Update every Saturday – Please remember to clear your browsing data and refresh the page!

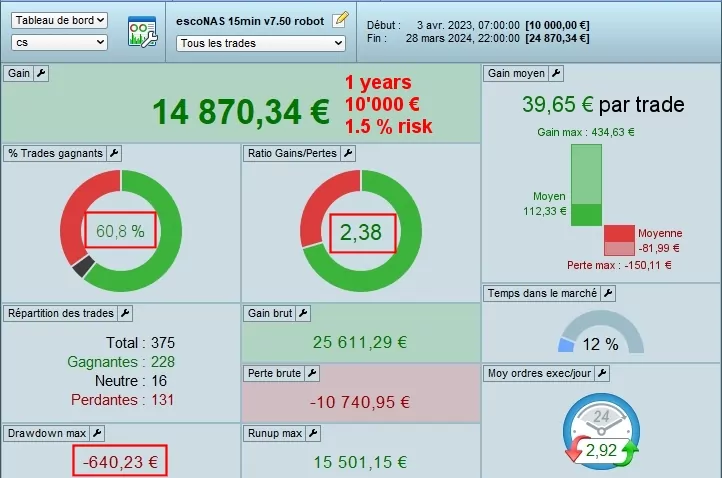

Real performance of our escoNAS robot, since 25.12.2023,

with a capital of 10,000 CHF and a 1.5% risk per trade:

List of closed positions – Bank account statements

For further details, please visit our website: www.escotrading.net.

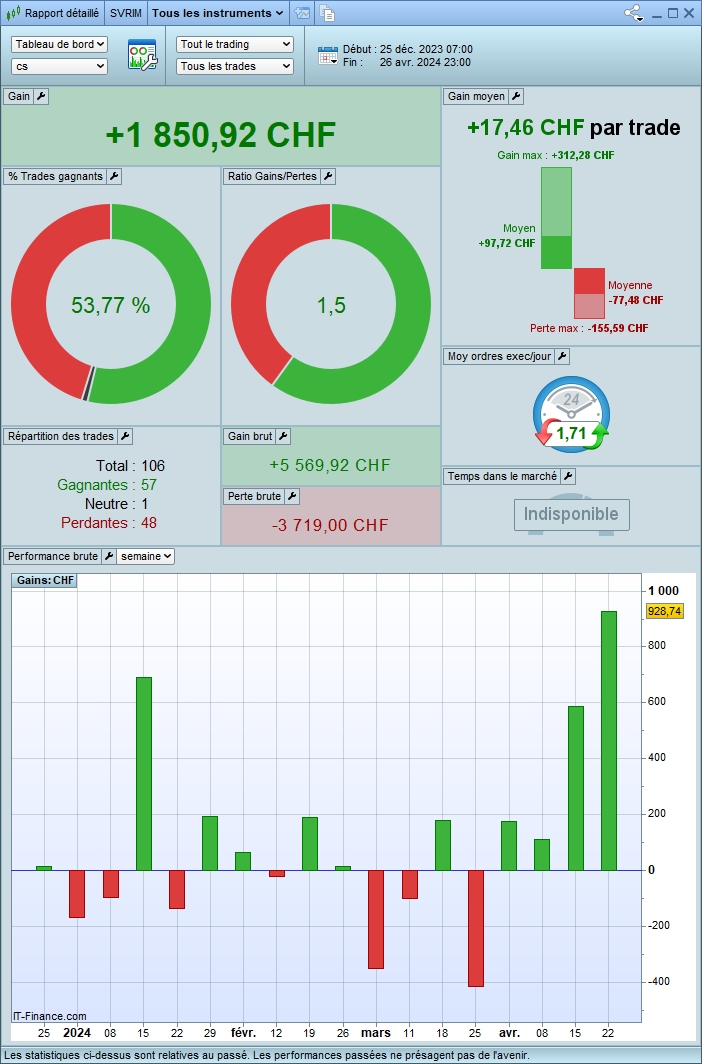

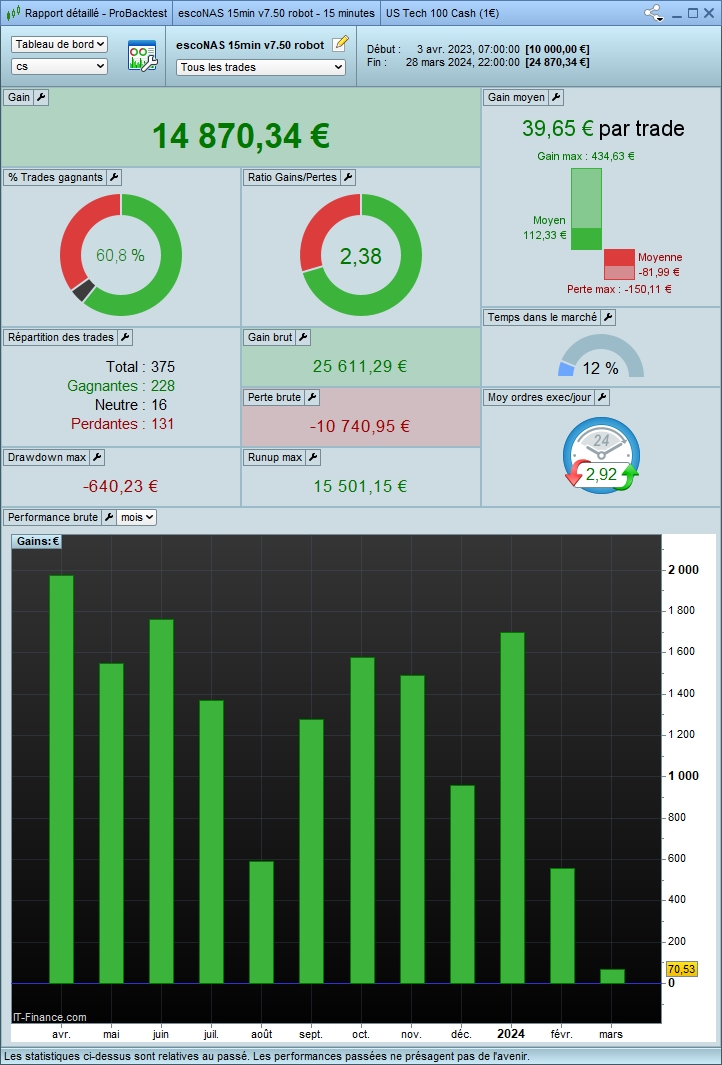

A backtest evaluates the performance of an algorithm with its latest version, currently v7.50, on historical data.

However, it’s important to consider the following two factors that can skew the results:

1. Parameter optimization: It’s possible to optimize the parameters of the robot to maximize results. However, this optimization becomes unavailable as soon as the robot starts trading in real-time.

2. Slippage: There’s a discrepancy between the actual execution price of orders and the one used during backtests.

1-year backtest of our escoNAS robot, with a capital of 10,000 € and a 1.5% risk per trade :

Functioning of Our Trading Robots

Our robots take both long (long) and short (short) positions on the CFDs of the Dax (DE), Nasdaq (USA), and Standard & Poor’s (USA) indices.

1. They initiate a transaction as soon as the trend resumes after a price retracement. During consolidation periods, they aim to avoid triggering trades.

2. They cut losses quickly and let gains run longer. This method has proven effective but is challenging to follow manually due to psychological factors.

3. They continuously assess, in real-time, whether Take Profit, Break Even, Stop Loss, or other conditions are met when a trade is initiated, to promptly close the transaction.

4. They close all positions on the same day to avoid overnight financing fees and to prevent any gaps that may occur overnight or over the weekend.

5. They execute trades on the ProOrder module directly from the ProRealTime platform, using an account with IG Bank (we are not affiliated). Thus, the computer can remain turned off.

Performance

1. Efficient, minimizing losses and maximizing gains.

2. Adaptable, to cope with the ever-changing market conditions.

3. Reliable, for confident use during real-time robot activity.

Money Management

You can exercise effective control over your money management by having the ability to set the risk level per trade based on your personal tolerance.

Required Capital

Recommended 3,000 € or more, minimum 1,200 € / 2,000 € (information).

Outlook

Thanks to the regular improvements we’ve made to our 〉algorithms, we are confident in the quality of our code. Additionally, we ensure continuous monitoring to adjust 〉variables as needed.

Current Version Features, v7.50

Strategy: Based on trend following after a price retracement.

Tactics: Cut losses quickly, let gains run longer.

Money Management: Excellent, thanks to the ability to set the risk per trade as a percentage.

Leverage: Our robots take advantage of leverage.

Compound Interest: Our robots can utilize the magic of 〉compound interest.

Martingale: No similar system, resulting in significantly minimized risk.

Programming: Our algorithms are coded with the ProOrder module of the ProRealTime software.

Data: Provided by IG Bank (we are not affiliated).

Charts: 15-minute candles.

Markets: Dax 40 (DE), Nasdaq (USA), and Standard & Poor’s (USA) indices.

Instrument: CFD.

Trading Type: Day trading.

Hours: Between 8:00 AM, at the earliest, and 10:00 PM, at the latest, on all weekdays.

About Take Profit, Stop Loss, and Break Even Targets

Take Profit (set at 1.5% of entry price) ⇒ Profit Security

Using a fixed take profit helps lock in profits when the price reaches a certain level. This is beneficial to avoid leaving positions open for too long, capturing potential gains before a possible trend reversal.

Stop Loss (set at 0.5% of entry price) ⇒ Risk Management

Using a fixed stop loss based on a predetermined percentage limits losses in case of unfavorable market movements. This contributes to rigorous risk management by automatically exiting a position when the price reaches a pre-established level.

Break Even (activated as soon as potential gain reaches 0.4% of entry price) ⇒ Capital Protection

Break-even, also known as break even, corresponds to the level where the market price reaches the entry price of the trade. By placing an automatic exit at break even when potential gain reaches a certain level, the goal is to protect the invested capital by ensuring that the trade incurs no loss when the index price reverses.

Reviews

There are no reviews yet.