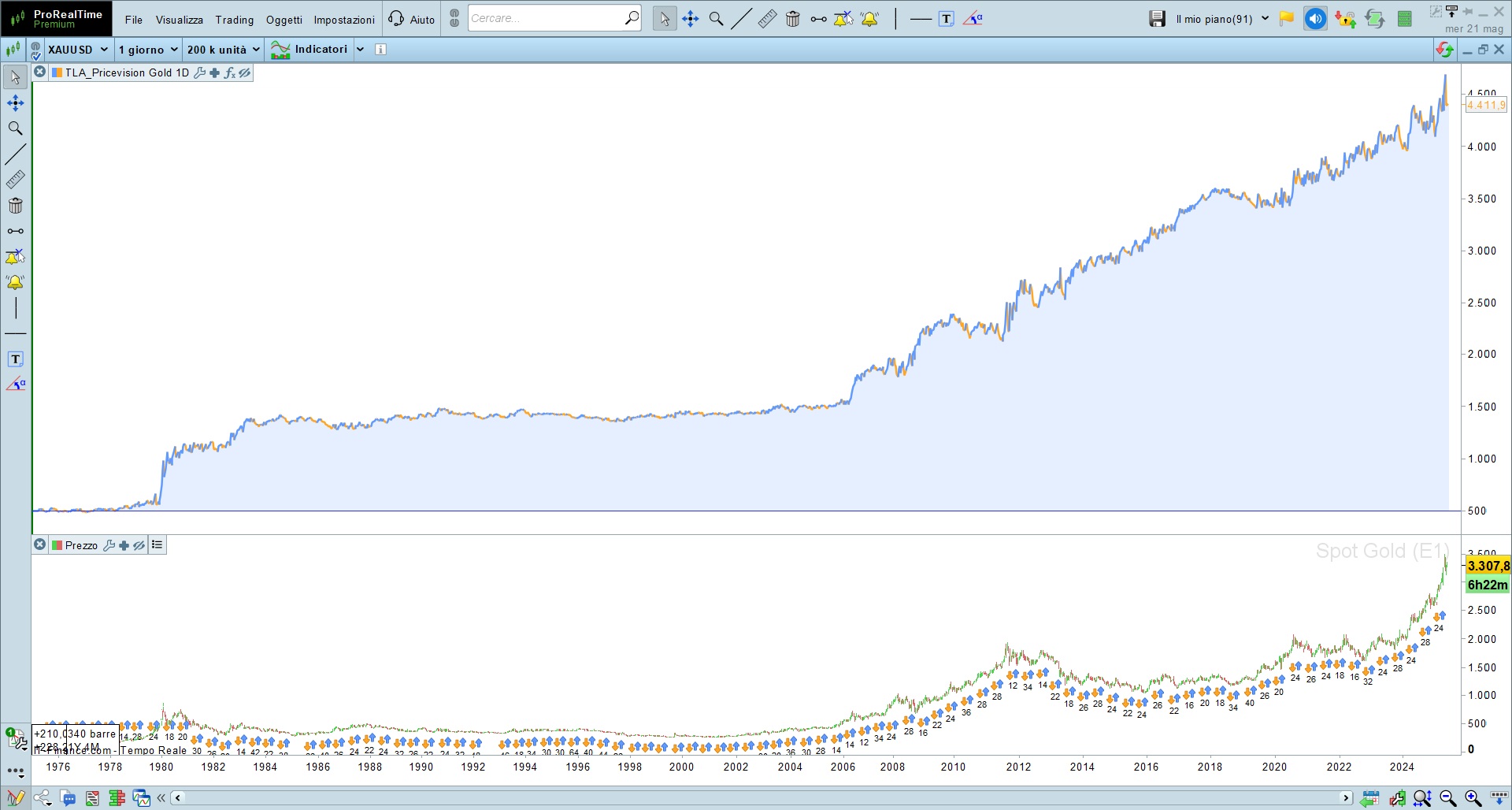

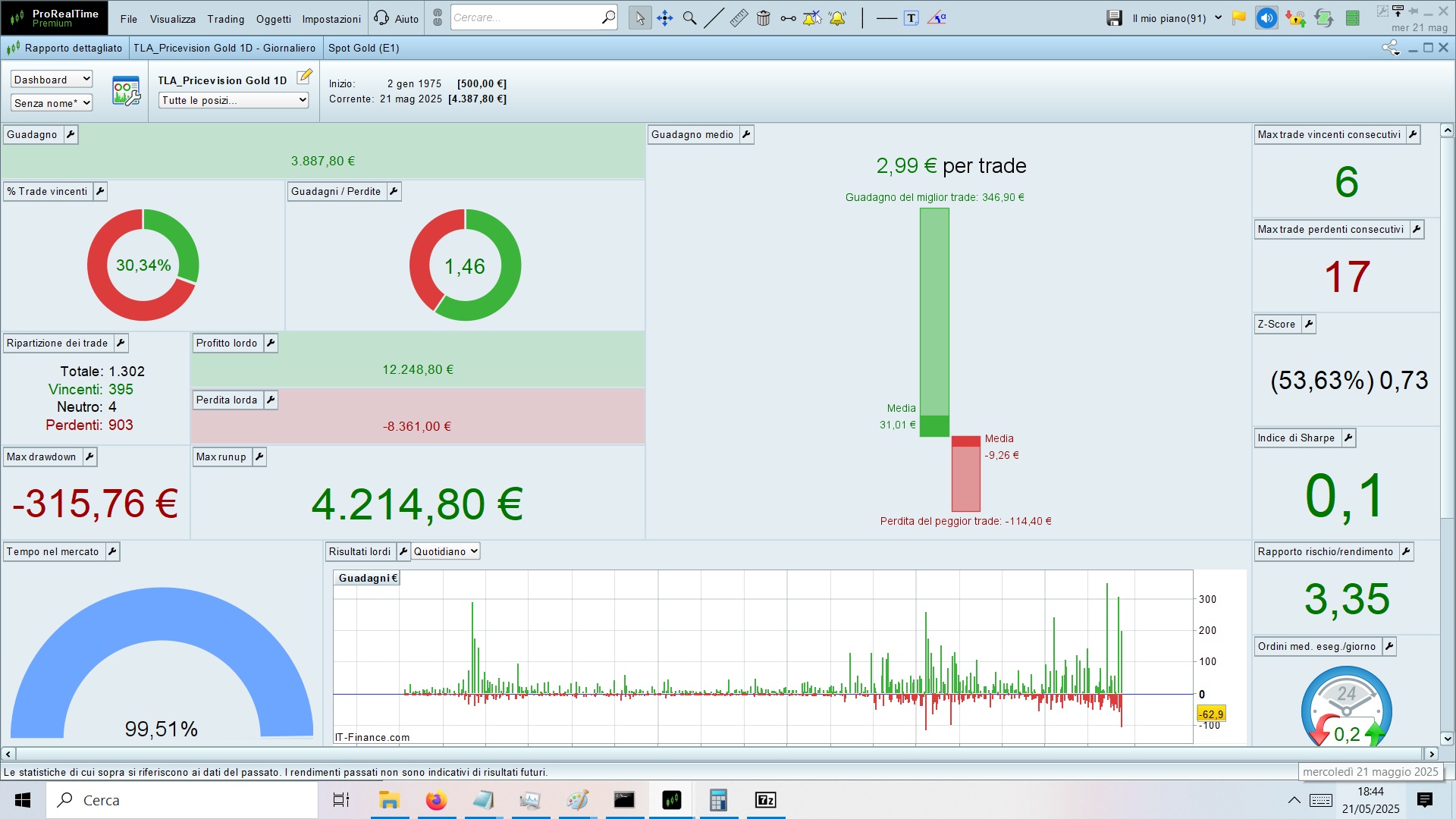

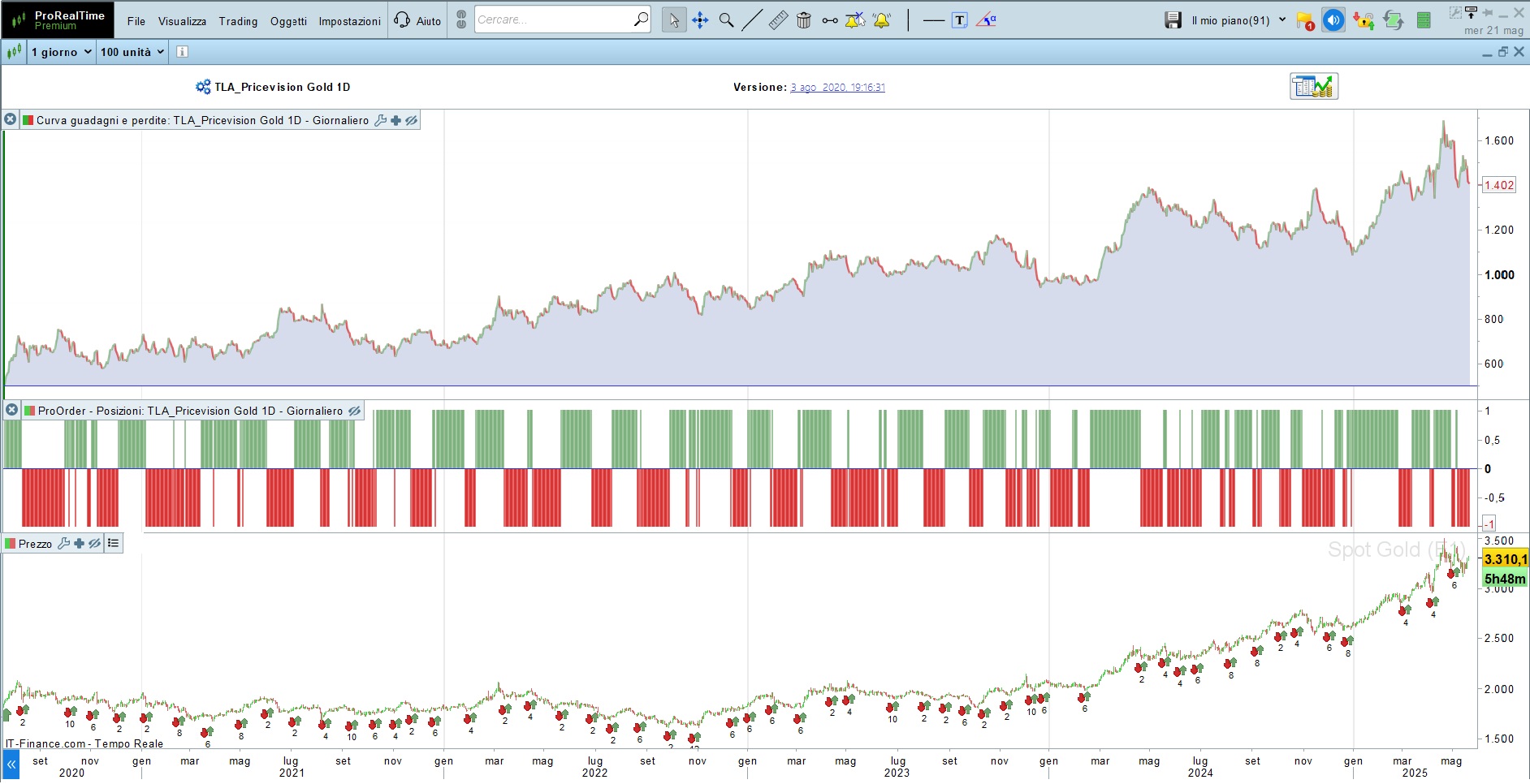

The TLA_Pricevision Gold 1D strategy is an algorithmic trading system developed for the gold market (XAU/USD) using daily candles. The backtest spans from January 2, 1975 to May 21, 2025, starting with an initial capital of €500, and closing with a total equity of €4.387,8 for a net gain of +€3,887.80.

The name PriceVision comes from the combination of “Price” (price) and “Prevision” (forecast), reflecting the strategy’s goal: anticipating market movements by analyzing price divergences and placing strategic orders to capture high-probability trend reversals.

Recommended Minimum Capital:

- GOLD MINI : 800 $

- Minimum Position Size: 2 contracts

- Price: $48 per 6 month, $72 per 1 year

The system operates counter-trend, triggering entries on price divergence signals, and uses multi-level stop orders to distribute risk and increase the chance of catching sustainable reversals.

The strategy is built on three pillars:

-

Historical robustness: Over 50 years of coherent performance

-

Market adaptability: Works in bullish, bearish, or sideways trends

-

Advanced risk control: Progressive entries with small exposure

⚙️ Strategy Features

-

Timeframe: 1D (Daily)

-

Asset: XAU/USD – Spot Gold

-

Strategy type: Counter-trend with divergences

-

Order type: Progressive Stop Orders

-

Risk control: Multi-entry distribution

-

Compatible with: ProRealTime v11+

📊 Detailed Performance (1975–2025)

Overall results:

-

📈 Initial capital: €500

-

💰 Final capital: €4.387,8

-

📊 Net profit: +€3,887.80

-

📉 Max drawdown: -€315.76

-

📈 Max runup: +€4,214.80

-

✅ Total trades: 1,302

-

✅ 395 winning trades (30.34%)

-

❌ 903 losing trades

-

🔁 4 neutral trades

-

-

🟢 Avg. gain per trade: +€2.99

-

🟢 Best trade: +€346.90

-

🔴 Worst trade: -€114.40

-

🔁 Max consecutive winners: 6

-

🔁 Max consecutive losers: 17

-

⏳ Market exposure: 99.51%

- Spread included in the backtest

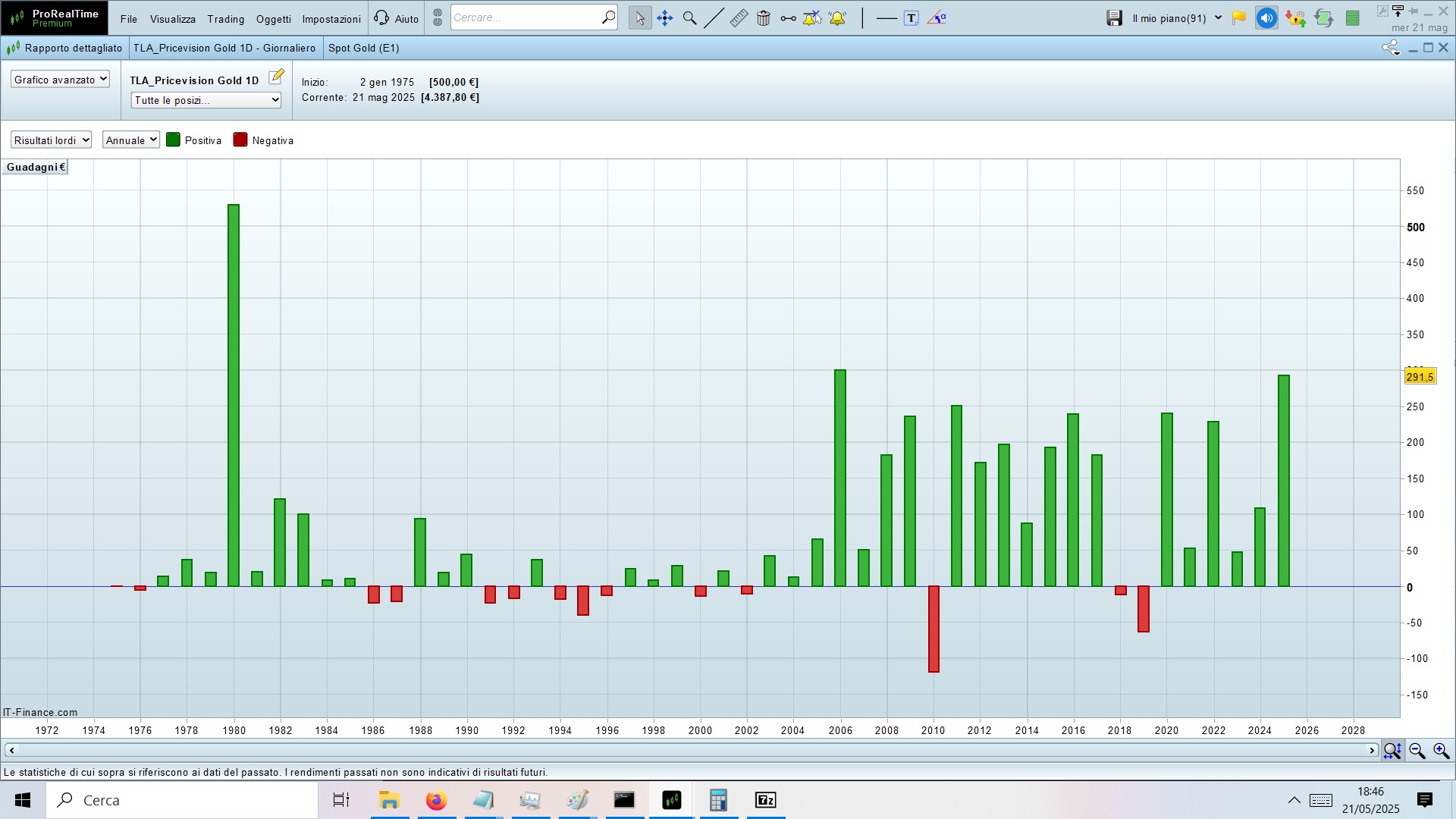

📈 Notable Annual Performance

-

1980: +500% (explosive bull run)

-

2006: +300% (long-term uptrend)

-

2010, 2013, 2020, 2021: over +€200

-

2025 (YTD): +€291.5

-

The strategy delivered positive results in over 85% of the years, including volatile and crisis periods.

🗓️ Tested in real mode

-

Strongest months: January, April, November

-

Weakest months: June, September

-

Effectively captures the cyclical behavior of gold, using algorithmic logic.

👤 Who Is This Strategy For?

-

Algorithmic traders seeking long-term stability and real track record

-

Investors wanting to diversify with gold

-

Systematic traders preferring layered risk management

-

ProRealTime users looking for a ready-to-use daily strategy

💵 Pricing & Terms

Recommended Minimum Capital:

- GOLD MINI : 700 $

- Minimum Position Size: 2 contracts

-

€48 – 6-month plan

-

€72 – 1-year plan (save €24!)

-

✅ 1-month free trial available

Avis

Il n’y a pas encore d’avis.