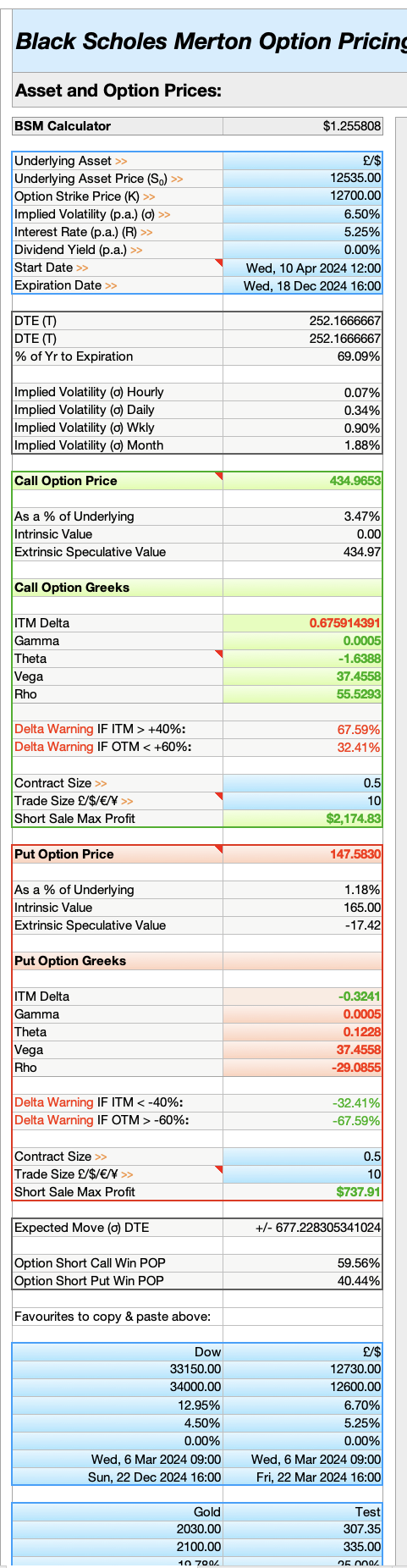

Calculator Features:

The Option Pricing and Profit and Loss Calculators come in a Pale Light Colour Theme and Blue / Gold Theme for you to choose which sheet you prefer. The version here is in EXCEL. APPLE NUMBERS is also available on PRC.

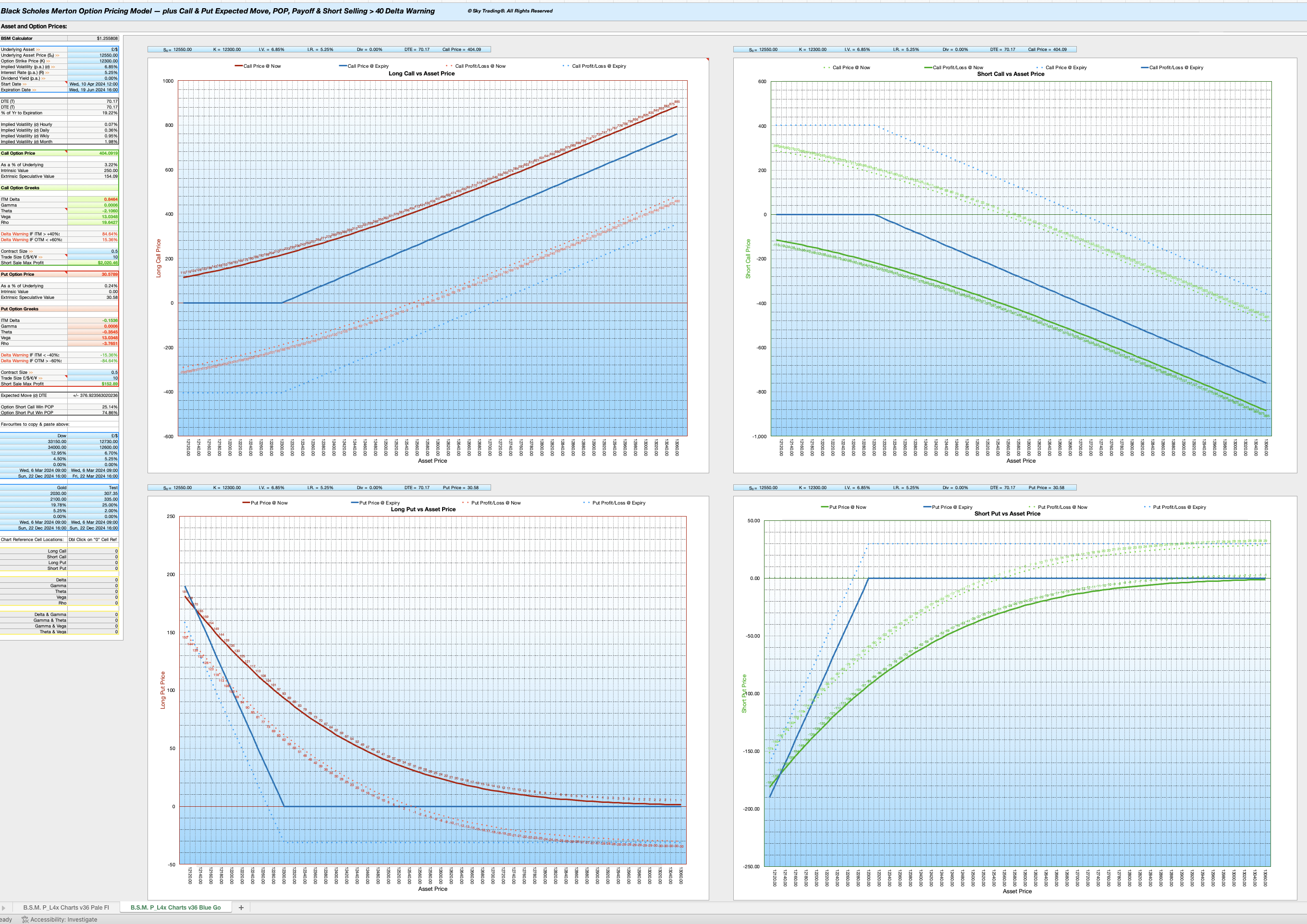

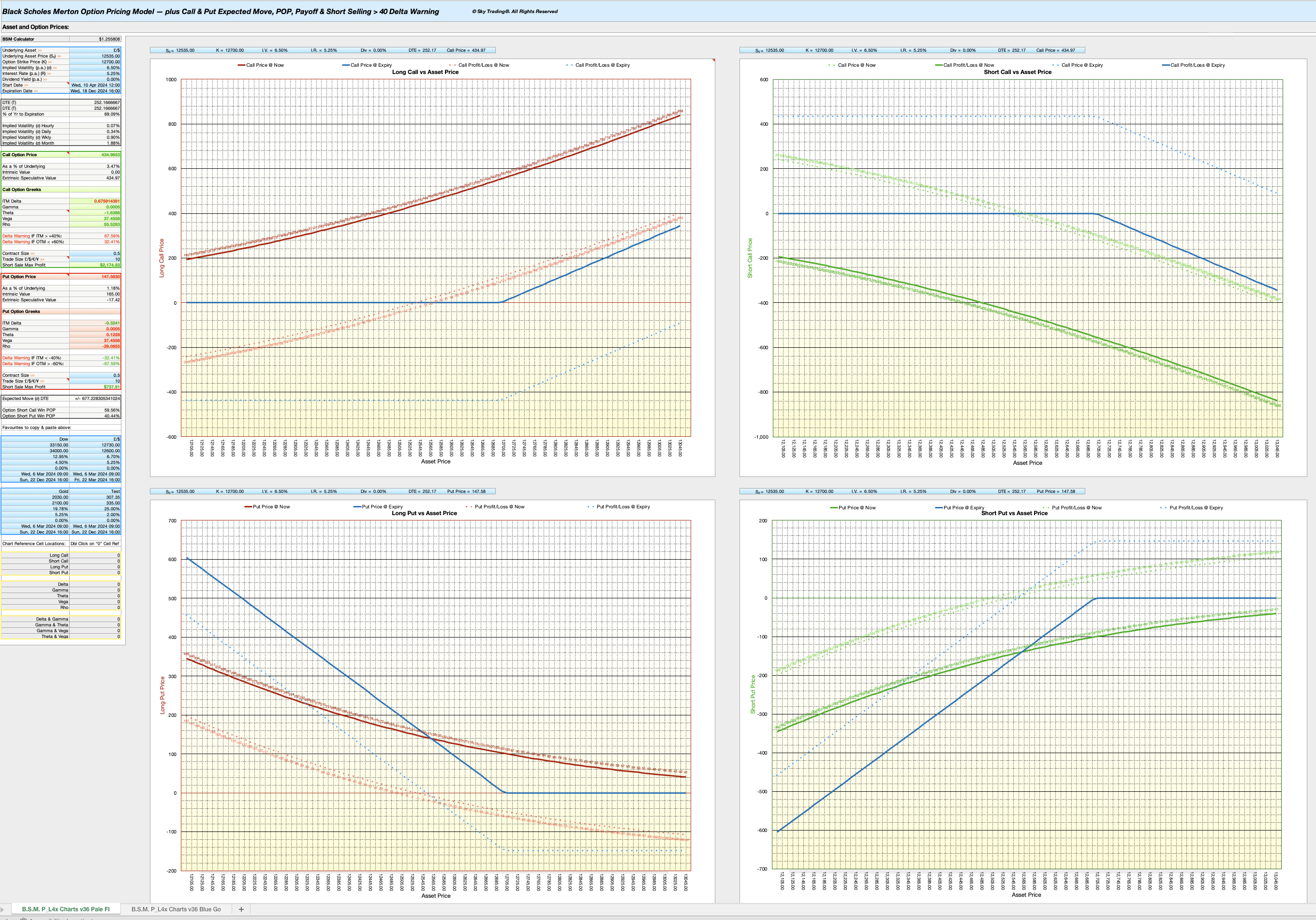

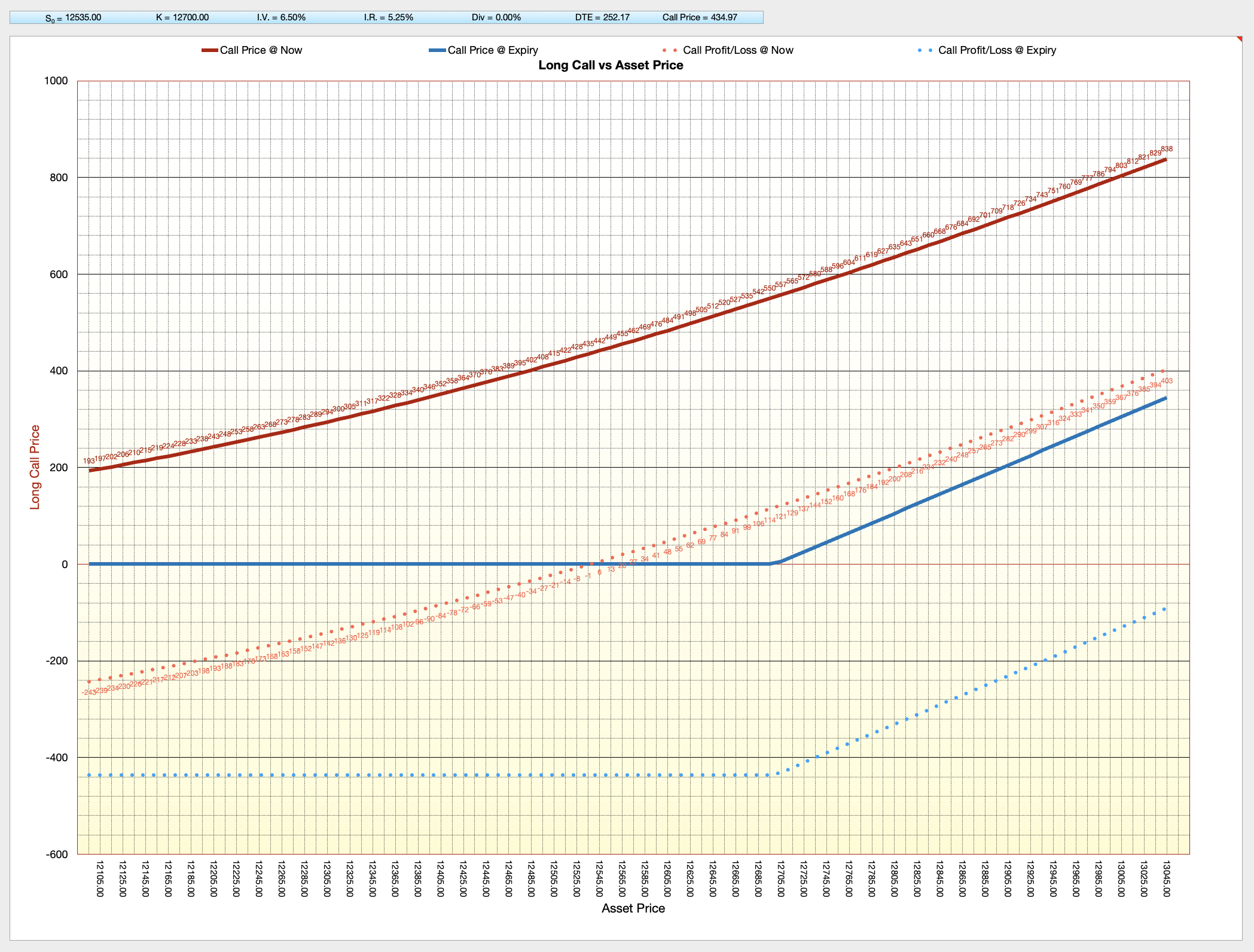

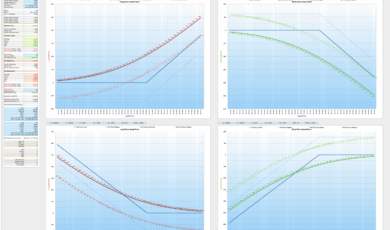

1. Comprehensive Large Charts for Real-Time Decision-Making:

- Two Sections: The top half allows Targeting of Asset Prices, the lower Targets Strikes.

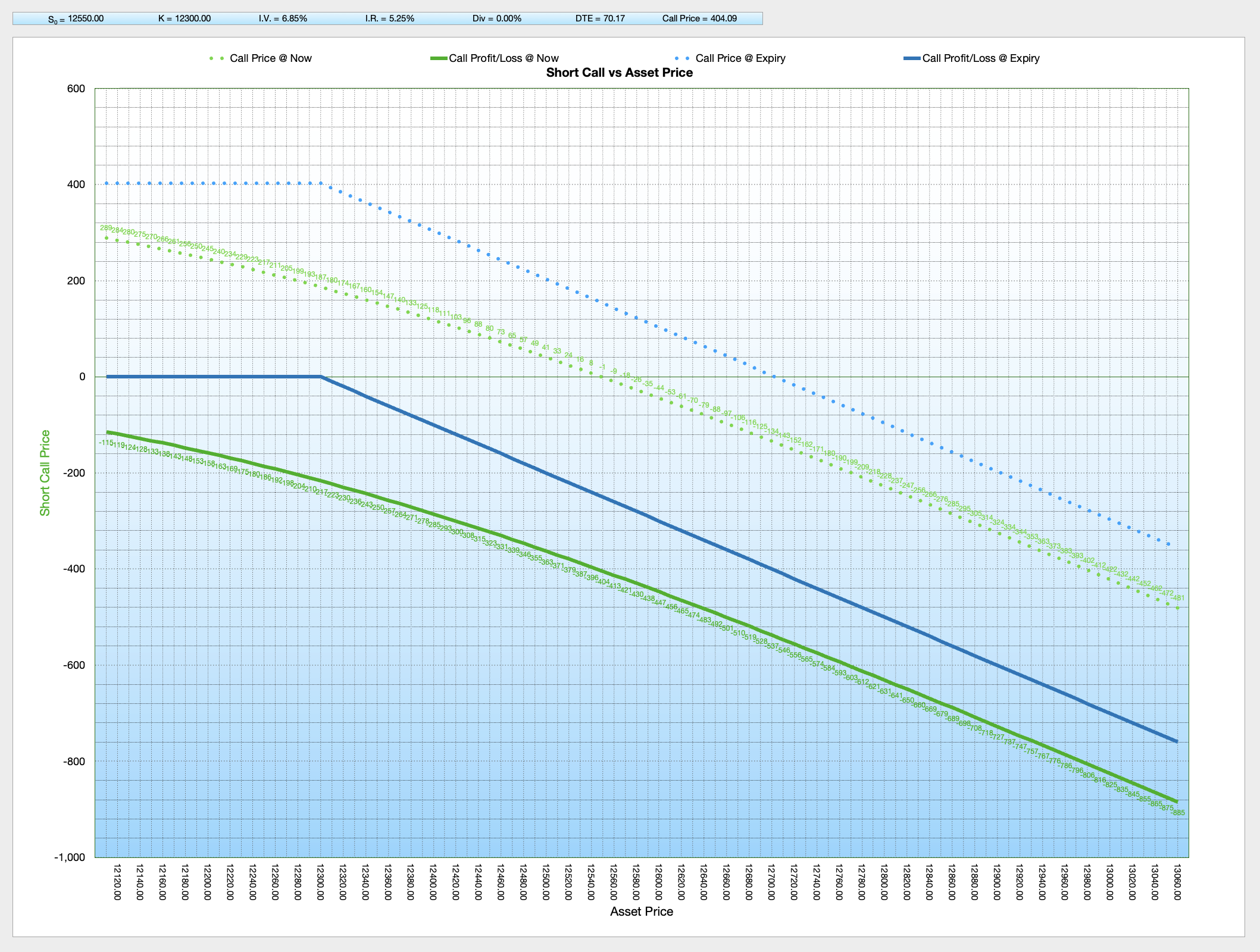

The spreadsheet displays Options Prices at the current moment and at expiry, along with Profit and Loss calculations at the current moment and at expiry, against asset prices. This data is presented in four separate charts, covering:

- Long Calls w. Options Price @Now and @Expiry, P/L @Now and @Expiry

- Short Calls w. Options Price @Now and @Expiry, P/L @Now and @Expiry

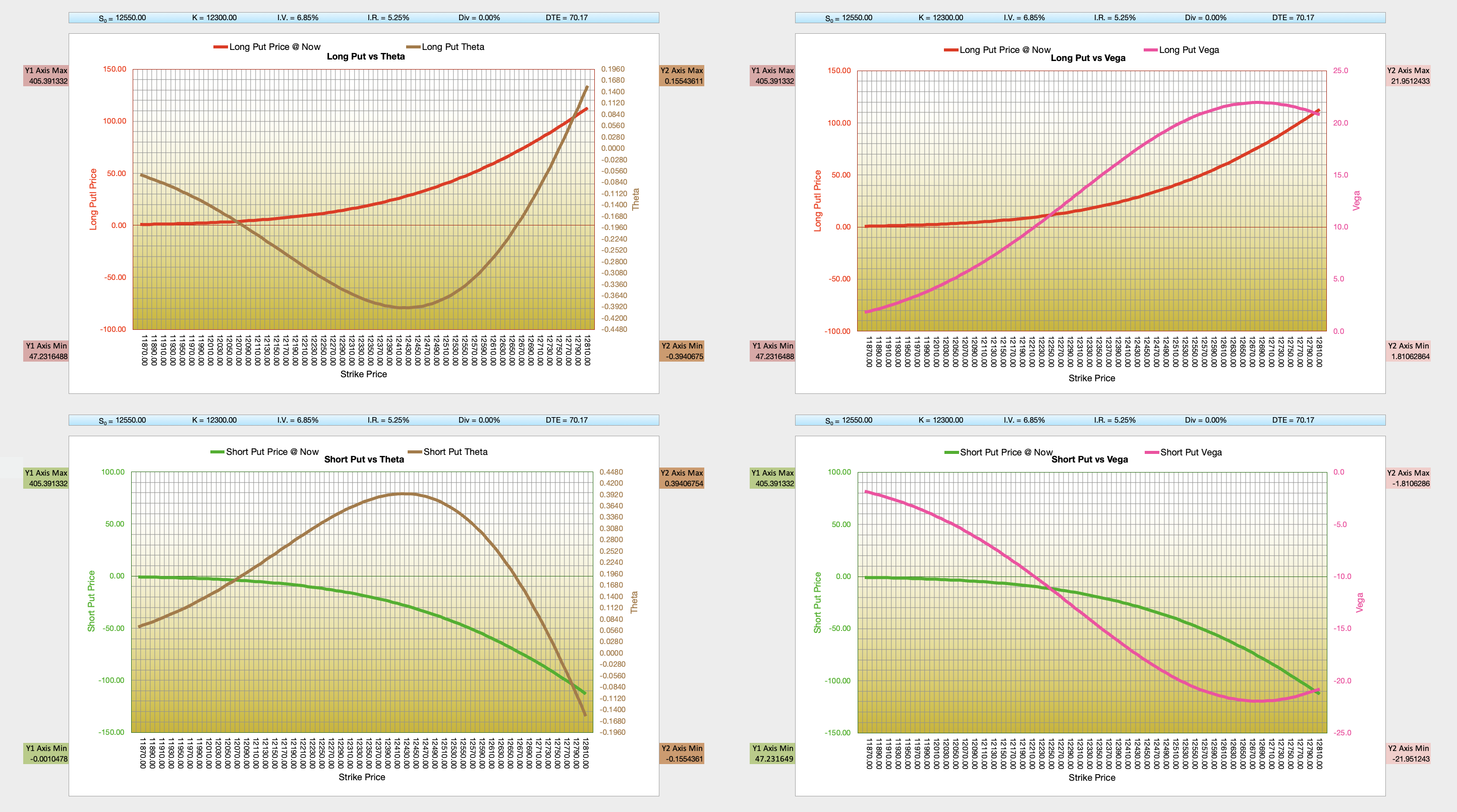

- Long Puts w. Options Price @Now and @Expiry, P/L @Now and @Expiry

- Short Puts w. Options Price @Now and @Expiry, P/L @Now and @Expiry

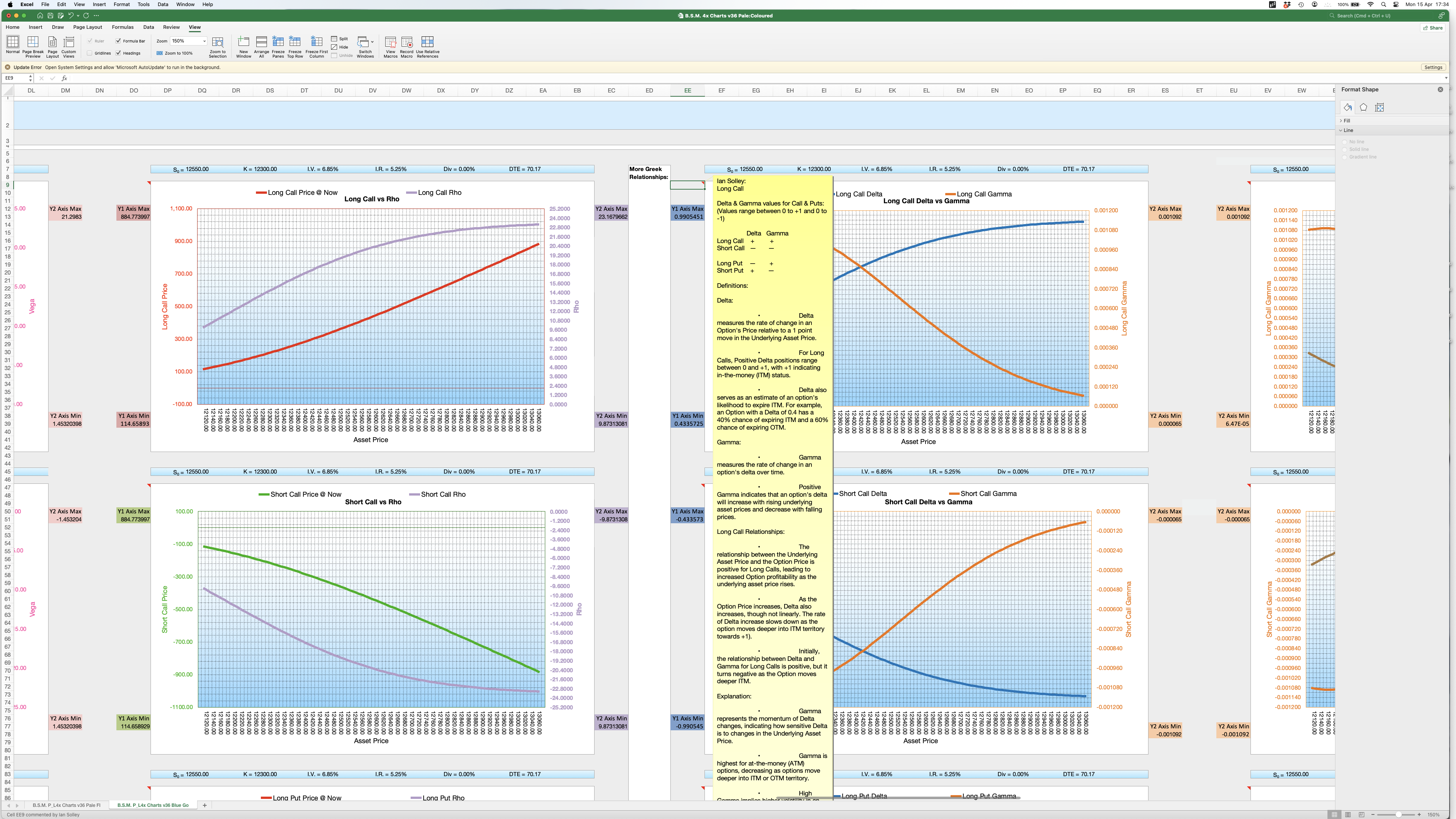

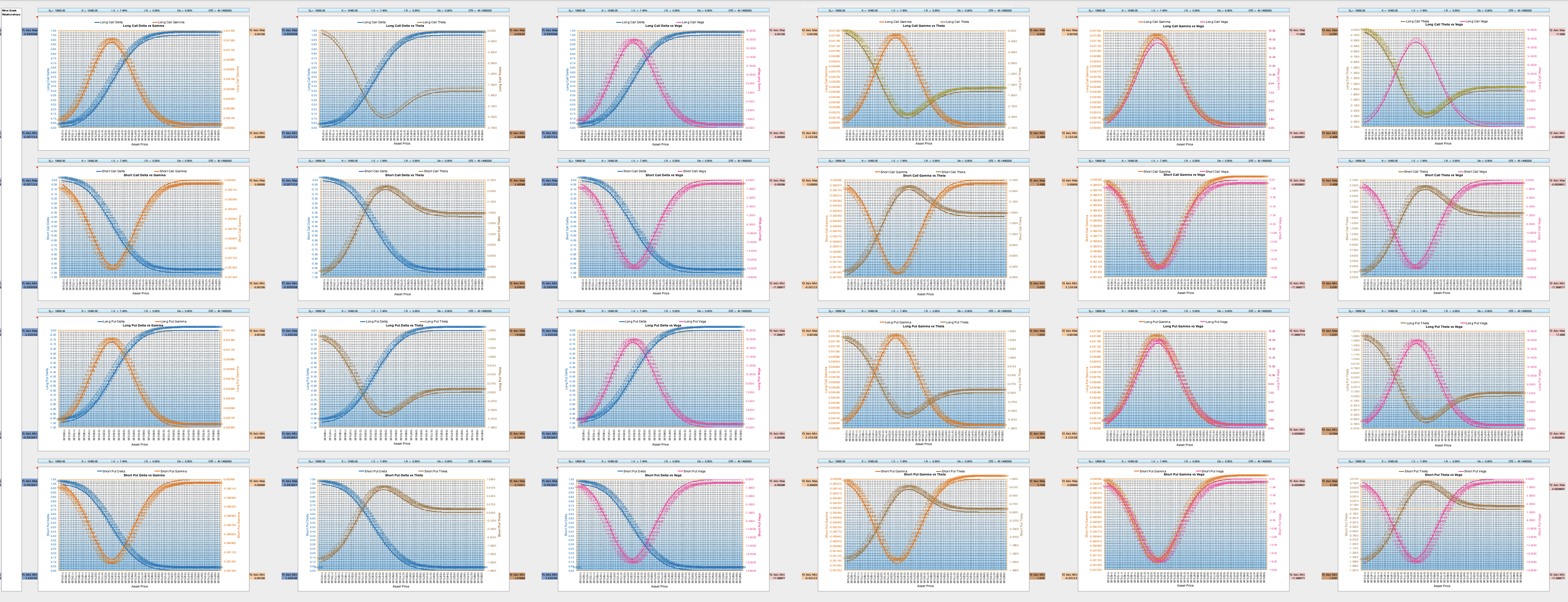

My calculator features eight individual large charts plotting Long Call, Short Call, Long Put, and Short Put Prices against a wide range of Underling Asset Prices and another 4x Option Charts versus Strike Prices (I.e. 8x Charts and 88x Greek Charts in total):

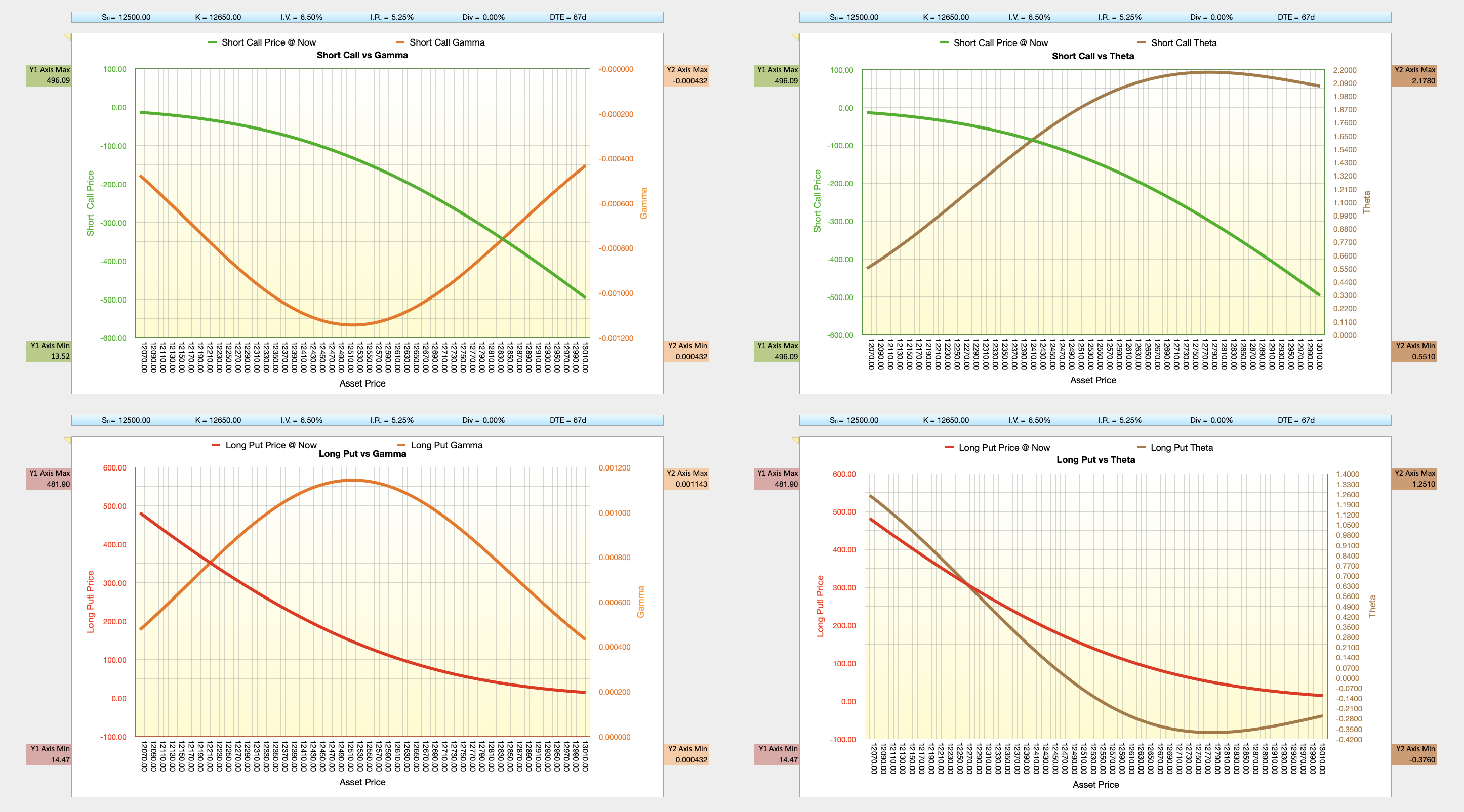

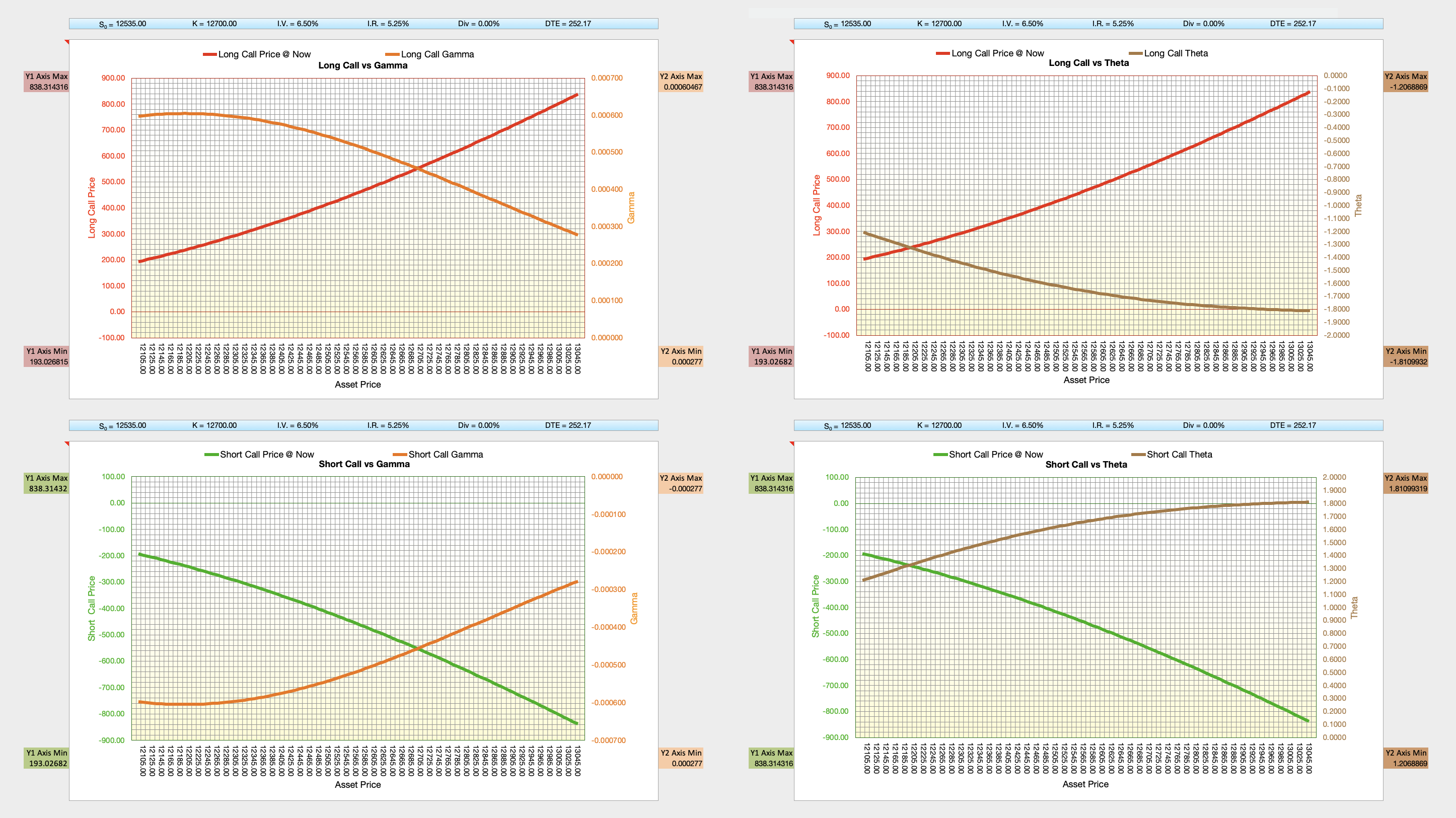

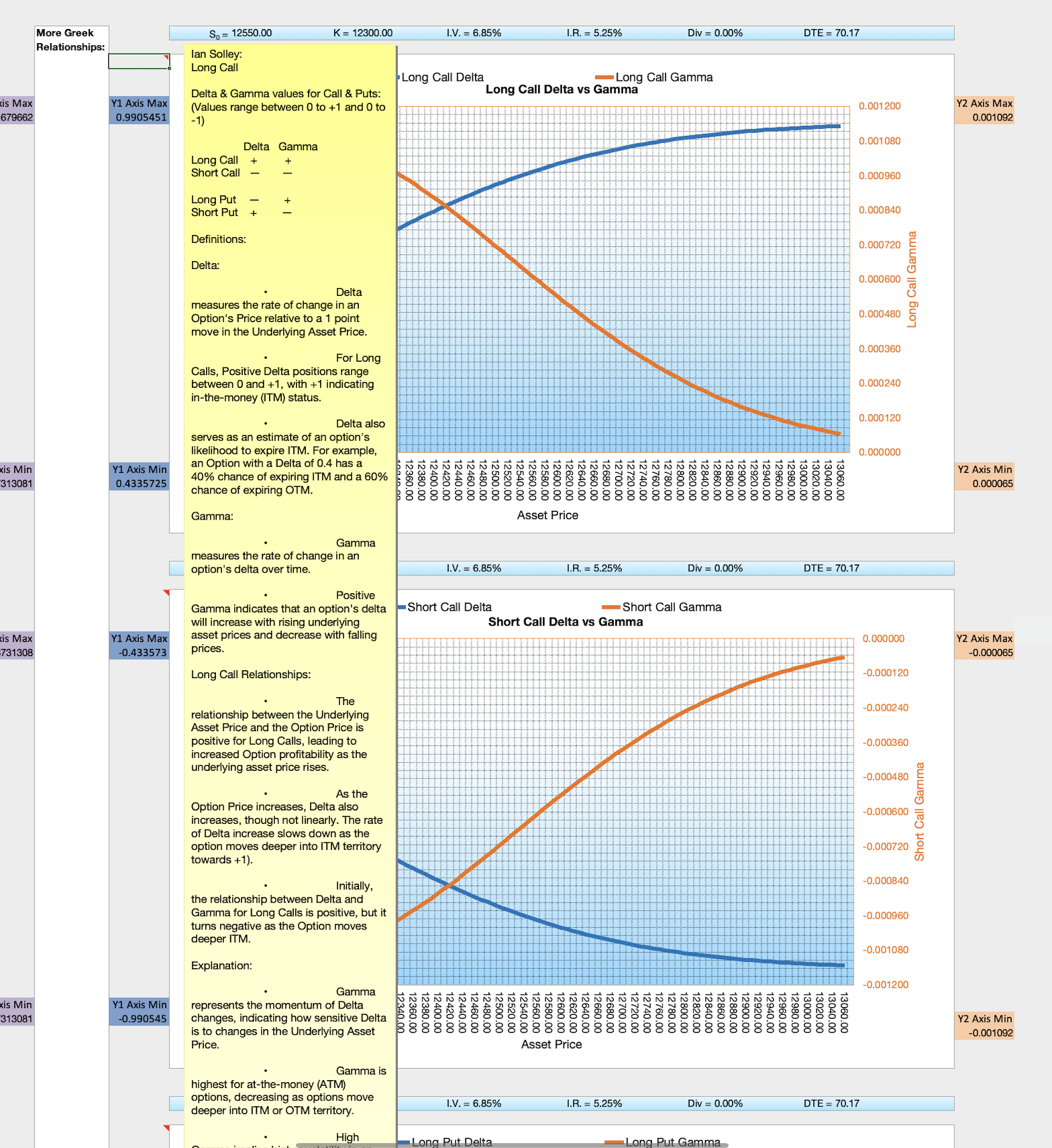

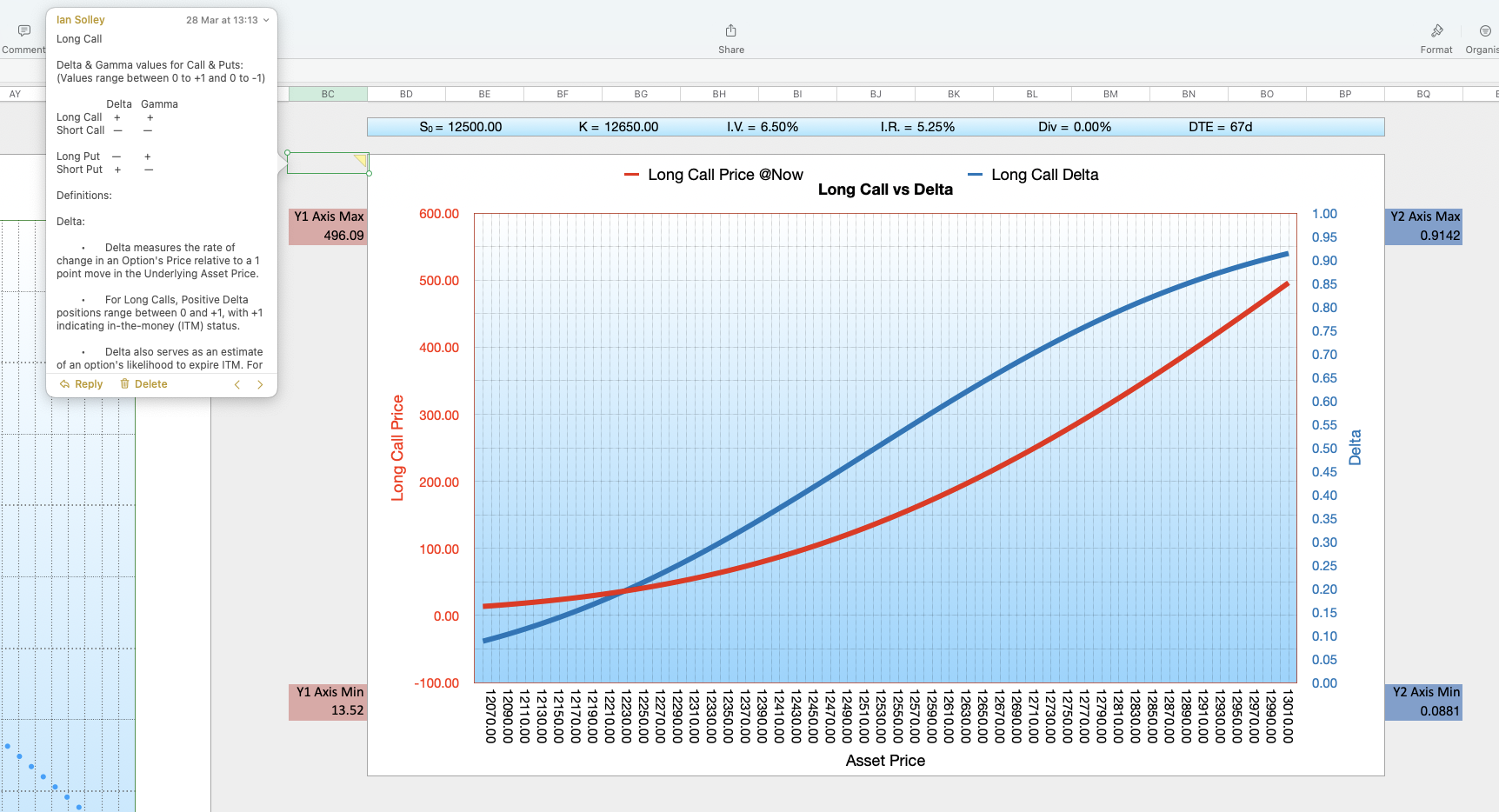

Additionally, you’ll find related Greek Derivative Charts for each of these option types, comprising Delta, Gamma, Theta, Vega, and Rho again for both Asset Prices and Strike Prices.

Charting:

- Two Sections: The top half targets Asset Prices (4x large charts plus 44x Greeks), the lower Strikes (ditto).

Total of 8x Large Charts for Long Calls, Short Calls, Long Puts and Short Puts Pricing and P/L plus 48x Smaller Greek Charts for Long Call, Short Call, Long Put and Short Put, displaying those Option Prices versus:

Delta,

Gamma,

Theta,

Vega,

Rho,

Essentially:

Long Call — Delta / Gamma / Theta / Vega / Rho

Short Call — Delta / Gamma / Theta / Vega / Rho

Long Put — Delta / Gamma / Theta / Vega / Rho

Short Put — Delta / Gamma / Theta / Vega / Rho

Plus

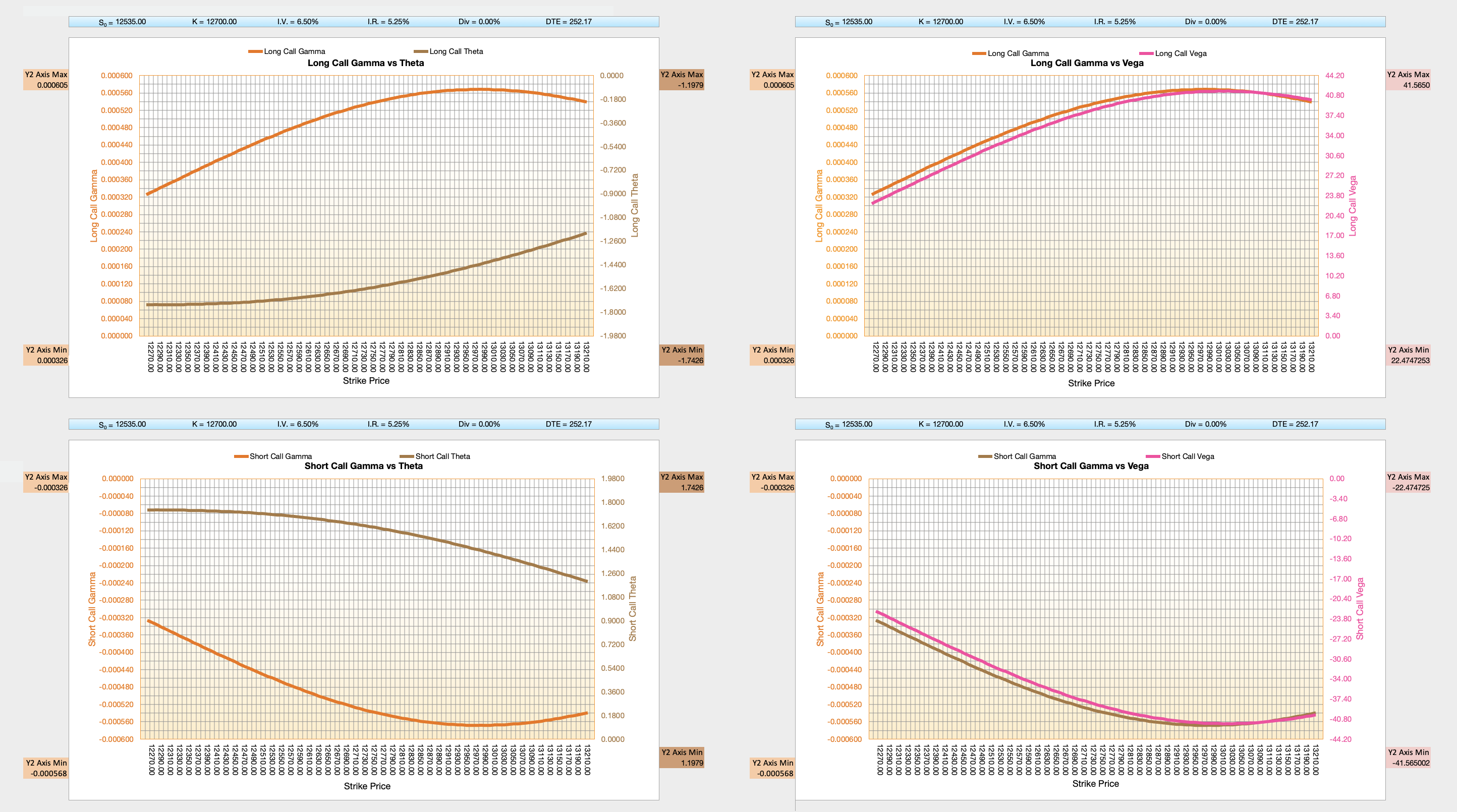

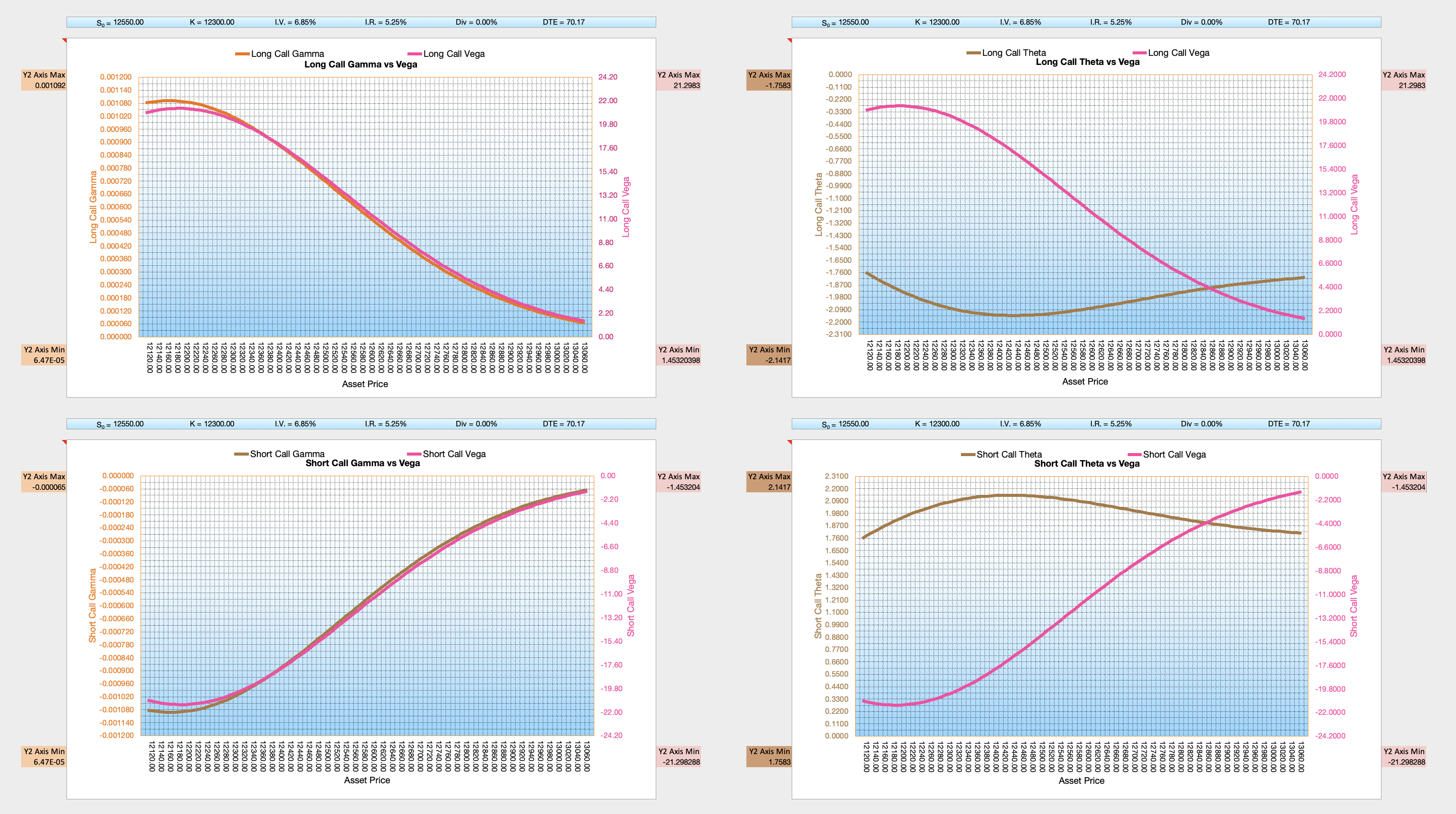

48x additional Charts to show the relationship for a Long Call, Short Call, Long Put and Short Put between:

Delta and Gamma,

Delta and Theta,

Delta and Vega,

Gamma and Theta,

Gamma and Vega,

Theta and Vega.

For targeting Asset Prices or Strikes. In total, you’ll have access to 8 large charts and 88 smaller Greek charts to refine your strategy.

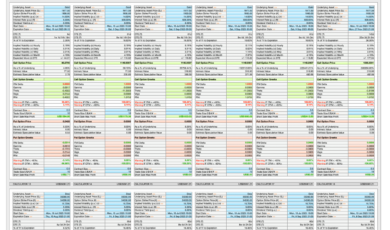

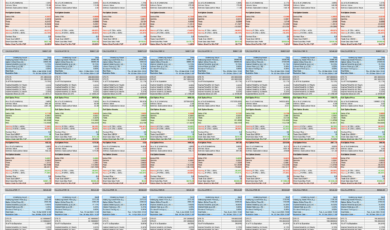

2. Versatility in Option Pricing:

My calculator provides precise option pricing to two decimal places. This accuracy helps you identify any discrepancies in your broker’s pricing, ensuring you get the best deal.

3. Implied Volatility Projections:

Gain insights into market moves with implied volatility projections for hourly, daily, weekly, and monthly timeframes.

4. Expected Market Moves:

Determine the expected market move in points for your chosen time frame, down to the minute. Plan with confidence.

5. Probability of Profit (POP):

Know your odds of success with individual Short Call and Short Put probability calculations for your selected time frame, even down to the last minutes before expiry.

6. Delta Warning:

Stay ahead with a red text Delta warning, especially designed for Short Sellers. This alert triggers when the OTM (Out of The Money) Delta falls below 60%, (change to suite your risk tolerance).

7. Greek Targeting:

Select Strike prices according to the likelihood of success based on Delta probabilities.

8. Real-Time Updates:

Set option start dates to @Now” to enable real-time monitoring of Call and Put Option Price changes in real time via a toggle button. Modify implied volatility (I.V.) and other variables, and witness the tables and charts adapt seamlessly.

9. 0DTE Calculations:

My calculator is capable of calculating option premiums for “0 days to expiry” (ODTE) right down to the last minutes before they expire.

10. Wide Asset Price Range:

My calculator accommodates a wide range of asset prices. For example, setting Cable (£/$) with a 25-tick (adjustable) increment allows the calculator to work out option prices from just above the 1.3700 Strike down to the 1.1400 Strike, ensuring you’re prepared for various market scenarios. Set the S&P 500 with a 25-tick (adjustable) increment and a strike price (K) of 4300. This configuration allows the calculator to calculate option prices for strikes ranging from just below 3200 to just below 5575, effectively covering a potential 25% market decline. By adjusting the asset width to 50-point increments, the calculator can accommodate asset prices from 2100 to 6800, ensuring comprehensive coverage in option pricing even for a 50% market downturn.

Embrace Precision, Control Risk:

As markets become increasingly volatile, our calculator is designed to help you navigate and anticipate Black Swan events, especially as a Short Seller. For instance, in the wake of unforeseen market shocks, like the 6-cent drop in Cable (£/$) following a political announcement, my calculator provides essential insights equivalent to a 500-point move. Take control of your market risk.

Download the Options Trading Calculator now to gain the upper hand in option pricing and risk management. Don’t let market uncertainties catch you off guard.

Best of Luck in Your Options Trading,

Ian

B.Sc. Finance (Hons)

Bewertungen

Es gibt noch keine Bewertungen.