📈 The M3 v2.0 – Trend-Following Trading Bot (Bullish Only)

Optimisé pour les marchés haussiers. Conçu pour s’adapter. Pensé pour performer.

🧠 The M3 v2.0 est un robot de trading algorithmique spécialisé dans la détection et l’exploitation des tendances haussières. Il ne trade que lorsque le marché montre une dynamique positive claire, ce qui en fait un outil stratégique pour ceux qui préfèrent suivre la force plutôt que de la combattre.

🔧 Entièrement personnalisable, il s’adapte à votre profil d’investisseur grâce à une configuration intuitive et modulaire. Chaque paramètre peut être ajusté pour répondre à vos exigences de gestion du risque, de timing d’entrée, ou de prise de profit.

⚙️ Fonctionnalités principales :

-

Détection algorithmique des impulsions haussières

-

Entrées intelligentes filtrées par des conditions de marché strictes

-

Gestion active de la position selon la force de la tendance

-

Optimisé pour les marchés CFD (IG / PRT)

- Aucune sur optimisation des paramètres

🎯 À qui s’adresse le M3 v2.0 ?

Aux traders qui veulent capitaliser uniquement sur les mouvements haussiers, éviter les phases de consolidation ou baissières, tout en gardant la main sur la logique stratégique de leur bot.

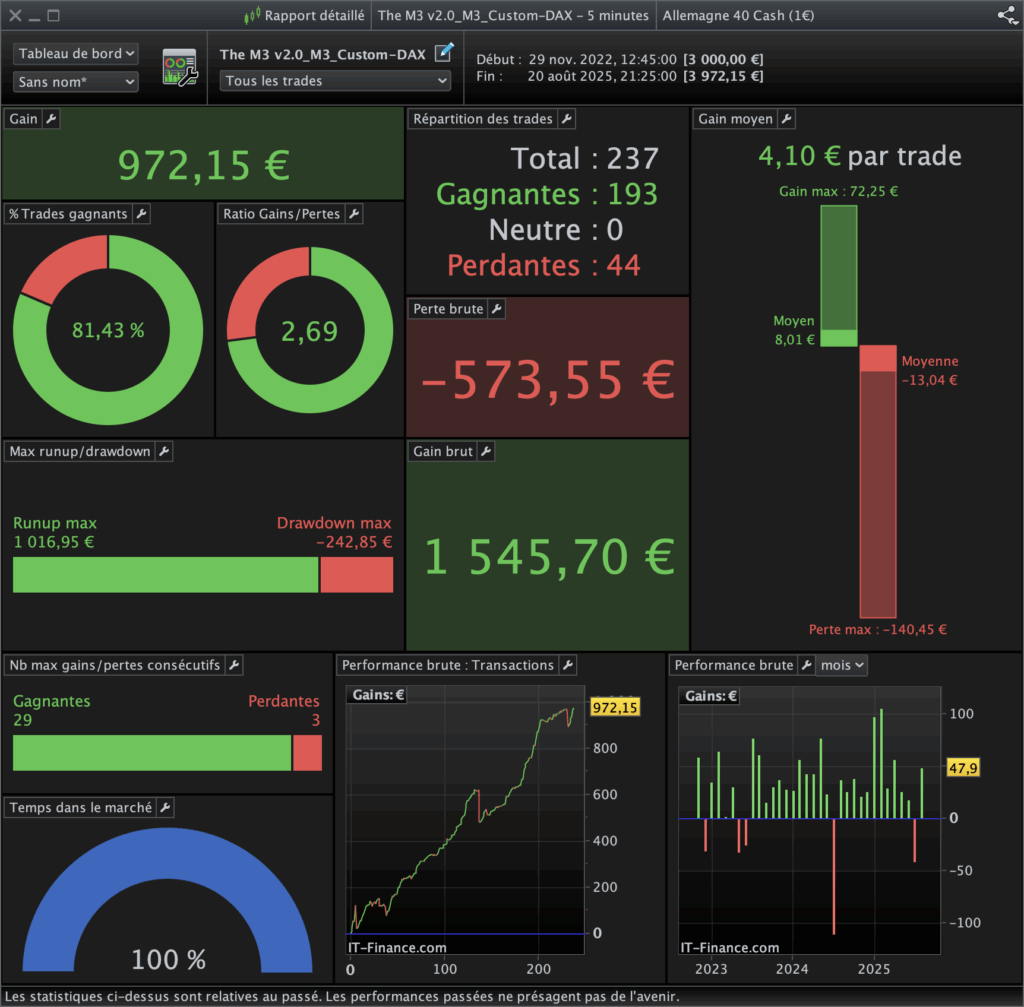

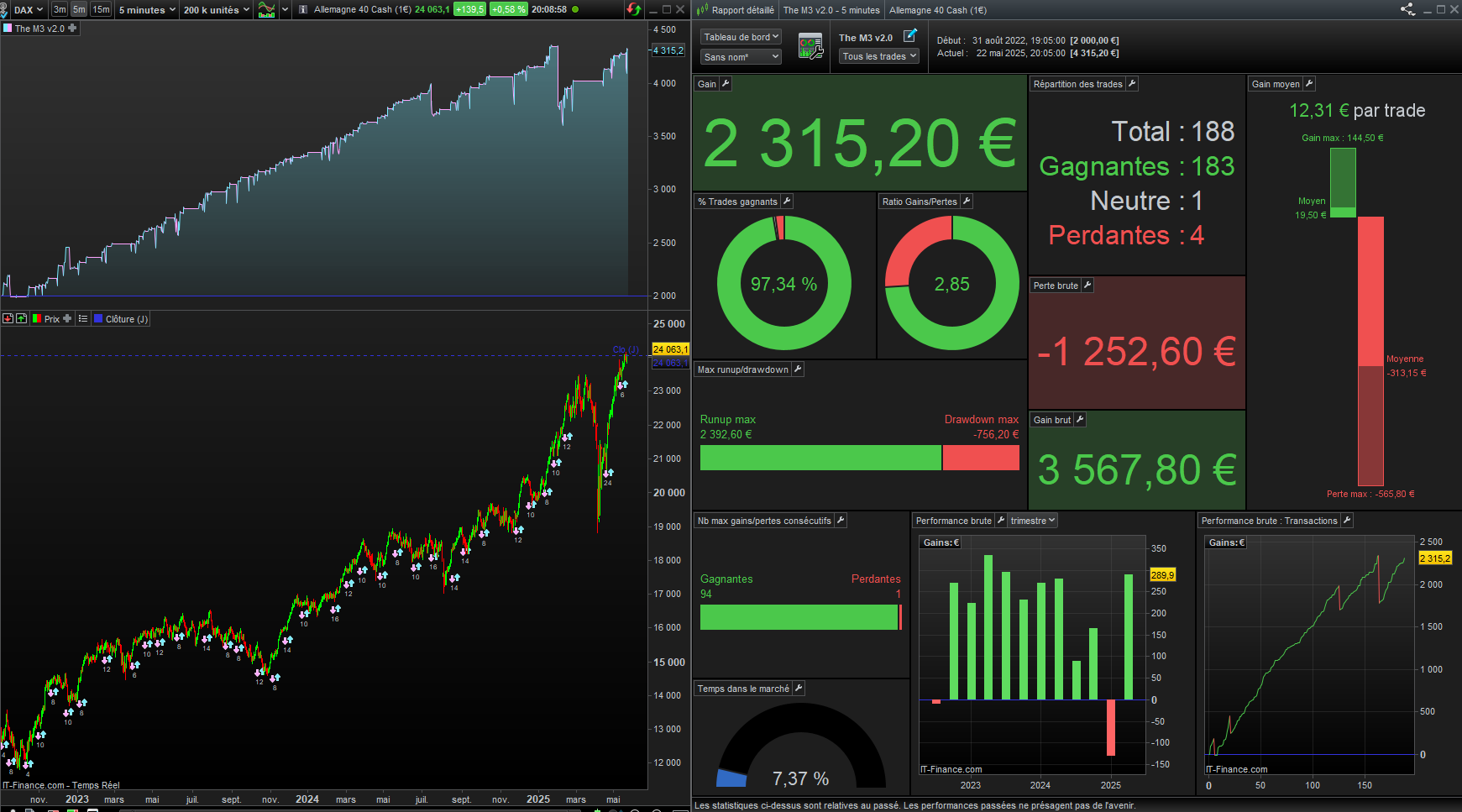

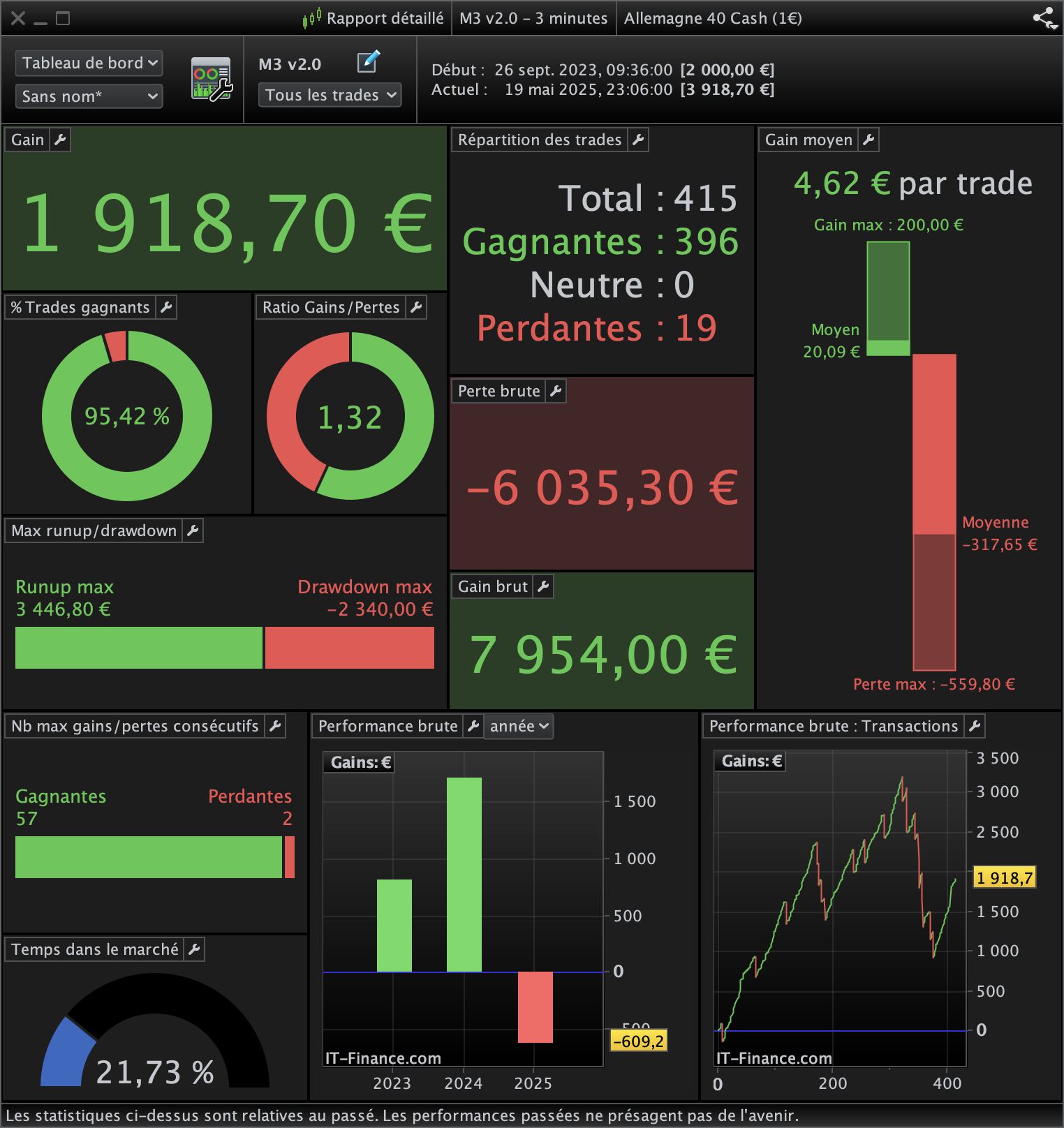

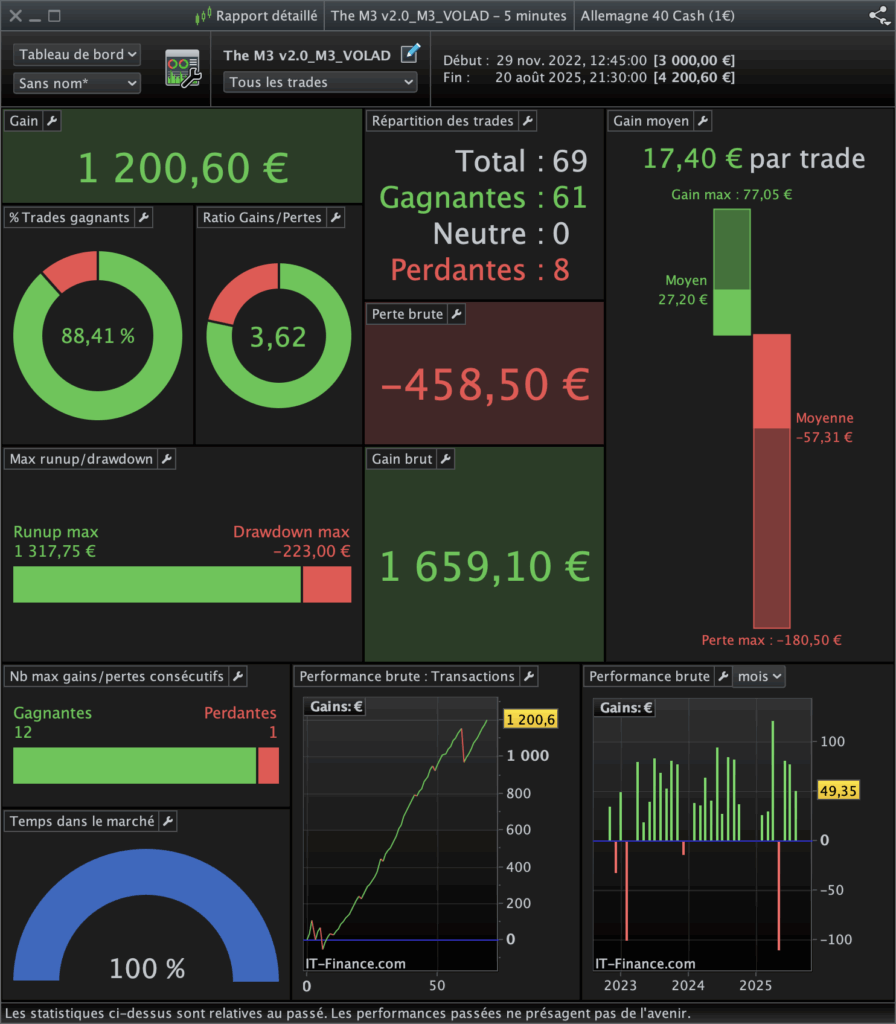

Exemple de configuration pour le DAX en timeframe 5 min:

Utilisation d’un filtre de volatilité simple et modifiable à loisir:

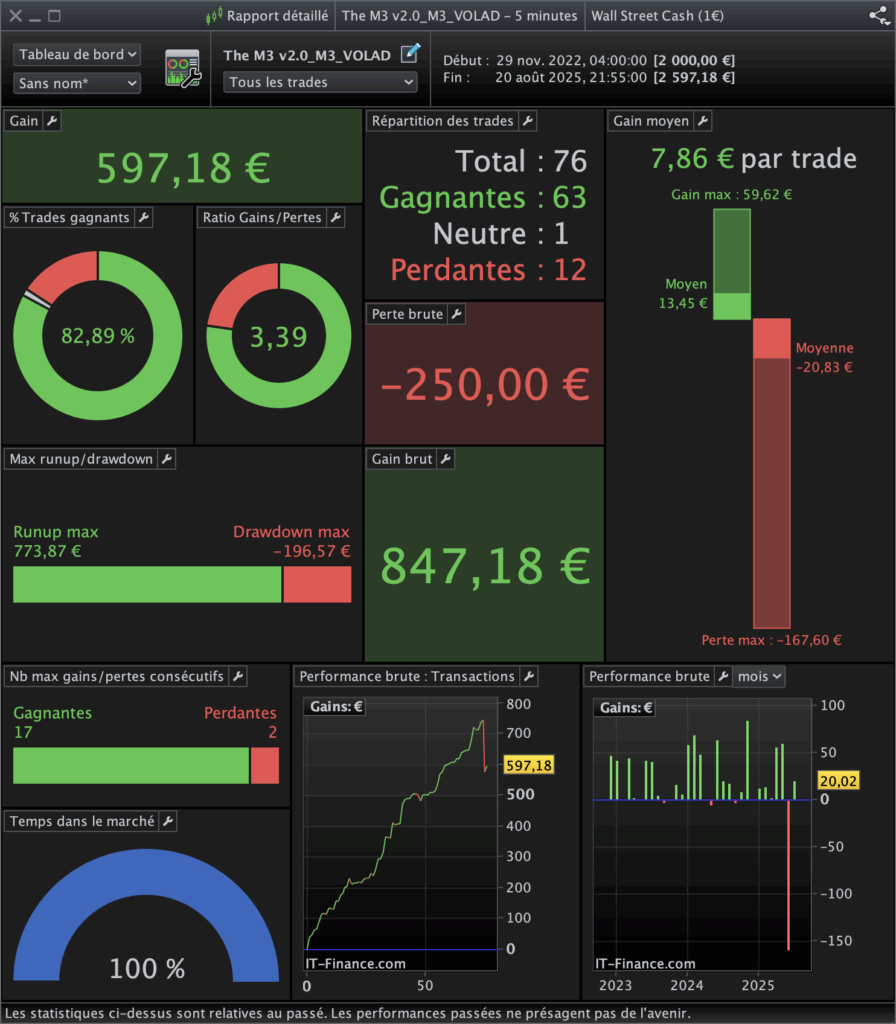

Ajout du réglage pour le Dow Jones TF M5 minutes:

📈 The M3 v2.0 – Bullish-Only Trend-Following Trading Bot

Built for uptrends. Designed for adaptability. Engineered for resilience.

🧠 The M3 v2.0 is a fully automated algorithmic trading bot designed to detect and exploit bullish market trends only. It avoids sideways and bearish conditions, executing trades exclusively during clear upward momentum.

🔧 Unlike over-optimized systems that fail outside backtest conditions, the M3 v2.0 is deliberately underfitted, making it resilient to market shifts and reliable over time. Its modular design allows for full customization of entry logic, risk settings, and exit strategies.

⚙️ Key Features:

-

Algorithmic detection of bullish impulses

-

Smart trade entries filtered by strict market conditions

-

Dynamic position management based on trend strength

-

Robust and not over-optimized – stable across different market regimes

-

Optimized for CFD markets (IG / PRT)

🎯 Who is it for?

For traders seeking to capitalize only on bullish momentum while relying on a bot that stays effective in the real world, not just in backtests

alexandre.marlier (verified owner) –

Unfortunately, perfromance is poor as per the last release compared to the backtest period. The algo seems overfited and I would not use it

delormesylvain (verified owner) –

Hello, obviously does not work on limited risk account

MICHAEL Reddi (verified owner) –

Top Performance