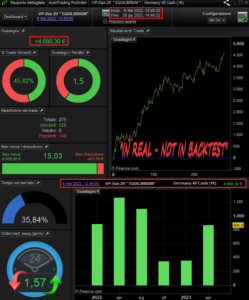

This algorithm is used on a “real account”

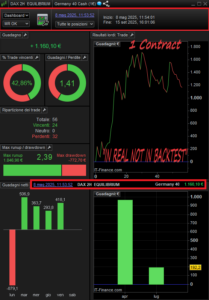

Only One Contract is used in the real trading system

////////////////////////////////////////////////////////////////////////////////////////

SCROLLING BELOW YOU WILL FIND ALL THE LIVE SHOWN AND NOT ONLY AND EXCLUSIVELY BACKTEST OR EXCEL NUMBERS

////////////////////////////////////////////////////////////////////////

BELOW IN THE ATTACHMENT YOU WILL FIND ALL THE PERFORMANCES OF THE BOTS IN MY PORTFOLIO

/////////////////////////////////////////////////////////////////////////////////////////

From January 1st to December 31th 2025

///////////////////////////////////////////////////////////////////////////////////////////

Product description :

Updates to the Dax 2H EQUILIBRIUM it will be shipped free of charge during the subscription period.

The market is constantly changing, to stay up to date with the changing market, the Dax 2H EQUILIBRIUM algorithm will be constantly monitored and updated to obtain an improvement in current performance.

– The Trading System is effective with both Long and Short operations

– Free choice on the number of contracts to be used with a simple instruction downloadable in the Download

– Backtesting performed until November 3, 2017

At the bottom of the page, I attach the original made on November 3, 2017, as you can see. The gain has always been constant since November 3, 2017, naturally the one in use, 2 additional filters have been inserted (but the original has not been modified) ,this has allowed us to improve the Max DrawDown and the performance, which in the updated one has definitely improved.

Having an algorithm, which has been earning cash for more than 6 years, gives security and reliability on future results

//////////////////////////////////////////////////////

DAX 2H EQUILIBRIUM

The algorithm incorporates both trend and reversal strategies

This strategy works well in all market situations, both with low and high volatility (e.g. 2020)

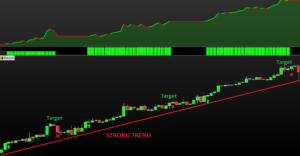

“TREND FOLLOWING”

Following the trend is one of the most effective and easy-to-use methods to make money by trading on a market.

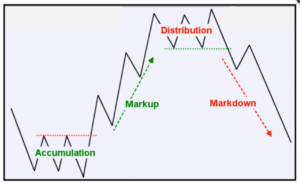

“Reverse Trading Strategies”

The main reason for an inverse strategy is that it gives us the opportunity to enter the trading system very close to support or resistance.

Below you can see both situations:

In the first figure, you can notice a strong bullish trend, the algorithm enters 3 times always following the primary trend always going to target.

In the following two figures, the TREND and REVERSE is depicted.

At the end of an uptrend there is usually a directional loss and often less volatility is seen with prices in a narrow range, before seeing a market reversal.

The following example is in an uptrend, but it also happens slavishly in a downtrend

////////////////////////////////////////////////////////////

“BACKTEST – DAX 2H EQUILIBRIUM “

“LIVE – DAX 2H EQUILIBRIUM “

performed an update May 8, 2025

Algorithm reactivated after problems with ProRealTime platform

ORIGINAL FROM NOVEMBER 3, 2017 ALWAYS POSITIVE

Avis

Il n’y a pas encore d’avis.