The strategy

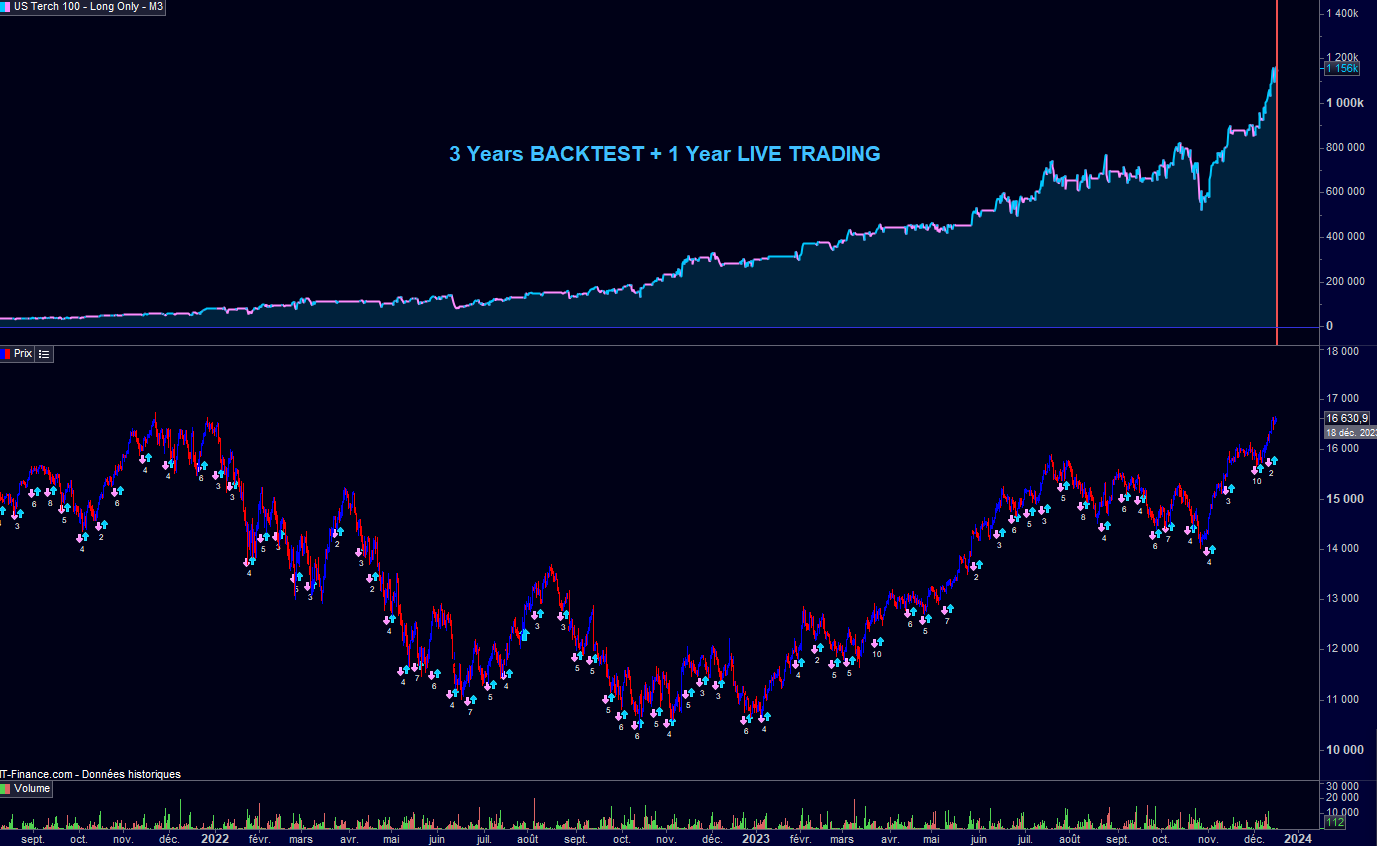

The strategy is a Nasdaq Long Only strategy that evolves in a 3 minutes timeframe. It is a momentum strategy that follows the trend when the Nasdaq 100 is in a bullish trend and finds reversals and rebounds when the Nasdaq 100 is in a bearish trend.

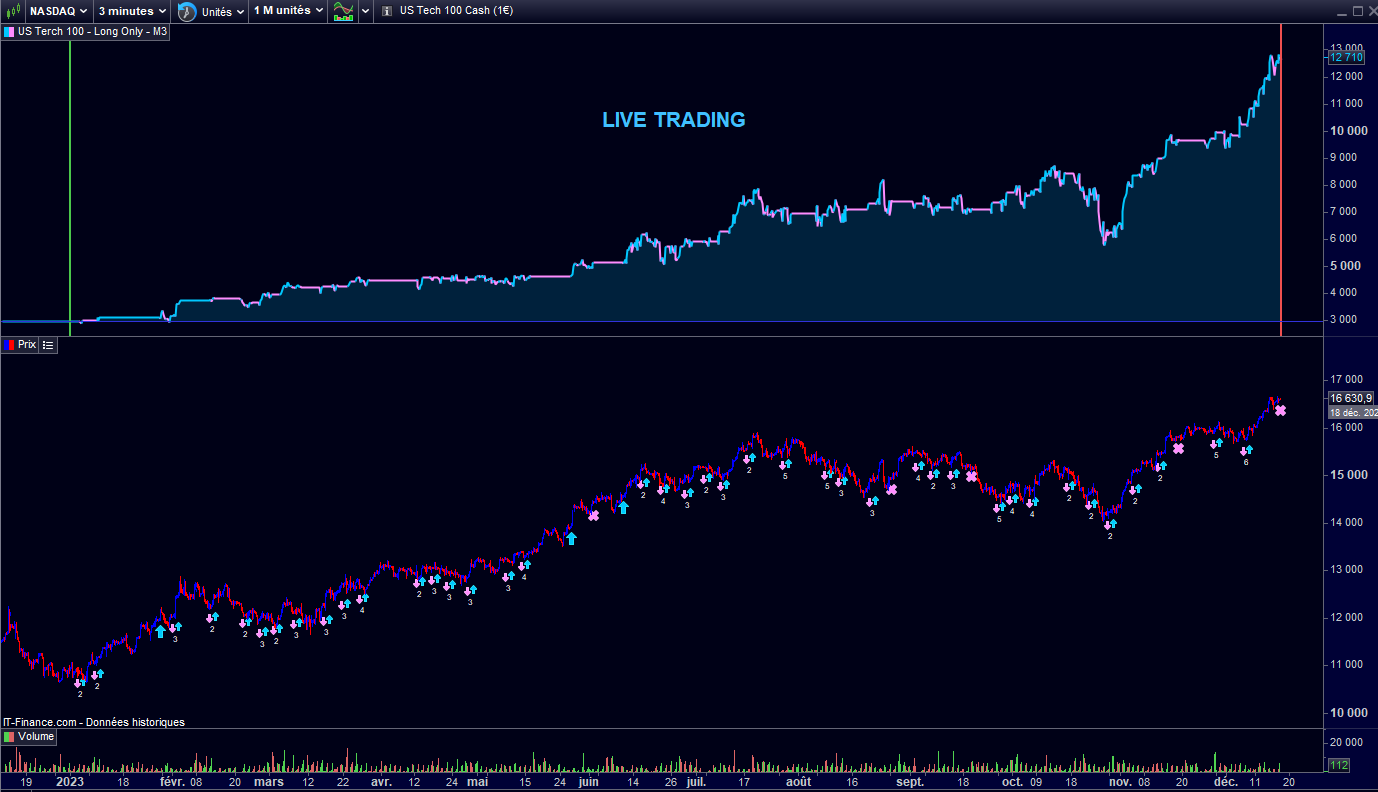

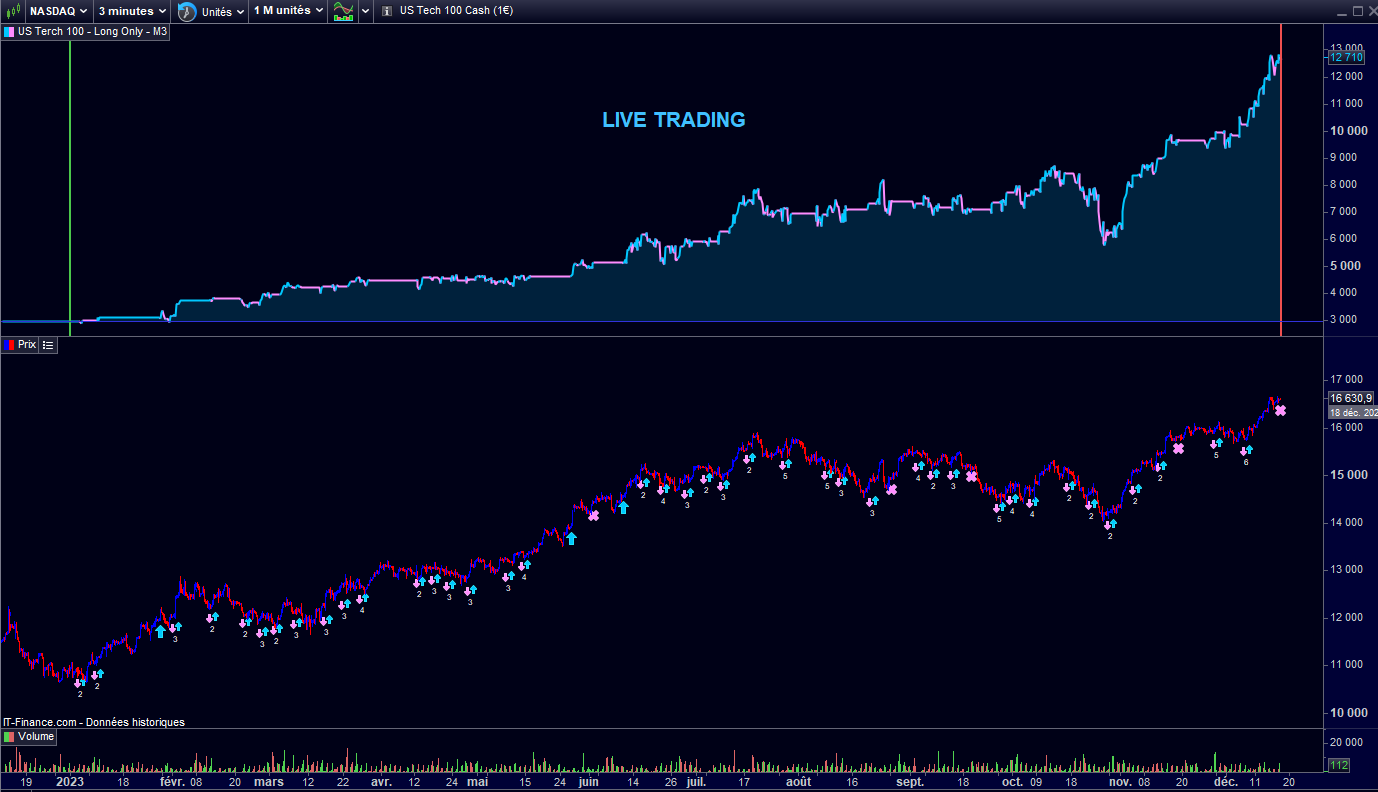

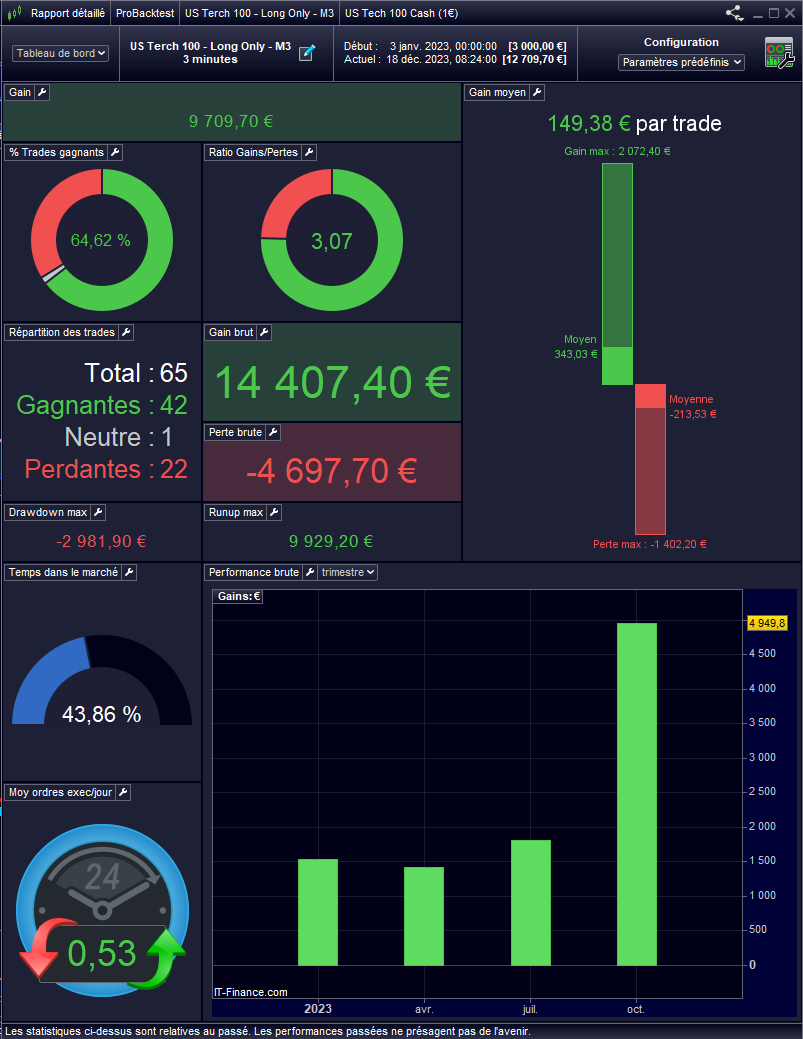

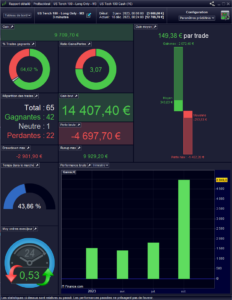

Live results made already 64% return with a 30% Max. DrawDown target since January 2023, date of its release, with gain reinvestment.

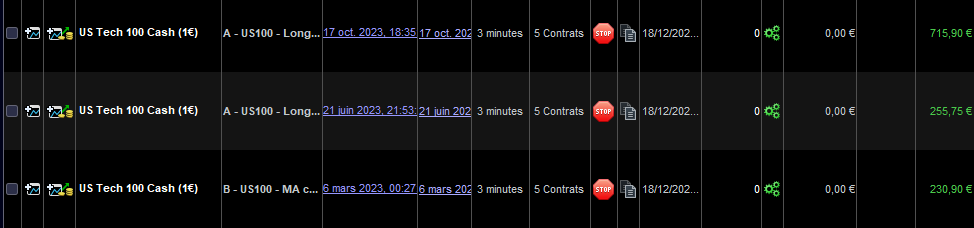

My LIVE RESULTS in a small account with 1 contract:

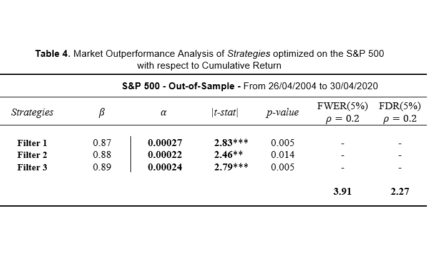

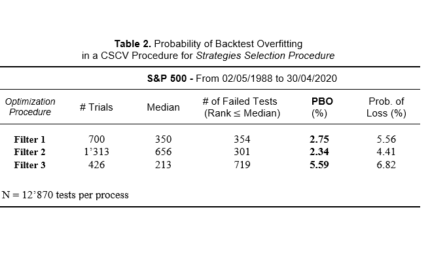

The technical filters used are controlled for Backtest overfitting using the Probability of Backtest Overfitting (PBO) of Bailey et al. (2015) on the Nasdaq 100 index data. Results are statistically significant at the 1% level.

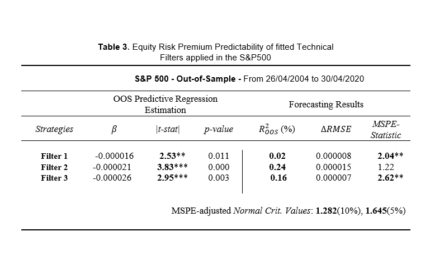

The indicator applied to the Nasdaq 100 shows statistically and economically significant out-of-sample predictive power for the daily equity risk premium at the 1% level, according to the MSPE-adjusted test of Clark and West (2006).

The strategy benefits from the upward priority direction of the Nasdaq 100 to open long-only positions and not be trap in a short position.

The parameters are as follows:

- 1 contract

- spread: 1.5 points

- 1 million backtest units

- time frame: 3 minutes

- gains reinvestment activated

- starting equity: 3’000 USD

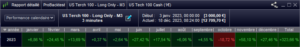

LIVE 2023 Results:

Results given start from 01/01/2023 to today. All results after 01/01/2023 are live results since the algorithm has been launched at this date.

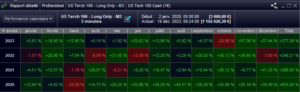

LIVE Quarter results

LIVE Performance Calendar

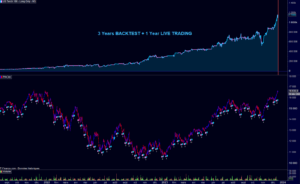

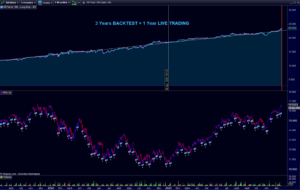

3 Years BACKTEST + LIVE 2023 Results:

Results without reinvestment show that even though the Nasdaq 100 suffered a 40% Max Drawdown during 2022 year, the equity curve stayed very consistent and stable even with a long-only approach. This is because the strategy detects mean reversal patterns.

Avis

Il n’y a pas encore d’avis.