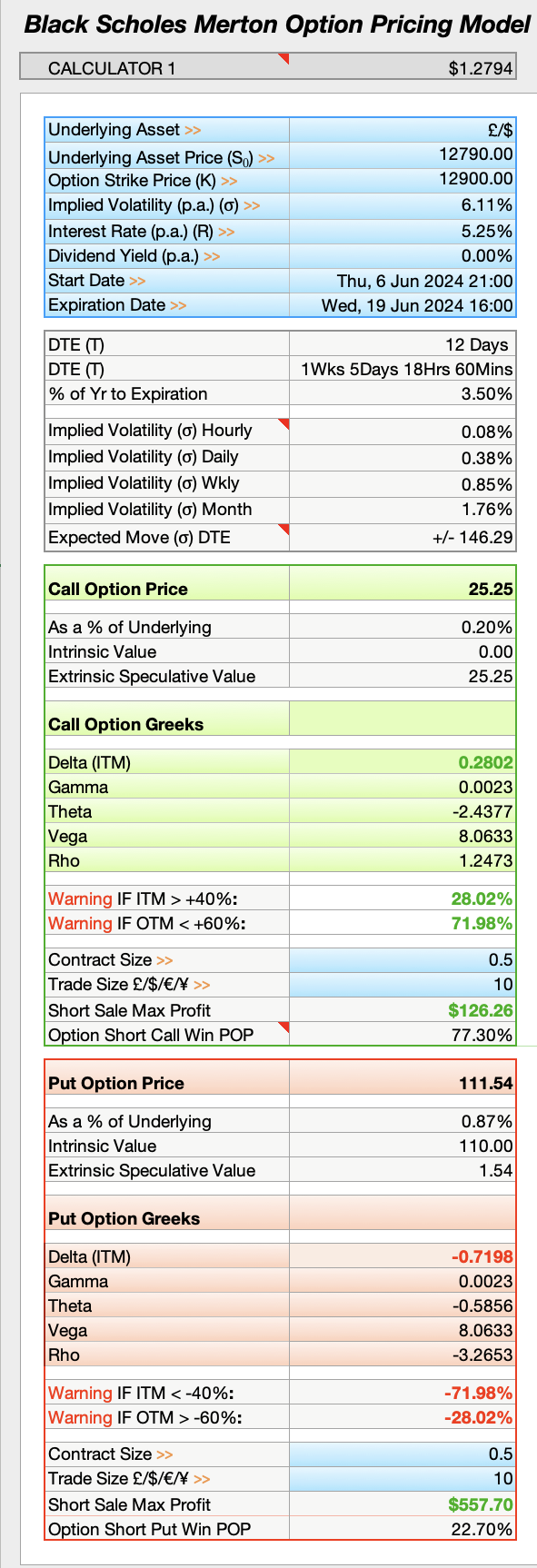

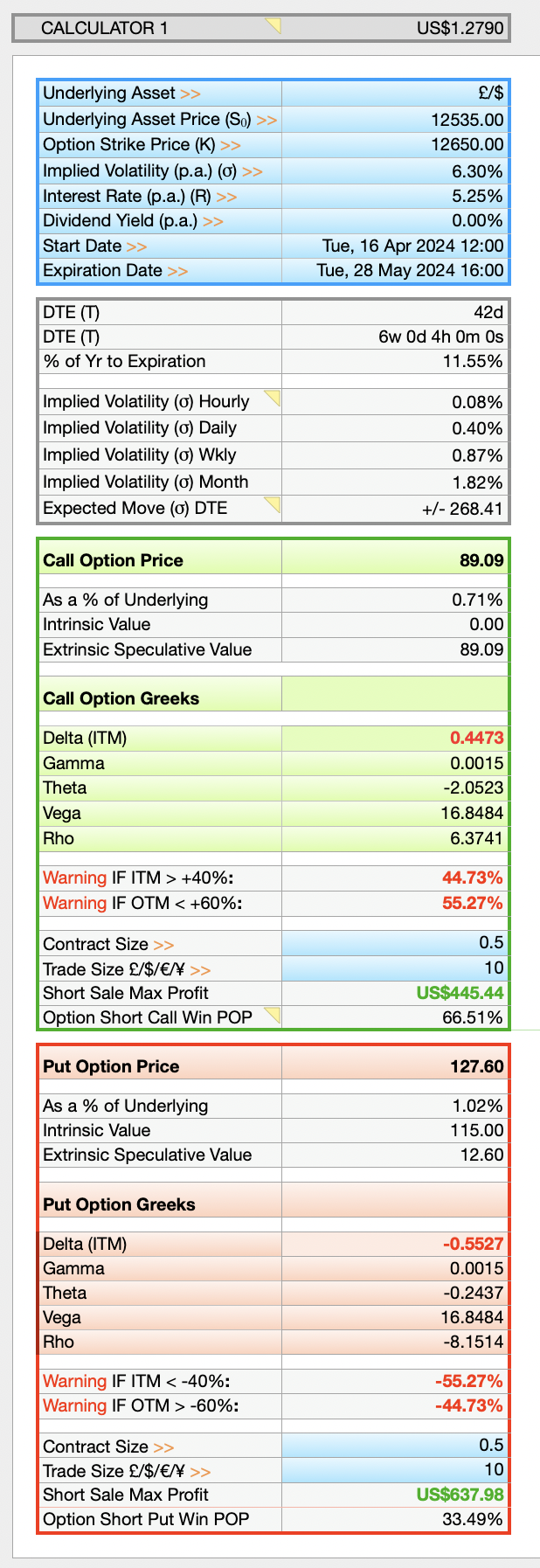

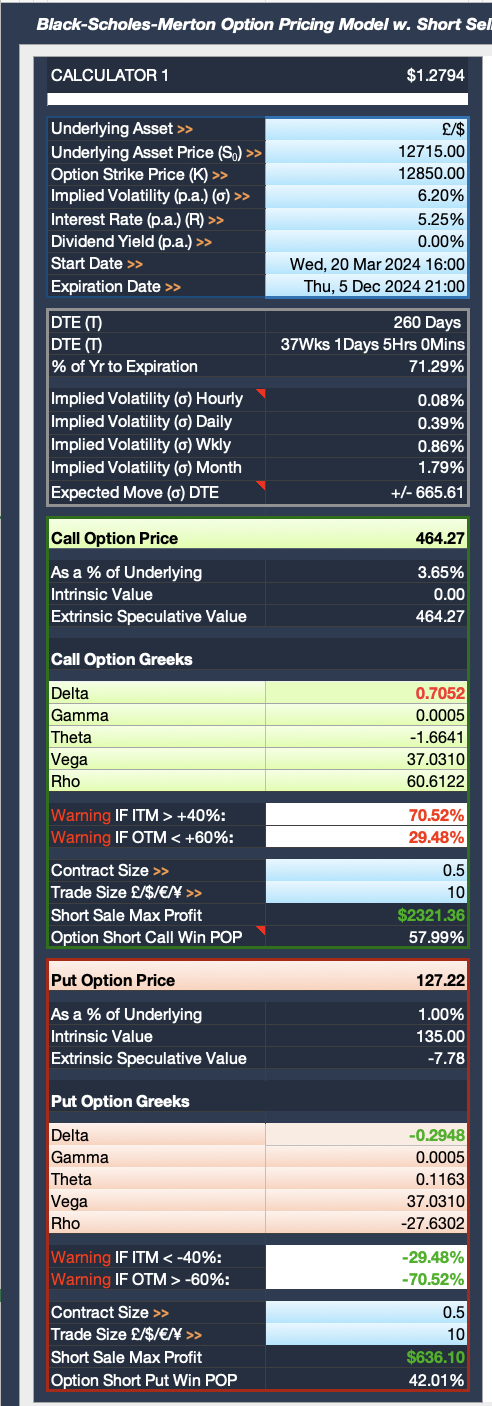

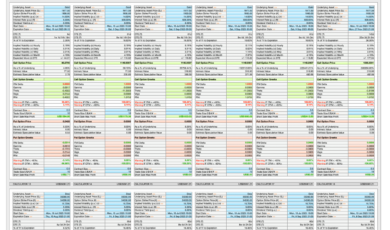

Main Features of Black Scholes Merton (BSM) 8×3 Calculator :–

Work Out if your Broker is Under and/or Over Pricing Options:

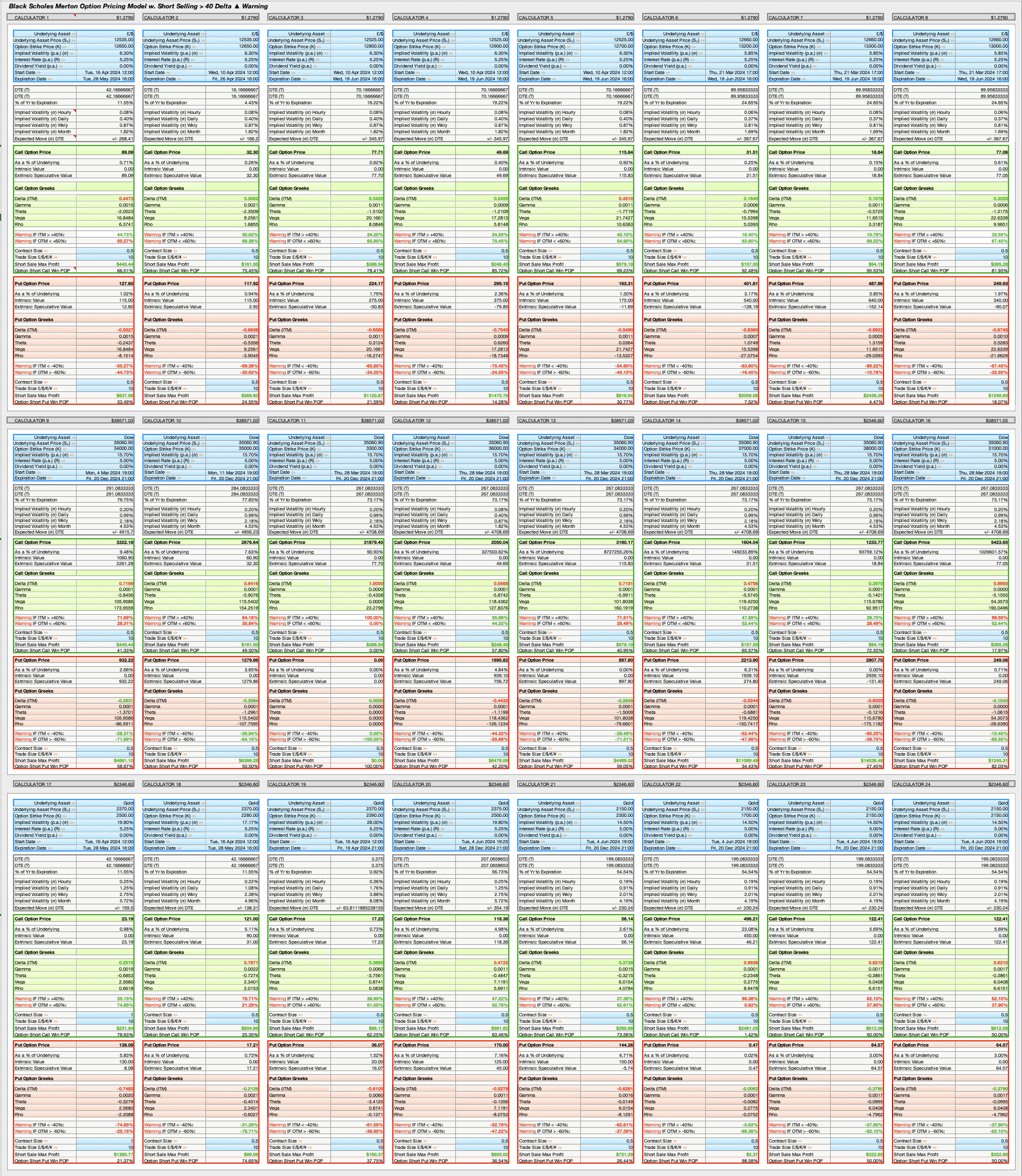

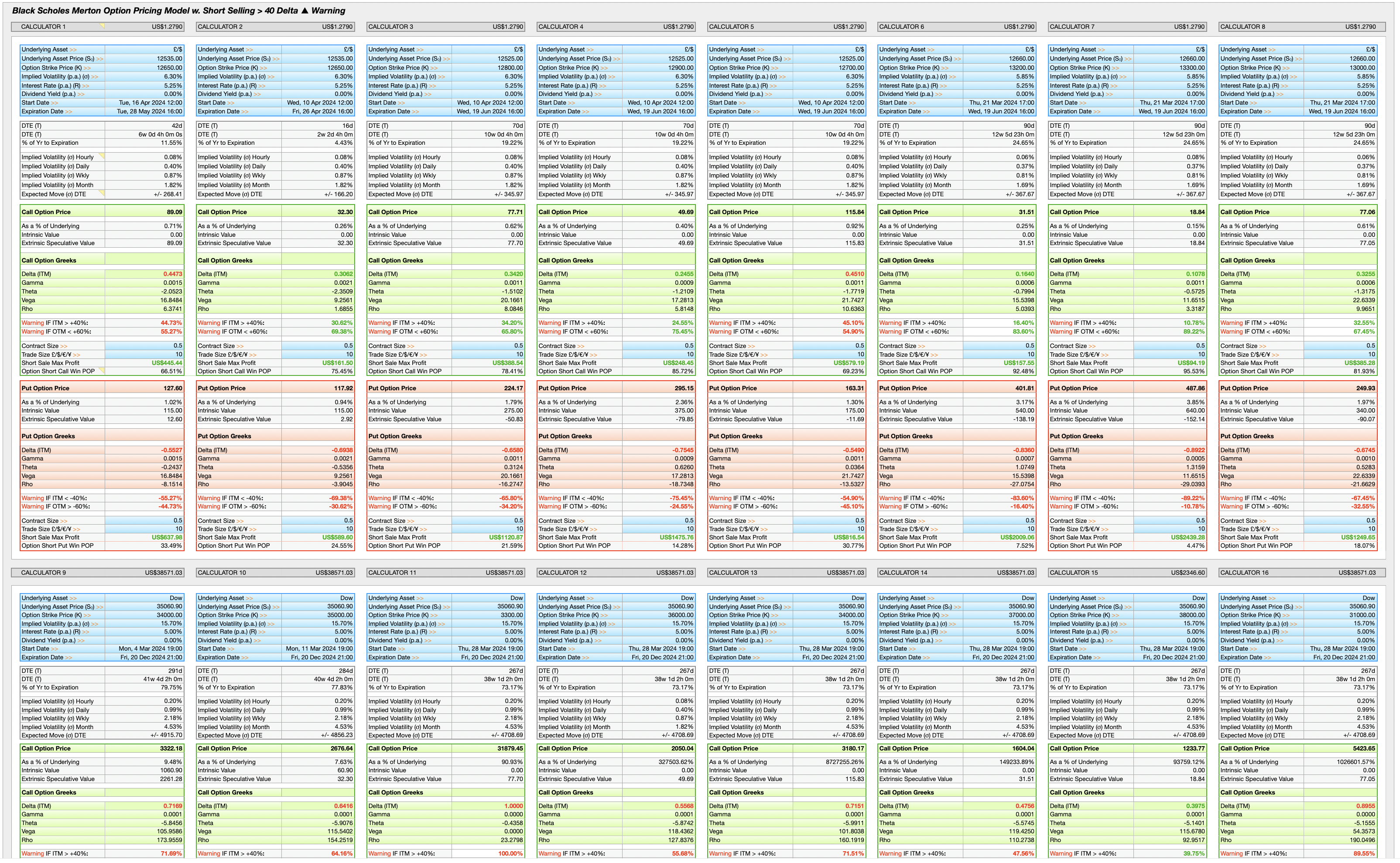

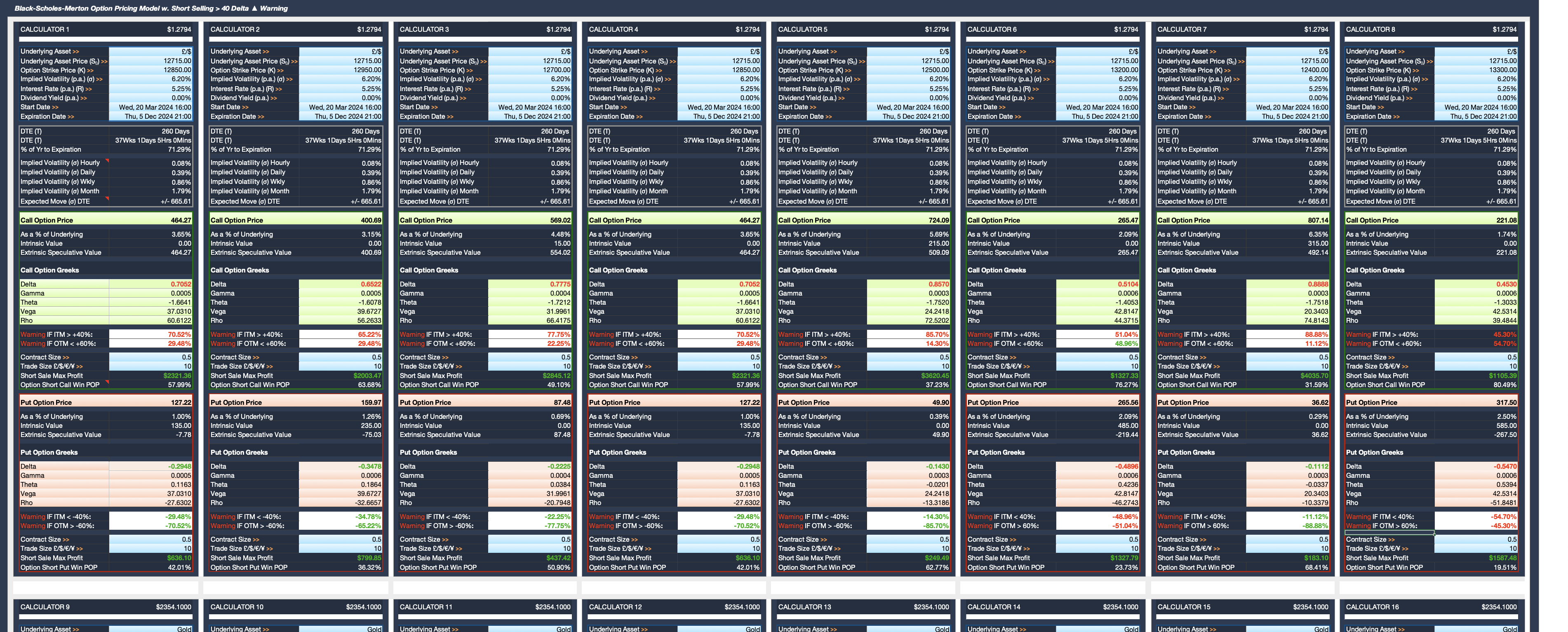

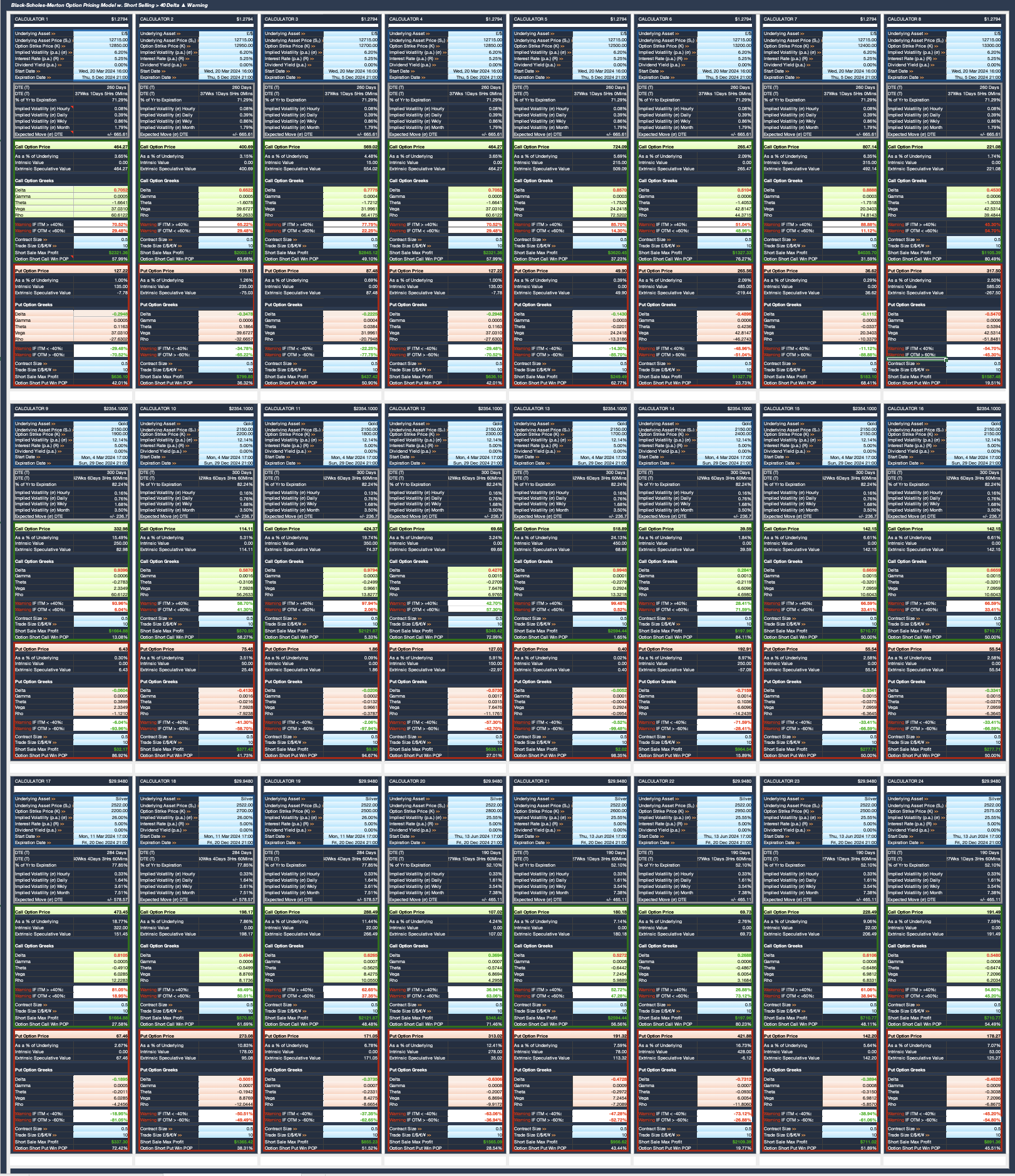

This Multi Bank Calculator allow you to trade your favourite assets and see if your broker is under or over pricing Calls or Puts. There are 8 calculators per row and 3 rows making 24 separate calculators in total and two sheets — a light and dark version – making 48 calculators in total. Note: Implied Volatility will need to match that of your brokers IV I the Option Chain in order to get an accurate assessment of option price differences between your broker and the BSM Model’s Call and Put price results.

Comes with “Greeks” Calculations, Delta, Gamma, Theta, Vega and Rho.

Calculates Greeks, based on the DTE remaining for the Option Contract for:

Delta: The rate of change of Option Prices to changes in the Underlying Price and Directional Move Probability.

Gamma: The speed Delta is Changing. Important for Options close to Expiry.

Theta: The amount Time Decay reduces the Option Price.

Vega: The impact of Volatility on the Option Price.

Rho: Sensitivity of Option Prices to Changes in Interest Rates.

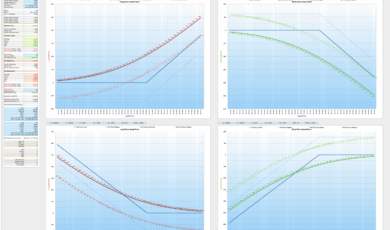

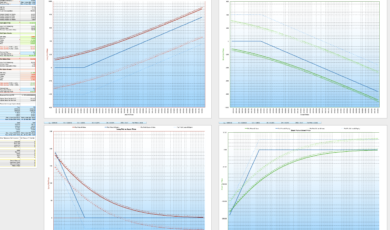

Calculate Option Premiums for 0DTE (Zero Days to Expiry) to Monthly:

Allows traders to see Option Prices for 0DTE (eg 8 hrs), 1DTE, 2DTE etc, Weekly Expiry, Monthly Expiry and longer, useful if traders are targeting premiums to earn from short selling Calls or Puts. All the online BSM calculators are for single use/input.

Includes Expected Moves Formula:

Each Calculator comes with the Expected Market Move in Points for whatever time period you set it to, all the way down to the final minutes of an Options life. Work out how much an Asset Price is Expected to Move from an Hourly to Yearly basis with:

68.2%

95.4%

99.7%

Probabilities / Confidence.

Understand how far the Market is Expected to Move and be able to work out Entries and Set Stop Losses easily.

It comes with examples of EM’s for Oil in the cell comment field in the calculator (I have also described the EM formula using Oil as an example below here in this description).

Implied Volatility (IV) Market Move Percentages

Allows you to see IV Percentages across multiple timeframes, Hourly, Daily, Weekly and Monthly

Accuracy:

Option Prices are calculated using the Nobel Prize Winning Black-Scholes-Merton mathematical Option Pricing Model and are accurate to 2 decimal places when tested against and compared to the Options Education org website calculator. Dependent upon using the same Implied Volatility figures from your broker. IG Index for example get their I.V. figures from the Union Bank of Switzerland (UBS).

Saves Time:

It saves traders time by avoiding the replication of inputting data like the Asset Price and Strike Price, Implied Volatility, Interest Rates, Start and End dates (DTE, Days to Expiry), over and over again as there are 6 calculators per row, and 3 rows making 18 individual calculators in total. I have mine set like this:

Row 1 — £/$

Row 2 — Gold

Row 3 — Dow Jones

On any Row, my first of 6 calculators is set for 0DTE, the second one for daily (1DTE) and then the rest for Days, Weekly and Monthly Pricing.

Live Option Price Updating:

Option Start Dates can be set to live “@Now” to see Call and Put Option Price changes in Real Time. (Computer CPU power dependent).

Dividends:

Allows for Dividend Interest Percentage input. (The Merton part of the Black Scholes Model)

Delta Warning for Short Sellers:

It comes with a Red Text Warning for Short Sellers when the OTM (Out the Money) Delta falls below <60%. (The % level can be changed to suit your own risk tolerance/trading style)

Yahoo Asset Price Feed:

It features an Asset Price Feed via Yahoo Finance.

Design:

Finished to a High Degree of Professional Design.

Not your basic free amateur Excel Spreadsheet like those found on the net!

For each calculator cells are editable and unlocked.

Simply the Best, Most Accurate Options Pricing Calculator on the Net.

Take Control of Market Risk.

Download my Options Trading Calculator Now.

€19.95 only for PRC Members (€29.95 everywhere else)

Avis

Il n’y a pas encore d’avis.