Introducing the Ultimate Investment Analysis Bundle: From Broad Market Trends to Detailed Pivot Points

Unlock a comprehensive approach to investment analysis with our expertly curated bundle, designed to guide you from broad market insights down to the most specific and actionable data points. This bundle brings together four powerful indicators that seamlessly integrate to provide a holistic view of market dynamics, ensuring you’re equipped to make informed and strategic decisions.

1. Institutional Levels Indicator:

Begin your analysis with a top-down approach by accessing precise and up-to-date data on the positioning of major institutional players, including CTAs and financial institutions, across key assets like stock market indexes, futures, commodities, and cryptocurrencies. This indicator divides institutional positioning into three strategic levels, offering you critical reference points to optimize your entry and exit strategies. With weekly updates and historical data, you can stay ahead of market movements, ensuring every decision is well-informed and strategically sound.

2. Pivot Zones Indicator:

Delve deeper into the market with our Pivot Zones Indicator, which pinpoints crucial price levels where an asset is likely to consolidate or reverse its trend. This tool highlights where institutional investors are taking significant positions, potentially altering the market’s direction. By identifying both major and minor pivot zones, and anticipating where new zones might form, this indicator provides you with a detailed map of potential market movements. The accompanying weekly videos and live sessions enhance your understanding, helping you apply these insights in real-time.

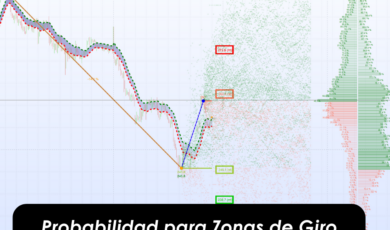

3. Trend Analysis with Pivot Zones:

As you narrow your focus, this advanced tool provides a visual representation of both past and future trends, analyzing primary and secondary market orders. It identifies critical turning points in the market, allowing you to anticipate potential shifts and align your strategies accordingly. The inclusion of probability scenarios and advanced statistics further refines your analysis, giving you a nuanced understanding of market dynamics and enhancing your decision-making process.

4. Gamma Levels Indicator:

For a final, detailed layer of analysis, the Gamma Levels Indicator offers a sophisticated look at market dynamics through the lens of options market activity, specifically for the S&P 500. By visualizing key gamma levels such as Call Wall, Put Wall, and Volatility Triggers, this tool provides crucial insights into potential support and resistance levels, as well as impending volatility. With daily updates and a historical view, this indicator is essential for timing your trades and understanding the deeper mechanics of market movements.

Why Choose This Bundle?

– Comprehensive Analysis: From broad institutional trends to specific pivot points and gamma levels, this bundle provides a full-spectrum analysis that covers all aspects of market behavior.

– Informed Decision-Making: Each indicator is designed to give you precise, actionable insights, helping you make well-founded investment decisions at every step.

– Continuous Learning: With ongoing updates, weekly videos, and live sessions, you’ll stay current with market trends and continuously refine your strategies.

– Seamless Integration: Each tool complements the others, creating a cohesive analytical framework that simplifies the complexity of market analysis.

Elevate your investment strategy with the Ultimate Investment Analysis Bundle—your comprehensive toolkit for mastering the markets from macro trends to micro pivots.

Avis

Il n’y a pas encore d’avis.