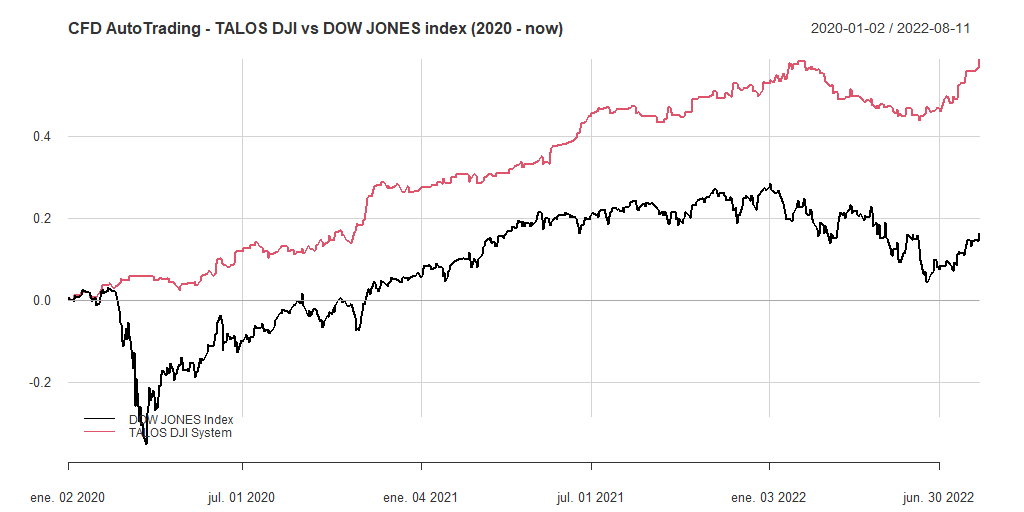

This trend-following strategy, combine long-lasting long positions with short-medium term short positions.

Almost as active as the version for NASDAQ, this version for DJI, does not look for a high ratio of win/loss trades, but through reduced SL it manages to maximise the profits of good trades. With a lot of market movement, it can launch multiple trades a day. The last version reduces significantly the time in market and the max SL of the operations, resulting in a so stable strategy.

—————– DATASHEET ———————————

Strategy type: Trend following

Input signals: Different indicators

Stop Loss: Always. Maximum of 1.1% for long positions and 0,4% for short positions

Profit handling: Trailing stop by blocks based on ATR and exit with profits in case of a strong trend change. Maximum target profit configured (dynamic).

General comments: Strategy specialised in consolidated trend following. Focuses on stability and drawdown of the operations, launching positions only in the current trend. Different configurations available (BE protection, emergency exit, only-long or only-short, 24h schedule or reduced to market hours)

Don’t be fooled: Results are shown for 1 contract at € 1 per point. Only 1 position at a time. Without martingales or partial closures (MM available, but not shown in results). Different configurations are available, and visible and non-obfuscated code. Visible headers in ProRealTime screenshots are shown here, distinguishing between backtest, real and demo in each case (avoid screens without headers and quick photoshops 🏴☠️). Available versioning and results full information in our website and groups, with full tracking.

Extras: Delivered to be used out-of-the-box, but configurable for experienced users. Money Management and Drawdown control modules are available.

ADVISE: For CFD, if you recently opened your trading account, you may get an error “trailing stop is not compatible with your account” when launching any system. That’s because you have a “limited risk” account. Please contact your broker’s support, preferably by phone, requesting to unblock your account. The problem will disappear after unblock your account and restart ProRealTime.

————————————————————————

To reduce the risk even in the same market, combine it too with our other DOW JONES different strategies, reducing the possible drawdowns too. Take advantage and a high discount by subscribing to the DOW JONES PACK

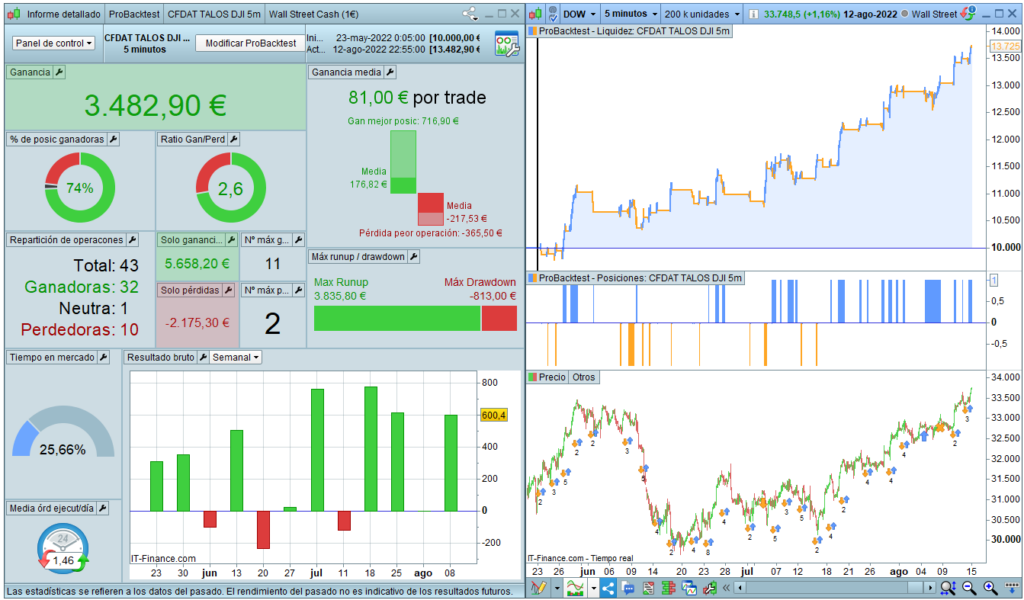

CURRENT VERSION BACKTEST

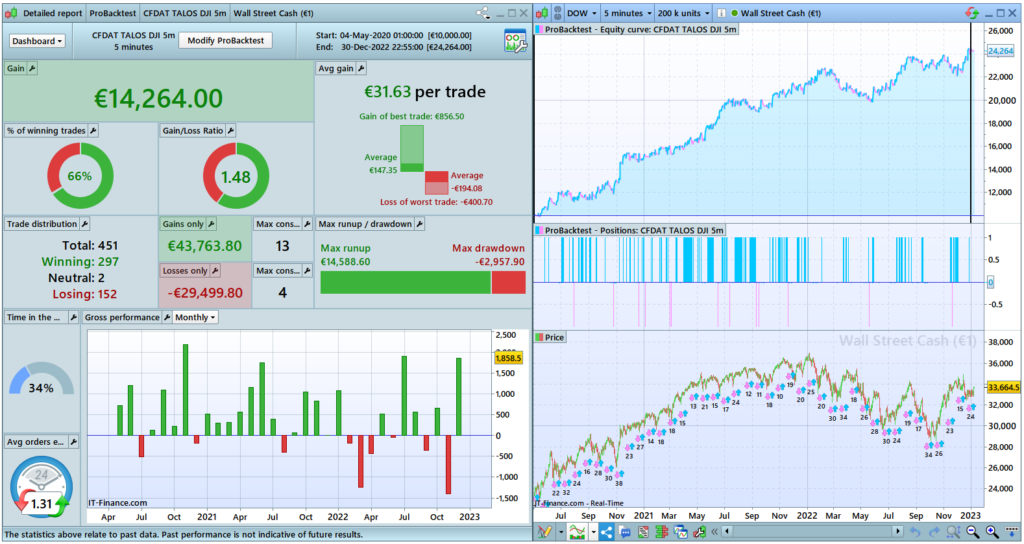

PREVIOUS VERSION BACKTESTS

SAMPLE RESULTS

Last winning streak that makes TALOS DJI return to ATH. Around 3,5k per contract in less than 3 months.

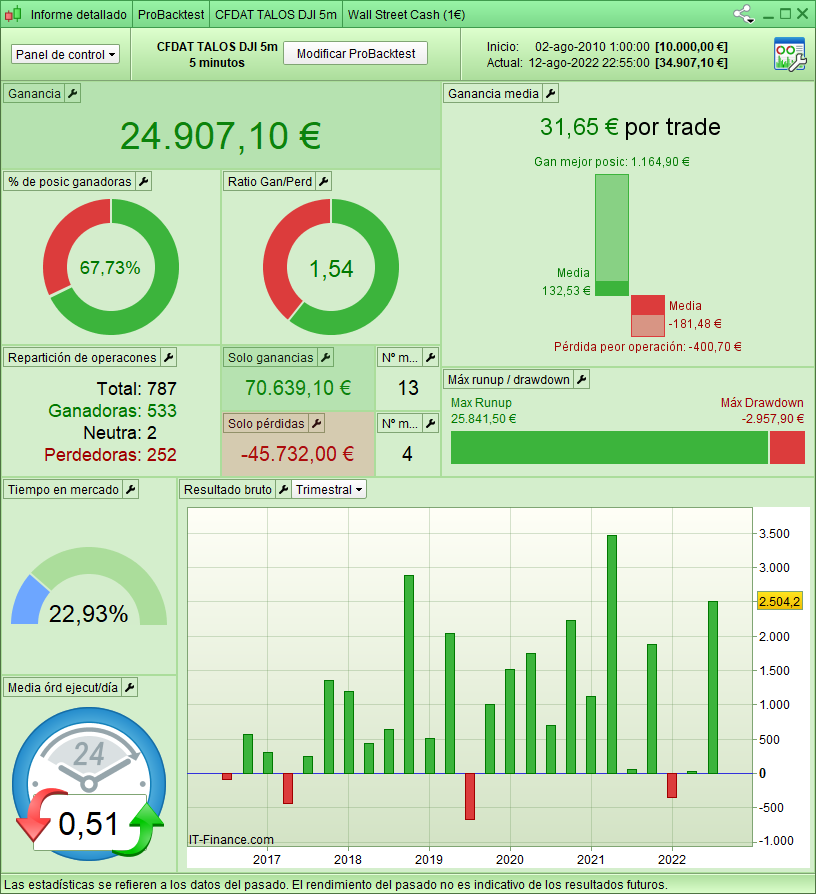

We do not make-up drawdowns, big gains need drawdowns. Avoid magic systems and ratios, don’t be fooled. Our results show always results in Out Of Sample considering always the publication date of each version. Some studies or comparisons could use the last version, but we do not make-up past results with the new versions or optimizations, our official results tables and publications always show the real results)

All our algos have a max 2% Stop Loss (or less), a money management system and a configurable drawdown limit to protect capital in the worst of cases. All images show results with 1 contract configuration.

This algo is delivered to be used “out-of-the-box”, not recommended any change even in changing circumstances. Let us do the best for you, if the strategy has to be updated, we will do it after the corresponding study and period in real in our accounts before distributing it

☆☆ Look at the live tweets for the latest results: https://bit.ly/cfdautoSMT-TalosDJI ☆☆

OLDER AND OTHER RESULTS

With this product license, we offer access to all updates of this strategy and customer support during the license period. You can participate in our support groups, and we can offer to you recommendations about configuration and reinvestment modules, system selection, drawdown and recommended equity…. even portfolio suggestions and coexistence with other systems.

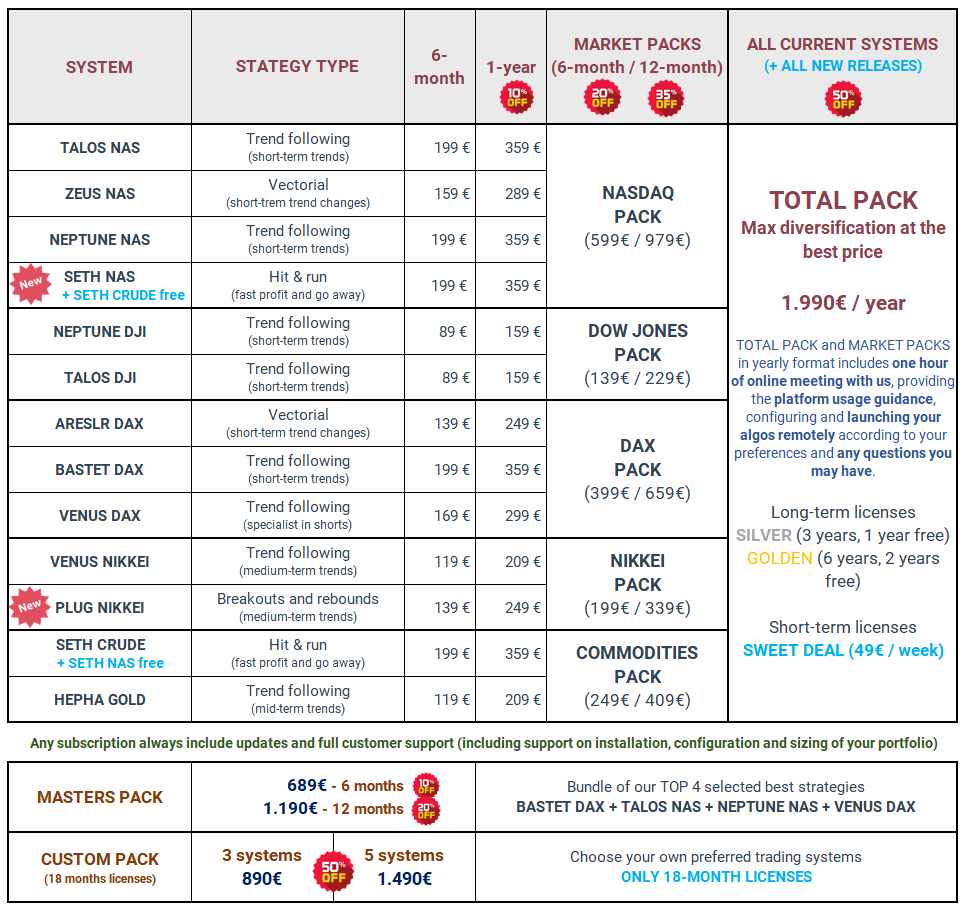

New 2024 Prices! We have significantly reduced prices in 2024, so don’t expect further offers as we will not be reducing prices further this year.

–> Update as of March 2024: The SETH NAS and PLUG NIKKEI systems have been included, leading to an increase in the price of the TOTAL PACK. (Previous owners of the TOTAL PACK received these systems at no additional cost)

Take a look at our complete portfolio. Stable and reliable systems for all kinds of market circumstances. You can backtest and verify the latest results by yourself using our free and public demo: https://cfdautotrading.com/demo

udo.krifter (verified owner) –

It hurts me to give this algo a bad rating. It looked so good at the beginning then in September with all volatility in the market this algo performance was very poor and almost made my deposit empty. With that said almost all algo sellers had a bad month in September.

Also CFD AutoTrading confirmed that this algo performance was not good and needed new programming and a update is incoming.

But CFD AutoTrading support I give the highest Rating. Best support by far. He/she is very helpful and very supportive and discord channel is awesome ⭐⭐⭐⭐⭐

As for now I can’t recommend this algo until an update is coming and then give it a new chance