Overview

The Pro Weekly Breakout Screener is a powerful tool designed to identify high-probability breakout setups for the next week trading session.

By analysing market compression, multi-week ranges, Central Pivot Range levels, and volume dynamics, this screener provides traders with actionable opportunities ready to break out of key levels.

Problem

Traders often miss powerful breakouts because they don’t spot compression and range conditions early enough.

Solution

Pro Weekly Breakout Screener automatically identifies weekly setups ready to explode, giving you a head-start before the market week opens.

Key features

- Dynamic breakout detection : Identifies setups ready to break out based on technical compression and range conditions

- Multi week-range evaluation : Analyzses narrow ranges over multi-week periods for breakout readiness

- Compression analysis : Detects low-volatility phases, signaling imprending price expansion

- Next-day mode: Works after market close and lets you prepare the watchlist for the next week

- Multi instrument support: Compatible with stocks, forex, futures and other assets

Benefits for traders

- Anticipate market big moves: Spot breakout opportunities in advance

- Save time: Automatically scan the market for the best setups

- Improve trade accuracy: Rely on precise and accurate CPR and range calculations to focus on high-probability breakout trades

- Adaptable strategy: use it during market hours for immediate setups or after week close for next week’s opportunities and preparation

- Versatile application: Works across various instruments and markets to suit yuour trading style

How it works

The Pro Weekly Breakout Screener uses advanced technical analysis to identify breakout-ready instruments.

- Compression detection: Identifies low-volatility phases by comparing the current range and CPR width against historical averages

- Range analysis: Evaluates muli-week ranges to detect narrow ranges signaling potential price expansion

- Inside weeks and multi-week pattern: Screens for consecutive inside weeks or narrow ranges, indicating heightened breakout potential

- Next CPR levels: Calculates next week’s CPR (Central Pivot Range) to anticipate breakout setups for the upcoming session

- Volume and price conditions: ensures sufficient volume and price activity to validate tehe strength of the setups

This systematic approach allows traders to pinpoint opportunities with minimal effort, ensuring they never miss a potential breakout.

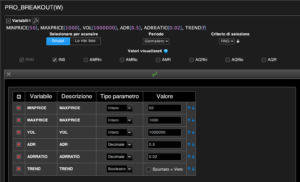

Settings

- PERIOD: leave it to “Daily”

- MINPRICE: the minimum price of the stock or asset to scan

- MAXPRICE: the maximum price of the stock or asset to scan

- VOL: the average volume of the asset (default = 1 Mio, ensures enough liquidity when used for stock scan)

- ADR: the minimum average daily range of the asset (default = 0,50$)

- ADRRATIO: the minimum ratio between the ADR and the last close price (default = 2%). The higher this number is, the more the asset is moving on a daily basis

- TREND: additional flag to spot opportunities in a trend (uptrend or downtrend). This helps orientating the trade bias (long or short).

Results

You can choose among the following information as info results of the screener:

- RNG: the ratio between last week range and AWR (Average Weekly Range); the lower this is (i.e. < 0.65, the more compression and breakout we can expect

- AMR: the Average Monthly Range that has alreaby been covered by the asset during the current month (in %).

- AMRhi: the distance in % between the last close price and the 100% monthly bullish target projected from current’s month low

- AMRlo: the distance in % between the last close price and the 100% monthly bearish target projected from curren’s month high

- AQR: the Average Quarterly Range that has alreaby been covered by the asset during the current month (in %).

- AQRhi: the distance in % between the last close price and the 100% quarterly bullish target projected from current’s quarter low

- AQRlo: the distance in % between the last close price and the 100% quarterly bearish target projected from curren’s quarter high

- INS: this refers to Inside weeks developed till the last week, included. It ranges from 0 to 3, with 1 indicating one inside week (increased likelihood of breakout), 2 indicating a double inside week pattern (even more likelihood of breakout) and 3 indicating a triple inside week pattern (very rare, explosive breakout opportunity).

- Independently from the “INS” result, the criteria of the screener are already optimized for the best breakout setups.

Who can use it?

- Swing Traders: Identify weekly breakout setups emerging from multi-week compression zones, ideal for holding positions over several days or weeks

- Position Traders: Focus on instruments with long-term breakout potential, leveraging weekly market trends

- Market Analysts: Analyze weekly price behavior and volatility phases for strategic insights into broader market movements

- Active Traders: Use weekly compression adn breakout signals to aling short-term trades with broader market structures

Reference

The methodology behind the Pro Weekly Breakout Screener is inspired by established principles of volatility-based analysis, including insights from Frank Ochoa’s teachings.

This screener has been independently developed and optimized for ProRealTime to provide traders with an efficient and reliable tool for weekly breakout forecasting.

Bewertungen

Es gibt noch keine Bewertungen.