Having access to precise and up-to-date data can make the difference between a successful investment and a significant loss. This is why we offer, exclusively for ProRealTime, a set of valuable data that breaks down the positioning of CTAs (Commodity Trading Advisors) and financial institutions in a variety of assets, calculated using proprietary quantitative models developed by @InversoresInstitucionales.

- S&P500

- Nasdaq 100

- Dow Jones

- Russell 2000

- Nikkei 225

- VIX

Strategically Structured Information

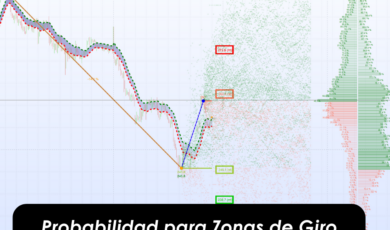

To facilitate the interpretation and application of this information, institutional positioning is grouped into three key levels:

- Top Institutional Level (NIS)

- Market Makers Level (NMM)

- Lower Institutional Level (NII)

These levels act as price triggers, providing clear reference points for your investment decisions. Each of these levels has been designed to offer you a deep understanding of the market, allowing you to identify the asset’s situation at any given moment.

Advantages of the Indicator Pack

- Informed Decision-Making: with access to historical data and precise analysis of institutional positioning, you can make well-founded investment decisions.

- Performance Optimization: identify optimal entry and exit points in your investments based on the behavior of major market players.

- Strategic Diversification: use the data to effectively diversify your investments, minimizing risks and maximizing returns.

- Continuous Access to Updated Data: stay up-to-date with market developments thanks to the weekly update of Institutional Levels.

- Easy Access and Practical Application

For a deeper understanding and practical application of these institutional levels, you can find a detailed description on the @InversoresInstitucionales YouTube channel. This guide will help you interpret the data and use it effectively in your investment strategies.

Don’t miss the opportunity to gain a competitive edge.

Subscribe now and take your investment to the next level!

Avis

Il n’y a pas encore d’avis.