How the “Price Action Strategy” works

This strategy is designed as a mid-term strategy (about 6 month) for timeframes 5 or 15 minutes so you should adjust the strategy regularly. The rules for determining positions are based on higher prices as the last long-movement for a long position and lower prices as the last down-movement for the short position. The long/down movements are described by the “trade” parameter – the bigger trend described by the “channel” parameter. By the way, with the option to adjust the strategy parameters, it could also be used in other time frames or run multiple time frames on one asset.

Developing the strategy, the main goals were a flexible algorithm and an efficient and convenient option for automated trading:

- best results were at several stock index!

- runnable at forex and commodities also

- maximum of probability

- efficiency with minimum drawdown

- reaction to changes in the market

- scaleable strategy

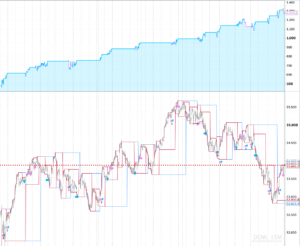

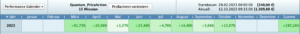

Some statistics and backtest

The initial capital set for the backtest was the minimum lot size for the asset – this shows you the real performance when running this strategy even with a small account.

Initial capital: 340 Eur / Runtime: about 8 month: / Performance: 235 %

A balanced ratio between the number of positions, probability and drawdown makes this strategy efficient:

Detailed statistics for long/short positions and drawdown ratio:

The performance was clearly positive every month – of course it could also be negative for a month and not every asset is suitable, so make some backtest on every asset you want to run:

How to adjust the strategy – Your Advantages!

The option to adjust the system makes the strategy very comfortable, flexible for your own trading style and offers many advantages:

Possibility of reaction

Even if a strategy has worked for a long time, a change in the market can cause it loose. To protect your capital, adjust the strategy every 2 or 3 months to respond to new market situations, new trends and volatility

Adjust the trend based on asset

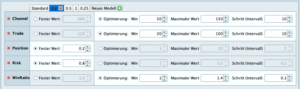

Optimize “Channel and Trade” (channel = bigger trend, trade = movement within the trend) that describe the number of candles to determine the trend. This option allows you to tailor the strategy to the asset you want to execute – also as a way to execute different time frames on an asset to diversify your trading. Of course, not every asset is suitable for this. Tweak the values, run a backtest and look for combinations that suit you

Risk management

For each trade-position, define the “Risk” you are comfortable with in percent of the base value (in this backtest example 0.6 % was the best one for me)

Define your reward

Define the “WinRatio” for the trades as a ratio to the given risk , for example 1.0 at 0.6% risk means the same “take profit” at 0.6% etc. By the way, this also depends on the probability that you choose with the “Channel and Trade” adjustment. If the probability is high, you should choose a lower “WinRatio” to achieve good performance as well

The ability to scale-up your cash-cows

The “Position” size of a lot (CFD lot size) is the ability to expand the strategy for high-performing assets or even if you want to run a larger account

Backtest the strategy before RUN !

Technical overview of the strategy backtest

Broker : IG

Share: CFD

Risk: 0.6 %

WinRatio: 1:1.3

Timeframe : 15 Minutes

Stock Index : WallStreet (1E)

Terms and Conditions

Please note our general terms and conditions.

These are accepted by you when purchasing our products.

Valoraciones

No hay valoraciones aún.