RANGE TRADING STRATEGY

The “Range-Trading” strategy is an approach to trading that leverages price movements within a predefined range, composed of support and resistance levels. This method is particularly suitable for markets exhibiting sideways or consolidating conditions, characterized by price fluctuations within specific limits. On the Dax, with a 15-minute timeframe, we frequently observe this pattern. For Dragon Dax, the “Range-Trading” strategy becomes a powerful asset. The bot is programmed to accurately identify these key support and resistance levels on the Dax with a 15-minute timeframe. When the price approaches the boundaries of this range, Dragon Dax takes a position, anticipating the bounce or the breakout, all with crystalline algorithmic precision, tested and reaffirmed multiple times. Human traders often attempt similar strategies based on “price action,” but they frequently encounter errors because their calculations and timing are not as precise as those of an automatic bot. With Dragon Dax, the outstanding results obtained confirm that this problem is finally resolved!

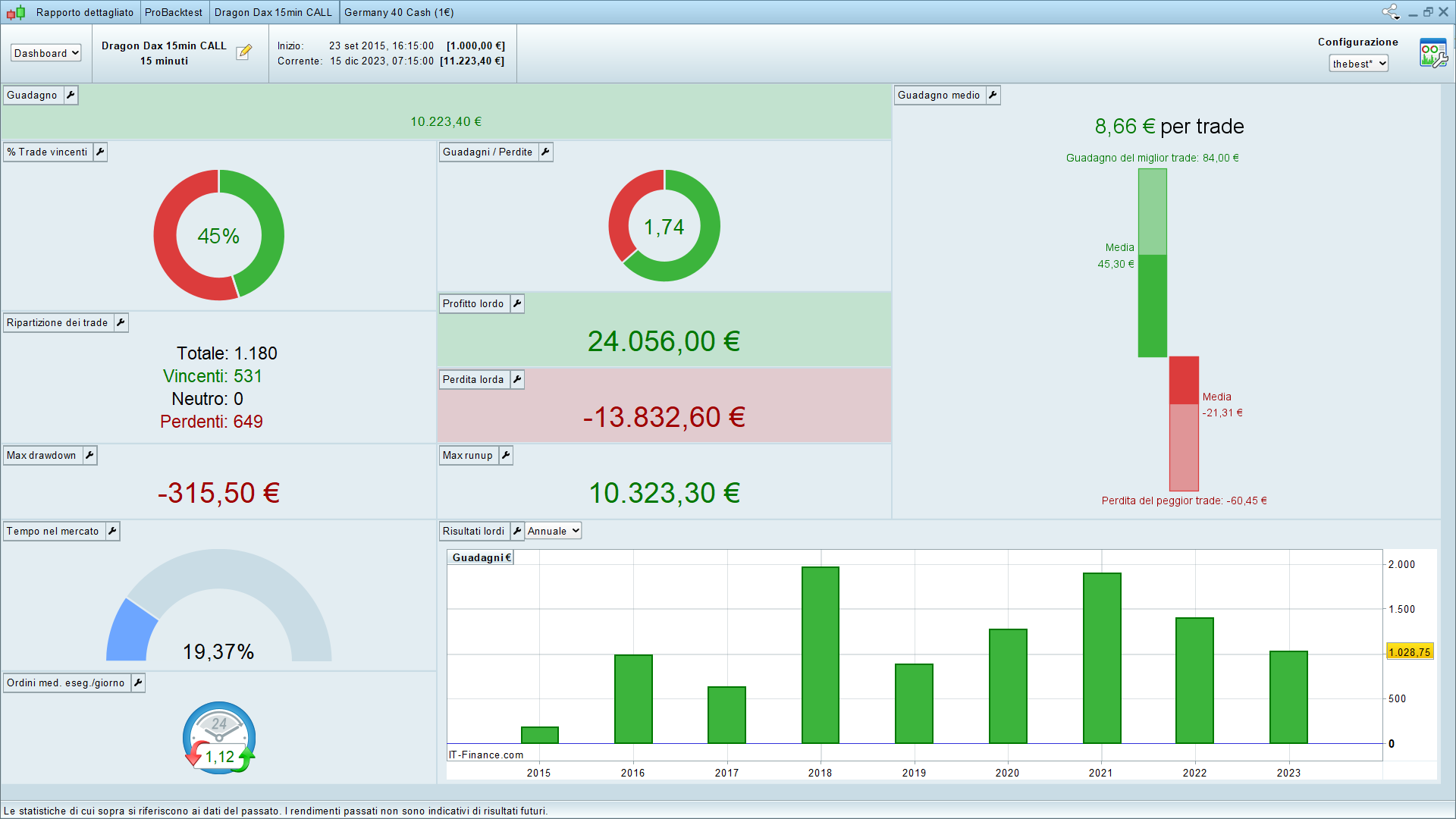

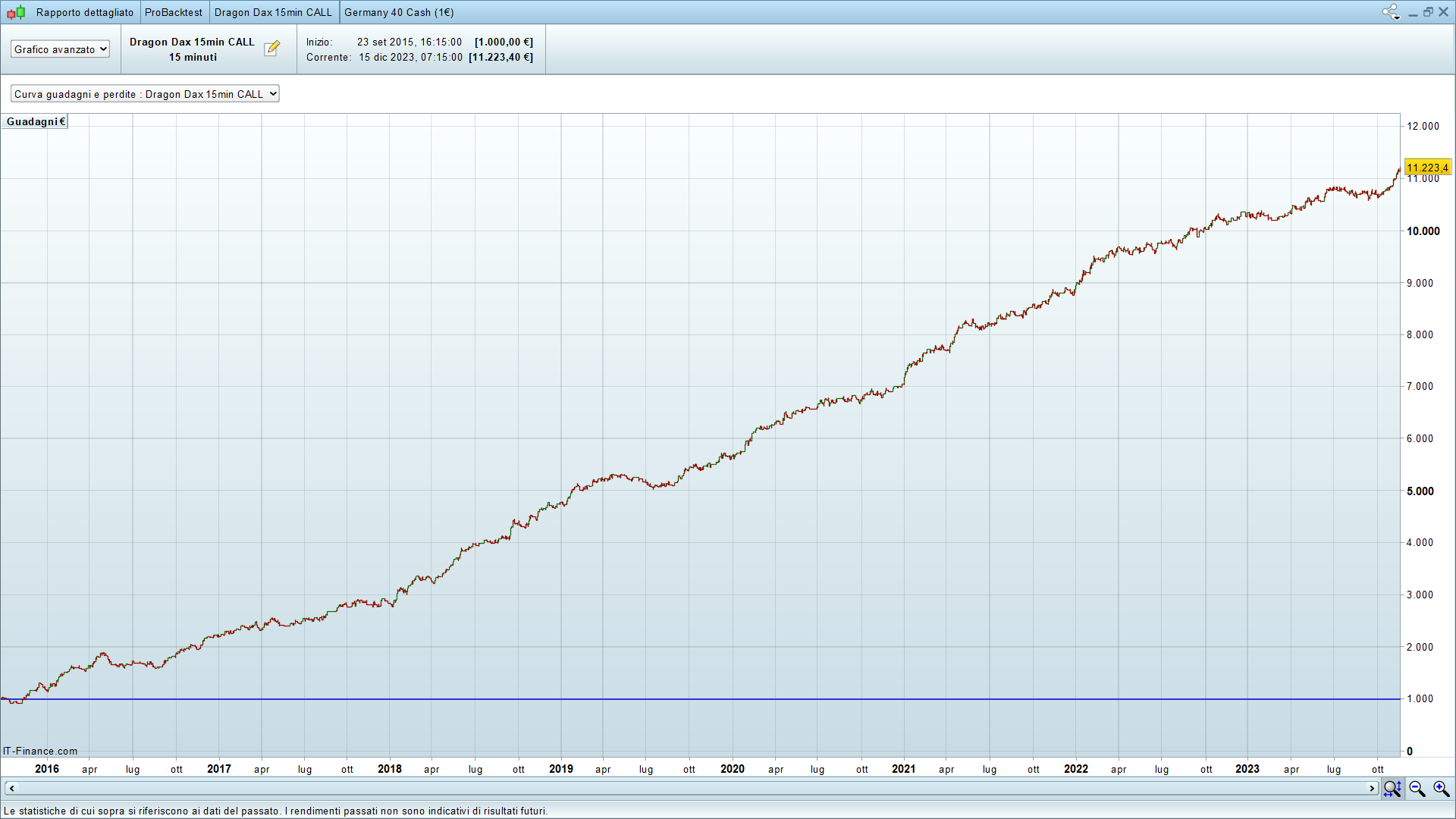

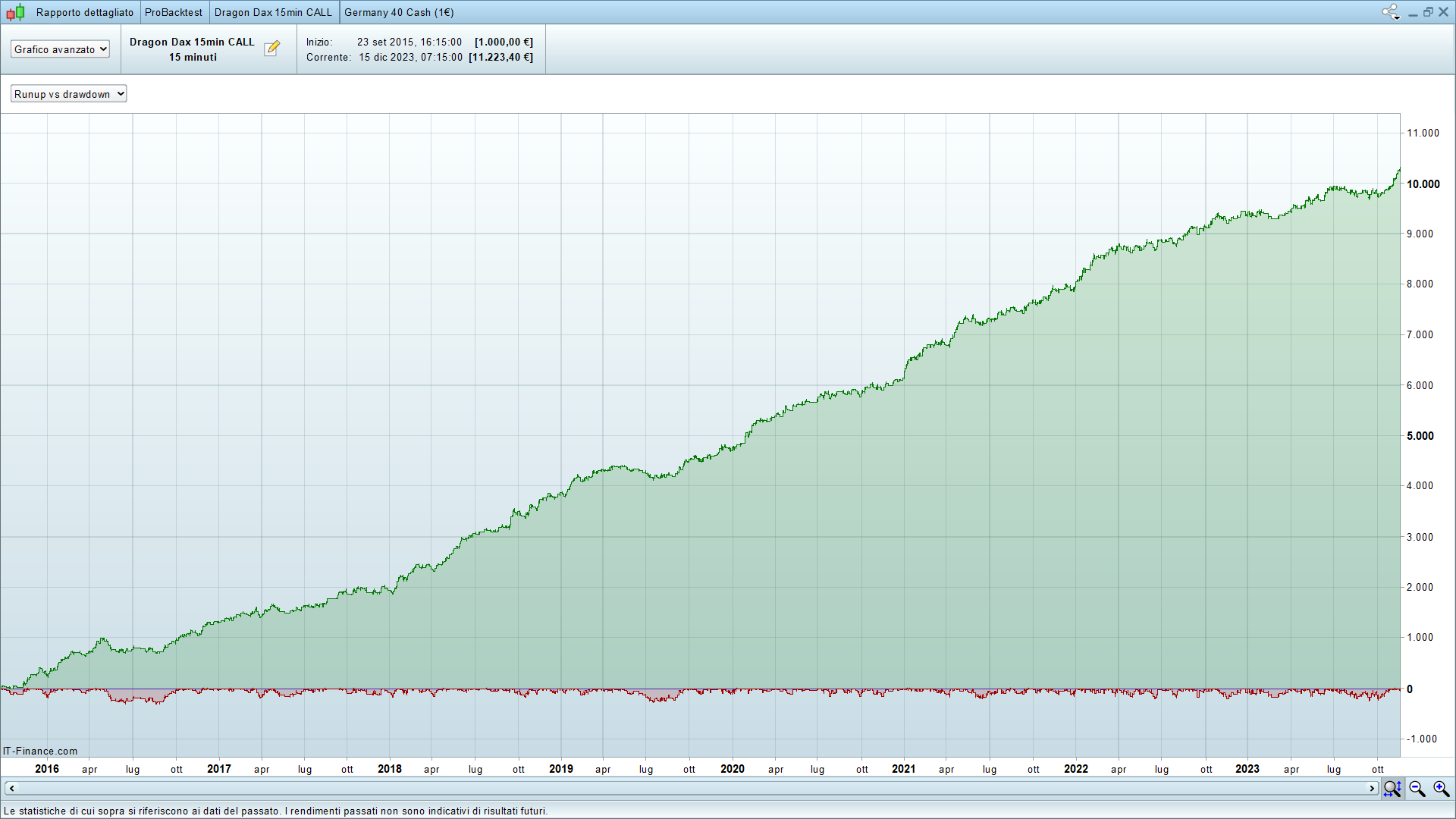

Overview

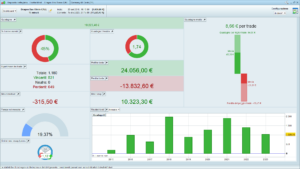

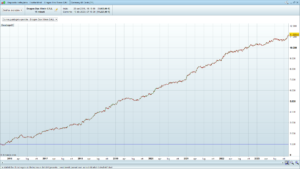

Let’s now see an overview of a backtest of the system in 8 years with an hypothetical capital of €1000 set with the default contract size at 0.5 on the DAX index (€1 per point) with a spread of 2 points. We note that the profit yield is really high, while maintaining a very limited drawdown.

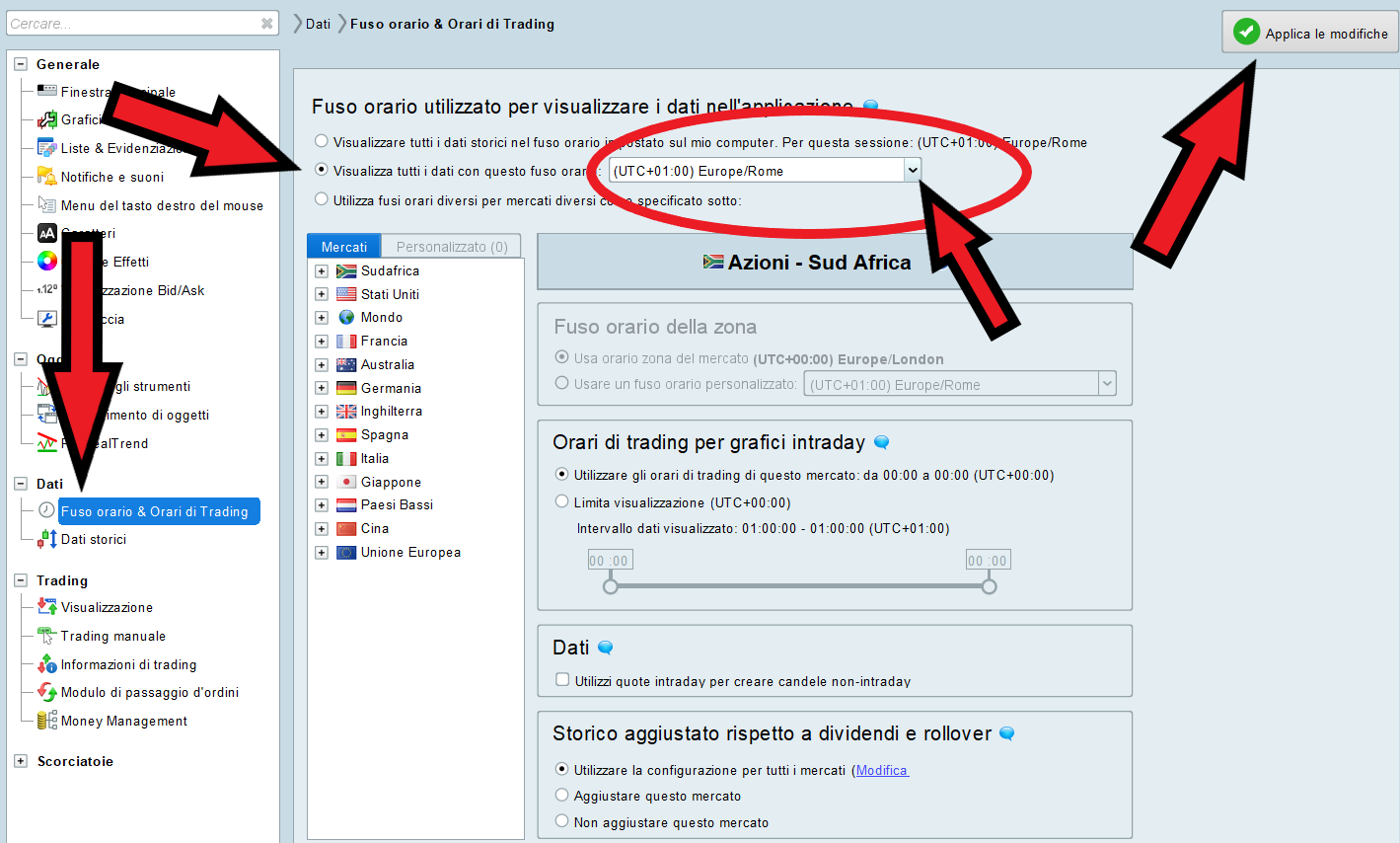

Set ProRealTime Time Zone to UTC+1.00

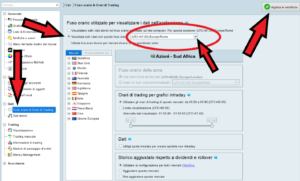

If you are not in the time zone with UTC+1, to obtain the best possible results from Dragon Dax it is recommended to set the ProRealTime time to UTC+1 (Rome, Berlin) as this helps the algorithm to better identify the price ranges best in which to operate in the various most active market sessions and avoid the night sessions in which there is little volatility.

To do this simply go to the settings panel, in the “Time zone and trading hours” section and tick the box to display trading times with UTC+01:00 – then click on the button at the top right to approve the changes (image below)

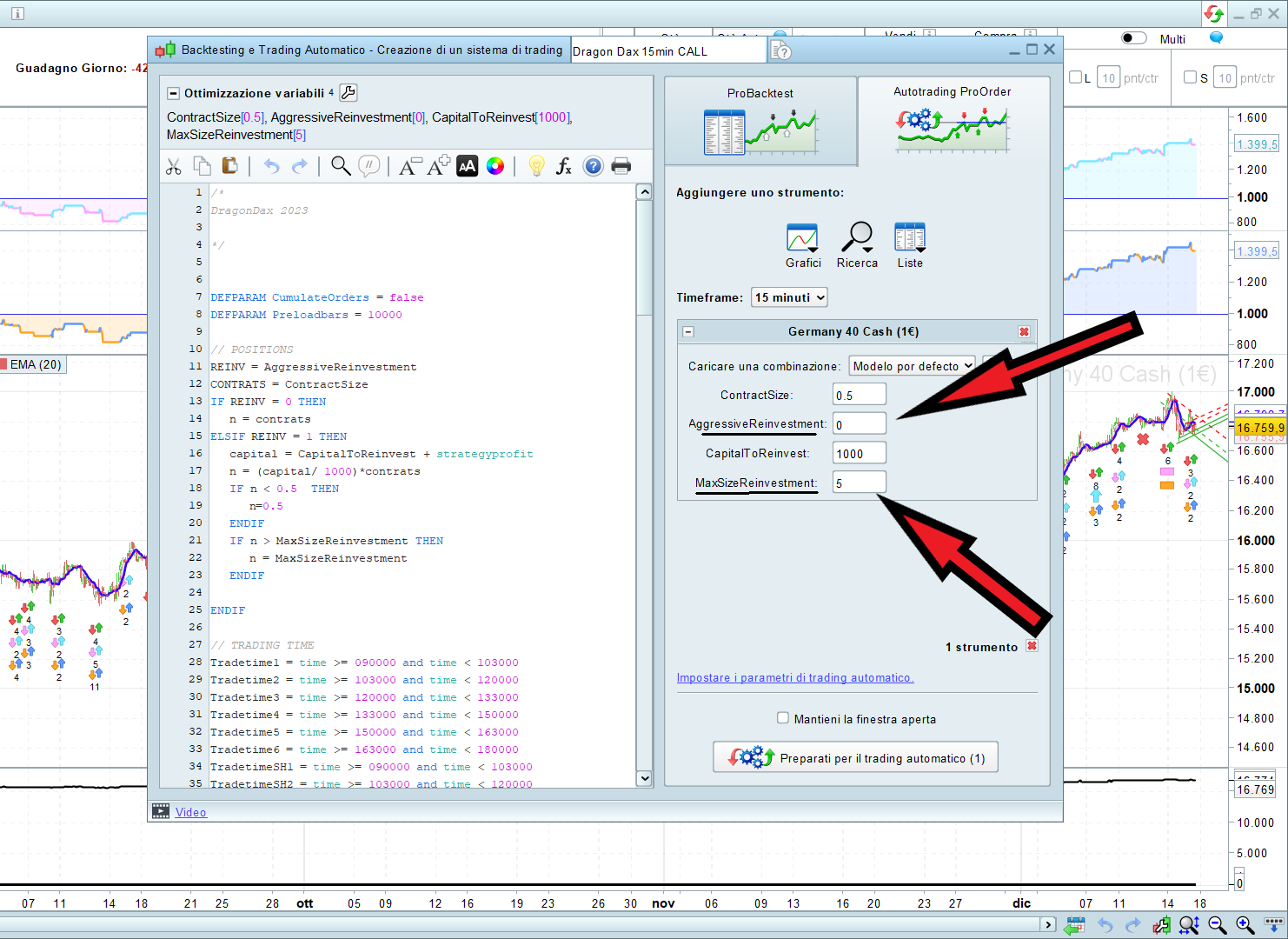

Settings and Aggressive Reinvestment

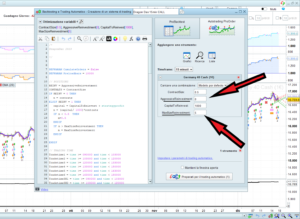

It is possible to decide the quantity of contracts that the bot will carry out for each trade by changing the value of the external variable “ContractSize” which is basically set to 0.5 as the standard quantity and will remain fixed if the reinvestment of profits is deactivated.

The Dragon Dax bot also offers the possibility of automatically reinvesting profits by setting the value of the external variable “AggressiveReinvestment” to 1 and deciding the amount of dedicated capital on “CapitalToReinvest” and the maximum amount of contract size that the bot can reach on “MaxSizeReinvestment”

! ATTENTION !

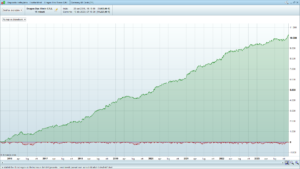

THIS IS A VERY AGGRESSIVE REINVESTMENT as the size for each trade gradually increases progressively up to the limit set on “MaxSizeReinvestment” which will therefore increase significantly in the long run

Above you see a backtest of the Dragon Dax with reinvestment activated and a maximum size set to 5. Huge profits but it also increases the potential drawdown, so think carefully before activating it, only do it if you are expert and know what you are doing, always do it first backtests to evaluate. If you are trading simple, don’t worry, you can also leave the reinvestment deactivated at 0, the results will still give good satisfaction.

Additional info:

The idea of the range trading strategy on the Dax in the Dragon Dax dates back to around 2020 when we were trying to do it manually, then we created an algorithm that is able to do it automatically and the results obtained on the German index have significantly improved! We have constantly tested and improved it and it has never given us any problems, the latest updated version of the bot that we have on our live accounts is from September 2023 and continues to perform excellently.

It doesn’t even require much initial capital as it offers excellent results with low drawdown even with a contract size of only 0.5, so €1000-€1500 starting capital can be enough.

We have decided not to set fixed StopLosses and TakeProfits considering that the best levels for entering and exiting operations depend on the width of the various price ranges in which the market is at that moment, the algorithm is very precise and able to evaluate when to take a position and exit in the best possible market conditions and will do all this by itself so don’t worry, there will be no excessively unbalanced trades with losses.

For any request, send an email to our customer support, we will always be available.

Abrasive (client confirmé) –

I’ve been using this system for 2 weeks so it’s still to early to give a review but the backtest presented (0.5 contract size, without reinvestment) is correct.

The backtest presented by the vendor was performed Dec 15th and the system was released on Dec 18th.

The performance of the bot since release is ~-303€ (1 contract).

The drawdown this year is ~336 € (1 contract).

(This is still only roughly half of the max drawdown presented in the product description, 315€ for 0.5 contracts)

Poor timing to release the bot but there is nothing at this time indicating that there are any issues with the bot itself nor discrepancies in the product description.

r.burger (client confirmé) –

I can not rate just now as I am using this only for 2 weeks. But I can say that the backtest and Live results match during these 2 weeks. Not good for now around -200 but also in the backtest there are some minor periods. The EURUSD did compensate this loss with a good +214. I will give this 2 months for all the Dragon EA’s and give my rating. Ok have to put in a rating, for now average then.