Opening Range Breakout Asia session

In simple terms, the Opening Range Breakout strategy is a daily trading strategy that seeks to take advantage of the trading range ahead of the London/Frankfurt opening session. You get trading signals daily from 8:00 am with exact entry prices for buy and sell (long / short) with stop loss and price target.

Time frame: H1, 3Om, 15m, 10m, 5m and 1m.

The first movement in the morning is often the decisive one.

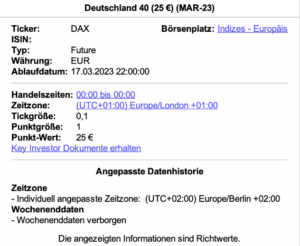

Once in ProRealTime, it is important to set the time zone. Make sure that the UTC+02:00) option is checked. The image shows an installation in Germany. Our systems are configured by default in CET time (Central European Time), that is the same for Spain, France or Sweden for example.

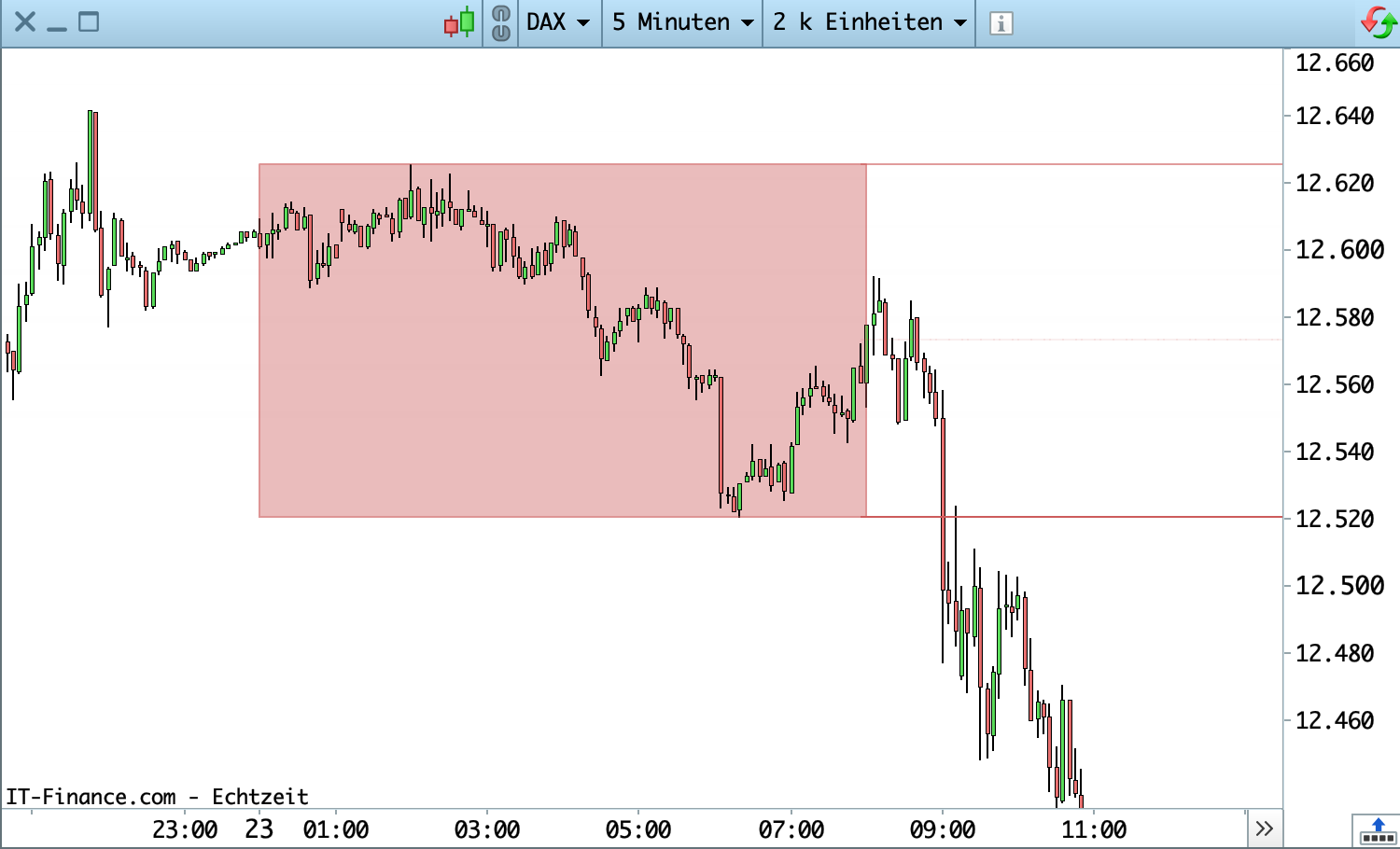

Wait until 8 am to see the size of the range of the asiatic session formed

To profit from the Morning Break Out, We look at the price movement between 0:00 and 8:00 am. We use the high traded during this time when it is exceeded to go long in the trend direction. However, if instead the low is undercut, We go short accordingly.

· BUY, if the price broke a resistance level (choose long)

· SELL, if the breakout occurs below a support level (choose short)

Only the first breakout is traded. Thus, there is only one trade on the day .

The range between 0 and 8 o’clock is the range for the trading day in points = 1 R. The larger the amplitude between 0 and 8 o’clock, the larger is the R for the respective day.

If then the breakout occurs we set 1 R as a take profit in trend direction and at the same time we set 0.5 R, so half a trading range as a stop loss. This gives us a profit to loss ratio for the trade of 2 to 1.

If the position is half a R in profit over the day, We tighten my stop loss to deuce – plus one point for transaction costs. This allows me to lose a maximum of 0.5 R per trade.

Example:

If the position has not been closed by 15:15 with a stop loss or a take profit, We close the position with a time stop. Thus, no position is held overnight.

Why it works:

Many large banks, insurance companies and mutual fund companies hold their so-called Morning Meeting every morning. At this meeting, investment professionals from the respective departments come together and discuss their strategy for the coming day. On the buy side, individual analyses are presented and specific trades are derived from them. After the Morning Meeting, corresponding orders are issued to the trading desks.

If the investment companies rather expect a friendly day on the capital market (risk-on), because e.g. positive news came from the USA and Asia overnight, they will buy stocks and overall favor a positive day trend

Pros:

§ Liquidity on Futures and Forex is usually good

§ Easy to explain

§ Strategy makes money on the long and on the short side

§ Stable results over time

§ Frequent signals

§ we don’t have to wait for days or weeks of price activity to confirm our moment of entry.

Cons:

- Chance of false signals (false breakouts), so risk management is very important

- Adding additional confirmation signals can reduce risk of false breakouts, but also decreases the odds of catching a big move

§ Automation complex to implement

§ Partly there is a slippage during real trading

§ Reliable tick data required for a backtest

§ Not suitable for institutional portfolio managers

Interesting:

§ Improvement of the strategy possible through individual chart analyst

§ Strategy works especially well after the financial crisis

§ Can be implemented in almost all trading styles – scalping, day trading, swing trading or position trading

michaelhasenbeck (verified owner) –

A simple strategy, easily described and implemented without many indicators, oscillators or trend lines. From 4 October to 7 October this indicator has yielded 413 points with the Dax Xetra in 15 minutes. Absolute recommendation from my side.”