Overview

The Pivot-based EMA Indicator is a powerful tool designed for traders of all levels to analyze and trade markets with precision. By leveraging Pivot-Based Exponential Moving Averages (PEMAs), it highlights trends, reversals, and high-probability setups across multiple timeframes. Whether you’re a day trader focusing on intraday pullbacks, a swing trader looking for mid-term trends, or a position trader seeking long-term opportunities, this indicator streamlines the process of market analysis and decision-making.

Plot

The indicator can be plot on any timeframe.

Example: PEMA plot on daily timeframe (AMZN), showing three nice pullback buy signals

Key features

-

Pivot-Based Moving Averages: Calculates PEMAs using central pivot points for dynamic market insights

-

Multi-Timeframe Precision: Suitable for short, medium, and long-term trend analysis

-

High-Probability Filtering: Identifies pullbacks, crossovers, and breakouts for actionable setups

-

Customizable Settings: Adapt the indicator to your specific trading strategies and criteria

-

Multi-Instrument Support: Works seamlessly with stocks, forex, futures, and other instruments

-

Comprehensive Strategy Support: Ideal for intraday, swing, and position trading strategies

Benefits for traders

-

Save Time: Quickly identify trends and setups with clear PEMA signals

-

Enhance Accuracy: Spot pullbacks, crossovers, and breakouts with precision

-

Improve Efficiency: Simplify market analysis with an easy-to-use indicator

-

Adaptable to Strategies: Integrates seamlessly into your preferred trading style

-

Expand Opportunities: Analyze broader market trends and dynamics effortlessly

How it works

The PEMA Indicator uses Pivot-Based Exponential Moving Averages (PEMAs) to dynamically analyze market trends and generate actionable signals.

Here’s how it works:

-

Stacked and Sloped PEMAs: Identifies trending markets when PEMAs align in a bullish or bearish configuration

-

Pullback Opportunities: Signals buy or sell pullbacks within the Trigger Zone between the fast and medium PEMAs

-

Crossover Signals: Highlights bullish or bearish crossovers between fast and slow PEMAs to indicate potential trend reversals

-

Breakout Detection: Scans for breakouts when price moves significantly above or below the PEMAs.

-

Mean Reversion: Detects overextended price movements with opportunities to fade back to PEMAs

-

Change of Bias: Identifies key moments when the trend shifts, marked by adverse price closes and PEMA crossovers

This indicator offers a systematic approach to analyze market trends, enabling traders to make confident, data-driven decisions across various timeframes.

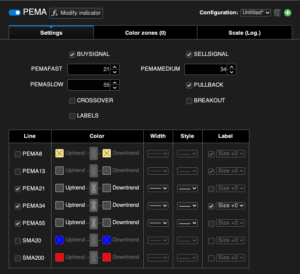

- BUYSIGNAL: plot buy signals on chart

- SELLSIGNAL: plot sell signals on chart

- PEMAFAST: Configure the period for the fast PEMA. This parameter will be used for signal detection (PULLBACK, CROSSOVER, BREAKOUT)

-

PEMAMEDIUM: Adjust the period for the medium PEMA. This parameter will be used for signal detection (PULLBACK, CROSSOVER, BREAKOUT)

-

PEMASLOW: Set the period for the slow PEMA. This parameter will be used for signal detection (PULLBACK, CROSSOVER, BREAKOUT)

-

PULLBACK: Enable or disable pullback detection.

-

CROSSOVER: Activate crossover buy or sell signals.

-

BREAKOUT: Turn on breakout detection for bullish or bearish setups.

-

LABELS: Show text annotations for each signal directly on the chart

- Line: flag all the PEMAs you wish to plot on the chart

Who can use it?

-

Day Traders: Utilize pullbacks and breakout signals for precise intraday opportunities

-

Swing Traders: Analyze multi-day trends and reversals for mid-term setups

-

Position Traders: Leverage longer-term PEMA alignments to plan strategic trades

-

Market Analysts: Gain insights into market trends, structural shifts, and reversals

-

Strategy Developers: Build robust trading systems using actionable PEMA-based signals

Reference

The methodology behind the PEMA Indicator is inspired by established pivot-based analysis techniques, including insights from Frank Ochoa’s teachings. This indicator has been independently developed and optimized for ProRealTime, providing a reliable and efficient tool for traders across all markets.

Reviews

There are no reviews yet.