Overview

The PEMA Screener for ProRealTime is a cutting-edge market scanning tool designed for traders of all levels. By leveraging Pivot-Based Exponential Moving Averages (PEMAs), it dynamically identifies high-probability setups, such as pullbacks, crossovers, and breakouts. Whether you’re a day trader seeking intraday opportunities, a swing trader analyzing mid-term trends, or a position trader focused on long-term setups, the PEMA Screener simplifies market analysis and decision-making by highlighting key opportunities across instruments and timeframes.

Key Features

-

Pivot-Based Moving Averages: Utilizes PEMAs based on central pivot points for accurate market insights

-

Advanced Screening: Scans for setups such as pullbacks, crossovers, breakouts, and trend alignments

-

Stacked & Sloped Analysis: Identifies markets with strong bullish or bearish momentum using stacked and sloped PEMAs

-

Multi-Timeframe Support: Suitable for short-term, mid-term, and long-term trading strategies

-

Customizable Settings: Adapt the screener to match your trading preferences and objectives

-

Multi-Instrument Compatibility: Works seamlessly with stocks, forex, futures, and other assets

Benefits for Traders

-

Save Time: Automatically scans the market for high-probability setups

-

Enhance Accuracy: Filters trends, pullbacks, and breakouts with precision

-

Improve Efficiency: Simplifies the analysis process by providing actionable screening results

-

Adaptable to Strategies: Supports intraday, swing, and position trading approaches

-

Expand Opportunities: Explore opportunities across multiple instruments and timeframes effortlessly

How It Works

The PEMA Screener leverages advanced PEMA analysis to scan markets and identify actionable opportunities:

-

Stacked and Sloped PEMAs: Highlights instruments with strong bullish or bearish momentum when PEMAs align and slope consistently

-

Pullback Signals: Detects pullbacks within the Trigger Zone between fast and medium PEMAs, offering reliable entry points

-

Crossover Signals: Screens for bullish or bearish crossovers between fast and slow PEMAs to indicate potential trend reversals

-

Breakout Signals: Identifies breakouts when price moves decisively above or below PEMA levels

-

Change of Bias: Flags moments when market direction shifts, marked by price action breaking PEMA alignments

-

All Setups: Combines multiple conditions to find the most promising buy and sell signals dynamically

This screener provides a systematic and comprehensive approach to market analysis, allowing traders to make confident decisions based on real-time data.

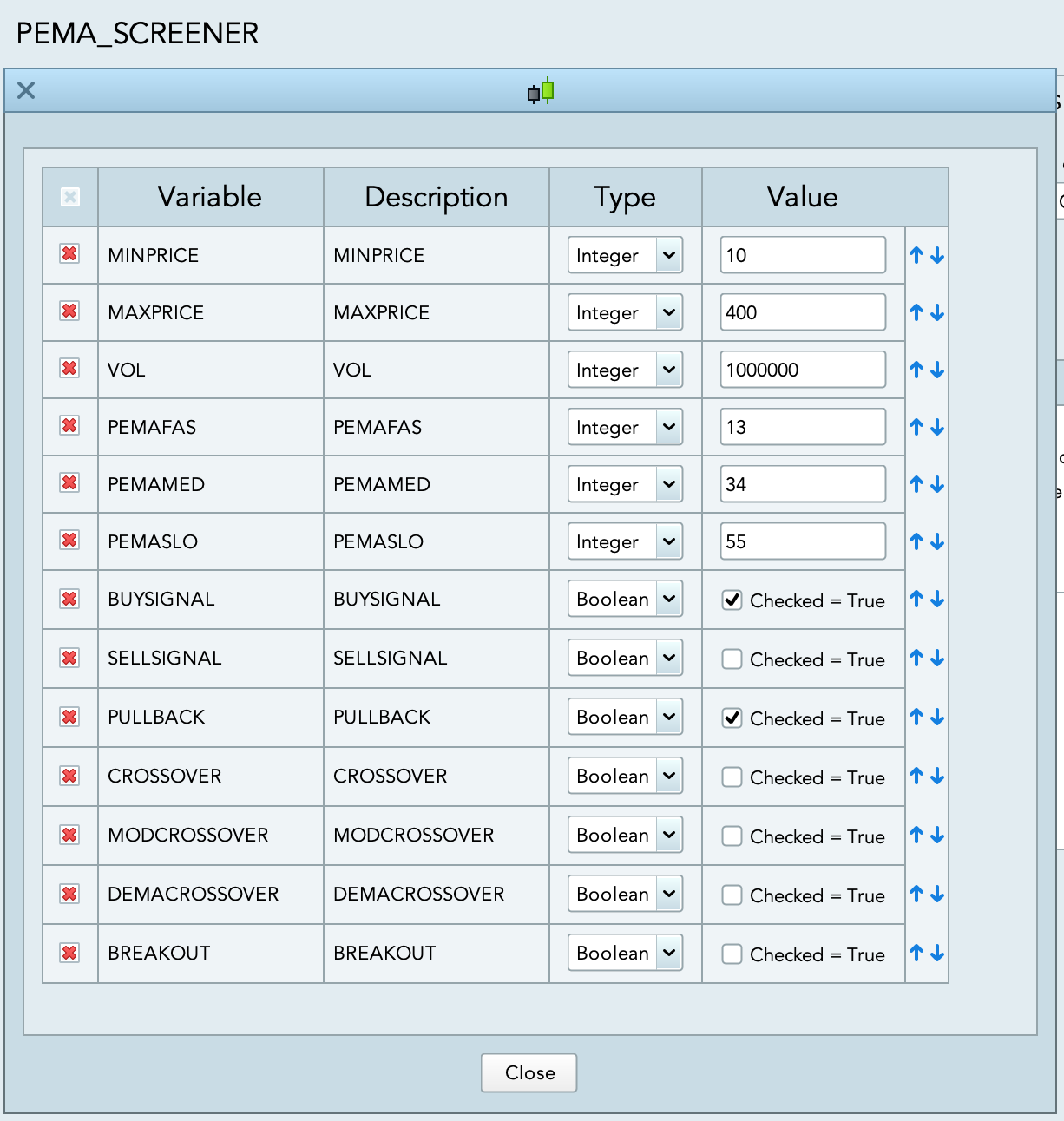

Settings

-

MINPRICE/MAXPRICE: Define the price range to scan the market

- BARSBACK: Number of bars to analyze stacked and slope PEMAs setups (default = 20)

- SLOPE: Slopeness degree, the higher it is the steeper is the trend with stacked and sloped PEMAs (default = 0.003)

- STACKED: Flag to filter for markets with stacked and sloped PEMAs to find trending instruments

- PEMAFAST: Configure the period for the fast PEMA used in signal detection (default = 21)

- PEMAMEDIUM: Set the medium PEMA period for pullbacks and crossovers signals (default = 34)

- PEMASLOW: Adjust the slow PEMA period for breakout and trend setups (default = 55)Flag only one of the following:

- BUYSIGNAL: Flag to filter just Buy signals

- SELLSIGNAL: Flag to filter just Sell signalsFlag only one of the following three signals:

- PULLBACK: Enable or disable pullback detection

- CROSSOVER: Activate or deactivate crossover signal screening

- BREAKOUT: Turn on breakout detection for bullish or bearish setups

or - ALL: Flag to scan for all the three type of signals above

Who Can Use It?

-

Day Traders: Scan for precise intraday setups, such as pullbacks and breakouts

-

Swing Traders: Identify mid-term trends and reversals for strategic entries and exits

-

Position Traders: Leverage long-term trend alignments to plan trades with high conviction

-

Market Analysts: Analyze broader market structures, trends, and shifts with ease

-

Strategy Developers: Use actionable signals to build and refine robust trading systems

Reference

The PEMA Screener methodology is inspired by established pivot-based analysis principles, including insights from Frank Ochoa’s teachings. Independently developed and optimized for ProRealTime, this screener provides a versatile and efficient solution for traders across all markets.

Valoraciones

No hay valoraciones aún.