This automated system has been designed to trade the Micro Nasdaq 100 using ProRealTime Trading + Interactive Brokers. It follows a professional, stable approach focused on achieving consistent results over time. It is built on a solid structure that maintains its effectiveness even under market changes, volatility shifts, or the natural evolution of the index, as reflected in the attached backtest using real historical data.

The strategy is based on a moving-average crossover, requiring the confluence of several simultaneous conditions to ensure higher-probability entries. It combines trend analysis, movement strength, and favorable volatility contexts, using indicators such as:

🔹 Slope and direction of the 200-period moving average (market structure)

🔹 Short- and medium-term moving-average crossover (impulse activation)

🔹 RSI and MACD to confirm momentum strength and timing

🔹 ATR as a volatility filter, avoiding noise zones or excessive expansion

🔹 Additional volume confirmation on short entries

The system uses an initial stop loss as a percentage of price, approximately 0.9% on long trades and 1% on short trades, allowing risk management to scale naturally as the asset evolves, maintaining long-term efficiency. Afterwards, a progressive trailing stop is activated, which follows the movement and aims to capture large trending segments, securing profits and limiting pullbacks.

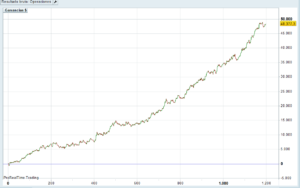

The system has been evaluated for more than six years with consistent results, demonstrating its ability to generate sustained profits, with an above-average win rate and balanced risk control. It maintains a clean and steadily rising equity curve, without major drawdowns, and with a solid balance between performance and stability.

It is designed for traders who want to automate their trading without complications and without the need for constant supervision, using a system that combines discipline, risk control, and market logic. Additionally, it is prepared to scale gradually according to account size or user profile.

Its design prioritizes long-term consistency over short-term extreme results. It does not require frequent optimizations and can be used both by individual traders and more advanced profiles looking to incorporate a stable, data-driven system into their workflow.

The shown backtest was performed trading one contract with an initial capital of $10,000, including commissions and a 0.3-point spread, using ProRealTime Trading connected to Interactive Brokers. Depending on account size and money management, the system can be scaled to trade more contracts, although it is recommended to start with one and progressively increase as the capital grows.

When is it recommended to activate the system?

It is recommended to activate the system only when there are no open positions, meaning the system is completely flat.

This ensures that the live trading begins in sync with the historical backtest and with the statistical logic of the strategy, avoiding differences between real and simulated results.

Activating it in the middle of an open trade may generate an unexpected entry price or disrupt the normal sequence of signals.

What timeframe does the system use?

The strategy operates on 4-minute charts.

Which broker is this system compatible with?

This system is designed to trade Micro Nasdaq futures (MNQ) using Interactive Brokers through ProRealTime.

What is the recommended minimum capital?

The backtest was performed with an initial capital of $10,000 USD.

You may use a smaller amount, although having a comfortable margin is recommended to avoid operational stress.

Does the system trade during specific hours?

Yes.

The system avoids the most volatile or illiquid periods, trading only within a time window where the Nasdaq has historically shown more stable behavior.

How many trades does it take per month?

Between 12 and 25 trades per month, depending on market conditions.

Since 2019, it has executed more than 1,180 verified trades.

Valoraciones

No hay valoraciones aún.