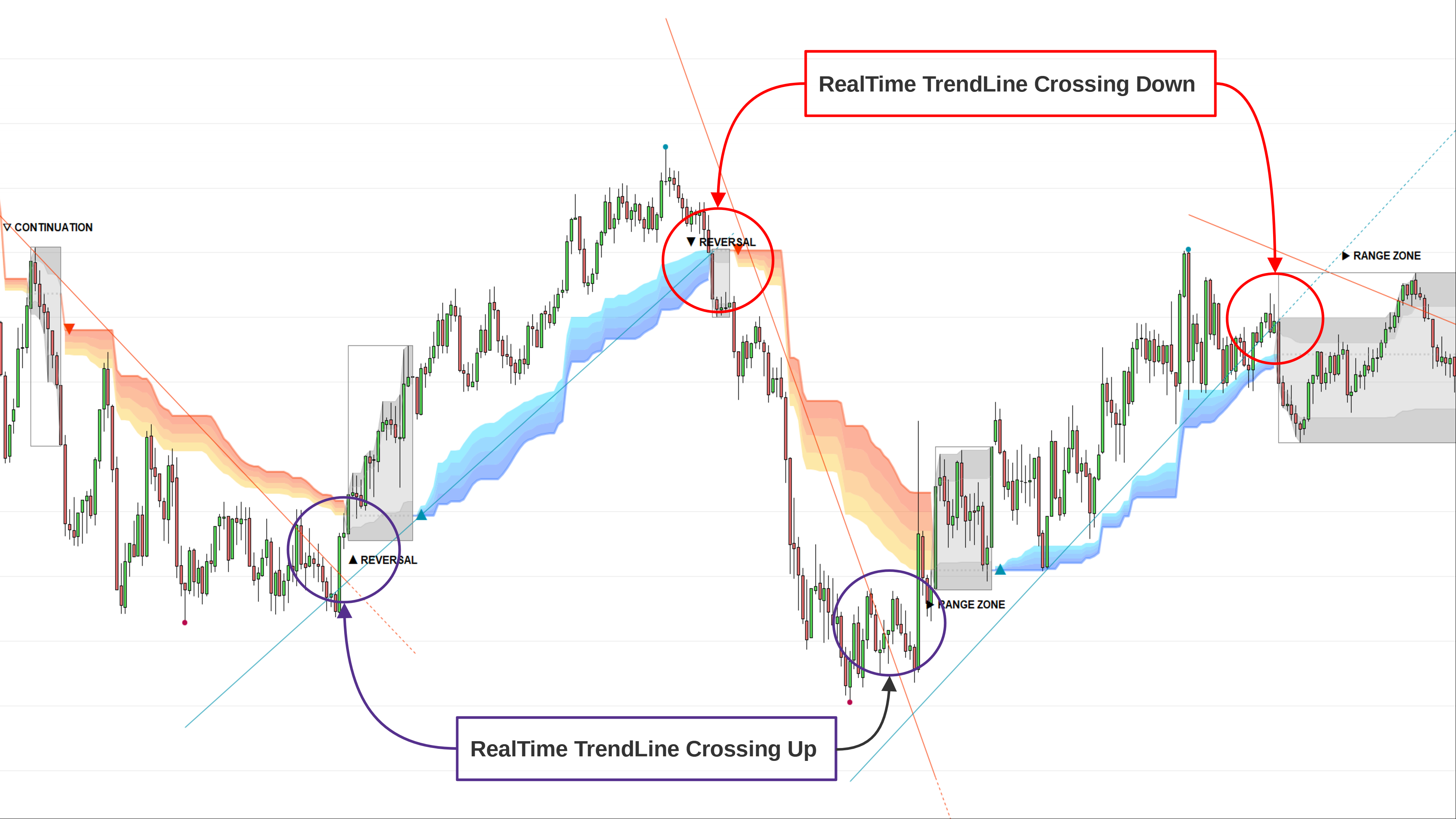

- With the RealTime TrendLine© vs the Projective TrendLine© – adjust immediately if the market accelerates North or South.

- With the RealTime TrendLine Crossing© – detect at the earliest the moment the Trend gets out of track, to get out of the train.

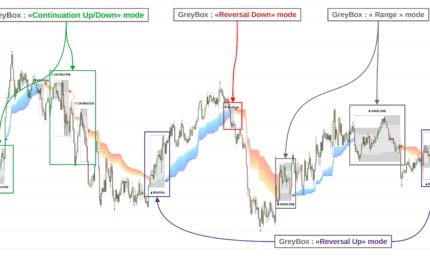

- With the GreyBox© – identify when the market gets out of the Trend with a new sequence of transition. Check if the market is in Range, Continuation or Reversal (Up or Down) and wait for the closing of the box to get the Trend signal.

- With the DecoderSignals© & Blue/Orange Clouds© – once the GreyBox has delivered its message, get the new direction of the Trend and see the probable zones of pull backs during the current direction.

Upgrade #3: Now including Fibonnaci Levels

- With the FiboLevels© – spot immediately which price levels the market will test.

For which asset?

TrendDECODER and its Screener are universal and work fine on all assets and all time-frames;

though, always work on a multi-timeframe environment to minimize risk;

Why we made these innovations?

Because the Trend indicators that we have found on the market lag a lot and do not clearly identify a trading reality: most of the time the price is not trending!

So you need to identify these moments, either to trade them accordingly in a “Range trading” strategy or to avoid them in order to be ready to jump in the train when this transitional sequence is finished.

Anyway we need much more powerful tools than Supertrend or a couple of moving averages crossings to get this done.

This is the core-concept of TrendDECODER.

How does it work and how to trade with TrendDECODER?

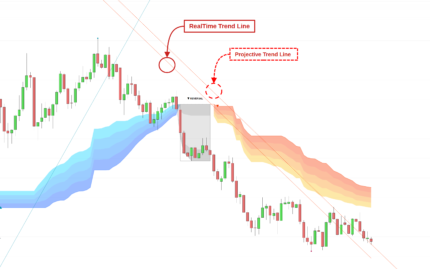

Projective TrendLine©

- As soon as a new high or a new low has been reached during the last move, the TrendDECODER traces a possible angle of the future movement based on the pace of the last one in the same direction.

- The distance between the Projective TrendLine and the Last Lowest (resp. Highest) gives you a possible bottom (resp. top) of the price range.

RealTime TrendLine©

- As soon as the Decoder GreyBox© has delivered its information i.e Range/Continuation/ReversalUp/ReversalDown and that a New High (resp. New Low) has been reached, the RealTime TrendLine© starts to show the pace and the angle of the new movement.

- The angles of the Projective and the RealTime TrendLine can be identical, telling you that the market moves smoothly in a global consensus. It can be a smart Trailing Stop Loss.

- Or these angles can be very different and it will call your maximum attention. You might want to switch to a superior timeframe to get the bigger picture.

FiboLevels©

- Once a new Trend is signaled, the levels of Fibonnaci are automatically placed

- They are calculated on the last Highest and Lowest of the former movement

—————————————————————————————————

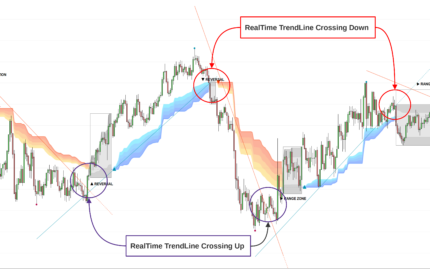

Strategy #1: Early Trend following : RealTime TrendLine Crossing©

- With this simple tool, get a very early signal of a probable inversion of the current Trend, way before the Decoder Signal is shown, once confirmed by the GreyBox.

Strategy #1: Early Trend following – Checklist

- Set a Multi Time Frame environment

- Check that the Main Time Frame and the Upper Time Frame are moving in the same direction (Up or Down)

- Entry:

- Main Time Frame: wait for the opening of the GreyBox

- Lower Time Frame: place your entry when a « TrendUp Signal » / « TrendDown Signal » has appeared

- First Stop Loss:

- Main Time Frame: place your SL under the lowerborder of the GreyBox

- Trailing Stop:

- Move your SL just under the lowest border of the Blue Cloud (TrendUp) or the highest border of the Orange Cloud (TrendDown)

- TakeProfits

- In a TrendUP, place your take profits just under the FibosLevels in order not to get exited (and above in a TrendDOWN)

Check our TradeMANAGER for Swing Traders and TradeMANAGER for Day Traders to automate and secure your trades: SL, BreakEven, TP1/TP2/TP3, Trailing and partial close.

—————————————————————————————————

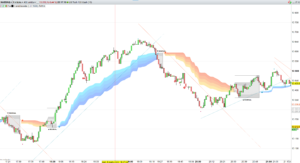

Strategy #2: Trend Following : DecoderSignals© & Blue/Orange Clouds© >>

- This is the moment we have been waiting for. The GreyBox has given the next probable movement and the Trend in on. The RealTime TrendLine guides us on the pace of this movement and the Blue/Orange Cloud figures the support/resistance of this movement.

- It will be wise not to jump immediately in the Trend as the signal appears as the price will very probably make a pullback in direction of the cloud first.

- The Blue/Orange Clouds are a proprietary synthesis of Price Action and Volume Exchange in real time.

Strategy #2: Trend Following – Checklist

- Set a Multi Time Frame environment

- Check that the Main Time Frame and the Upper Time Frame are moving in the same direction (Up or Down)

- Main Time Frame:

- check the appearance of the « TrendUp Signal » or the « TrendDown Signal »

- Entry:

- buying « at Market » immediately at « TrendUp Signal » is quite risky as many times the price will pull back near the Blue Cloud (TrendUp) or reverse up near the Orange Cloud (TrendDown)

- a good option is to buy 1/2 the position at market on signal and 1/2 after the pull back

- First Stop Loss: place your SL under the lower border of the GreyBox (for an expected TrendUp) or the higher border (for an expected TrendDown)

- Trailing Stop: just under the lowest border of the Blue Cloud (TrendUp) or the highest border of the Orange Cloud (TrendDown)

- TakeProfits : in a TrendUP, place your take profits just under the FibosLevels in order not to get exited (and above in a TrendDOWN)

Check our TradeMANAGER for Swing Traders and TradeMANAGER for Day Traders to automate and secure your trades: SL, BreakEven, TP1/TP2/TP3, Trailing and partial close.

Here is an example of such a strategy with a TrailingStop:

—————————————————————————————————

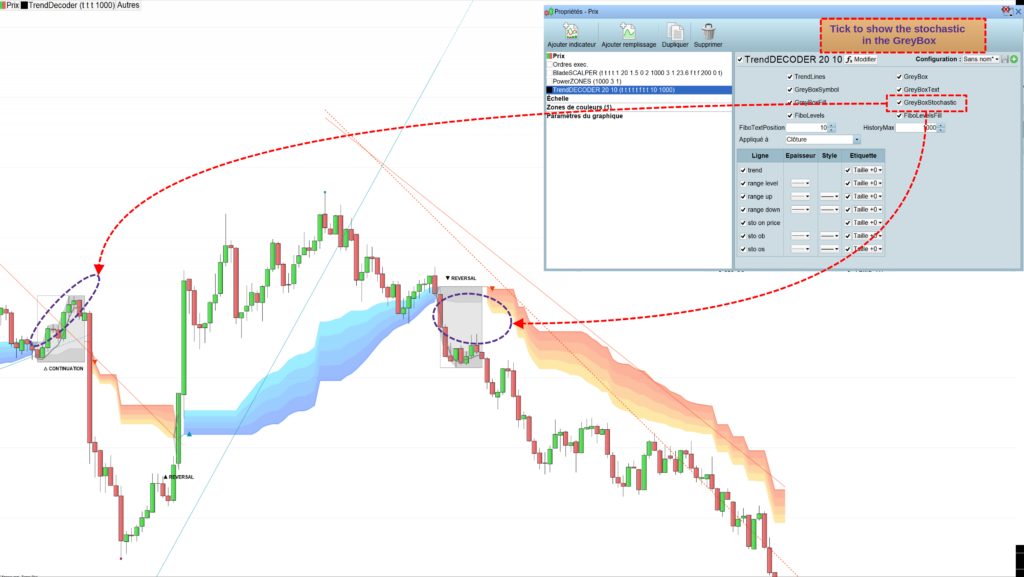

Strategy #3: Range Trading : GreyBox©

- The GreyBox concept is based on a proprietary stochastic algorithm. It enables TrendDECODER to detect the next probable price movement once the box is “closed”, establishing a new signal.

- Be patient enough to let the box give its verdict! Or trade it accordingly in a Range Trading strategy!

Strategy #3: Range Trading – Check List

- Set a Multi Time Frame environment

- Entry:

- Main Time Frame: buy when the Stochastic in the Grey Box is in “oversold” zone / sell when it is in “overbought”

- For better entries place your entry when a « TrendUp Signal » / « TrendDown Signal » has appeared on Lower Time Frame

- First Stop Loss: place your SL under the lower border of the GreyBox (for an expected TrendUp) or higher border (for an expected TrendDown)

- Exits / Take Profit:

- sell at the perfect timing when the Stochastic in the Grey Box is in “overbought” zone / exit short when it is in “oversold”

Check our TradeMANAGER for Swing Traders and TradeMANAGER for Day Traders to automate and secure your trades: SL, BreakEven, TP1/TP2/TP3, Trailing and partial close.

—————————————————————————————————

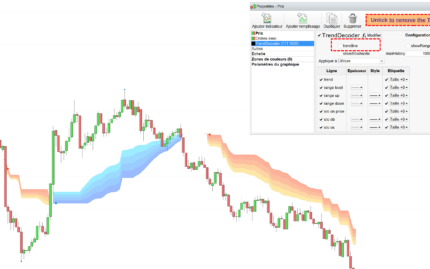

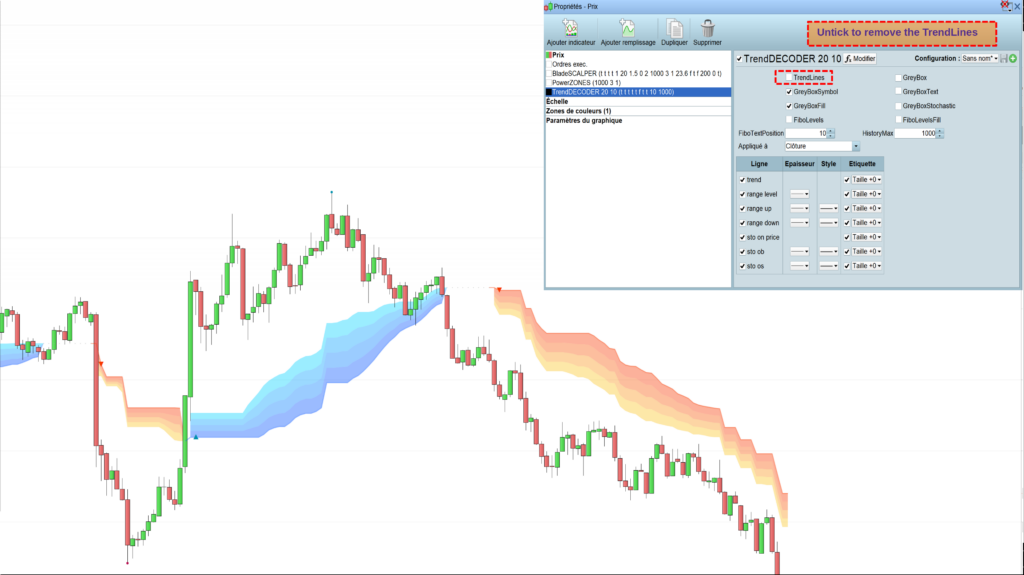

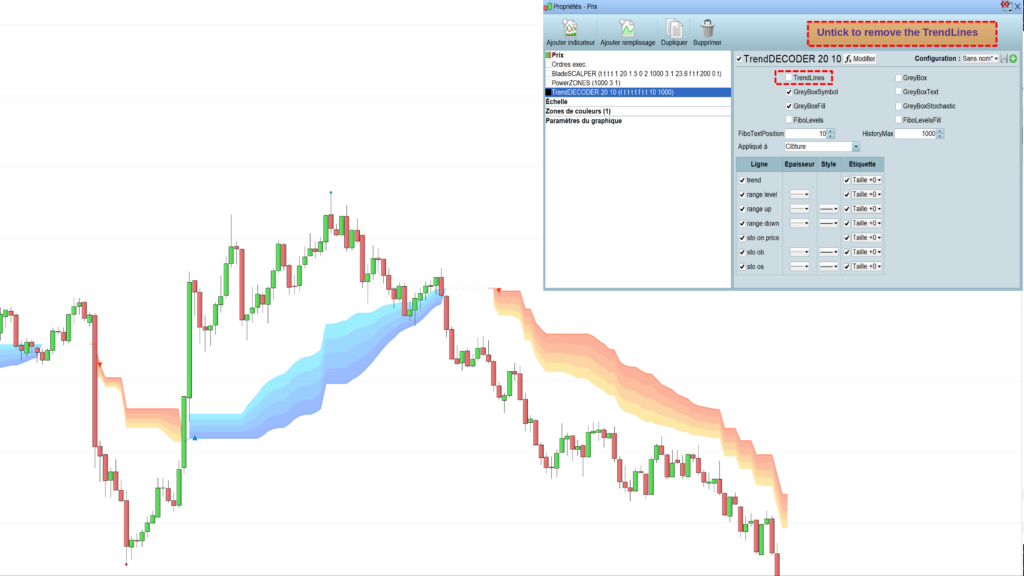

Configuration

Well, basically you do not have to do anything !

But here are some adjustments you can take to make TrendDECODER perfectly yours:

Configuration TrendDECODER Screener

———————————————————————

🔔 Want FREE SIGNALS with our tools? 🎁

👉 join our Telegram group here

Patrick Skalitzky (verified owner) –

The indicators provided by MetaSignals Pro are incredibly helpful for identifying resistance and support levels, which are automatically drawn on the chart. They are also excellent for trend recognition, especially when using multiple charts with different time frames, allowing for quick identification of overarching trends.

I have closed several positions based on these indicators because the overarching trend did not align. Four out of five times, this decision proved to be correct.

I would like to highlight the excellent customer service provided by Chris, who took a significant amount of time during a video call to explain everything to me.

Unfortunately, automated trading does not work with Interactive Brokers, so I cannot evaluate this feature. Overall, I would like to give a clear recommendation to purchase MetaSignals Pro.

JEAN MARIE DETRIEUX (verified owner) –

indicateur genial! à ce jour que des trades gagnants !

Andreas Kuhn (verified owner) –

It is very helpfull to be on the right side of the market and you can also use it for SL´s . That helps my trading a lot and makes it much easier and successful!!

A perfect tool and the best I buyed for trading!!

Thanks a lot for this work and the very nice price for this.

JUAN JESUS MONTOYA RAMOS (verified owner) –

Very happy with the great product. It has improved my day to day trading and I am getting very good returns. I recommend it 100%. The salesman helped me with several problems. I am very grateful.

pintris (verified owner) –

Great product. Did already boost my success rate and I just started to get used to it. Great support. Something did not work with V12 or prorealtime but this was fixed by the dev in 1 day. Thanks again!

Grégory MARTIN (verified owner) –

TrendDecoder is a good trading assistant. Work zones, supports and resistances are quickly identified. It has a good visual and the ability to modify variables. Everything is explained in the pre-purchase description, which is very realistic. TrendDecoder and BladeScalper work well together to optimize gains and increase profitability, thus helping you to consolidate your strategy. I recommend this product. What’s more, the PRT team and the developer were quick to answer any questions I had.

carlo.155 (verified owner) –

If you use the indicator this Proscreener is critical to give timely entry imputs. You can’t set it to backward candles/signals (2 or 3 periods I mean) like other PRT11 Proscreener so on short timeframes, 5 or 15min for example, you have to stay alert in front of your pc. It is still a great help and I rate 5 well-deserved stars

Yaseen Abbas (verified owner) –

This is a very good screener to have in your trading it finds trading setups for you without you looking for trading assets to trade. Huge time saver so guys get this Screener and let the system to do the work for you.

douguedroit.serge (verified owner) –

very good indicator which helps to position oneself on the right side of the trend.

fredrik.dahlander (verified owner) –

Excellent complement to find the next trade.

chriskelley123 (verified owner) –

Very happy, indicator and screener work well. Effective in MTF as described. Keeps the emotions in check. Vendor very helpful and quick to respond to questions. Brought the blade scalper screener also & now considering the trade manager. Would recommend

garyoaten (verified owner) –

This helps keep you on the right side of the trend, and that alone will help with the win rate. Use this with MTF analysis and you will see improvements. Plus the vendor is very happy to help where needed and has made slight tweaks when asked. Very good all round and I would recommend this product.