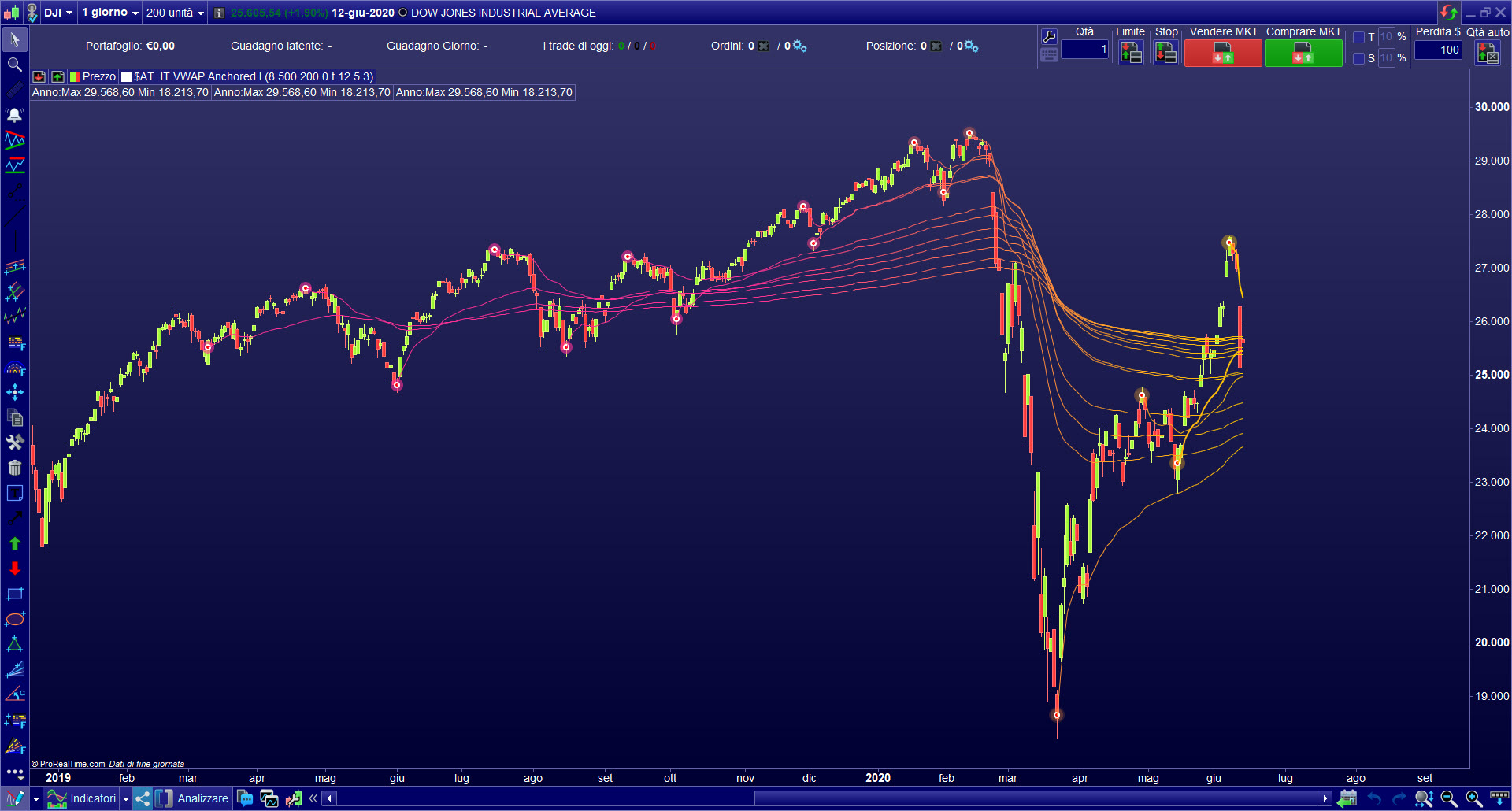

Volume Weighted Average Price (VWAP) is a measure that represents the weighted average between the price and the exchanged volumes. Therefore it gives a perfect indication of the true price of the underlying.

The Swing VWAP indicator is a whole new approach to using VWAP. Indeed, by anchoring it in each new swing (top or bottom) of the price, we obtain a micro market structure which allows us to orient ourselves on the direction of the market and on its average prices which act as magnets (support / resistance ).

The images speak for themselves, we see that the average prices revealed by the VWAP Swing allow us to place ourselves on the right price levels to allow either a re-entry in established trend, or an entry in counter-trend for the reintegration of the price to VWAP clusters.

The Swing VWAP clusters allow to quickly identify the important area which will be irretrievably reworked by the market! This gives us a real advantage over traditional forms of trading operating with “classic” moving averages.

Interface of the Swing VWAP indicator is very simple:

- Depth : Value of the period, between a new maximum and a new minimum. This variable affects the size of the Pattern

- Deviation : It is the maximum of points to discard a new extremum. This variable affects the size of the Pattern.

- Backstep : it is the maximum of bars to discard a new extremum and replace it, if a new one is found.

- nVWAP : select number of anchored VWAP in the past point

- Multicolors: Enable multy colors function

- colorR: select value of RED

- colorG: select value of GREEN

- colorB: select value of BLUE

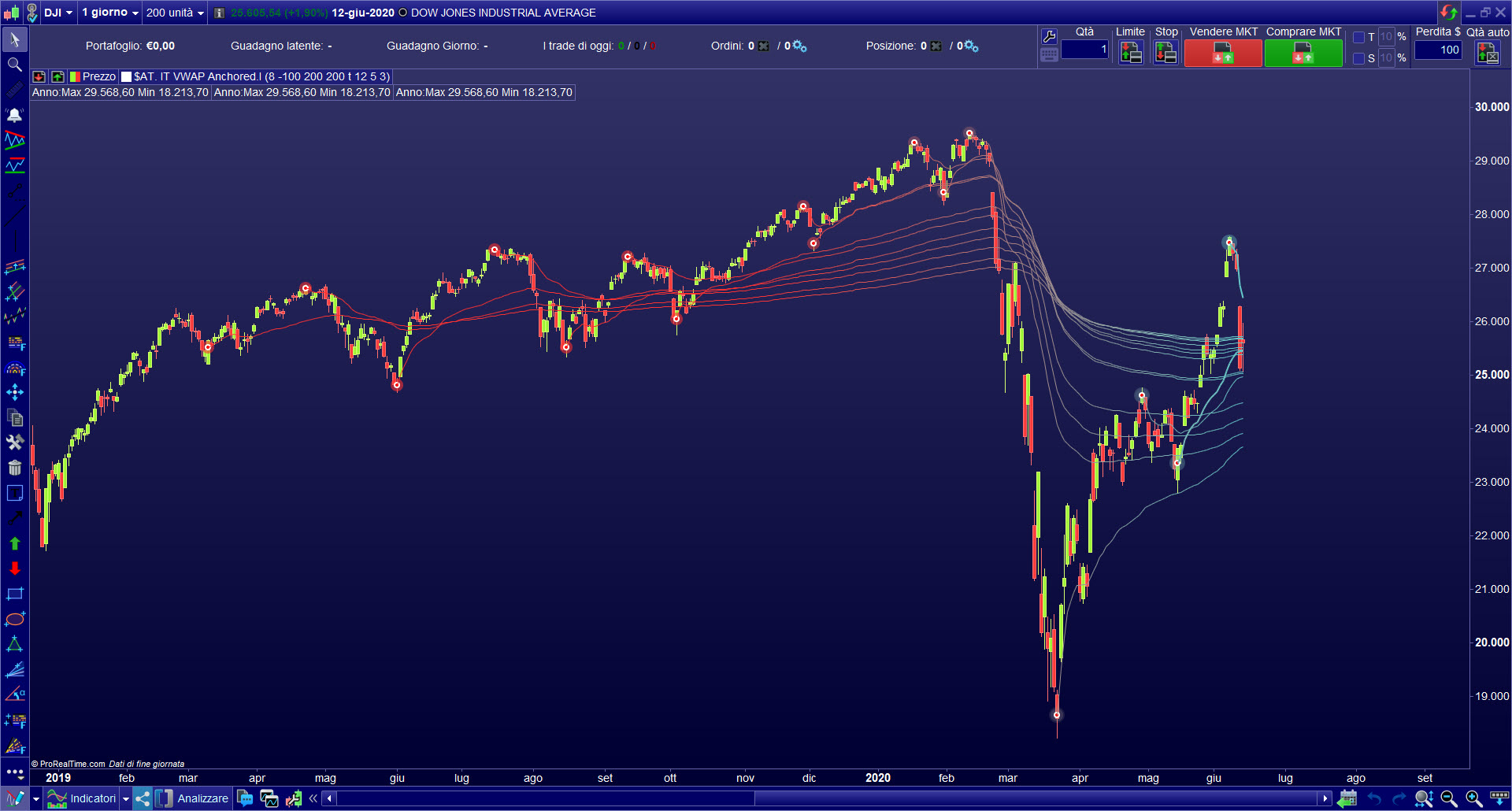

Multicolors:

You can manage a multicolor for your favorite vision, or to differentiate it distinctly from other linear indicators

Swing VWAP indicator, is a great support for swing strategies, trend following strategies and breakout strategies.

Avis

Il n’y a pas encore d’avis.