DRAGON DOW PRO IDEA

The Dow Jones index is generally considered a trend follower; therefore, in Dragon Dow Pro, we have developed an algorithm that primarily operates on breakouts. This does not mean that on the DJ, periods of short-term corrections or reversals cannot occur because, like all financial markets, it can be strongly influenced by a variety of factors, including economic news, geopolitical events, and other variables, leading to temporary price movements outside the main trend direction. This can be deceptive and make a primarily trend-following strategy unsuccessful. However, this is unlikely to happen with our trading system in action because we have thoroughly studied and analyzed the Dow Jones index. We have created and refined an algorithm that can cope even with the most unexpected changes in market perspectives!

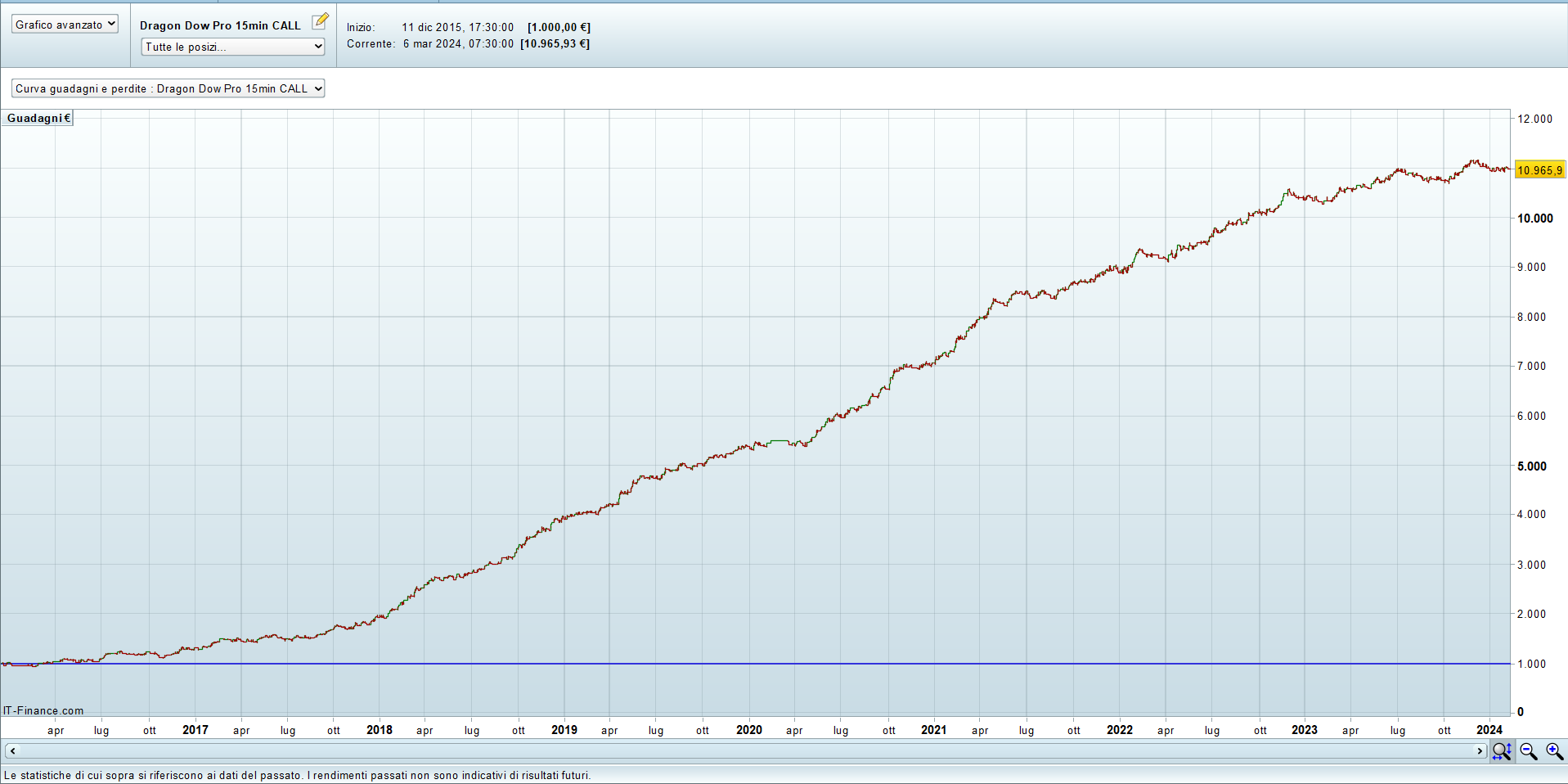

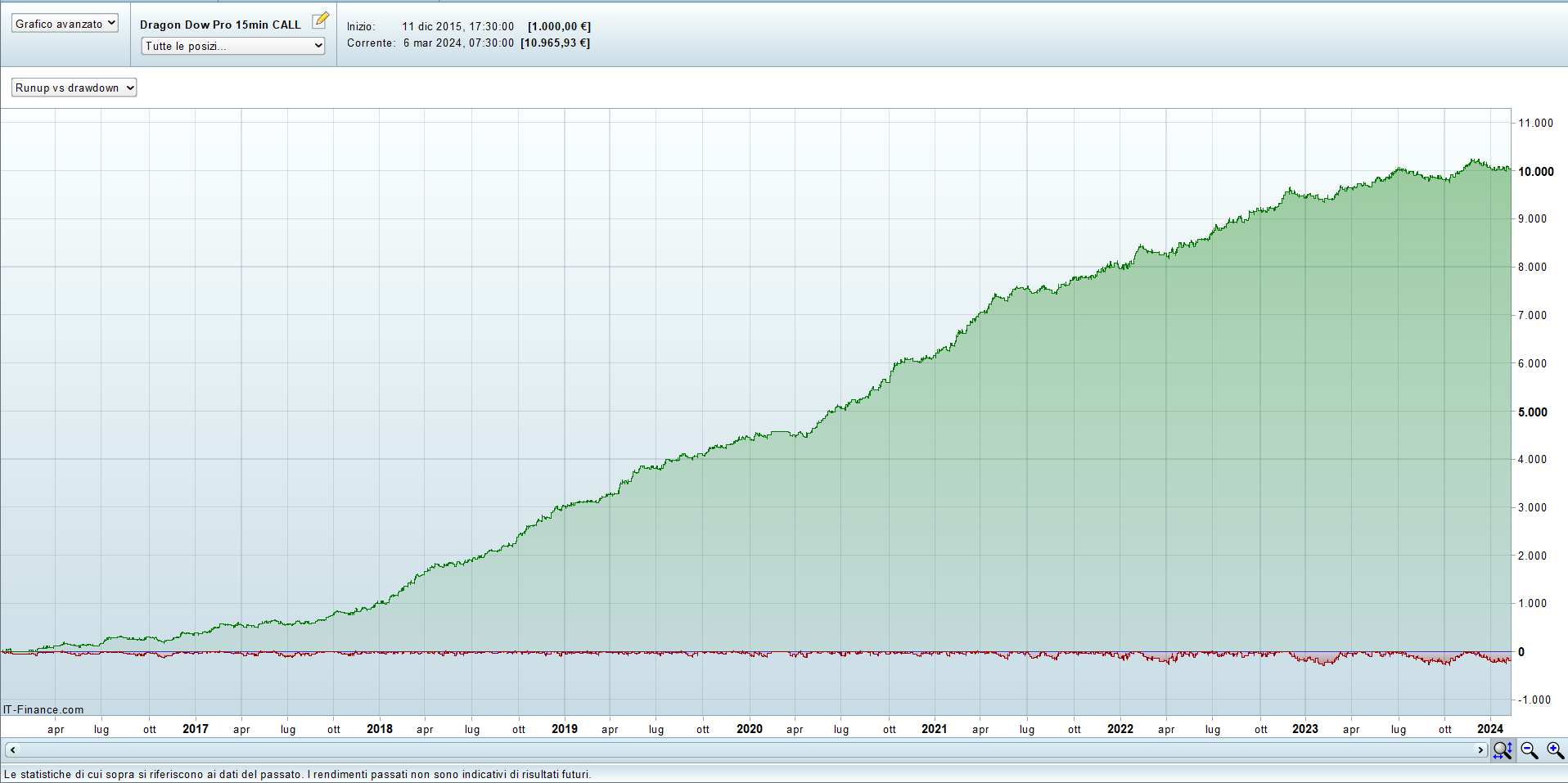

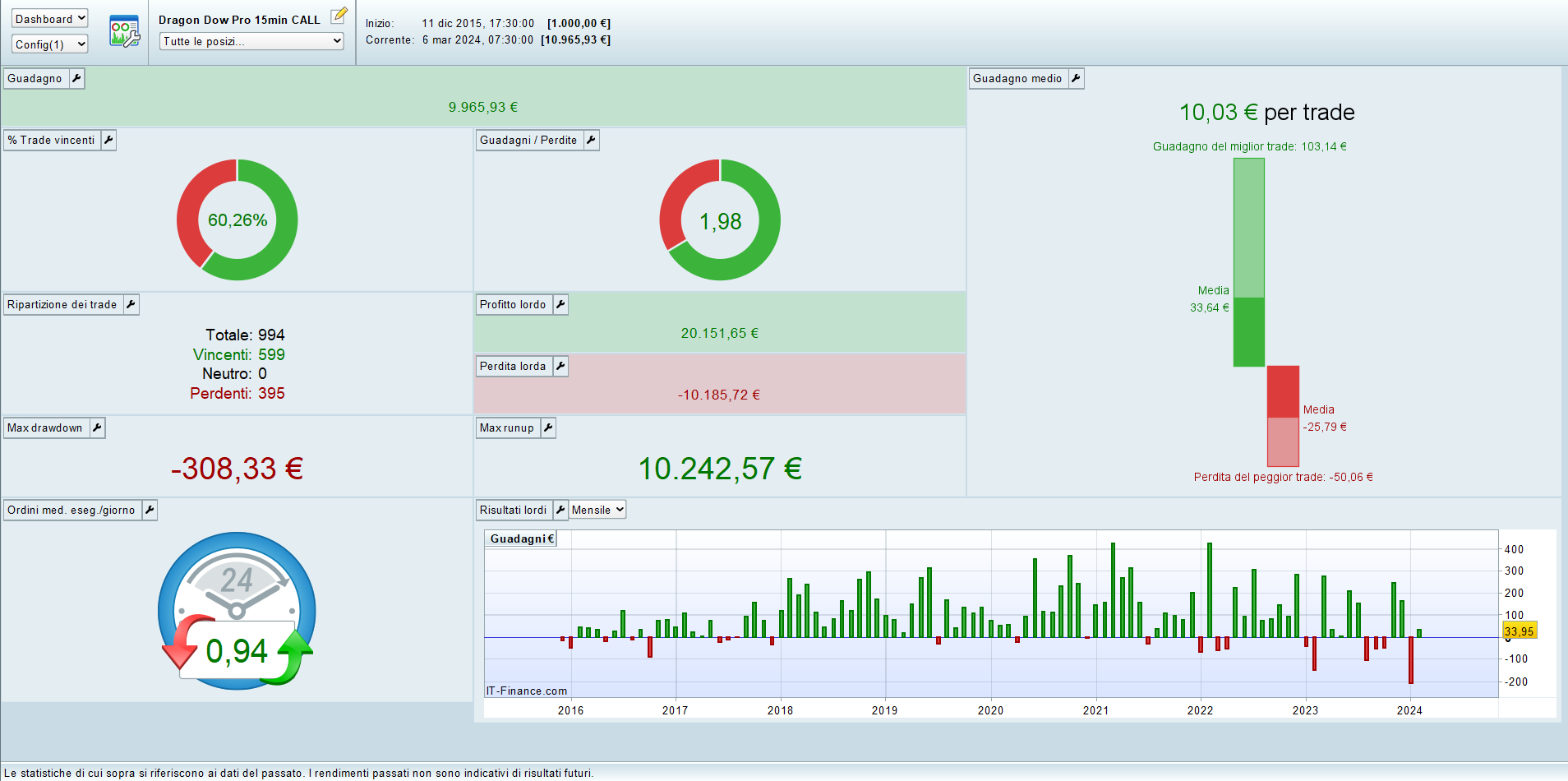

OVERVIEW

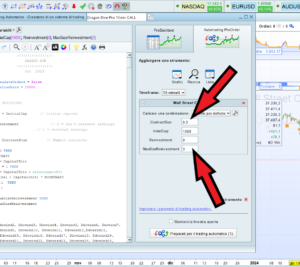

Here we can see data from a backtest of approximately 9 years with a fixed contract size of 0.2 on “Wall Street Cash (€1 per point)” with a spread of 2 points. You immediately notice that there is an incredibly low drawdown and constant return over time, making a low-risk trading system accessible to everyone even with little capital.

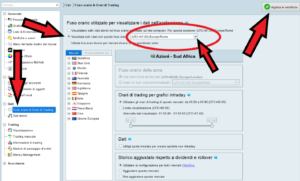

Set ProRealTime Time Zone to UTC+1.00

If you are not in the time zone with UTC+1, to obtain the best possible results from Dragon Dow Pro it is recommended to set the ProRealTime time to UTC+1 (Rome, Berlin) as this helps the algorithm to better identify the price ranges best in which to operate in the various most active market sessions and avoid the night sessions in which there is little volatility.

To do this simply go to the settings panel, in the “Time zone and trading hours” section and tick the box to display trading times with UTC+01:00 – then click on the button at the top right to approve the changes (image below)

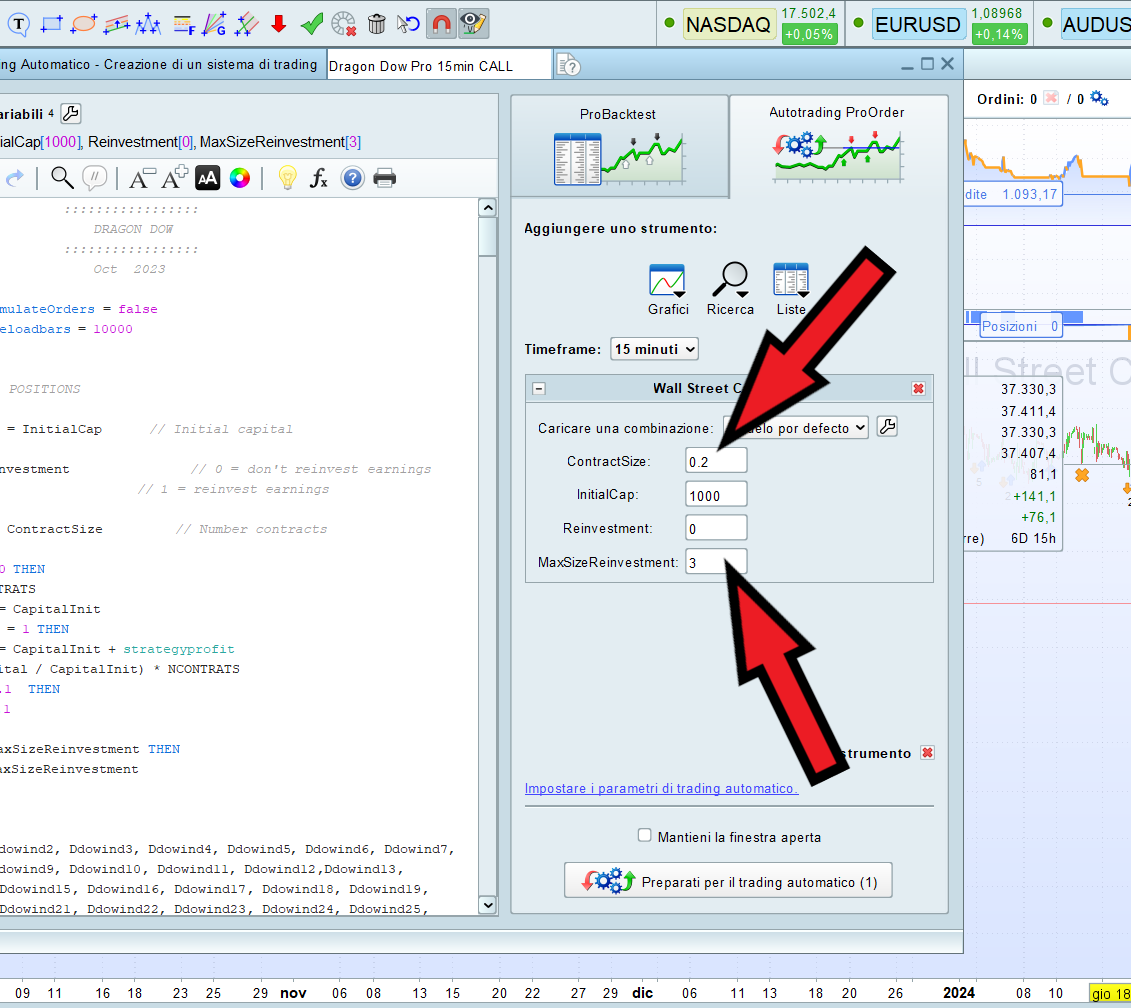

Settings and Aggressive Reinvestment

It is possible to decide the quantity of contracts that the bot will carry out for each trade by changing the value of the external variable “ContractSize” which is basically set to 0.2 as the standard quantity and will remain fixed if the reinvestment of profits is deactivated.

The Dragon Dow bot also offers the possibility of automatically reinvesting profits by setting the value of the external variable “Reinvestment” to 1 and deciding the amount of dedicated capital on “InitialCap” and the maximum amount of contract size that the bot can reach on “MaxSizeReinvestment”

! ATTENTION !

THIS IS A VERY AGGRESSIVE REINVESTMENT as the size for each trade gradually increases progressively up to the limit set on “MaxSizeReinvestment” which will therefore increase significantly in the long run

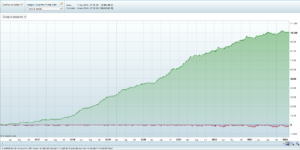

Above you see a backtest of the Dragon Dow Pro with reinvestment activated and a maximum size set to 3. Huge profits but it also increases the potential drawdown, so think carefully before activating it, only do it if you are expert and know what you are doing, always do it first backtests to evaluate. If you are trading simple, don’t worry, you can also leave the reinvestment deactivated at 0, the results will still give good satisfaction.

Additional info:

It doesn’t even require much initial capital as it offers excellent results with low drawdown even with a contract size of only 0.2, so €1000 – €1500 starting capital can be enough.

We have decided not to set fixed StopLosses and TakeProfits considering that the best levels for entering and exiting operations depend on the price strenght and others various signals in which the market is at that moment, the algorithm is very precise and able to evaluate when to take a position and exit in the best possible market conditions and will do all this by itself so don’t worry, there will be no excessively unbalanced trades with losses.

Do a backtest before running it live to make sure everything is set up correctly and understand roughly what results to expect.

For any request, send an email to our customer support, we will always be available.

didiosousa84 (proprietario verificato) –

Excellent trading system!!!