This trading system aims at exploiting three statistically well verifiable effects:

1) Within the trading session, the DAX is likely to print the max and the min of the session at specific time

2) There are time windows within a session when the DAX movement is more likely to persevere in the same direction

3) It is more likely that a strong intraday trend develops after a period of volatility contraction.

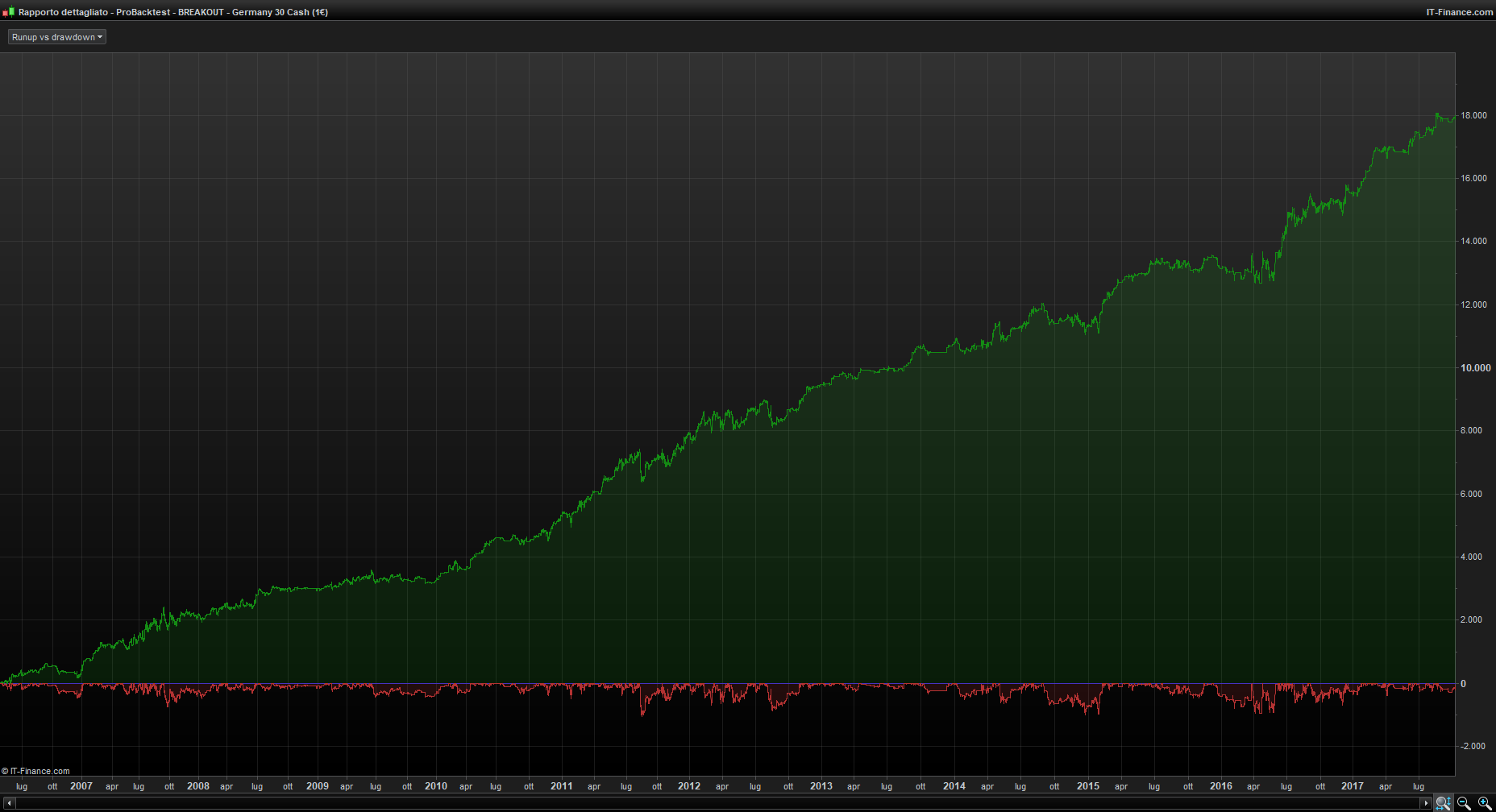

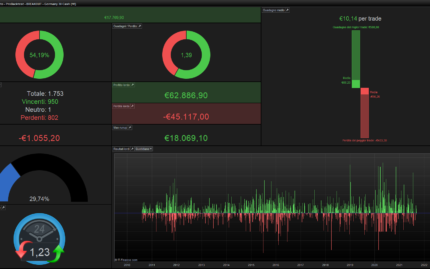

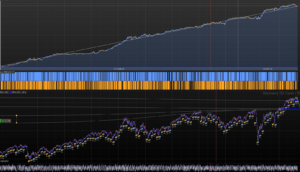

This strategy merge all the above mentioned effect, delivering the follwing backtest results:

- Good IN_sample vs OUT of sample results:

- The Profit vs Max Drawdown ratio (CALMAR) is a very healthy 17

- The Average holding period is about 17 hrs for long positions and 6hrs for short positions

- The average trade is slighlty larger than 10 pips.

LIVE RESULTS:

- About me:

- Master’s in Theoretical physics from Pisa University and quantitative finance from Bocconi University.

- More than 15 years of experience in finacial market, since 2016 full time systematic trader.

- This is my profile on prorealcode https://www.prorealcode.com/user/francesco78/

- This is my linkedin profile https://www.linkedin.com/in/francesco-landolfi-2311953/

- This is my youtube channel https://www.youtube.com/channel/UC0AZNJoJ62jX7MT4QJzY5Cg

- Instagram : https://www.instagram.com/france.landolfi/

Avis

Il n’y a pas encore d’avis.