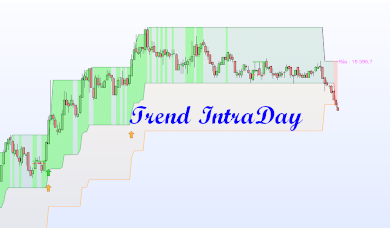

This indicator detect trend on stocks and index.

It has been optimized for small timeframes.

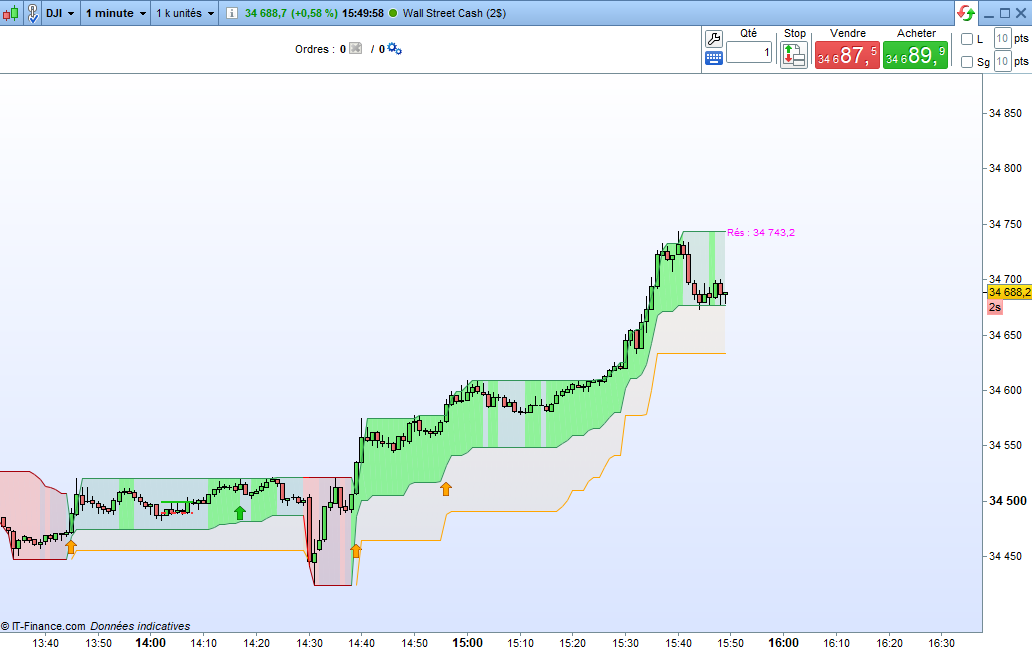

I use this indicator in timeframe 1 minute on DowJones and Dax when I do daytrading.

But you can use it in daily or weekly timeframes too.

When I do trendfollowing on actions, I only search orange arrows.

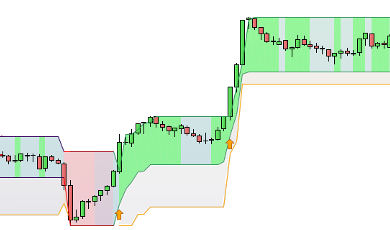

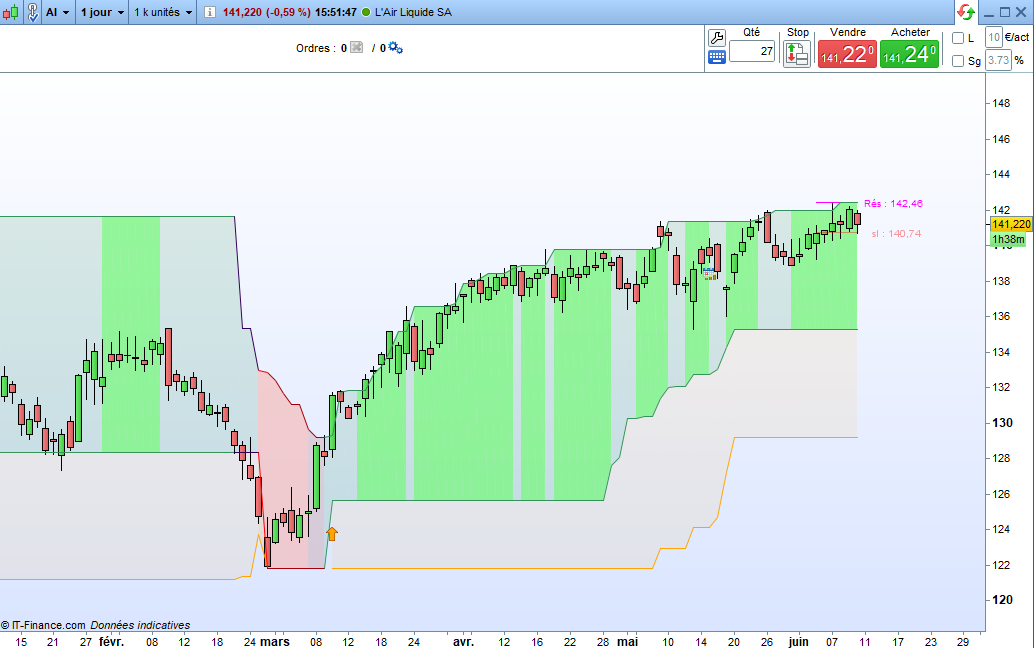

- a stock or index in a downtrend is displayed in a red channel. In this case we should only take sell positions.

- a stock or index in an uptrend is dispayed in a green channel. In this case we should only take buy positions.

Under the green channel, we can see a orange channel which is a no-trade zone. If the price is in this zone, we should wait before entering a position (buy or sell).

This indicator also shows some buying and selling points. Be careful, I advise you not to take a selling position when the signal is given in a uptrend, unless you have other indicators that allow you to identify a trend return.

- when a buying point is detected, a green segment is drawn and a dotted segment is drawn to indicate a possible stoploss. A green arrow is addeted when a signal is quite good.

- when a selling point is detected, a red segment is drawn and a dotted segment is drawn to indicate a possible stoploss. A red arrow is addeted when a signal is quite good.

- a orange arrow is drawn when we begin a uptrend or a there is a good breakout in an uptrend. This is the better signal to take a buying position.

In the video below, you have an example of the use of the “Breakout detector” and “Trend intraday” indicators:

Advantages:

- you can identify quickly the trend and make no overtrading.

- this indicator can be combinated with my “breakout”.

- a screener is available to detect those signals on a list of stocks/index.

Gilles Goblet (verified owner) –

Even though this indicator was developed for intraday trading, it works very well in conjunction with the screener of the same name for swing trading. Well done to its developer.