Informations

- Instrument(s) = Mini Nasdaq (NQ) / Micro Nasdaq (MNQ)

- Number of contracts = 1 minimum / adjustable by the user

- Timeframe = 5 minutes

- Trade direction = Long & Short

- Maximum number of trade per day = 5 long & 5 short

- Overnight = yes

- OverWeekEnd = no

- Set Up = based on OPR, Open Price Range 15 minutes

- Initial amount required = margin value (depending on the instrument and number of contracts) + estimated drawdown amount based on backtesting.

Strategy description

This auto trading system is based on the OPR (Open Price Range) strategy for the first 15 minutes of the session.

When the price breaks the OPR, and under certain filtering conditions, a position is taken in the direction of the breakout (long or short). The position is taken based on the OPR breakout, but also on filters that optimise the performance: long timeframe volatility / short timeframe excess / long timeframe trend.

The trade is immediately protected with a stop, which will become a trailing stop according to the trading system’s criteria. The trade is exited via the trailing stop or, if this is not triggered, 10 minutes before the opening of the next trading session, or by opposite signal. When a position is closed by a stop, the automatic trading system may reopen a similar position if the price makes a pullback on the OPR.

No trades are held over the weekend; all positions are closed no later than Friday evening, 5 minutes before closing.

The trading system was designed, developed and optimised over a period of nearly 6 years (06/05/2019 – 16/03/2025) to obtain a robust long-term system capable of coping with different market conditions (range, bullish, bearish, volatility, etc.).

Results

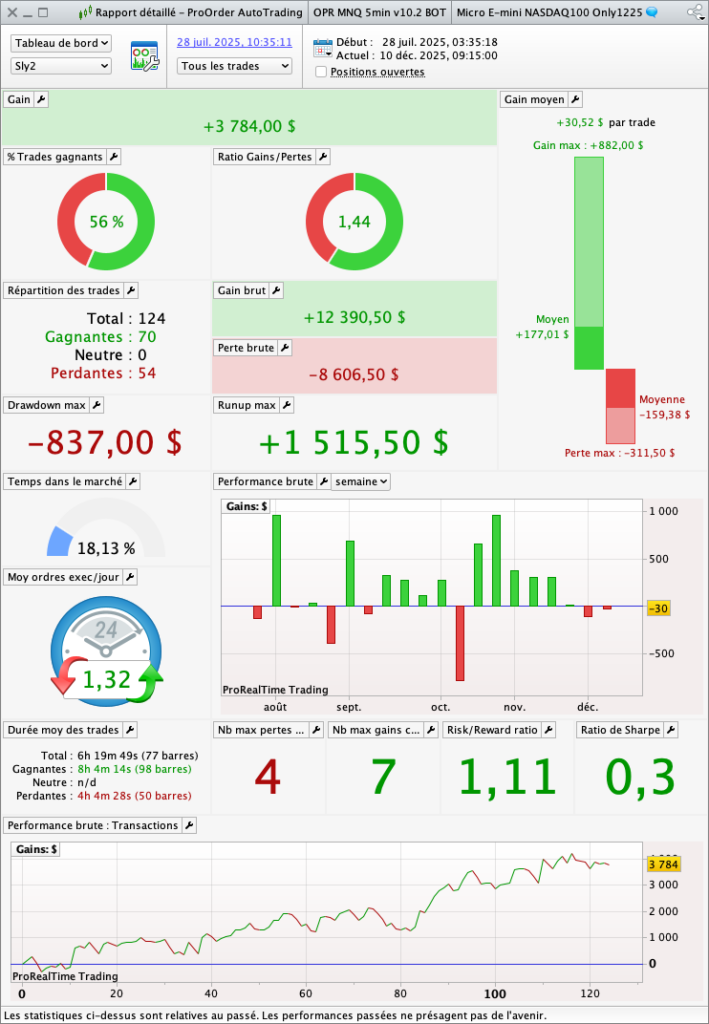

The results presented below were achieved with one contract on the Micro Nasdaq (MNQ), without reinvesting the gains made, comissions included and 0.5 points spread.

- Backtest results for the development period 06/05/2019 – 16/03/2025

- Backtest results for the post development period 16/03/2025 – 19/01/2026

- Actual trading results for the period 28/07/2025 – 10/12/2025

Disclaimer

The automated trading systems offered have been developed and optimised using historical data covering a period of several years.

The aim of this development is therefore to obtain automated trading systems that are robust in the long term, regardless of market conditions. However, past performance is no guarantee of future results, and investing in the financial markets involves risks that may result in the total loss of capital.

Users of the tools offered understand and accept that they use these tools under their sole and entire responsibility. P2C Trading declines all responsibility for the use of the tools and any consequences that may arise from it.

🇫🇷 Stratégie OPR Nasdaq / 🇮🇹 Strategia OPR Nasdaq / 🇩🇪 OPR Strategie Nasdaq / 🇪🇸 Estrategia OPR Nasdaq

JEAN BAPTISTE THETIOT (Verifizierter Besitzer) –

Je recommande fortement. Permet de trader facilement sans se prendre la tête, avec des résultats assez rapidement