Congestion in the stockprice is a lateral price movement characterised by relatively small price variations, a low volatility.

Identifying and monitoring congestion can enable you to enter a position when congestion breaks.

The Congestions screener scans the market to find stocks whose prices are moving within a congestion zone.

The results are ranked according to the position of the current price in the congestion:

- 0 = in the congestion

- 1 = breaking out the congestion on top

- 2 = breaking out the congestion on bottom

A general filter, in daily UT, based on the share price and trading volumes (in capital or number of transactions), enables you to choose the desired level of liquidity for the share.

Our Congestion indicator shows the congestion detected by the screener directly on the chart.

This indicator is supplied with the screener.

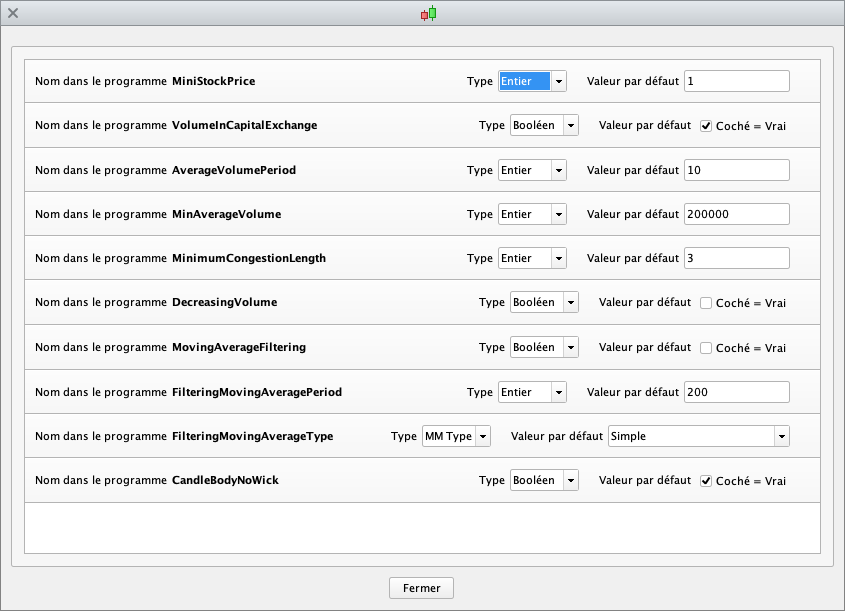

All parameters are ajustables without modifying the code, that will allow to adjust the Congestion detection to your own criteria. Simply use the “variables” 🔧 menu of the screener :

Adjustable validation criteria :

- Minimum congestion length, in number of candlesticks

- Candle body or Candle body + wicks

Available filters :

- Average volume is decreasing

- Price position above a moving average

General filter :

- Minimum stock price

- Minimum average volume

- Average volume expressed in transaction number or in capital exchange

Characteristics :

- Works on all TimeFrames

- ProRealTime V11 and later versions compatible

- Free ProRealTime (daily closings) compatible

- Congestion Indicator included

- Automatic and free updates

Watch the video user’s guide on our Youtube channel, subtitles available in English :

🇫🇷 Congestion / 🇮🇹 Congestione / 🇩🇪 Stau / 🇪🇸 Congestion

Reviews

There are no reviews yet.