The Screener scans the market for stocks near to break, or breaking, a bearish resistance.

Works on all timeframes.

Bearish Oblique Resistance indicator included

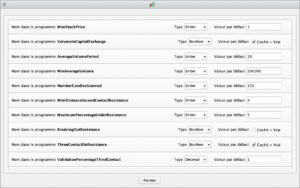

Many ajustable parameters available without modifying the code.

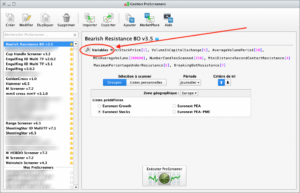

To adjust screener parameters, simply open the Variables 🔧 menu :

The values shown above are given, as examples and do not constitute an optimal or recommended setting, everyone should find his own settings.

A first general filtering of stocks is carried out on the Daily time frame according to 2 criterias :

- minimum stock price (for those who do not wish to have a penny in the results for example)

- minimum average volume (expressed in number of transactions or capital exchanged) to have the desired level of liquidity on the stock.

Résults Ranking :

The results are sorted in the “% Resistance” column as the distance from actual stockprice to the bearish resistance

Adjustable validation criteria :

- Number of candles to be scanned

- Mini distance to last contact with resistance

- Maxi percentage under resistance

Available filters :

- Third contact to validate resistance

- The short term trend is bullish toward resistance

- Actual candle is breaking resistance

General filter :

- Minimum stock price

- Minimum average volume

- Average volume expressed in transaction number or in capital exchange

Characteristics :

- Works on all TimeFrames

- ProRealTime V11 and later versions compatible

- Free ProRealTime (daily closings) compatible

- Automatic and free updates

- Bearish Oblique Resistance indicator included

Watch the video user’s guide on our Youtube channel, subtitles available in English :

🇫🇷 Resistance Oblique Baissière / 🇮🇹 Resistenza Obliqua Ribassista / 🇩🇪 Resistance Schräge Bärisch / 🇪🇸 Resistencia Oblicua Bajista

Valoraciones

No hay valoraciones aún.