What is it about ?

Prorealtime is a fantastic trading tool but what if you want to execute your trade with more options than just a StopLoss and a TakeProfit, but with BreakEvens, specific TrailingStops, execute partialy your position on target?

Unless you are a savvy coder and have time, you cannot do this;

Now with Trade MANAGER Swing©, everybody can.

For who?

Anybody who

- is a Swing Trader i.e trading Up or Down Trends

- wants to get in control of his/her trading with all the options of an advanced tool without coding

- and does not want to spend day and night in front of the screens

IMPORTANT: for specific developments please contact us via the support zone.

For which assets?

- Trade MANAGER Swing is universal and works fine on all assets

Want FREE SIGNALS with our tools

🔔 https://t.me/metasignalspro_prorealtime

Why these innovations?

Because as traders,

- we absolutely needed a tool that allow us to have some flexibility with our trade plans

- and you want to see them alltogether in one place

How does it work?

Here are the steps to launch your Trade MANAGER Swing smoothly:

- Pick your asset from a Screener or from your own lists

- We advise you to set up a Multi Timeframe environment

- With a very small time frame of 1 minute for exemple like hereunder so you can enter the market rapidely

IMPORTANT:

> The TimeFrame on which you launch your Trade MANAGER will be the TimeFrame of your Trailing StopLoss

> You will be executed at the opening of the next candle of the current TimeFrame;

- if you choose a 1 Hour TF

- you launch you Trade MANAGER 5mn after the start of the current candle

- >> then the order will be executed in 55 minutes = opening of the next 1hour candle

> You will need to adapt the TrailingPeriod consequently; for exemple :

- you launch in 1 minute TF to enter rapidely the market

- you want to have a Trailing of a Moving Average of 1 hour

- >> your TrailingPeriod will be “60” = 60 x 1 minute = 1 hour and NOT “1”

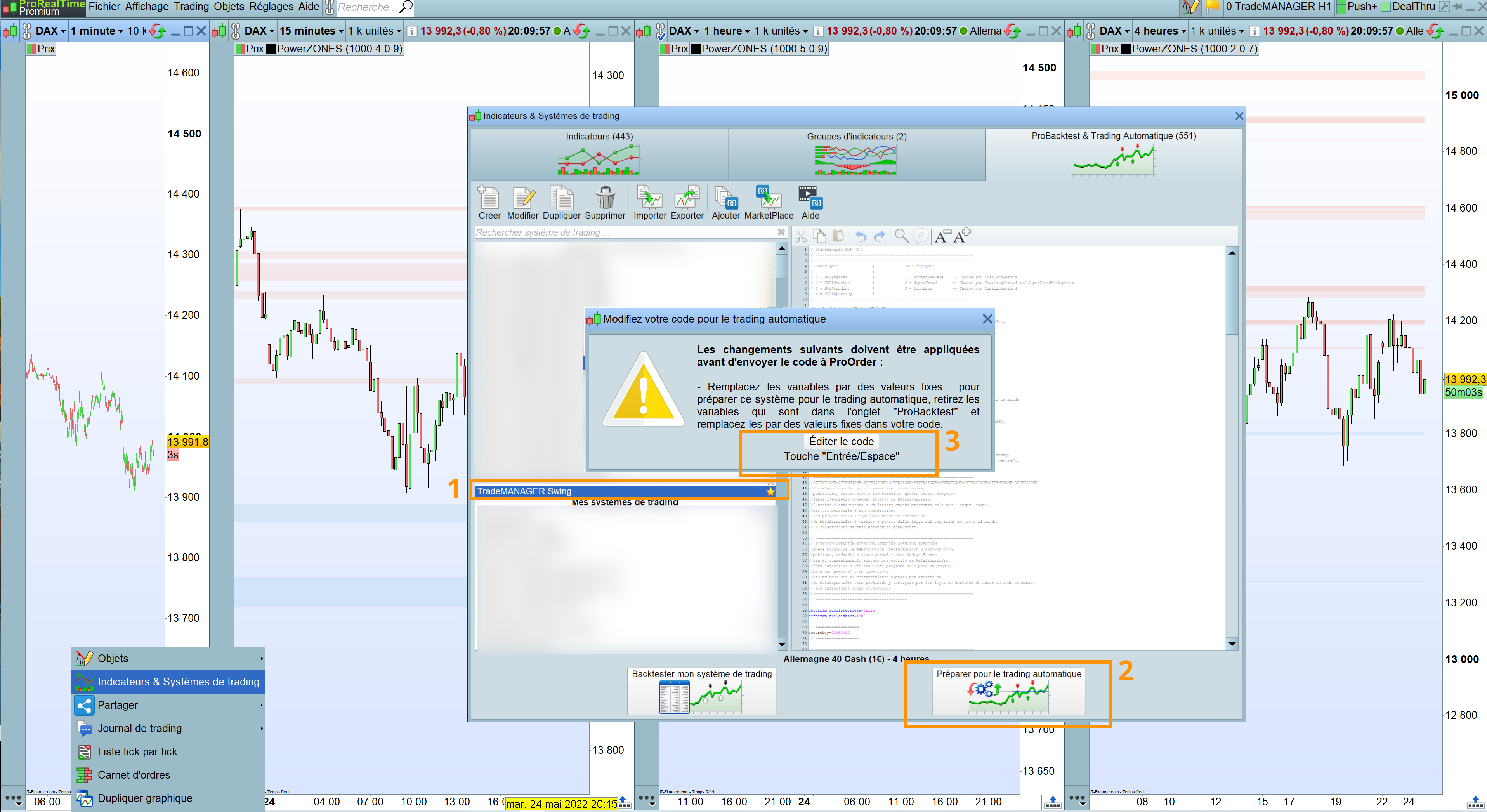

- Go into the Strategy section

- Here we want to launch the Trade MANAGER on the 1 minute TimeFrame

- Select Trade MANAGER Swing in the list of stratégies

- Click on “Prepare for Automatic Trading”

- “Edit the code” to put your settings

IMPORTANT:

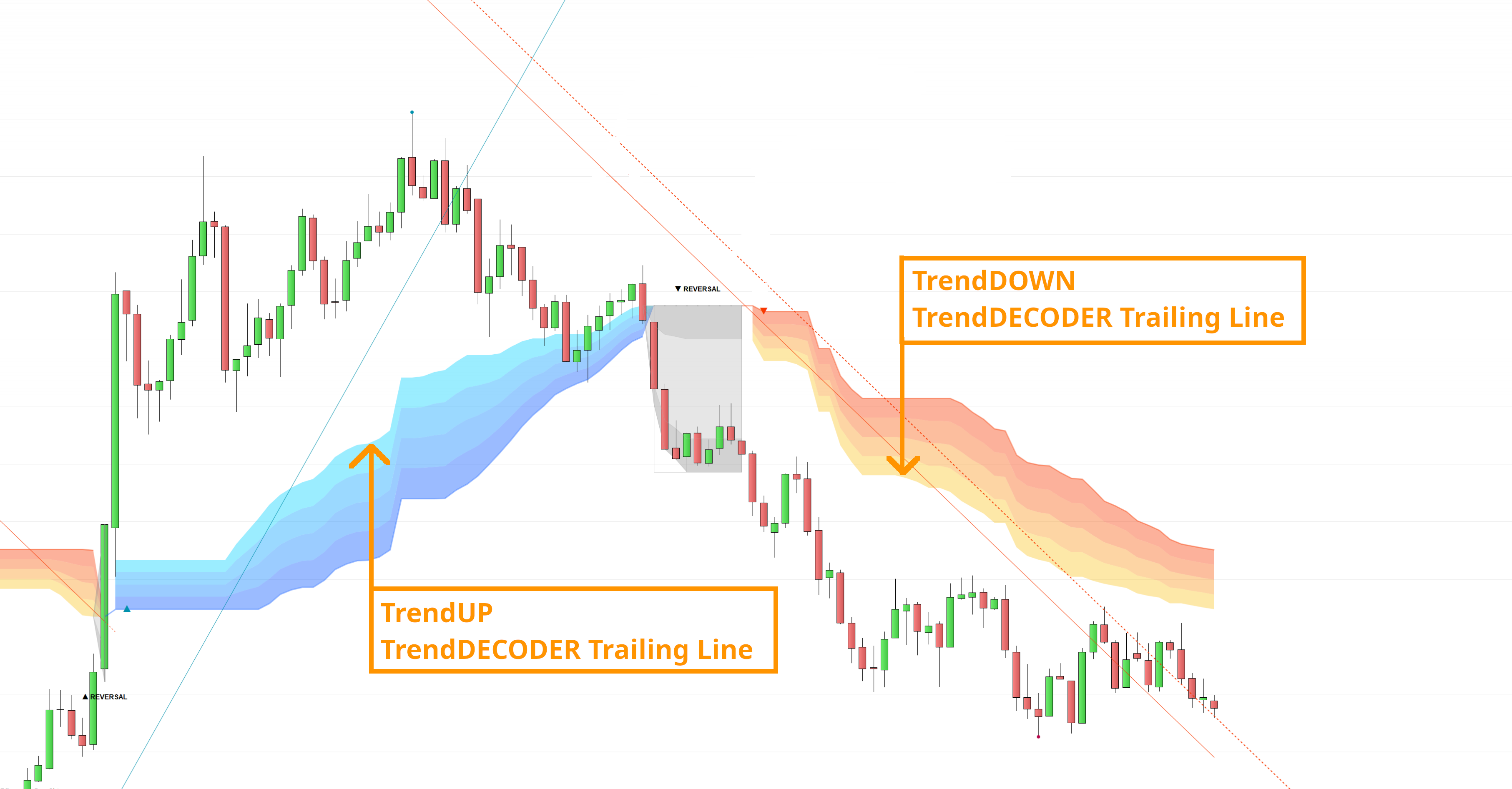

If you have a TrendDECODER licence select “Trade MANAGER Swing for TrendDECODER“

>> You will be able to have the Blue and Orange Clouds as additional Trailing StopLoss Options (see below in Configuration)

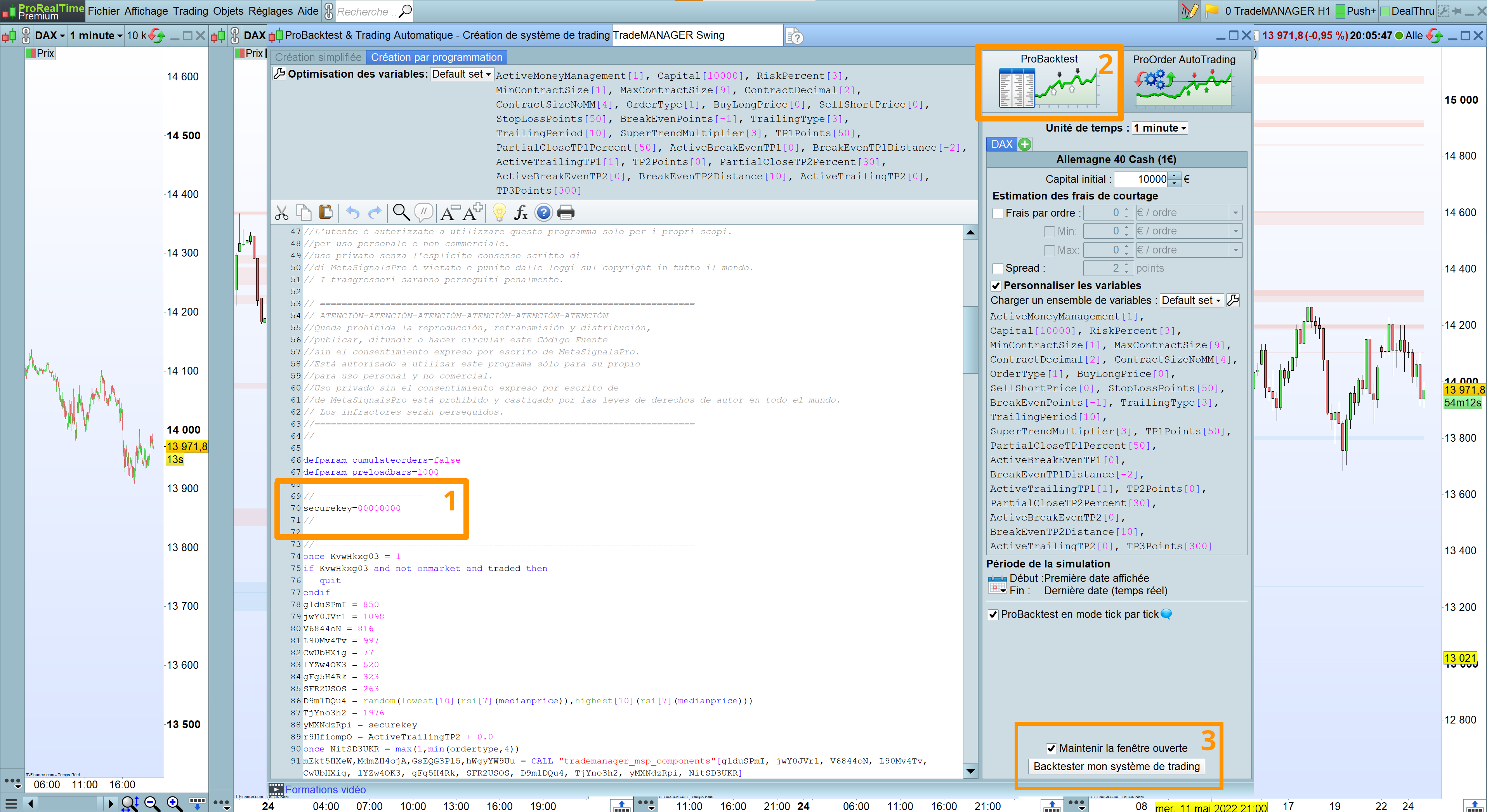

Registration of the SecureKey

- Replace the 00000000 by the key number you have received directly by mail from MetaSignalsPro (1)

- Click on “ProBackTest” tab (2)

- Click on “Backtest my Trading System” to register the TradeMANAGER with YOUR SecureKey (3)

- “Edit the code” again like you just did above: your Trade MANAGER has now YOUR SecureKey

IMPORTANT:

>> Don’t forget to duplicate this new version (with YOUR SecureKey) if you want to store a second Trade MANAGER with other parameters (for ex: different partial closure percentages)

>> Without YOUR SecureKey the Trade Manager will not work

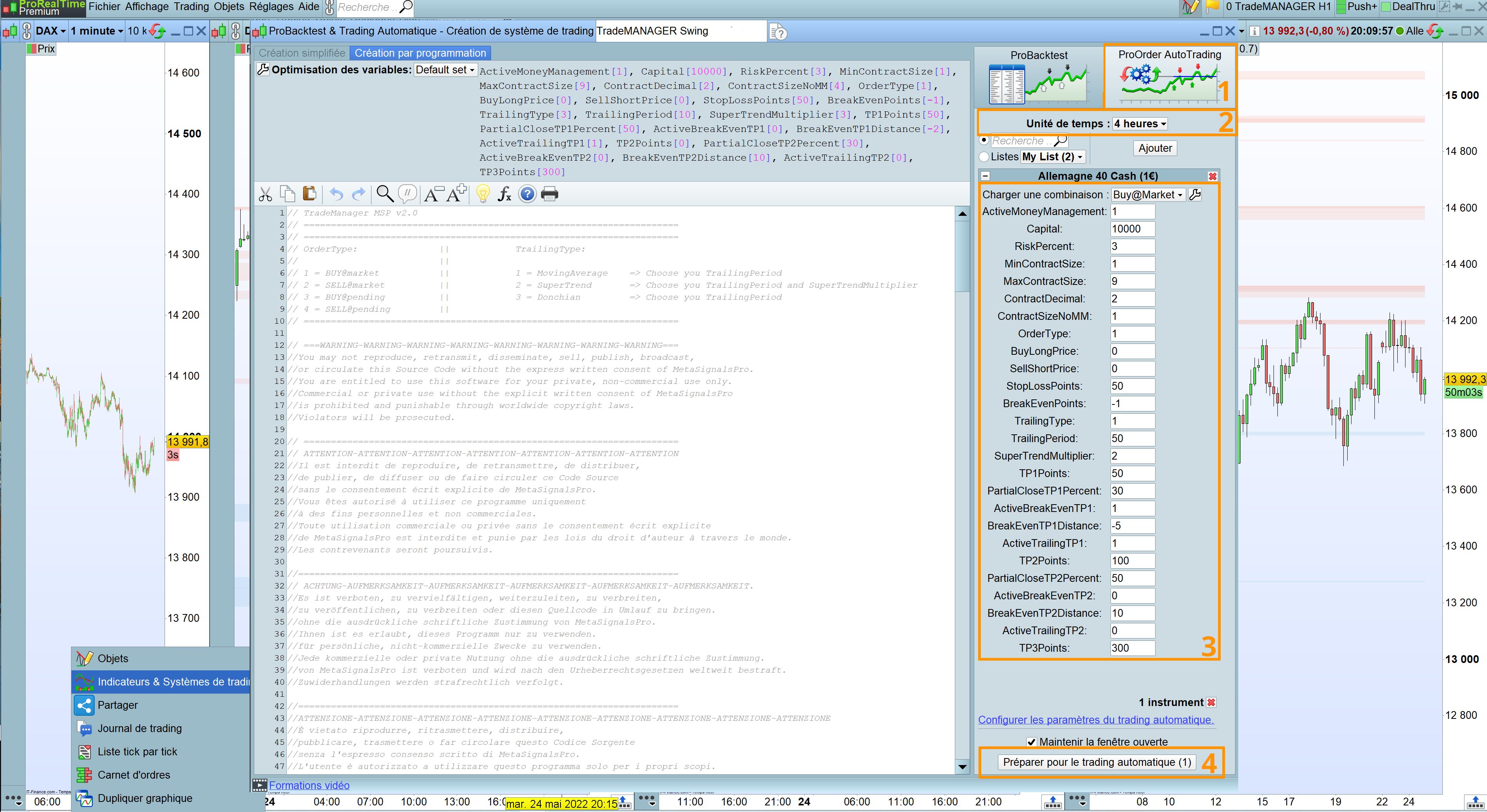

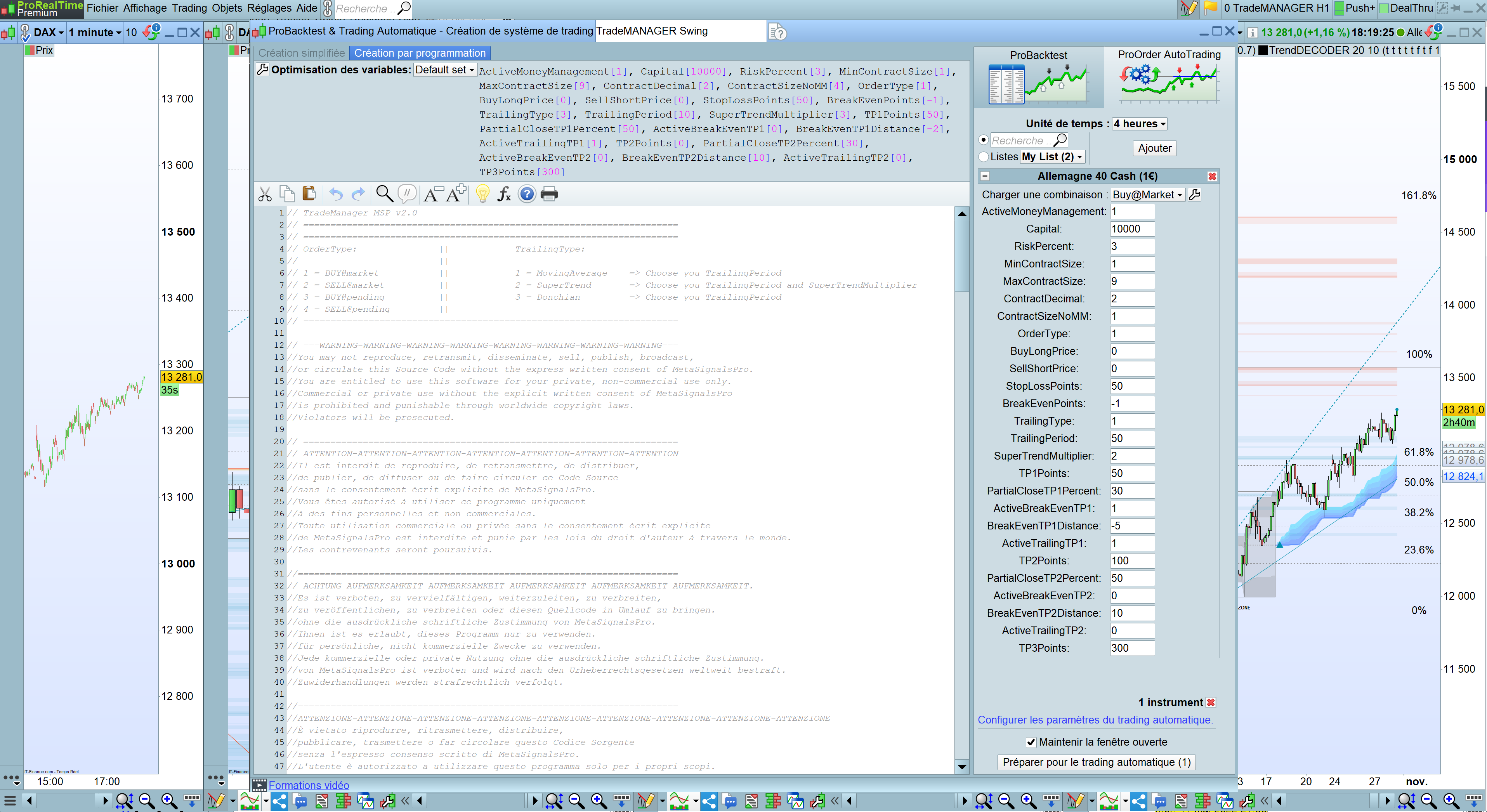

Preparing your Trade MANAGER

- Select now “ProOrder Trading” Tab (1)

- Choose the Main Time Frame on wich you will follow your trade (2)

- Enter your Trade Plan and adjust your trailing period accordingly to the Time Frame you chose (3) = here the Trail will be a Simple Moving Average of 50 period of the 4h candles

- Click on “Prepare for automatic trading” (4)

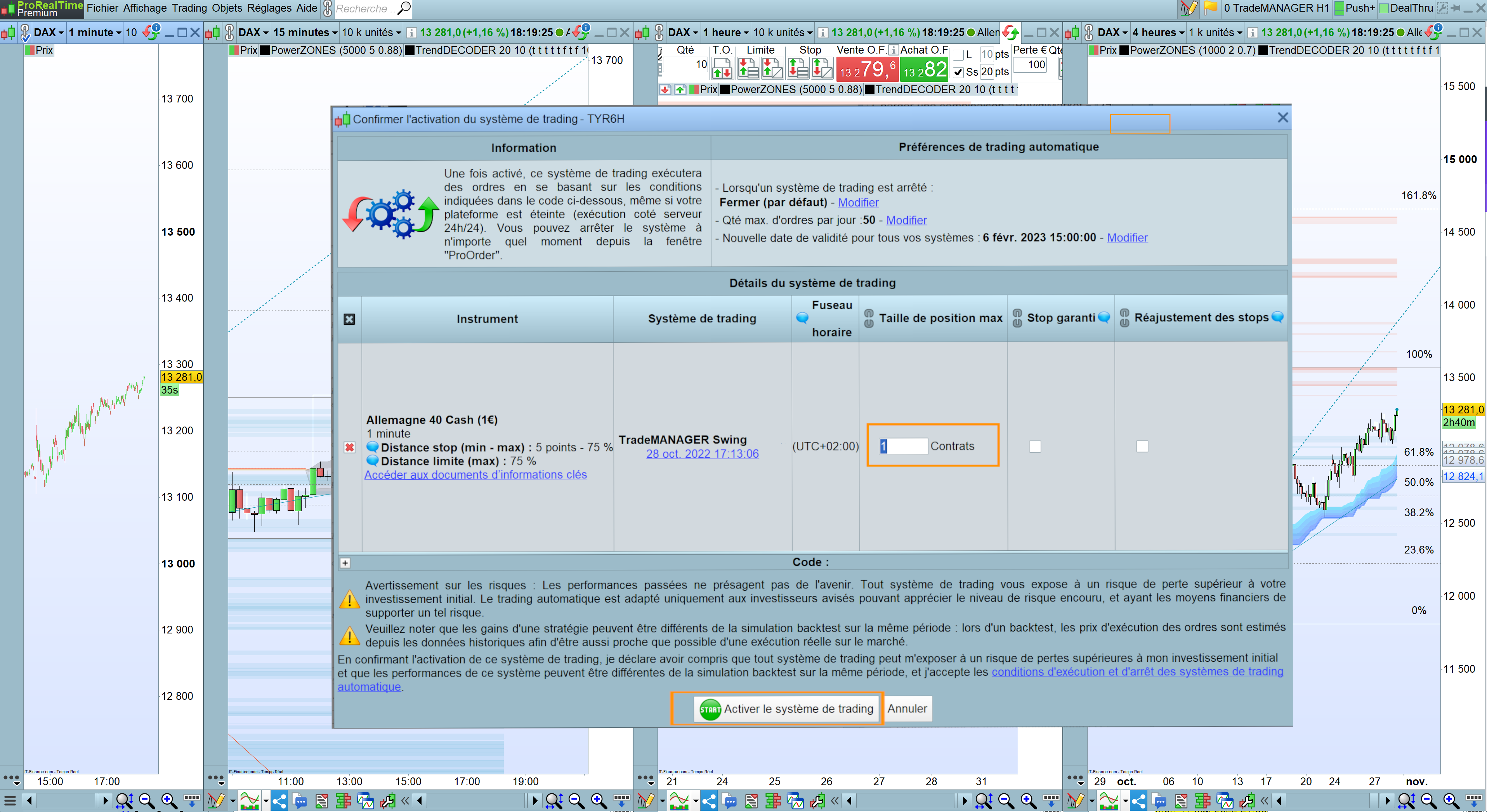

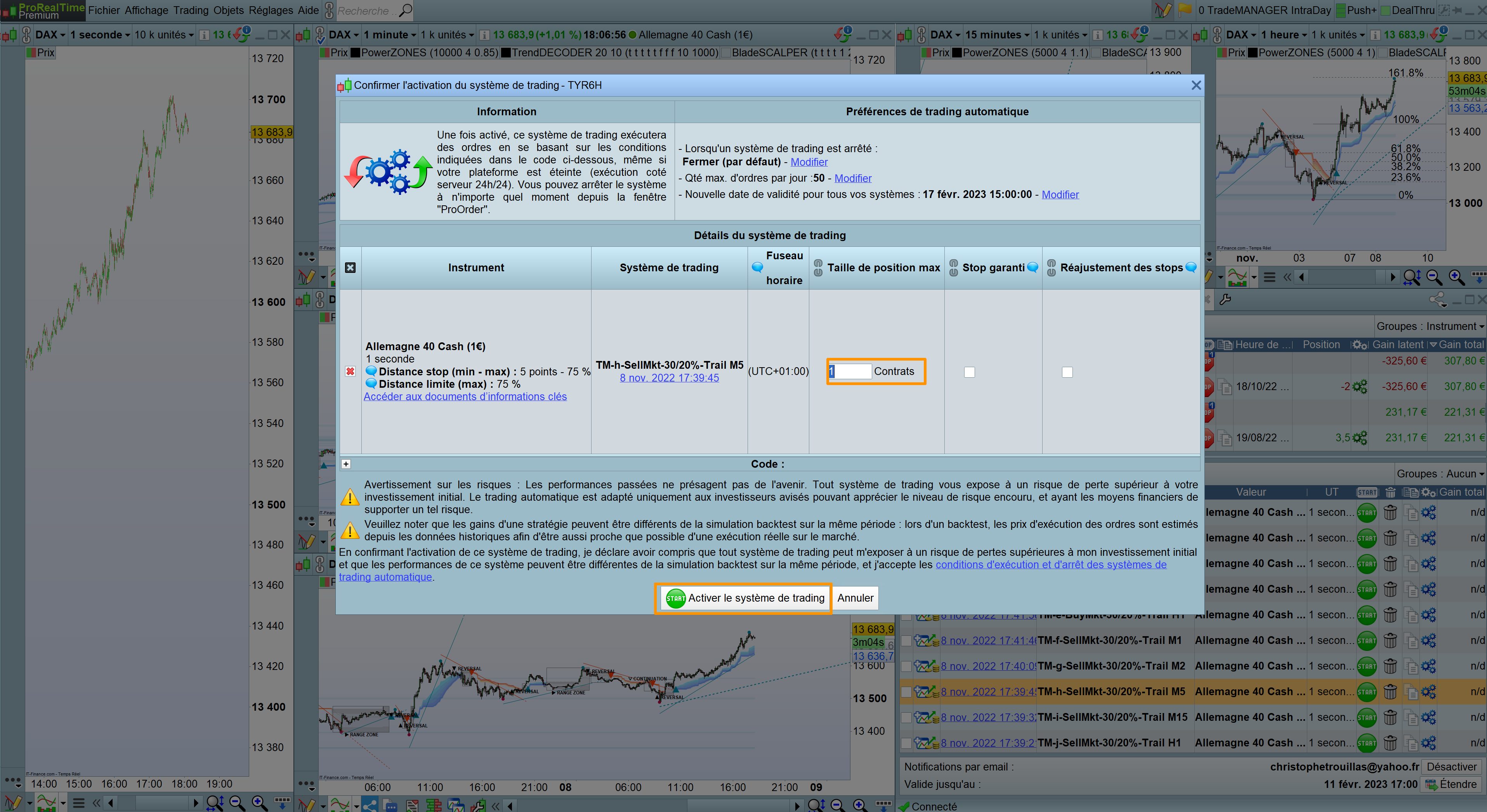

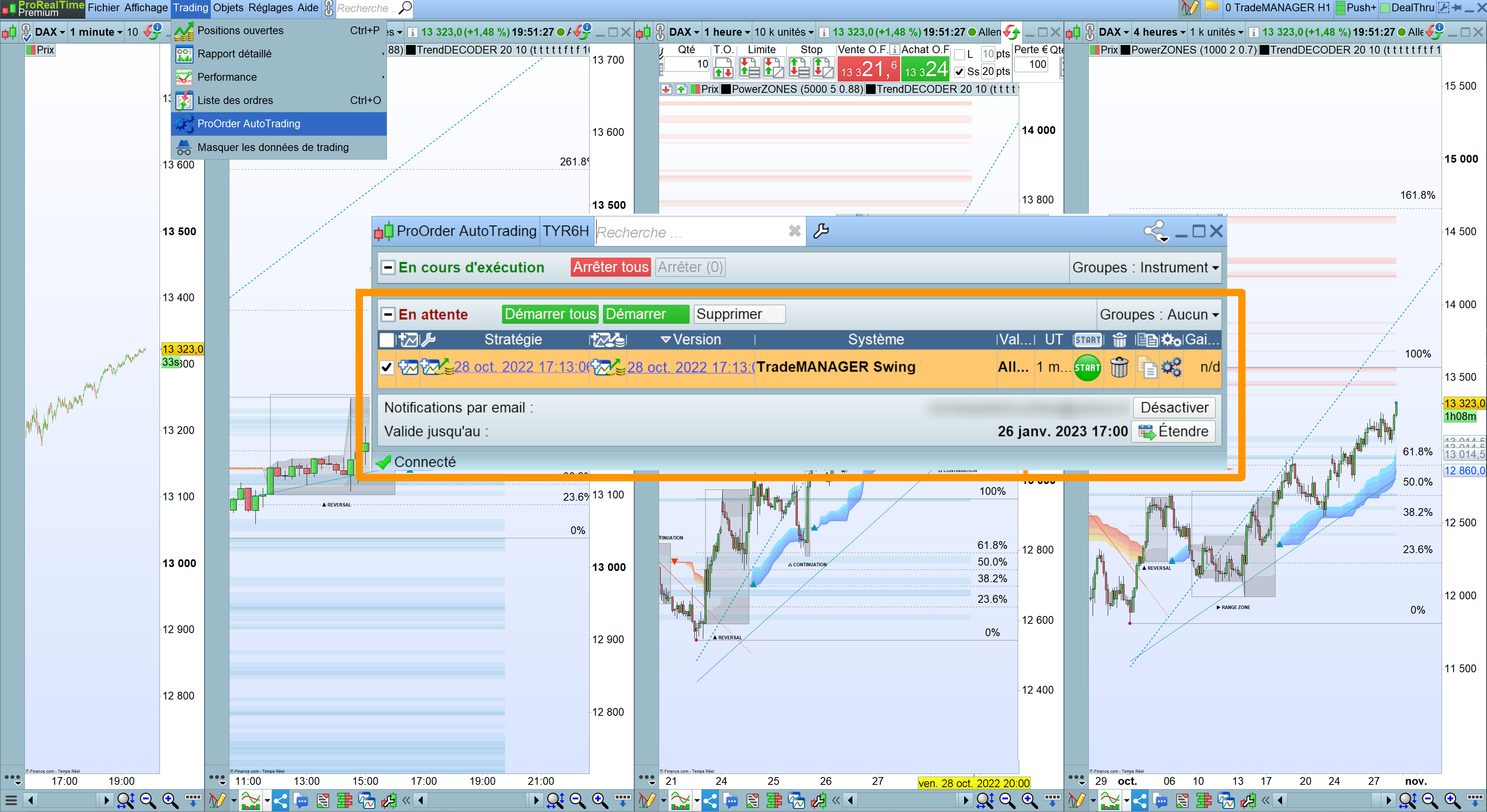

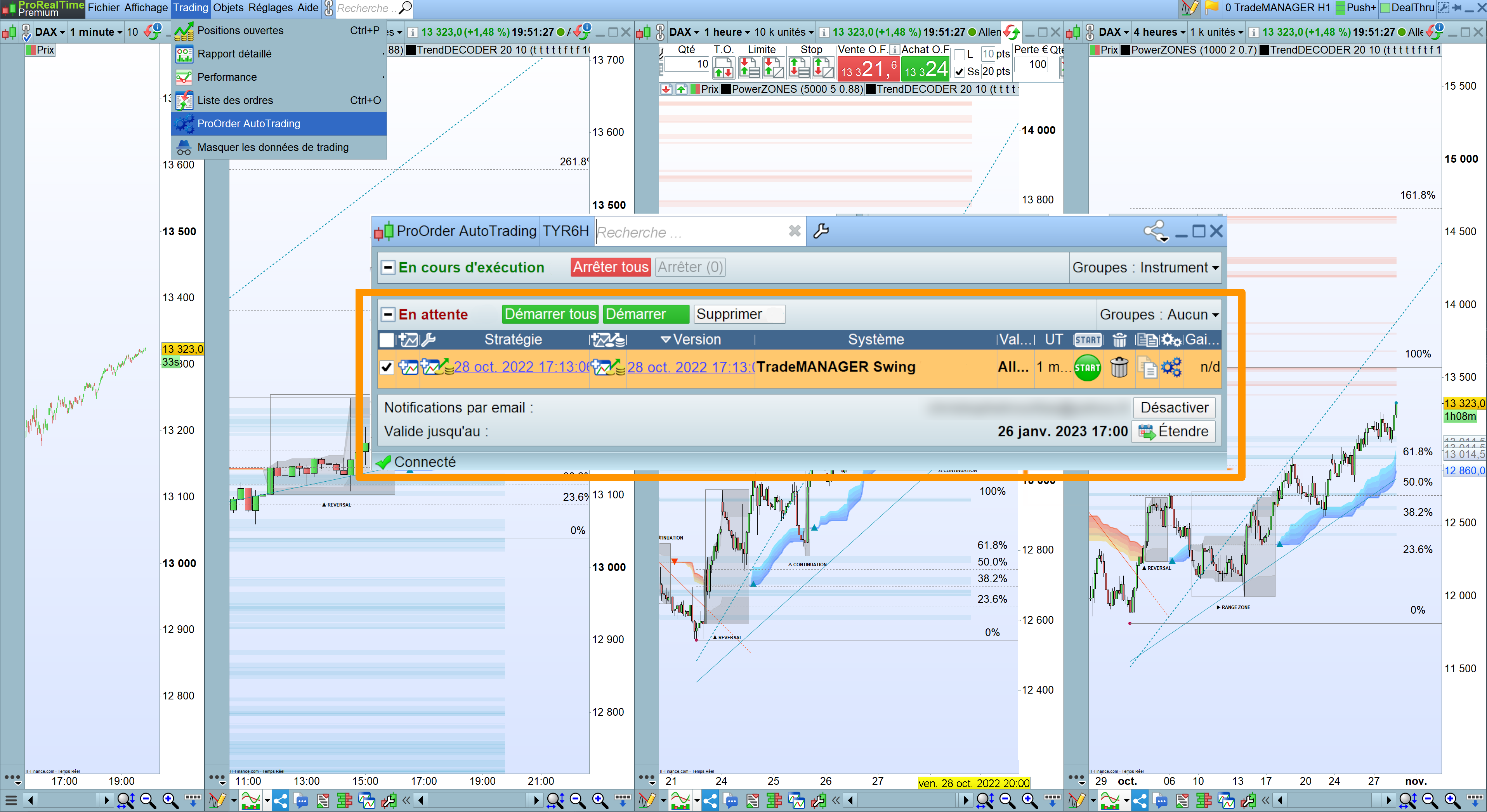

Launching your Trade MANAGER

The program is now listed among the strategies in pending status

- Select in the upper menu Trading / ProOrderTrading to make appear the ProOrder AutoTrading window

- Click on “Start” to activate your Trade MANAGER Swing

- Set the maximum contracts that the strategy can launch: this is a protection from Prorealtime

- Click on “Activate the trading system”

- Your order is now waiting to be executed and your trade plan will be automatically followed

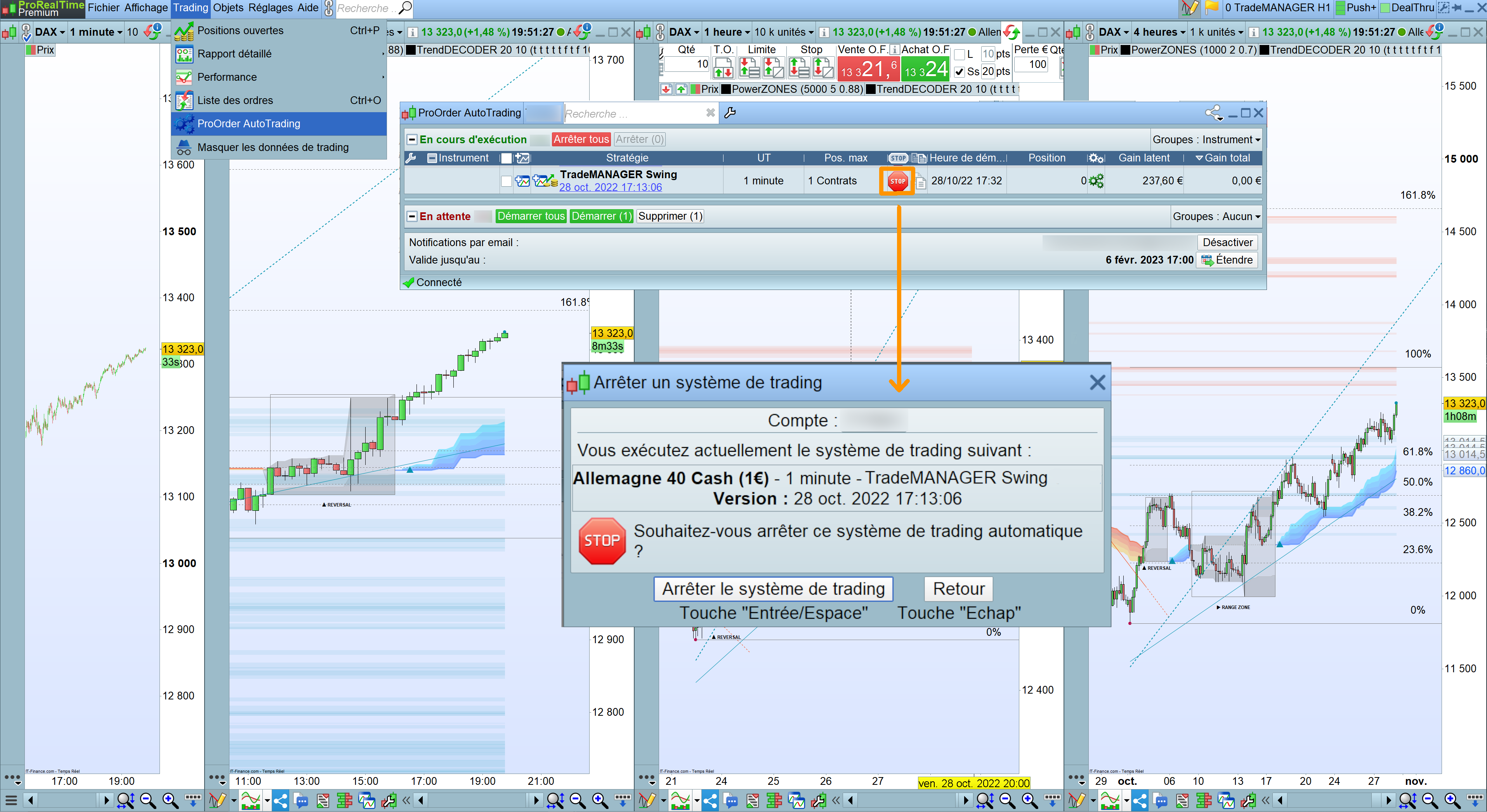

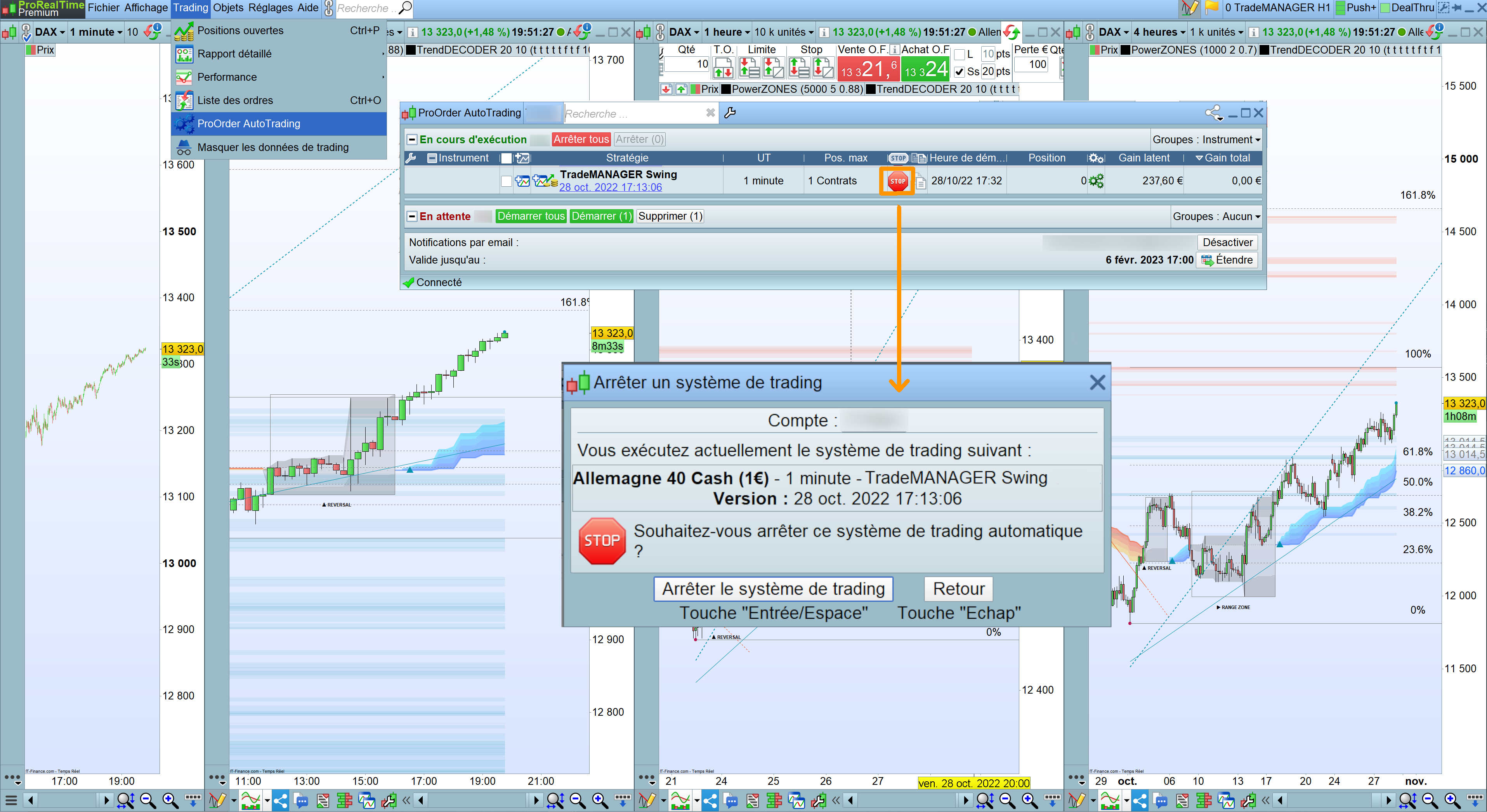

Stoping your Trade MANAGER

- You can stop your trade at anytime by pressing the “stop” button in the PRT Algo Manager

- A new window opens and confirm by clicking on “Stop the trading system”

Configuration

ActiveMoneyManagement:

- ActiveMoneyManagement = 1 => activates the MoneyManagement (RiskPercent / MinContractSize / MaxContractsize / ContractDecimal) => very much recommanded

- ActiveMoneyManagement = 0 => no MoneyManagement

Capital: the amount of money of your account, that will be converted in contracts (mandatory for Money Management option and automatic contract size calculation)

RiskPercent:

- this is the maximum percentage of your capital that you accept to loose

- if your Capital is 10.000€, 2% of risk per trade means you are risking at maximum 200€

- Good money management set this maximum risk per trade between 0.5% and 2% depending on the configuration of the market

MinContractSize / MaxContractSize:

- allows the calculation of the contractSize when MoneyManagement is activated

- is a protection from a human mistake

- MinContractSize is designed to prevent contract size too small for the current asset (minimal contract size depends of the broker)

ContractDecimal: adjust this number to fit the MoneyManagement and RiskPercent options

(designed for a better accuracy of contract size calculation to fit the maximum loss percentage of the capital. Can also be changed to fit the setting of the allowed size for the current asset (broker limitation)

If you activate the MoneyManagement, here is an exemple of how it works:

– Capital : 10 000 €

– Risk : 2% => amount you are ready to risk is : 200 €

– StopLoss : 50 points (remember your risk is base on the position of your StopLoss)

– Number of stocks TradeMANAGER will buy is : 200 / 50 = 4 contracts

ContractSizeNoMM: (NoMoneyManagement)

- select cautiously the number of contracts you will trade

- will work in case of No MoneyManagement activated

- ActiveMoneyManagement = 0 => no MoneyManagement

OrderType:

- OrderType = 1 => BUY at market

- OrderType = 2 => SELLSHORT at market

- OrderType = 3 => pending BUY

- OrderType = 4 => pending SELLSHORT

BuyLongPrice: the price at which your Pending BUY order will be executed (if current price is above the BuyLongPrice, a LIMIT Order will be used, otherwise a STOP Order).

SellShortPrice: the price at which your Pending SELLSHORT order will be executed (if current price is below the SellShortPrice, a LIMIT Order will be used, otherwise a STOP Order).

StopLossPoints: the number of lost points at which the system will exit you (StopLoss are automatically attached to orders in broker orders book).

BreakEvenPoints: sets the number of points the price should gain to shift the StopLoss to BreakEven = your price of Entry

TrailingType

- TrailingType= 0 => No Trailing Stop Loss is requested

- TrailingType= 1 => TrailingStopLoss based on a Moving Average indicator (see below for period)

- TrailingType= 2 => TrailingStopLoss based on a SuperTrend indicator (see below for period and Multiplier)

- FYI the SuperTrend is based on an Average True Range

- TrailingType= 3 => TrailingStopLoss based on a Donchian indicator (see below for period)

IMPORTANT:

If you have a TrendDECODER licence

- TrailingType= 4 => TrailingStopLoss based on the upper line of the Blue Clouds and the lower line of the Orange Cloud

TrailingPeriod:

- set the lookback period of the above Trailing indicators

IMPORTANT:

> The TimeFrame on which you launch your Trade MANAGER will be the TimeFrame of your Trailing StopLoss

> You will need to adapt the TrailingPeriod consequently; for exemple :

- you launch in 1 minute TF to enter rapidely the market

- you want to have a Trailing of a Moving Average of 1 hour

- >> your TrailingPeriod will be “60” = 60 x 1 minute = 1 hour and NOT “1”

SuperTrendMultiplier: enter the number you want the SuperTrend to be multiplied with;

- will be > 1 if you want the trail to be more distant from the price

- will be < 1 if you want the trail to be closer from the price

TP1Points: your first Take Profit objective in number of points

PartialCloseTP1Percent: defines the part of your position you want to close when reaching TP1

ActiveBreakEvenTP1:

- ActiveBreakEvenTP1 = 1 => will move your StopLoss to BreakEven (your entry Price)

- ActiveBreakEvenTP1 = 0 => not active

BreakEvenTP1Distance: adjust the BreakEven StopLoss (BE-SL) position in points when reaching TP1;

- will be > 0 if you want the BE-SL to be above the Entry Price; for exemple +10 = +10 points above Entry

- will be < 0 if you want the BE-SL to be under the Entry Price; for exemple -10 = -10 points under Entry

ActiveTrailingTP1:

- ActiveTrailingTP1 = 1 => will activate the chosen Trailing StopLoss Indicator in TrailingType when reaching TP1

- ActiveTrailingTP1 = 0 => not active

TP2Points: your second Take Profit objective in number of points

PartialCloseTP2Percent: defines the part of your position in percentage you want to close when reaching TP2

ActiveBreakEvenTP2:

- ActiveBreakEvenTP2 = 1 => will move your Stop Loss to BreakEven (your entry Price)

- ActiveBreakEvenTP2 = 0 => not active

BreakEvenTP2Distance: adjust the BreakEven StopLoss (BE-SL) position in points when reaching TP2;

- will be > 0 if you want the BE-SL to be above the Entry Price; for exemple +10 = +10 points above Entry

- will be < 0 if you want the BE-SL to be under the Entry Price; for exemple -10 = -10 points under Entry

ActiveTrailingTP2:

- ActiveTrailingTP2 = 1 => will activate the chosen Trailing StopLoss Indicator in TrailingType when reaching TP2

- ActiveTrailingTP2 = 0 => not active

TP3Points: your third Take Profit objective in number of points

- IMPORTANT: TP3Points = 0 if you want your Trailing Indicator to close the last part of your position if you have set a TP1 and TP2 partial closure

🔔 Want FREE SIGNALS with our tools?

https://t.me/metasignalspro_prorealtime

———————————————————————————————————————————————

* Offer valid for non-professional investors who do not yet have a ProRealTime Trading account, and for all new ProRealTime Trading accounts opened with Interactive Brokers or SaxoBank Denmark.

———————————————————————————————————————————————

CryptomanMP (verified owner) –

This is a just a very important tool for me and proves these guys are traders to propose it;

I have lost so much by being impulsive in my trading; now I just stick to the plan and let the machine execute it;

if you are serious about trading and understand that trading is about money management and letting emotinos out, I can only recommend this stuff.

PenserArnaud (verified owner) –

Very efficient and well thought out stops associated with TrendDecoder they are perfect….

It is possible to use it in Forex with the decimal system, futures and all commodities,

Very good stops and systems. entries on a desired level are possible and especially if you miss a stop in your strategy, the creator can create it or adapt it to you!

Thanks Chris, very nice work !

John Garton (verified owner) –

I have tested this Trade Manager on live trades and with the features that I use turned on, this worked perfectly every time. I sent some queries to the creator and he responded quickly and positively. I understand further features are to be added and will update this review in due course but based on my experience with the current version, I would recommend it without reservation.