A reversal island is a very rare and powerful trend reversal structure made up of several Japanese candlesticks.

An initial gap opens in the current trend, followed by one or more candlesticks before a second gap appears, opposite to the first, forming the reversal island.

The first and second gaps remain open, with no contact even with the candlestick wicks.

The screener scans the market to find stocks making a Reversal Island, with two opposing gaps. Last 100 candlesticks are scanned.

Results are sorted to easily know if it’s a bearish or a bullish reversal island :

- 1 = bullsih

- 2 = bearish

Use our Gap Indicator to see the gaps!

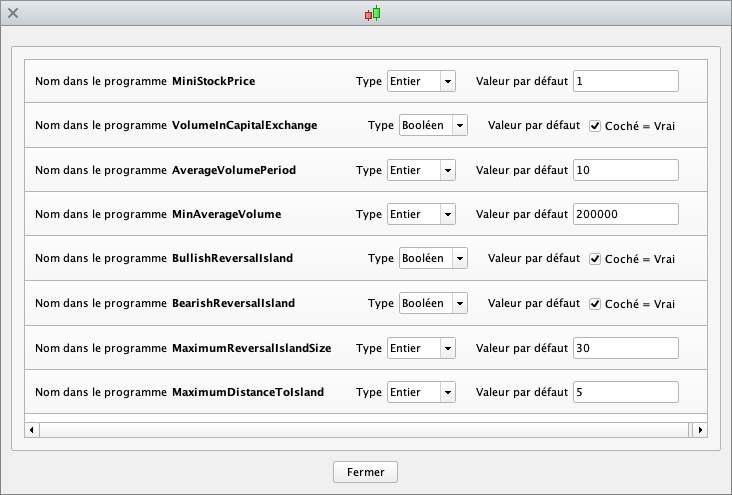

Parameters can be adjusted without modifying the code, that will allow to adjust the reversal island to your own criteria. Simply use the “variables” 🔧 menu of the screener :

Use our Gap Indicator to see the gaps!

Adjustable validation criteria :

- Maximum island size, in number of candlesticks

- Maximum distance from current candle to the last gap

Available filters :

- Bullish Reversal Island

- Bearish Reversal Island

General filter :

- Minimum stock price

- Minimum average volume

- Average volume expressed in transaction number or in capital exchange

Characteristics :

- Works on all TimeFrames

- ProRealTime V11 and later versions compatible

- Free ProRealTime (daily closings) compatible

- Automatic and free updates

Watch the video user’s guide on our Youtube channel, subtitles available in English :

🇫🇷 Îlot de retournement / 🇮🇹 Isola di inversione/ 🇩🇪 Insel der Umkehrung / 🇪🇸 Isla de inversión

Reviews

There are no reviews yet.