Linear Reversion Strategy

This strategy is based on a statistical advantage achieved through a combination of both mean reversion and linear regression. Mean reversion in financial terms assumes that price will tend to converge to an average price over time. Using mean reversion as a timing strategy involves both the identification of the trading range as well as the computation of the average price using quantitative methods. Linear regression on the other hand is one of the most basic and commonly used methods for predictive analysis. Together these methods provide a great statistical tool for identifying high probability mean reversion opportunities.

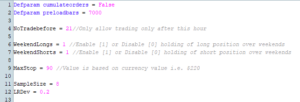

It has also specifically been developed with the idea of keeping things as simple and uncomplicated as possible. For this reason it features only 2 primary variable inputs which dictate the start of the trading hours and the maximum allowed loss. Further than this it has 2 secondary variable inputs that can be adjusted to suit a whole range of different instruments and markets.

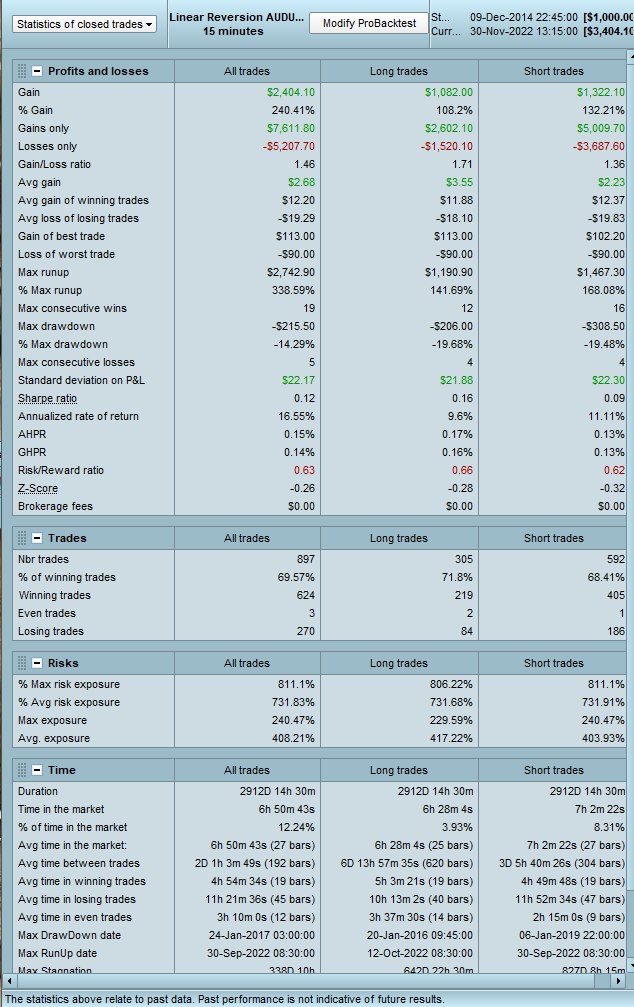

In preparation for the public launch of the strategy I have been running in it in parallel on both the AUDUSD and AUDCHF markets since the 8th of April (as can be seen in the screenshots from the gallery). The advantages this gave me is that not only could I verify the initial back tested results and edge of the strategy in a Live environment but also get a better idea of the true spread involved. As an example adjusting the back test date to match the period for which I ran the strategy live, I was able to conclude that the true average spread on the AUDUSD market was in fact 2 points compared to the IG quoted value of 0.6. I could then use this new spread to run a more accurate back test for the strategy to see how it would have performed under more realistic conditions in the past. The back test attached to the gallery is therefore based on this ‘true spread’ and validates the robust nature of the strategy.

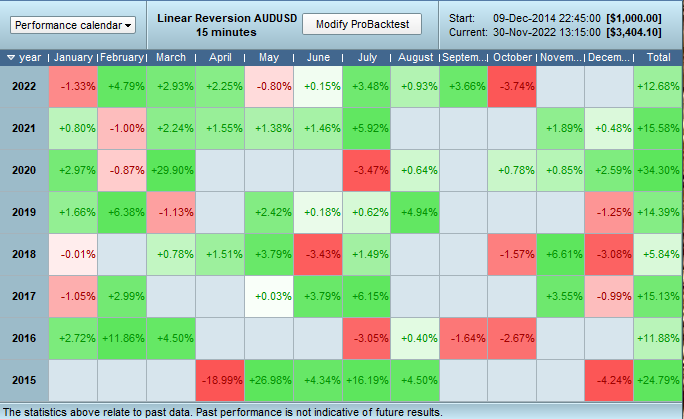

According to the performance calendar we see positive results each year for the past 8 years with an expected average annual return of 16.8%, this result is also achieved by maintaining a high winning rate of ~70% and a gain to loss ratio of 1.46. Other noteworthy aspects are that the average gain is 58% bigger than the average loss. And the largest win is 35% bigger than the worst loss.

Here is a screenshot from the actual love results for 2023 so far:

About Me:

I am a professional ProRealTime developer with 5+ years experience in creating and coding ProRealTime strategies.

You can view my PRC profile here: https://www.prorealcode.com/user/juanj/

Strategy Features:

- Once-off cost with no yearly fees!

- Built-in volatility filter will suspend trading if market conditions become unsuitable

- Variables are adjustable for adaptation to different markets

Requirements and Recommended Market:

- Account Type: IG Standard International Account

- Minimum Recommended Account Size: $1000 (Covers Margin and Risk)

- Market: AUDUSD mini (15-minute timeframe)

- Timezone: Configured for UTC +2 (contact vendor for assistance in configuring for your timezone)

Strategy Parameters:

The NoTradeBefore variable is used to dictate the start of the strategy’s trading hours. When used on AUDUSD this value must coincide to 21h00 (UTC +2)

Note that the default MaxStop value is based on a single AUDUSD mini contract and needs to be scaled accordingly for bigger contract sizes or different markets.

Pierre JOANNIN (client confirmé) –

Excellente stratégie. Elle est active en réel sur mon compte depuis le début, et je n’ai pas à m’en plaindre : l’achat du système a été largement remboursé.

A tel point que je suis passé à 2 contrats, tant le R/R semble bien maitrisé.

Attention cependant : le stop de sécurité est assez lointain, ce qui pourrait occasionner (mais ça n’a encore jamais été le cas) une perte assez importante.

Un aperçu de l’exécution du système en réel sur mon compte :

Paire : AUD/USD Mini

Gain : EUR572.22

Nombre positions prises : 37

Positions gagnantes : 32

Taux de réussite : 86%

Gain moyen : EUR23.65

Perte moyenne : EUR-36.92

Ratio gain/perte : 0.64:1

Rentabilité : 1.42

Bref, je recommande les yeux fermés ! (même si le passé n’augure pas du futur évidemment :o)