Divergence trading is a popular strategy among technical traders, as it allows them to identify potential reversals in a financial instrument’s price.

In order to understand how divergence trading works, it’s important to first understand what divergence is. Divergence is a concept in technical analysis that occurs when the direction of a financial instrument’s price and the direction of a technical indicator diverge from each other. For example, if a stock’s price is making higher highs but the relative strength index (RSI) is making lower highs, this would be considered divergence.

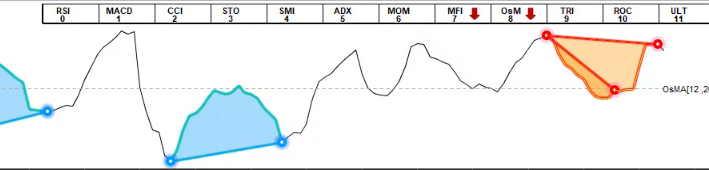

Divergence can be either positive or negative. Positive divergence occurs when the price of a financial instrument is making lower lows but the technical indicator is making higher lows. This can be seen as a bullish signal, as it suggests that the underlying strength of the stock is increasing despite its recent price declines. On the other hand, negative divergence occurs when the price of a financial instrument is making higher highs but the technical indicator is making lower highs. This can be seen as a bearish signal, as it suggests that the underlying strength of the stock is decreasing despite its recent price gains.

- bearish divergence trading

- bullish divergence trading

So, how can traders use divergence to their advantage? One way is to look for positive divergence as a potential buying opportunity. For example, if a stock’s price is in a downtrend and the RSI is showing positive divergence, this could be a sign that the downtrend is losing steam and the stock may be due for a reversal. In this case, a trader may enter a long position in the stock, with the expectation that the stock will eventually start to move higher.

On the other hand, traders can also look for negative divergence as a potential selling opportunity. For example, if a stock’s price is in an uptrend and the RSI is showing negative divergence, this could be a sign that the uptrend is losing momentum and the stock may be due for a reversal. In this case, a trader may enter a short position in the stock, with the expectation that the stock will eventually start to move lower.

Of course, it’s important to note that divergence trading is not a perfect strategy and there are no guarantees that a divergence will lead to a reversal in price. As with any trading strategy, it’s important to use proper risk management techniques and always consider the potential risks before entering a trade.

Additionally, it’s also important to remember that divergence can be found on different timeframes, so traders need to consider the time horizon of their trade when looking for divergence. For example, a trader may find positive divergence on a daily chart, but when they look at the weekly chart, they may see that the stock is actually in a long-term downtrend. In this case, the trader may want to avoid entering a long position in the stock, as the overall trend is still bearish.

In conclusion, divergence trading is a popular strategy among technical traders, as it allows them to identify potential reversals in a financial instrument’s price. While it is not a perfect strategy and there are no guarantees, traders can use divergence to help identify potential buying or selling opportunities. As with any trading strategy, it’s important to use proper risk management techniques and always consider the potential risks before entering a trade.

Why you should add divergence trading in your arsenal?

Divergence trading, a popular strategy among technical traders, can offer several potential benefits, including the ability to identify potential reversals in a financial instrument’s price. Some other potential advantages of divergence trading include:

- It allows traders to potentially capitalize on a stock’s underlying strength or weakness. By looking for positive or negative divergence, traders can identify stocks that may be due for a reversal despite their recent price movements. This can give traders a potential edge in the market and allow them to enter trades at advantageous prices.

- It can help traders confirm the strength of a trend. Divergence can be a valuable tool for traders who are looking to confirm the strength of a trend. For example, if a stock’s price is in an uptrend and the RSI is showing positive divergence, this can be seen as a confirmation of the stock’s underlying strength and may indicate that the uptrend is likely to continue.

- It can provide an early warning of a potential trend reversal. Divergence can sometimes be an early warning sign of a potential trend reversal. By keeping an eye on the technical indicators for divergence, traders can potentially identify potential reversals before they happen and take action accordingly.

- It can be used in conjunction with other technical analysis tools. Divergence trading can be a valuable addition to a trader’s toolkit, as it can be used in conjunction with other technical analysis tools to help provide a more complete picture of a stock’s price action. For example, a trader may use divergence in combination with support and resistance levels or chart patterns to help confirm their trading signals.

Divergences trading made easy with a scanner

One of the key benefits of using a scanner to find potential divergences automatically is the ability to save time and effort. Manually scanning for divergences can be a time-consuming and tedious process, especially if a trader is looking at multiple stocks or timeframes. By using a scanner, traders can quickly and easily scan for divergences across a wide range of stocks and timeframes, allowing them to focus on other aspects of their trading strategy.

Another potential benefit of using a scanner is the ability to backtest trading strategies. Many scanners allow traders to backtest their trading strategies by applying them to historical data and seeing how they would have performed in the past. This can be a valuable tool for traders who are looking to improve their divergence trading strategy, as it allows them to see which settings and parameters have worked best in the past and make adjustments accordingly.

Additionally, using a scanner can also help traders stay organized and keep track of their trades. Many scanners allow traders to create watchlists and alerts, which can help traders monitor the stocks they are interested in and receive notifications when certain conditions are met. This can be a useful tool for traders who want to stay on top of their trades and make sure they don’t miss any important developments.

Here is a product that use scanner to find potential divergences:

In conclusion, divergence trading can offer several potential benefits for traders, including the ability to identify potential reversals in a stock’s price, confirm the strength of a trend, provide an early warning of a potential trend reversal, and be used in conjunction with other technical analysis tools.