This screener detects bearish hammers by scanning the market up to 8 timeframes simultaneously: 1′ / 2′ / 5′ / 15′ / 30′ / 1h / 2h / 4h.

Ideal for intraday trading.

Everyone has their own search criterias, validation of a hammer, this screener has many adjustables parameters so that everyone can have his own hammer screener. These settings are done in a very simple way and without having to modify the code.

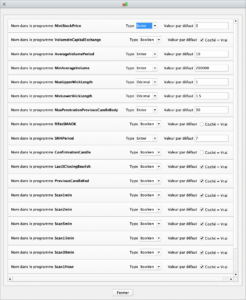

To adjust the parameters, simply open the Variables 🔧 menu :

A first filtering of stocks is carried out on the Daily time frame to ensure the minimum liquidity required.

- minimum stock price (for those who do not wish to have a penny in the results for example)

- minimum average volume (expressed in number of transactions or capital exchanged) to have the desired level of liquidity on the stock.

The hammer specifics criterias and its position in the trend of the title can be adjusted.

Results are then classified by criteria in the “TimeFrame / UT” column. This corresponds to the timeframe in which the hammer was detected :

The values shown above are given, as examples and do not constitute an optimal or recommended setting, everyone should find his own settings.

The values shown above are given, as examples and do not constitute an optimal or recommended setting, everyone should find his own settings.

Adjustable validation criteria :

- Minimum lower wick length

- Maximum upper wick length

- Bearish trend before the Hammer appears

- Maximum penetration in the previous candle

- Independant activation of the scanned timeframes

Available filters :

- Previous candle red

- Risk / reward ratio > 1

- Confirmation candle

General filter :

- Mini stock price

- Mini average volume

- Average volume in capital exchanged or number of transactions

Characteristics :

- Specific for intraday trading

- ProRealTime V11 and later versions compatible

- Automatic and free updates

- Hammer Indicator included

Watch the video user’s guide on our Youtube channel, subtitles available in English :

Valoraciones

No hay valoraciones aún.