Overview

The CPR Relation Screener (Daily) is a versatile tool designed to streamline your day trading process. By analyzing the 2-period CPR relation using daily pivot levels, this screener identifies instruments with high-probability setups and potential trend or reversal opportunities. With its precise filtering, it saves time and enhances decision-making, giving day traders a competitive edge in volatile markets.

Key features

- 2-Period CPR Analysis: Scans markets based on the relationship between current and previous daily CPR levels.

- High-Probability Filtering: Identifies instruments with potential trend, breakout, or change of bias setups.

- Real-Time Updates: Provides dynamic results during market hours for quick decision-making.

- Customizable Settings: Adapt the screener to your preferred criteria and trading style.

- Multi-Instrument Support: Works across stocks, forex, futures, and other asset classes.

- Intraday Focus: Tailored specifically for day traders seeking precision and efficiency.

Benefits for traders

- Save Time: Quickly identify instruments matching high-probability CPR setups

- Enhance Accuracy: Focus on trades with clear trend or reversal signals

- Improve Efficiency: Streamline your intraday analysis process

- Adaptable to Strategies: Customize the screener for your specific day trading needs

- Expand Opportunities: Scan multiple markets to uncover hidden trading setups

How it works

The CPR Relation Screener (Daily) leverages advanced market analysis to identify key trading opportunities by scanning for relationships between the current and previous day’s CPR levels.

Here’s how it works:

-

Inside CPR Relationship: Finds instruments where the current day’s CPR is narrower and contained within the previous day’s CPR, often signaling consolidation and potential breakouts

-

Higher CPR Relationship: Identifies instruments where the current day’s CPR is positioned above the previous day’s CPR, indicating bullish momentum

-

Lower CPR Relationship: Scans for cases where the current day’s CPR is entirely below the previous day’s CPR, signaling bearish momentum

-

GPZ Bullish Zone: Highlights setups where the CPR levels align with Camarilla support levels, suggesting bullish confluence

-

GPZ Bearish Zone: Identifies instruments where the CPR levels align with Camarilla resistance levels, indicating bearish confluence

-

Inside Advanced CPR Relationship: Detects instruments with consecutive narrow CPR patterns or multi-day inside relationships, signaling compression and a heightened likelihood of breakouts

-

Change of Bias to Long: Highlights transitions from a 2-period CPR lower relationship to a bullish bias when price closes above the upcoming CPR

-

Change of Bias to Short: Detects shifts from a 2-period higher CPR relationship to a bearish bias when price closes below the upcoming CPR

This screener provides a systematic way to analyze market structures and price behaviors, helping day traders quickly pinpoint high-probability setups with minimal effort.

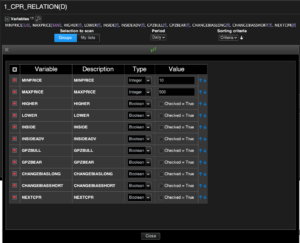

Settings

- MINPRICE: the lowest price to scan the market for

- MAXPRICE. the highest price to scan the market for

- HIGHER: flag to scan for 2-period CPR higher relationship (very bullish)

- LOWER: flag to scan for 2-period CPR lower relationship (very bearish)

- INSIDE: flag to scan for 2-period CPR inside relationship (potential breakout)

- INSIDEADV: flag to scan for 2-period CPR inside advanced relationship (more potential breakout)

- GPZBULL: flag to scan for 2-period CPR higher relationship with Camarilla L3 in confluence with the CPR (very bullish)

- GPZBEAR: flag to scan for 2-period CPR lower relationship with Camarilla H3 in confluence with the CPR (very bearish)

- CHANGEBIASLONG: flag to scan for 2-period CPR change of bias from short to long relationship (bullish)

- CHANEGBIASSHORT: flag to scan for 2-period CPR change of bias from long to short relationship (bearish)

- NEXTCPR: flag to scan the market for the upcoming 2-period CPR relation. Unflag to scan the live market for current 2-period CPR relation.

Who can use it?

-

Day Traders: Looking for precise intraday opportunities based on CPR relationships

-

Scalpers: Seeking reliable and quick setups for short-term trades

-

Market Analysts: Interested in identifying trends, consolidations, and bias shifts

-

Traders Across Asset Classes: Applicable to stocks, forex, futures, and other instruments

-

Strategy Developers: Leveraging CPR relations to create and refine trading systems

-

Beginners: Gaining structured insights into market dynamics with user-friendly scanning

Reference

The concept of 2-period CPR relations and their application in market analysis is inspired by established pivot-based trading methodologies, including insights from Frank Ochoa’s teachings. This screener has been independently developed and optimized for ProRealTime, offering a practical and efficient tool for traders to leverage these principles in their strategies.

Reviews

There are no reviews yet.