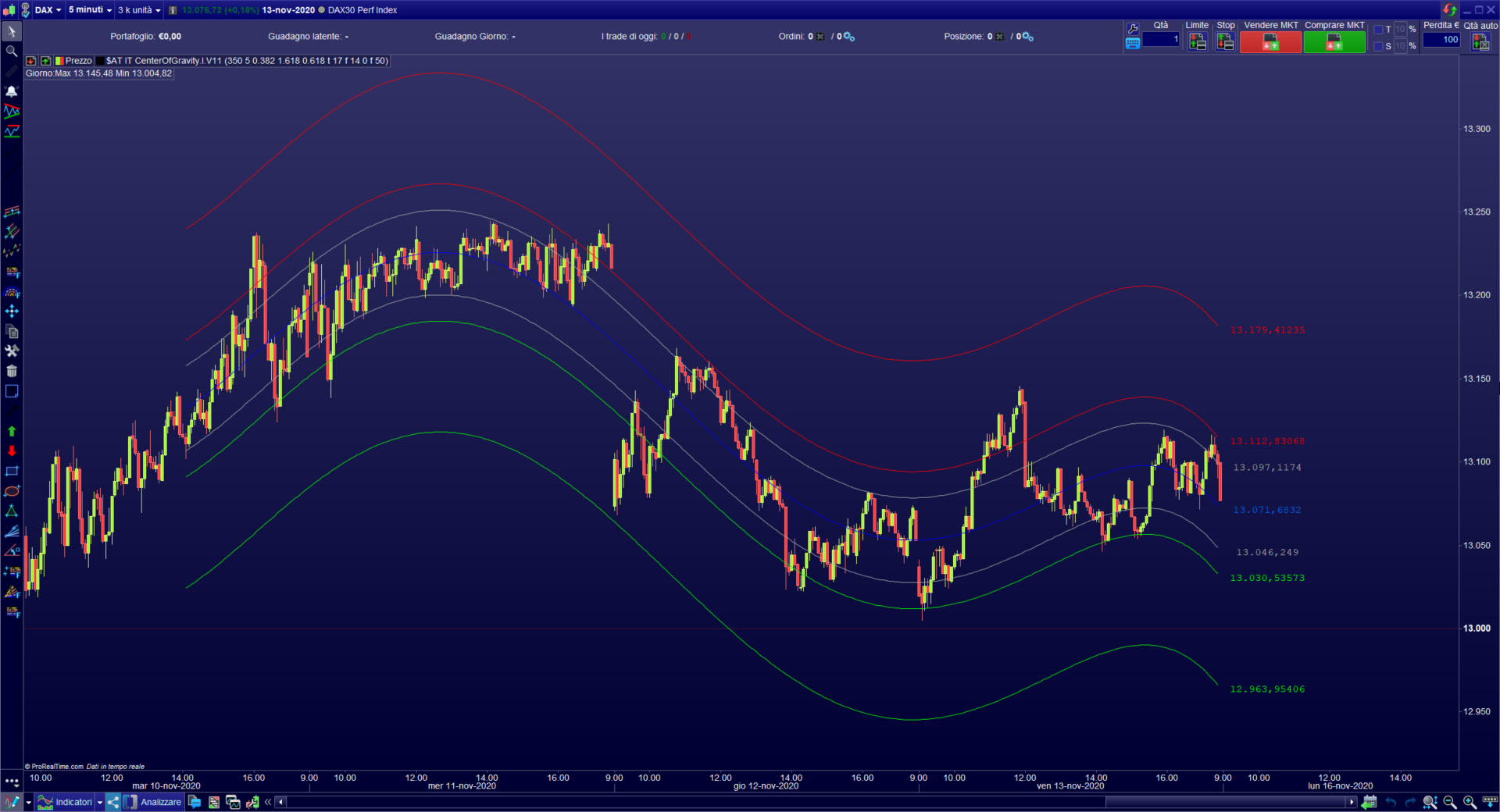

The “Center Of Gravity indicator” is a technical indicator that calculates the price center of gravity of any market, oscillating between its recent tops and bottoms. It has been developed by the famous french trader Mostafa Belkhayate who has won many trading contest over the years.

The Center Of Gravity indicator

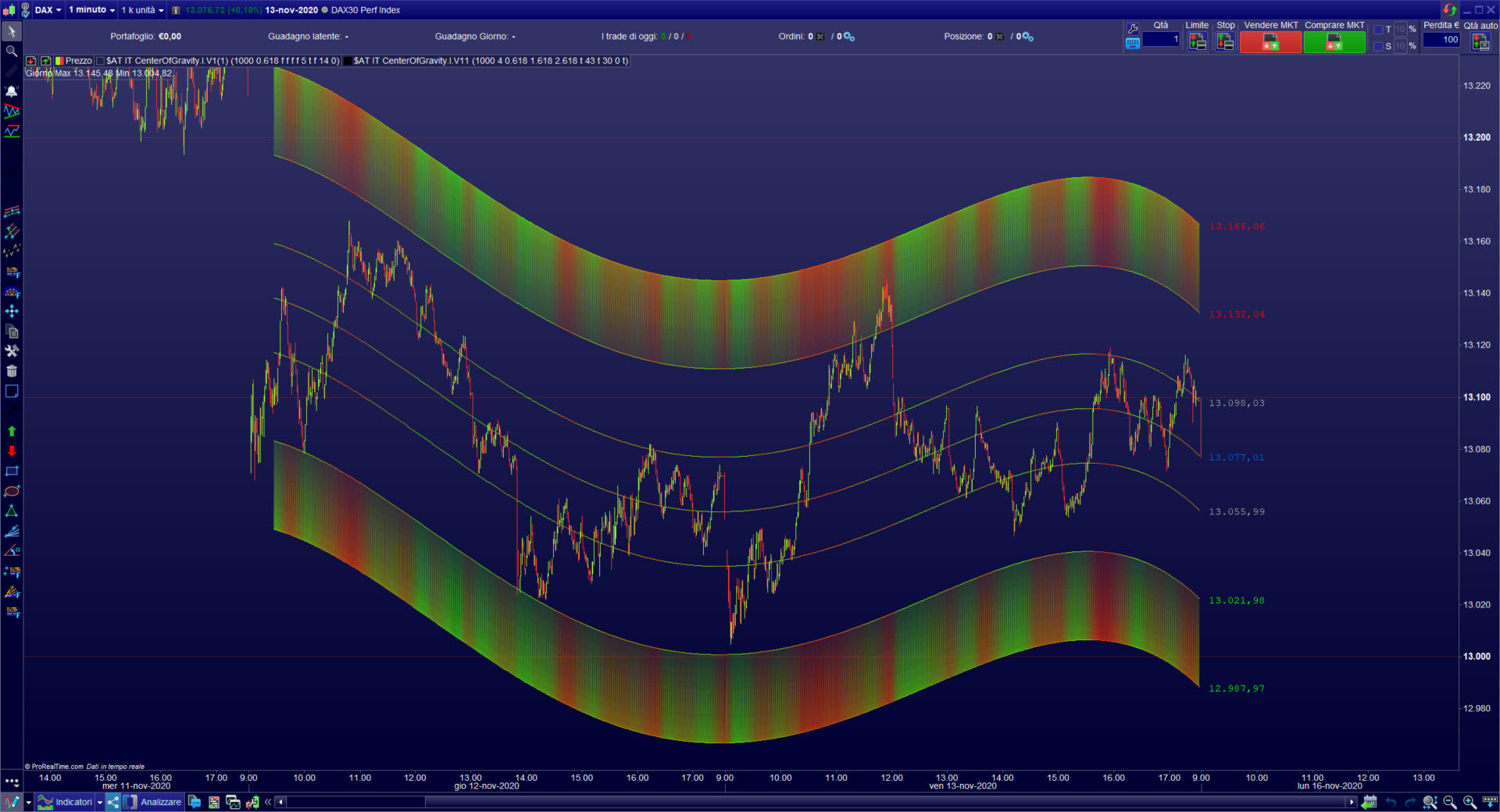

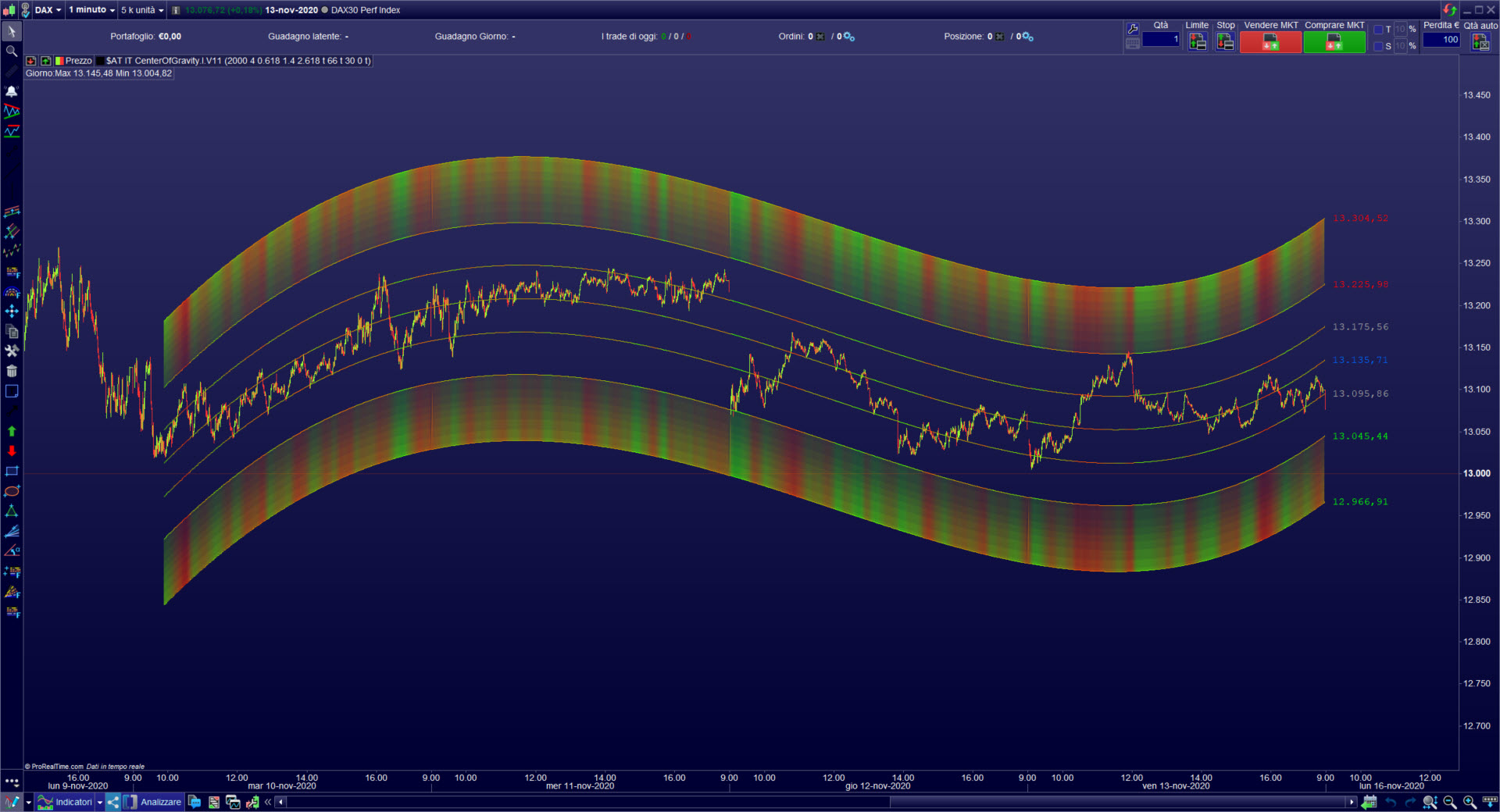

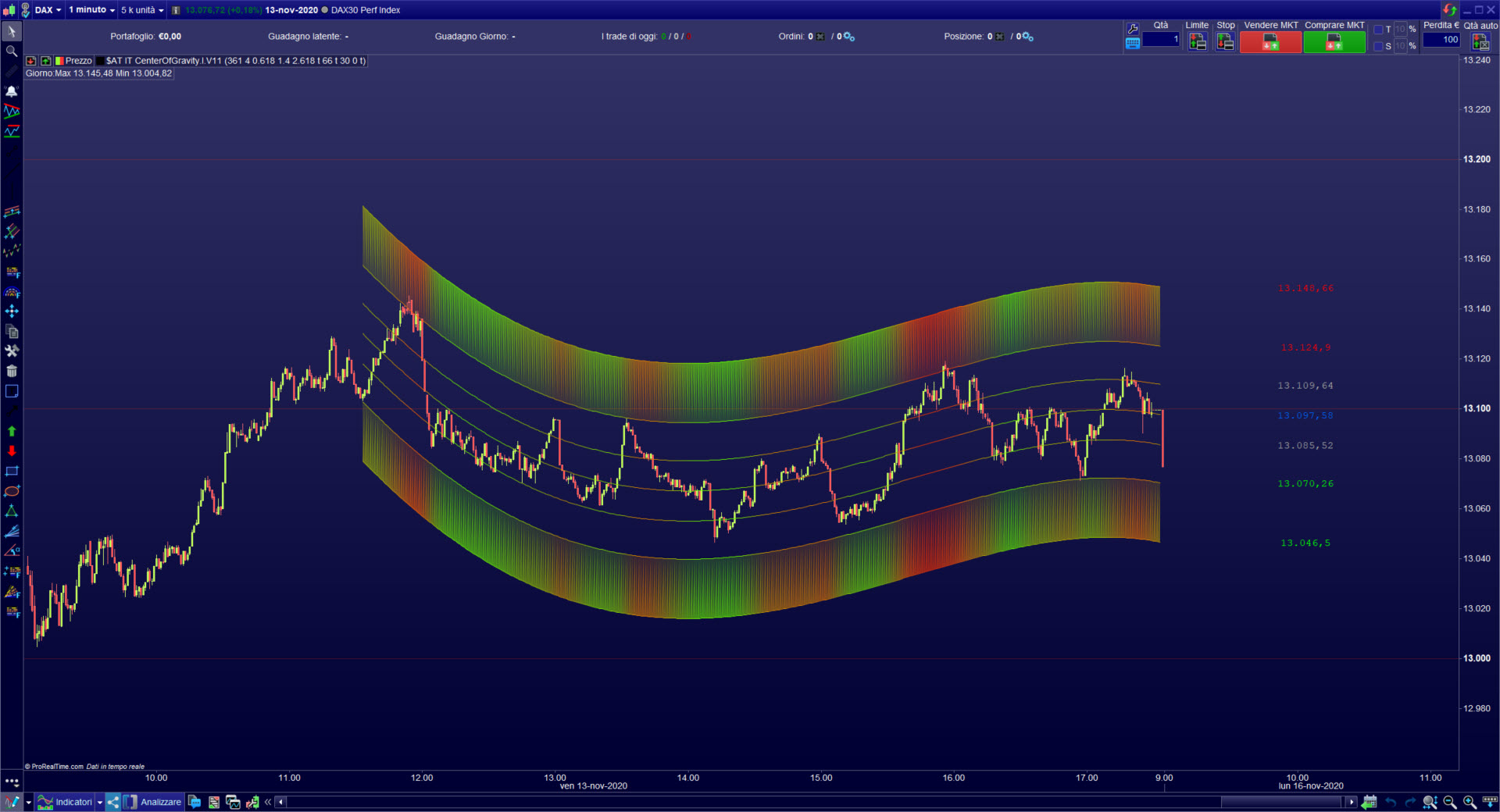

The COG (Center Of Gravity) makes it easier to read the direction of the price and its extremes. Indeed, thanks to the upper and lower bands added or subtracted from the center of gravity, it is easy to understand towards which price levels this one will turn towards the COG.

The upper and lower bands are obtained by adding (or subtracting) the center of gravity to multiples of the golden ratio (around 1.618), which is also used to calculate Fibonacci retracements. You can set variable for upper and lower band as you prefer:

POLYNOMIAL ORDER

You can set the order of polynomial as you prefer:

MBFX Timing indicator

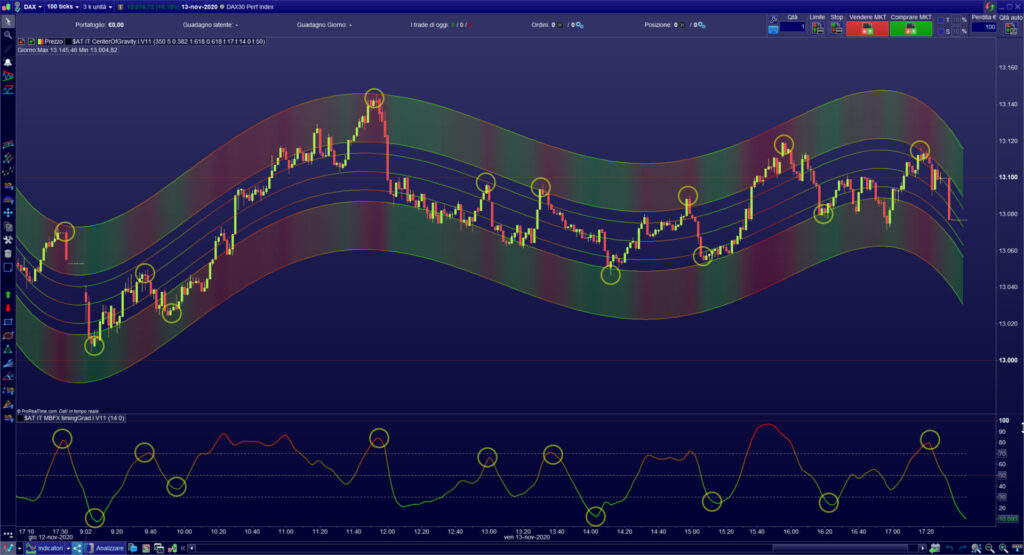

Our own version of this COG indicator also includes free of charge the second indicator that Mostafa Belkhayate uses in his famous system (MBFX system), the “Belkhayate Timing”. This is positioned under the price chart and makes it possible to find the market turning points in correlation with the center of gravity.

See these examples:

The overbought and oversold zones of the Timing indicator are materialized by colored zones in the COG!

Our own version of the Belkhayate gravity center includes the information of the MBFX Timing directly readable in it, when price is in overbought or oversold areas the color of the channel automatically adapt:

Many ways to use the Gravity Center for trading

Several color themes and ways of representing the Gravity Center are possible, examples:

Interface

Please note that due of its calculation formula (polynomial regression analysis of the price), the COG is a repainting indicator.

fredrik.dahlander (propietario verificado) –

Realmente satisfecho con él, también se ve muy bien.

Peter Kershaw (propietario verificado) –

He estado utilizando un producto similar en otro sitio de operaciones y me ha resultado muy útil para calcular posibles movimientos futuros. Encontrar esto para PRT en el servicio IG fue muy satisfactorio, pero entonces ser capaz de encajar el Williams Alligator dentro de la banda exterior del indicador COG fue lo mejor de ambos mundos para mí de todos modos porque el ‘Alligator’ podría mostrar un estancamiento de una tendencia, pero las bandas exteriores todavía muestran probable progresión o regresión. En la actualidad se ejecuta en 3 marcos de tiempo: 6 M, 30 M y 4H, 2 índices y VIX con diferentes configuraciones COG

Francisco Gale (propietario verificado) –

Hola, llevaba mucho tiempo buscando el COG para prorealtime y por fin lo he encontrado. Funciona igual que en otros softwares con los que solía operar, ahora puedo hacerlo con prorealtime. Buenas opciones y buen aspecto.