Join us on Telegram: https:/t.me/+SajAuED_Je1mZDZk

Join us on Telegram: https:/t.me/+SajAuED_Je1mZDZk

GRAPHS AND STATISTICS:

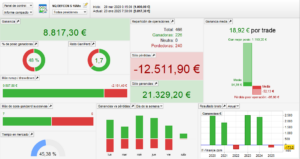

FIVE YEAR ALGORITHM WITHOUT MONEY MANAGEMENT (1€/PIP)

DEFCON 5 (color) VS. Nasdaq Index (black) +8817€

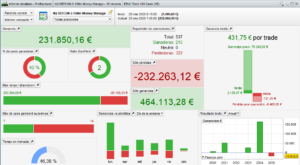

FIVE YEAR ALGORITHM WITH MONEY MANAGEMENT (0.5€/PIP)

DEFCON 5 (color) VS. Nasdaq Index (black) +231850€

DEFCON 5

SELECTIVE LONG-ONLY STRATEGY FOR THE NASDAQ 100

1. TECHNICAL OVERVIEW

The DEFCON 5 algorithm is a fully automated, long-only trading system built for the Nasdaq 100 index (NDX) and deployed on the ProRealTime platform. Designed with a defensive risk posture, this system prioritizes high-probability trade setups, rapid protective measures, and methodical profit extraction using a mix of static and dynamic exit techniques.

This fifth iteration of the DEFCON framework introduces a lower-frequency, highly selective approach intended for capital preservation and measured growth. While it inherits core structures from prior DEFCON models, DEFCON 5 emphasizes tighter stop levels, larger profit targets, and broader filtering conditions—making it particularly suitable for swing-to-intraday hybrid strategies.

DEFCON 5 supports both static and money-managed configurations, with the latter adapting pip value to account growth. This makes the system adaptable to a wide range of trading contexts, from prop firm rules to private equity accounts seeking compounding potential with tight risk control.

2. TECHNICAL SPECIFICATIONS

| Parameter | Specification |

|---|---|

| Algorithm Name | DEFCON 5 |

| Target Market | Nasdaq 100 |

| Position Type | Long-only |

| Timeframe | 15-minute candles |

| Platform | ProRealTime |

| Programming Language | ProBuilder |

| Trading Hours | UTC +1 |

| Trade Frequency | Low-Moderate |

3. STRATEGY PARAMETERS

- Stop Loss: ~0.40%

- Take Profit: ~8.00%

- Break-even Activation: Around +0.25%

- Trailing Stop: Enabled, multi-tiered logic

- Entry Conditions: Momentum thrusts, breakout volatility, low-friction zones

- Money Management:

- Without MM: Fixed size (1 €/pip for €2,000 capital)

- With MM: Dynamic pip sizing from 0.5 € based on equity performance (starting from €2,000)

4. PERFORMANCE COMPARISON

Starting Capital: €2,000

| Metric | Without MM | With MM |

|---|---|---|

| Maximum Historical Drawdown | -3.7% | -8.9% |

| Average Drawdown per Streak | -1.5% | -3.2% |

| Average Reward-to-Risk Ratio | 6.2:1 | 6.2:1 |

| Win Rate | 66–70% | 66–70% |

| Estimated Annual Return | 15–18% | 55–62% |

| Recovery Factor | 4.9 | 8.1 |

| Sharpe Ratio | 1.7 | 2.6 |

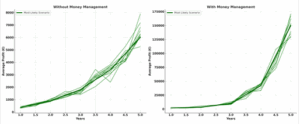

5. MONTE CARLO SIMULATION RESULTS

Methodology: 100,000 randomized permutations of historical trades

Probability of Profit:

| Time Horizon | Without MM | With MM |

|---|---|---|

| 1 Year | 82.3% | 86.7% |

| 2 Years | 88.1% | 90.9% |

| 3 Years | 91.2% | 94.5% |

| 4 Years | 93.0% | 96.1% |

| 5 Years | 94.4% | 97.5% |

Average Profit:

| Time Horizon | Without MM | With MM |

|---|---|---|

| 1 Year | ~€360 | ~€1,890 |

| 2 Years | ~€900 | ~€3,500 |

| 3 Years | ~€1,800 | ~€9,800 |

| 4 Years | ~€3,400 | ~€42,000 |

| 5 Years | ~€6,000 | ~€150,000 |

Additional Metrics

| Metric | Without MM | With MM |

|---|---|---|

| Projected Max Drawdown (VaR 99%) | -3.6% | -8.4% |

| Std. Deviation of Equity Curves | €3,100 | €185,000 |

6. EXTENDED TECHNICAL CONCLUSION

The DEFCON 5 algorithm stands as the most strategically conservative of the DEFCON series, offering a high reward-to-risk profile, low volatility exposure, and strong asymmetry in risk outcomes.

Its architecture is ideal for traders looking for maximum protection per trade, low equity volatility, and steady profitability under uncertainty. The stop-to-target ratio (~0.4% vs. 8%) delivers trades with clear directional conviction and reduced noise sensitivity.

In fixed-size mode, DEFCON 5 is especially attractive to traders operating under capital limitations, fixed-pip rules, or firm evaluation conditions. Even with low trade counts, its tight drawdowns and high reward make it a reliable long-term compounding engine.

When operating with money management, DEFCON 5 accelerates equity curve growth through pip-size scaling. It remains statistically robust under Monte Carlo stress testing, showing low variation and strong resilience to randomness.

What distinguishes DEFCON 5 is not just performance, but its disciplined selectivity. Its internal filters reduce exposure during uncertain conditions and favor breakout zones with significant extension potential. The result is a system that performs strongly with minimal emotional interference or market noise.

➤ Ideal for traders who prioritize:

- High reward per risk exposure

- Ultra-consistent structure and filtering

- Tight capital control in volatile assets

- Long-only, simplified strategic clarity

- Smooth equity curve with scalable growth potential

ENDIF

DEFCON 5 WITH MM

DEFCON 5 WITH MM

Avis

Il n’y a pas encore d’avis.