Backtest

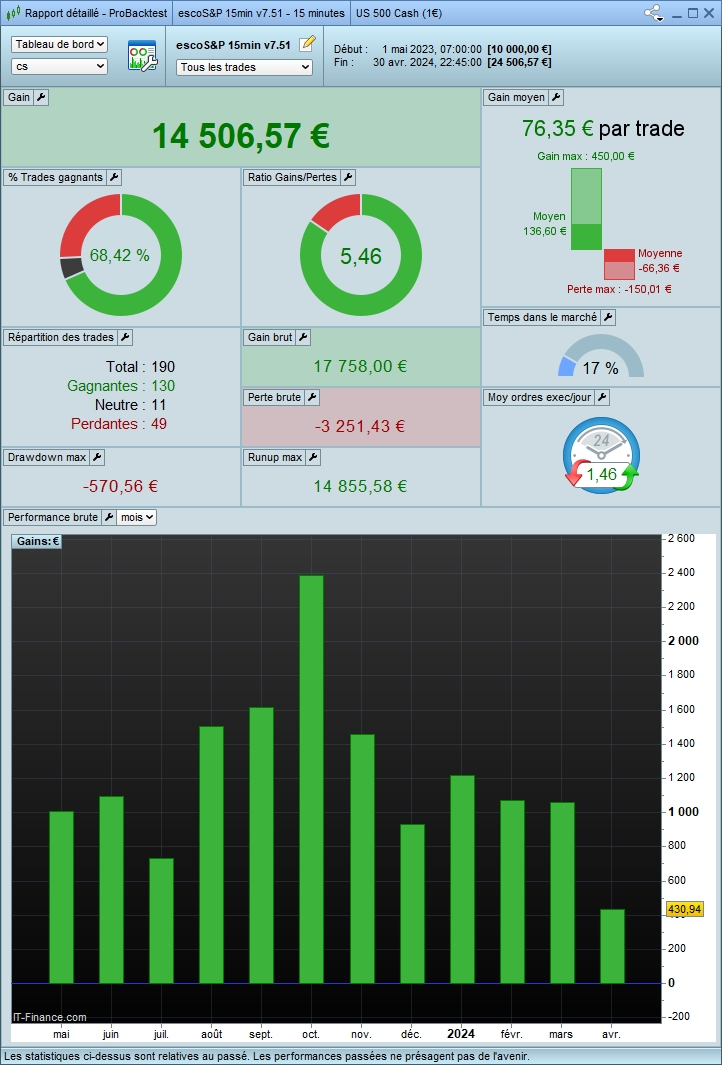

Backtest over 1 year with a capital of €10,000, a risk per trade of 1.5%, and a leverage of 3:

————————-

————————-

Real Performance

Presenting a robot without disclosing its real performance carries a significant risk for you: it may seem effective in backtesting but can lead to substantial losses in real-world conditions.

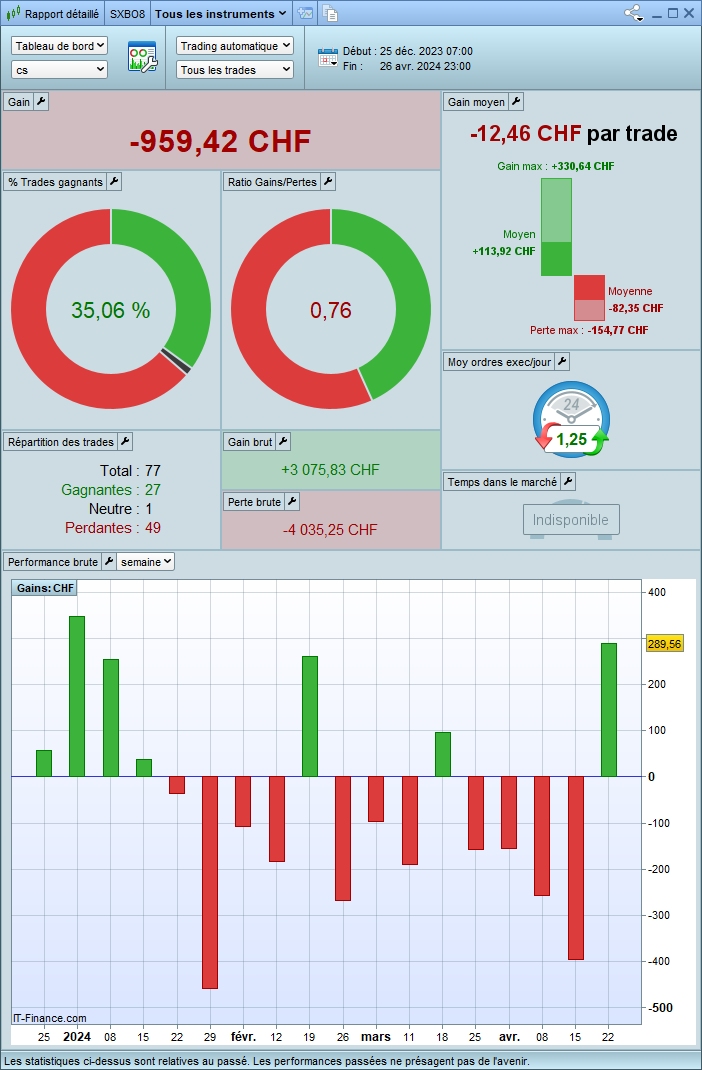

Since April 1, 2024, the detailed report below illustrates this result, achieved with an initial capital of CHF 10,000, a risk per transaction of 1.5%, and a leverage of 3.

Updated every Saturday – Remember to clear your browsing data and refresh the page! Note: you can open this page for more details and to view the list of closed positions and bank account statements.

Johan Söderberg (verified owner) –

Great system and impressive gains. Support has been fantastic, strongly recommend.