Check our Real Trades using the Bellcurve Strategy at the bottom of this page!

BellCurves identifies Reversals & Trends in any market and timeframes. The indicator is simple to use and understand therefore valuable to all trading styles.

BellCurve Impulse:

The market moves in Impulses. An Impulse can either be a sign of a trend reversal or the very first impulse that triggers a new trend. You have to understand that market impulses can have different meanings in different situations.

The BellCurve indicator aims to identify the most significant market impulses.

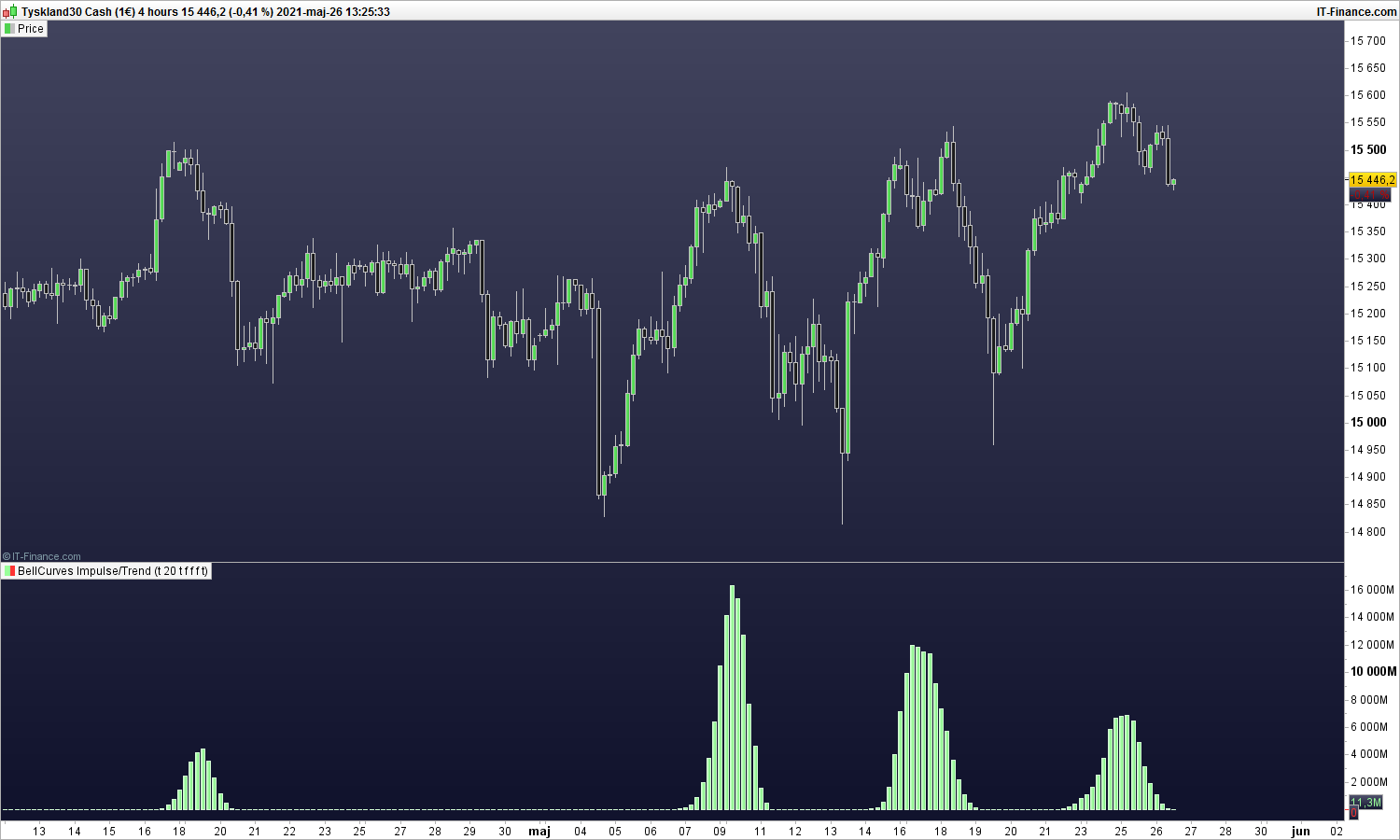

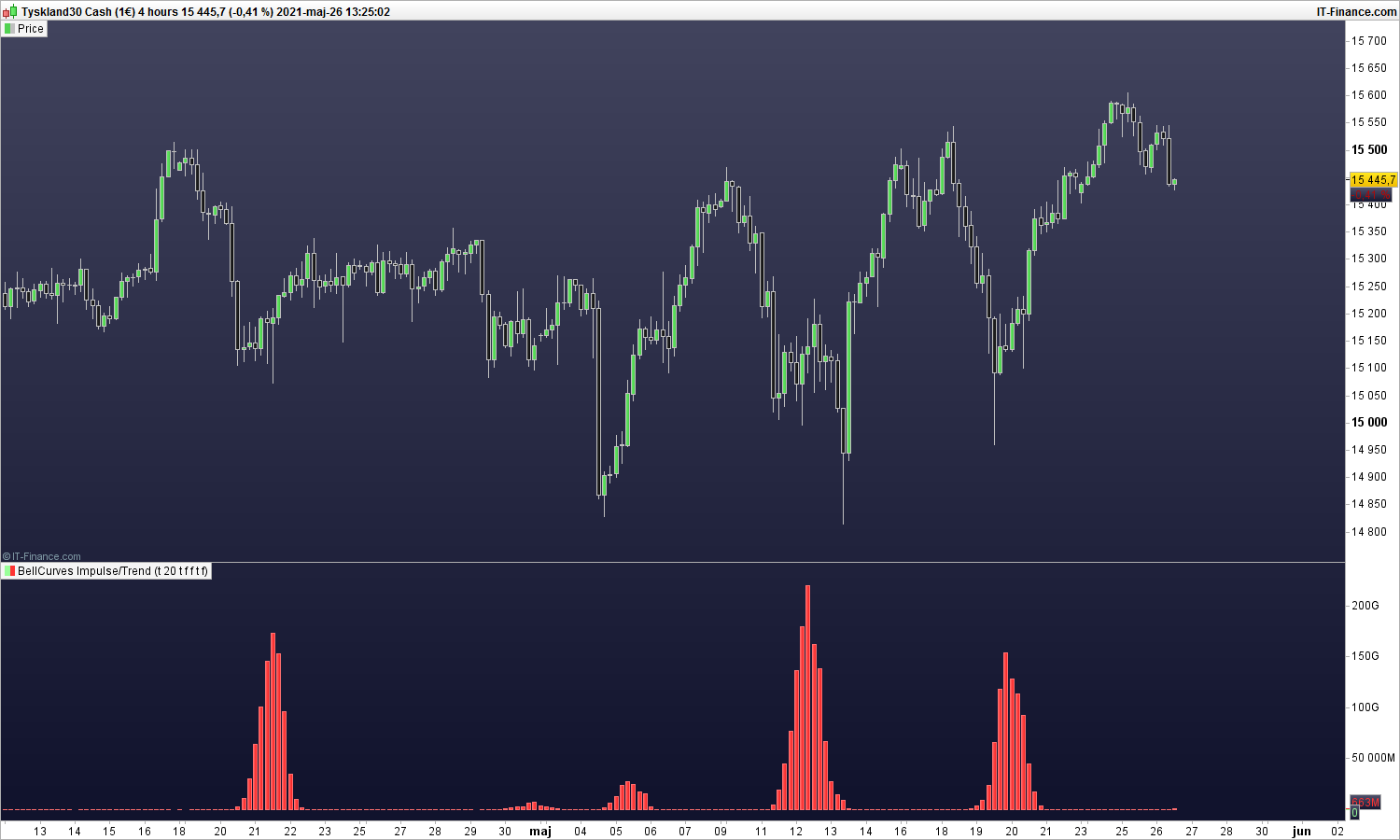

BellCurve Trend:

If you instead want to display the trend + impulse you can enable the Trend Feature. This is for traders that want to get a feel of the overall trend whilst having a good understanding of where the market has a chance to form a temporary Top/Bottom. (Good take profit areas).

Insights and Value the indicator brings:

✔ Clear perspective identifying short-term and long-term Reversals

✔ A simple and convenient way to recognize significant market impulses.

✔ Identify the short-term and long-term Trends. (Trend settings have to be enabled)

HOW TO USE

- Use the indicator to understand where the market has a high probability to reverse.

- Use the indicator to find Take Profit Points.

- Use the indicator to find an understanding of when the market is about to start a trend.

- Use the indicator to identify the current trend. (Trend settings have to be enabled)

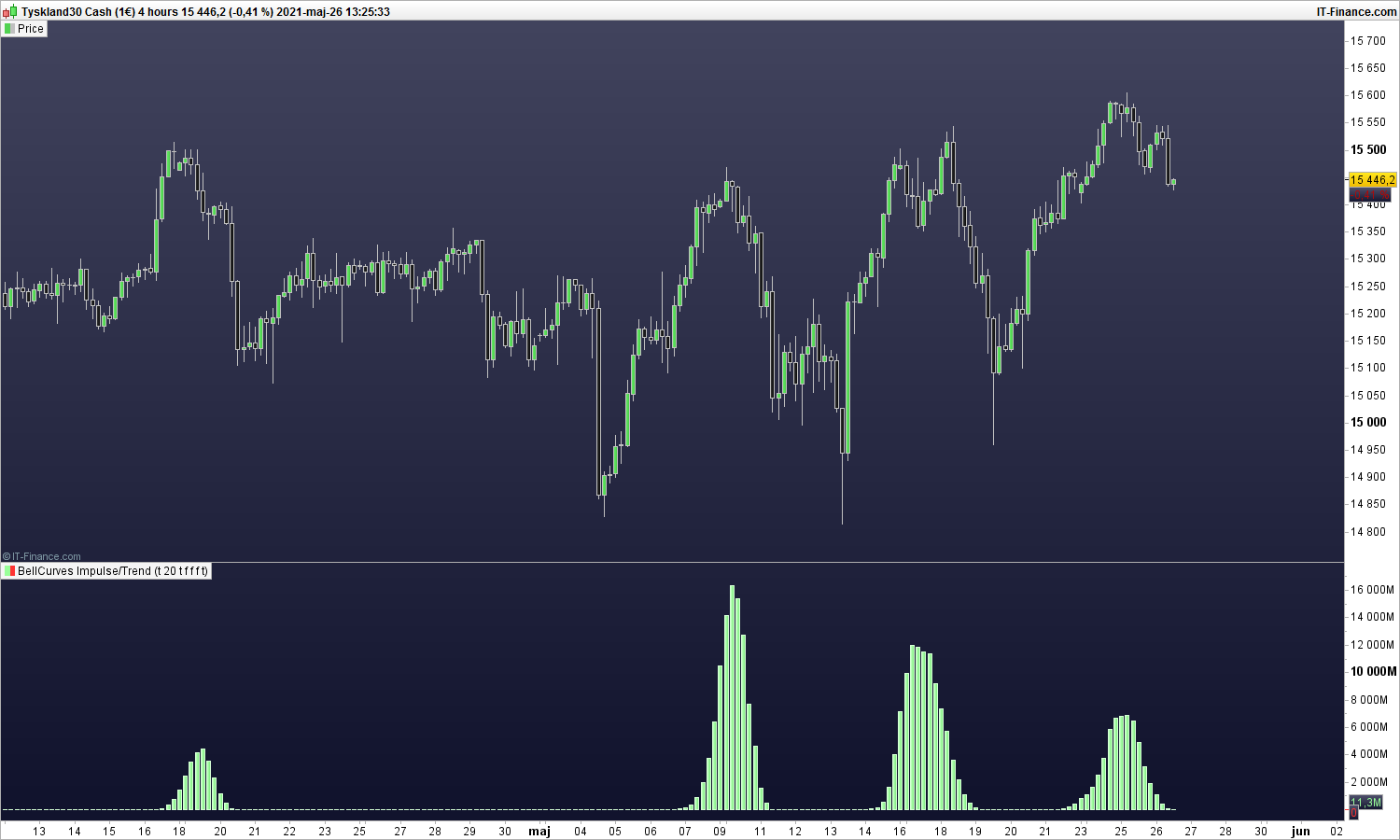

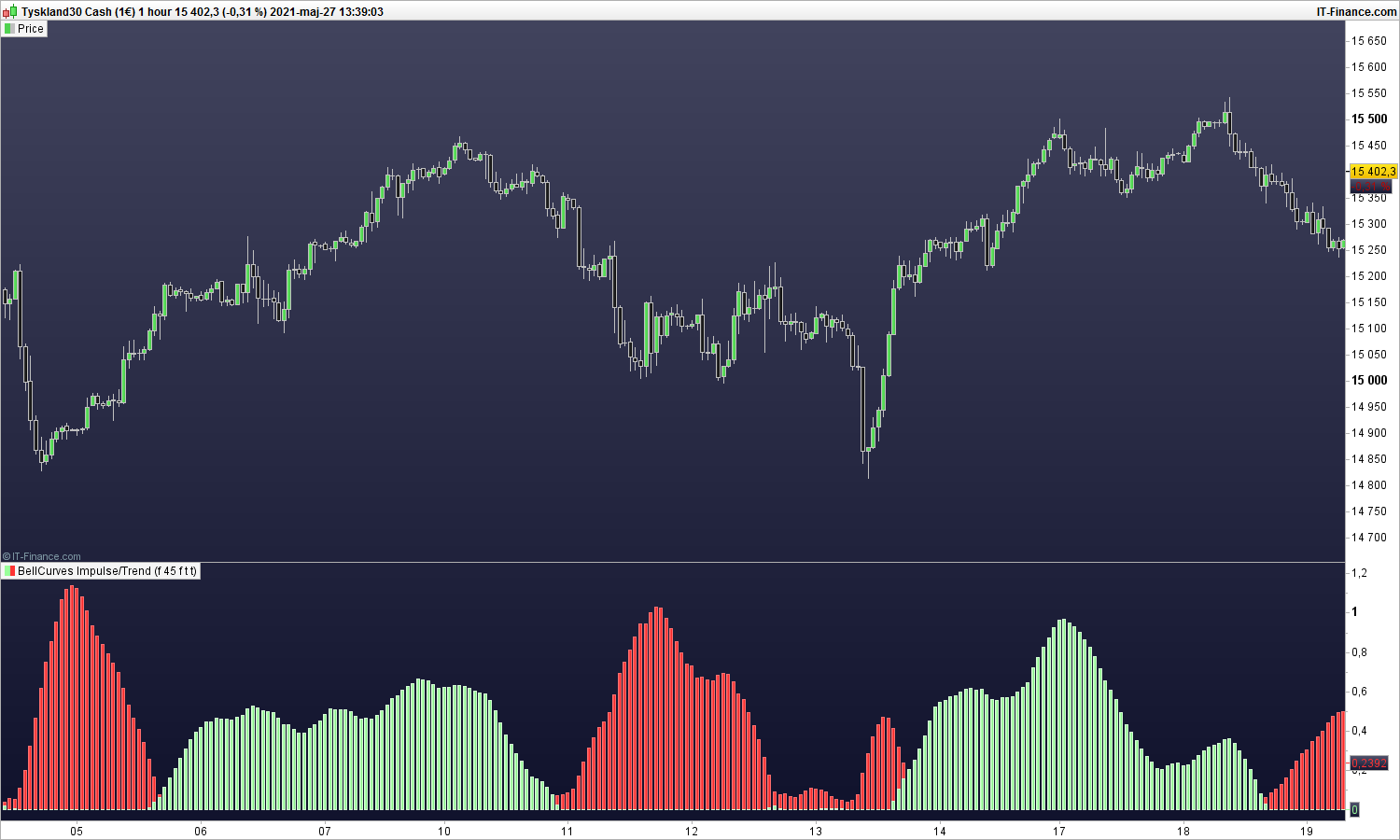

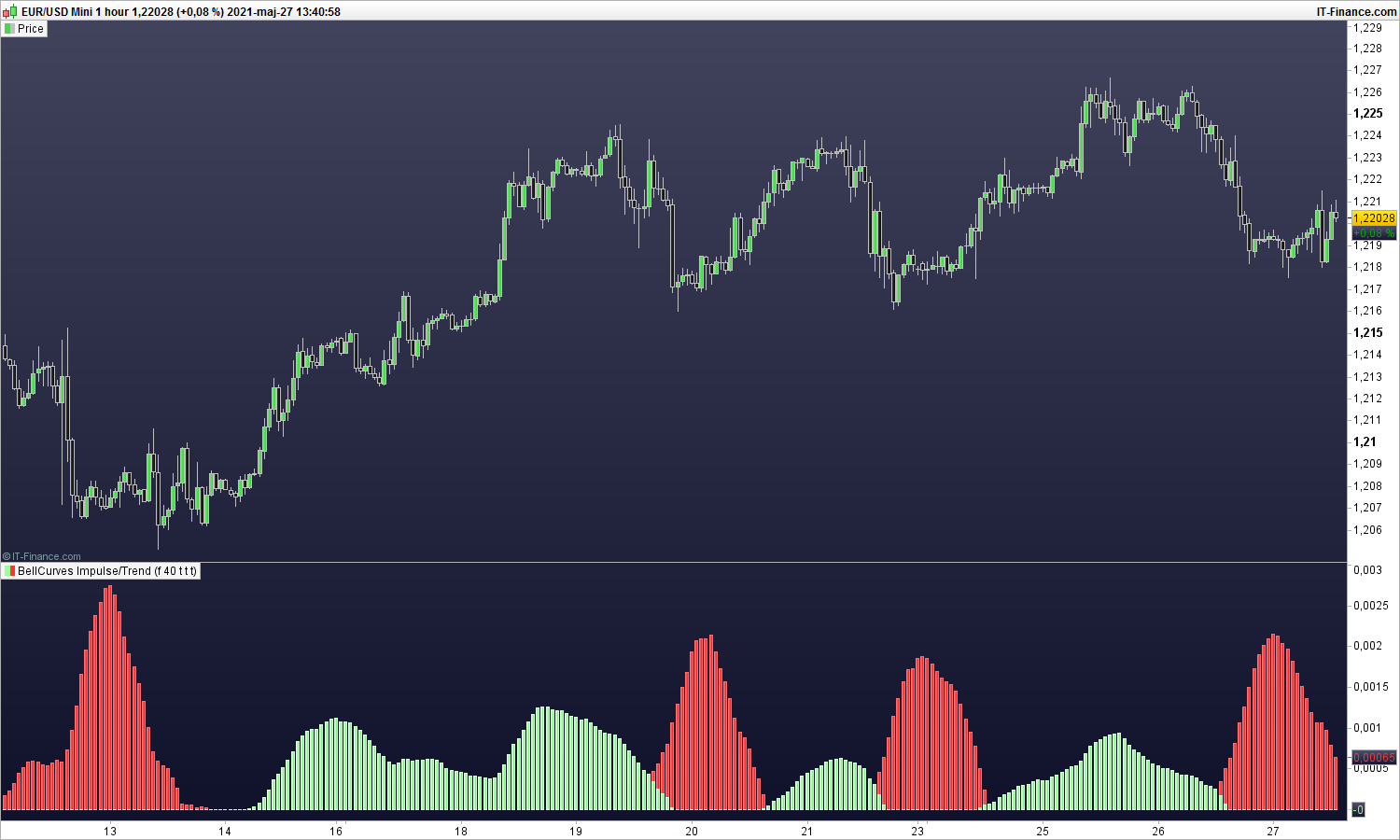

INDICATOR IN ACTION

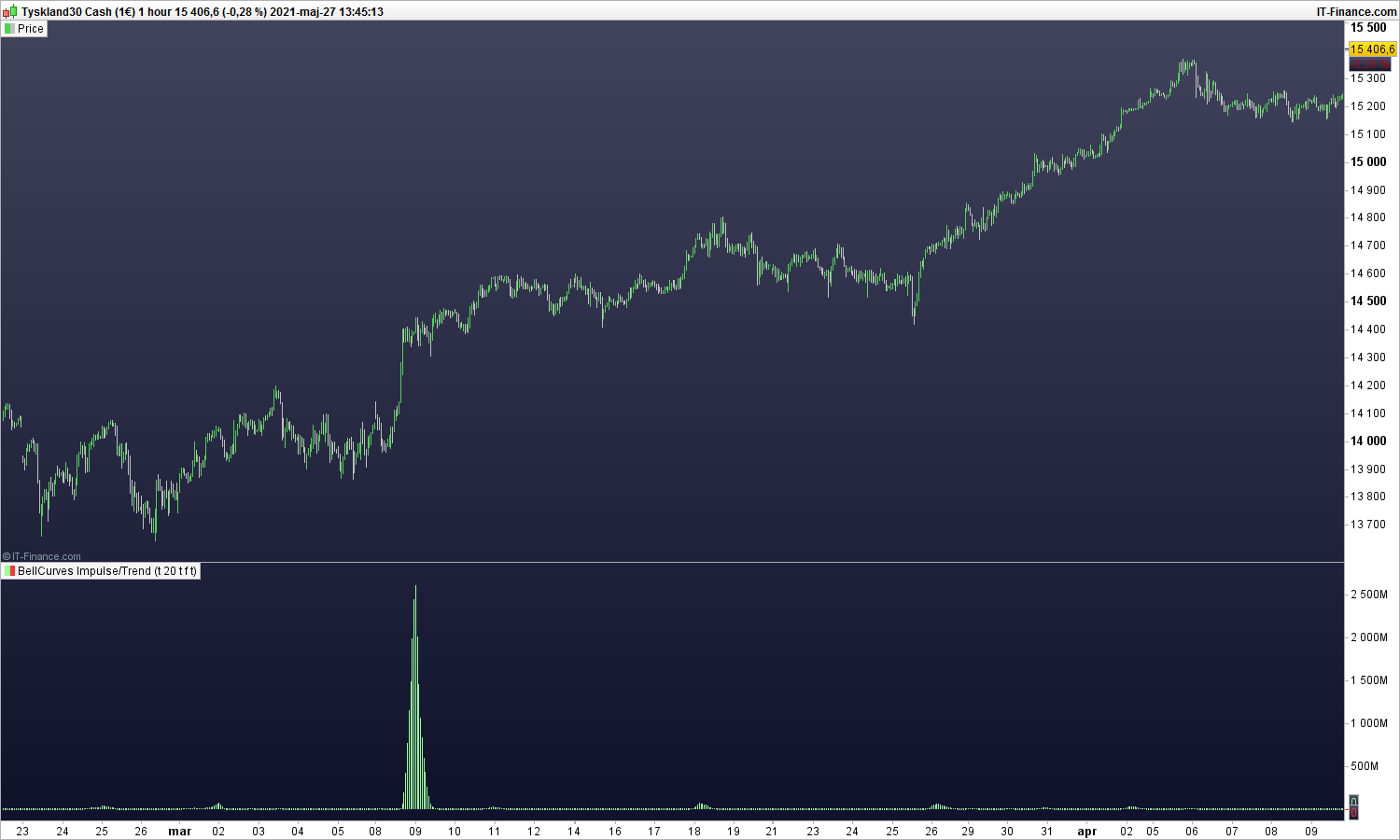

A Negative Impulse that triggers a Trend Reversal

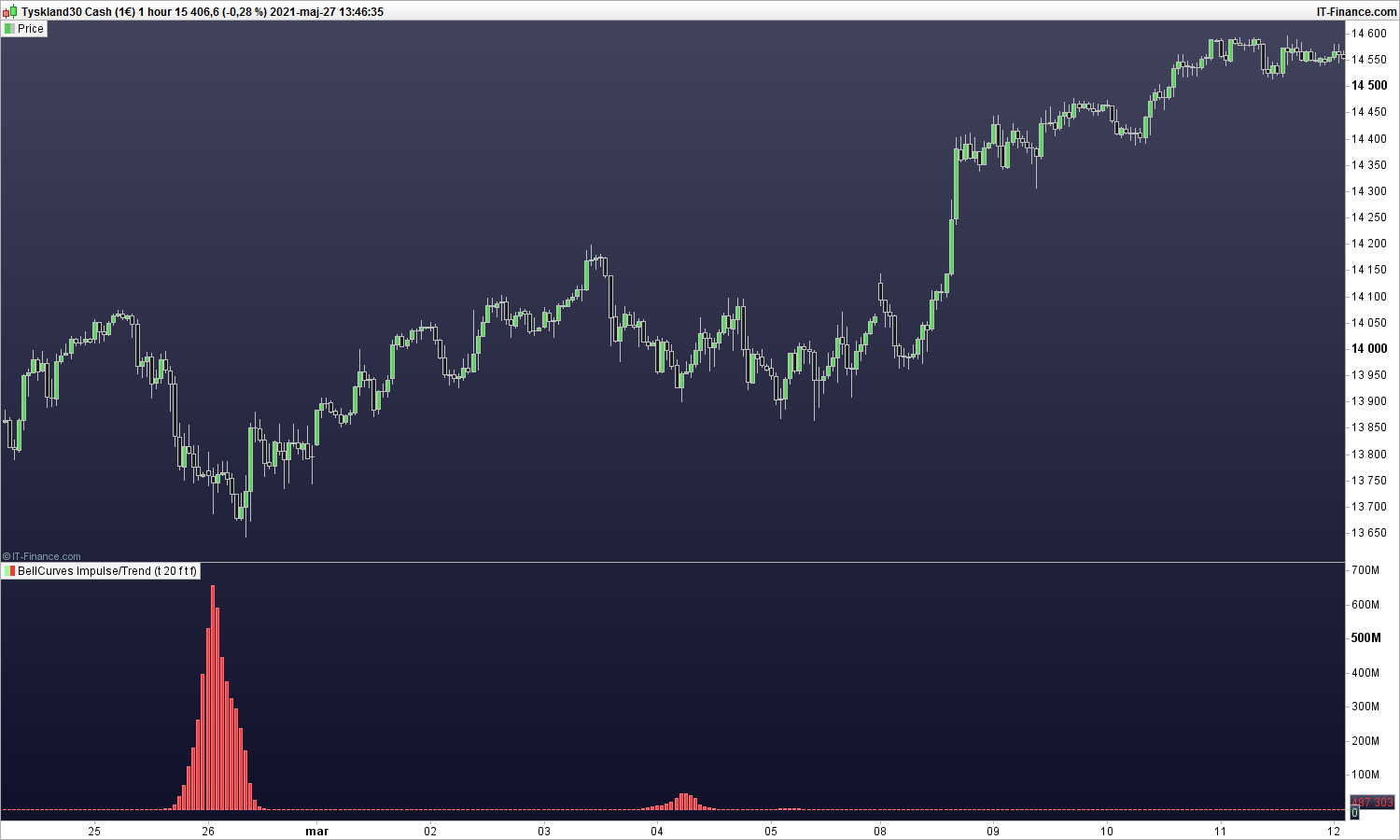

A Positive Impulse that triggers a new Bullish Trend

First, a strong negative Impulse that leads to a reversal. Closely followed with a strong positive impulse that starts a bullish trend.

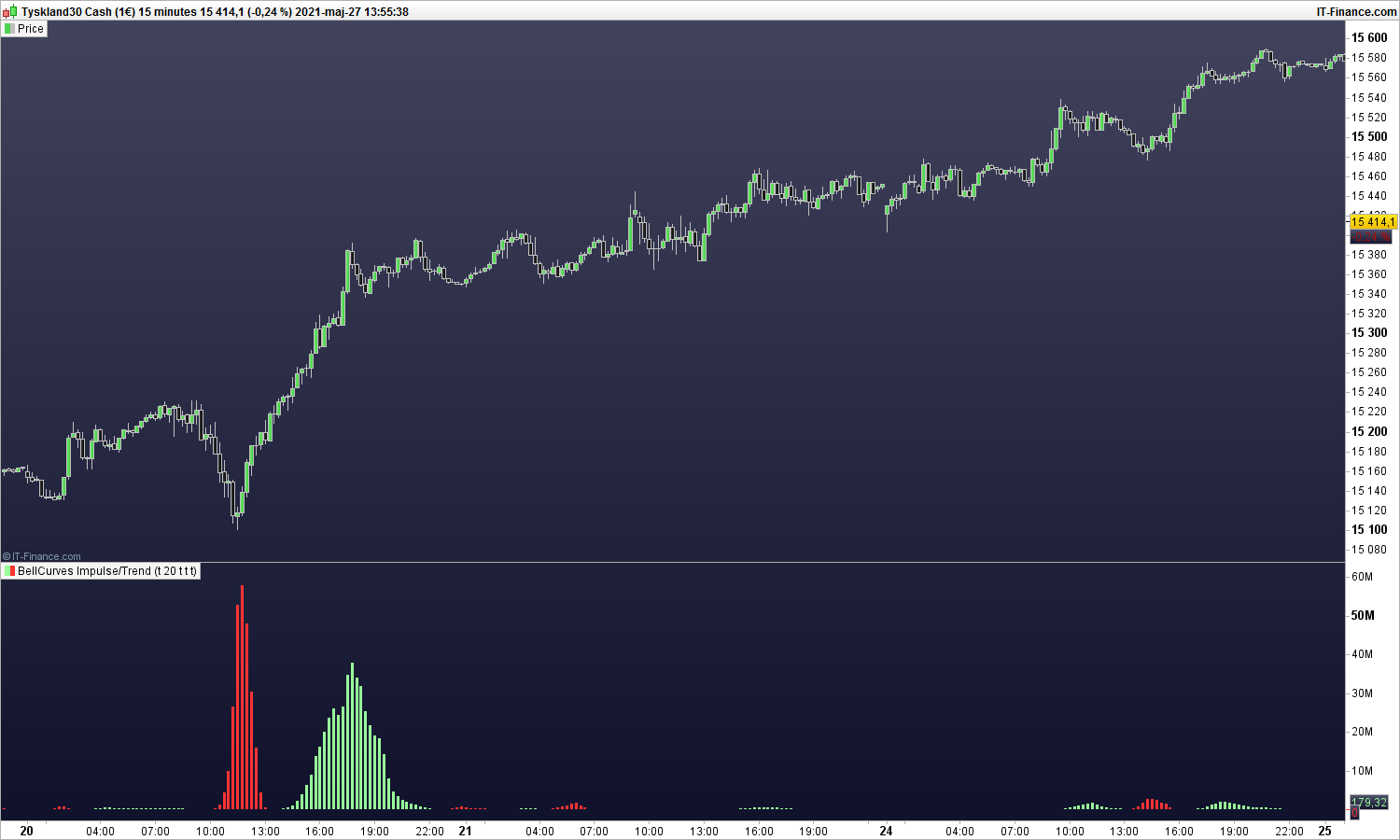

Bullish Impulses lead to a Reversals

Bearish Impulses lead to a Reversals

Trend Feature:

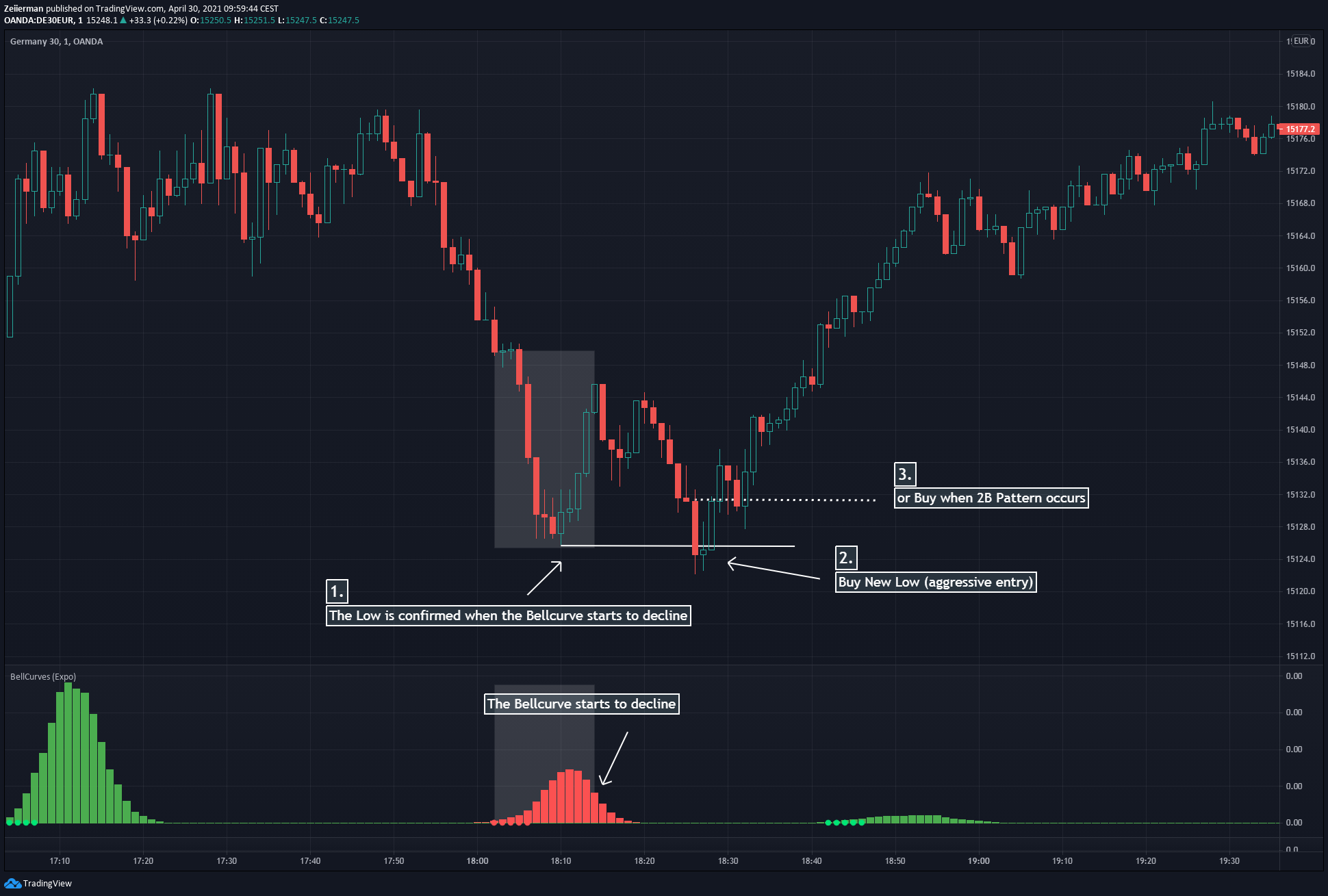

Simple Strategy that can be used:

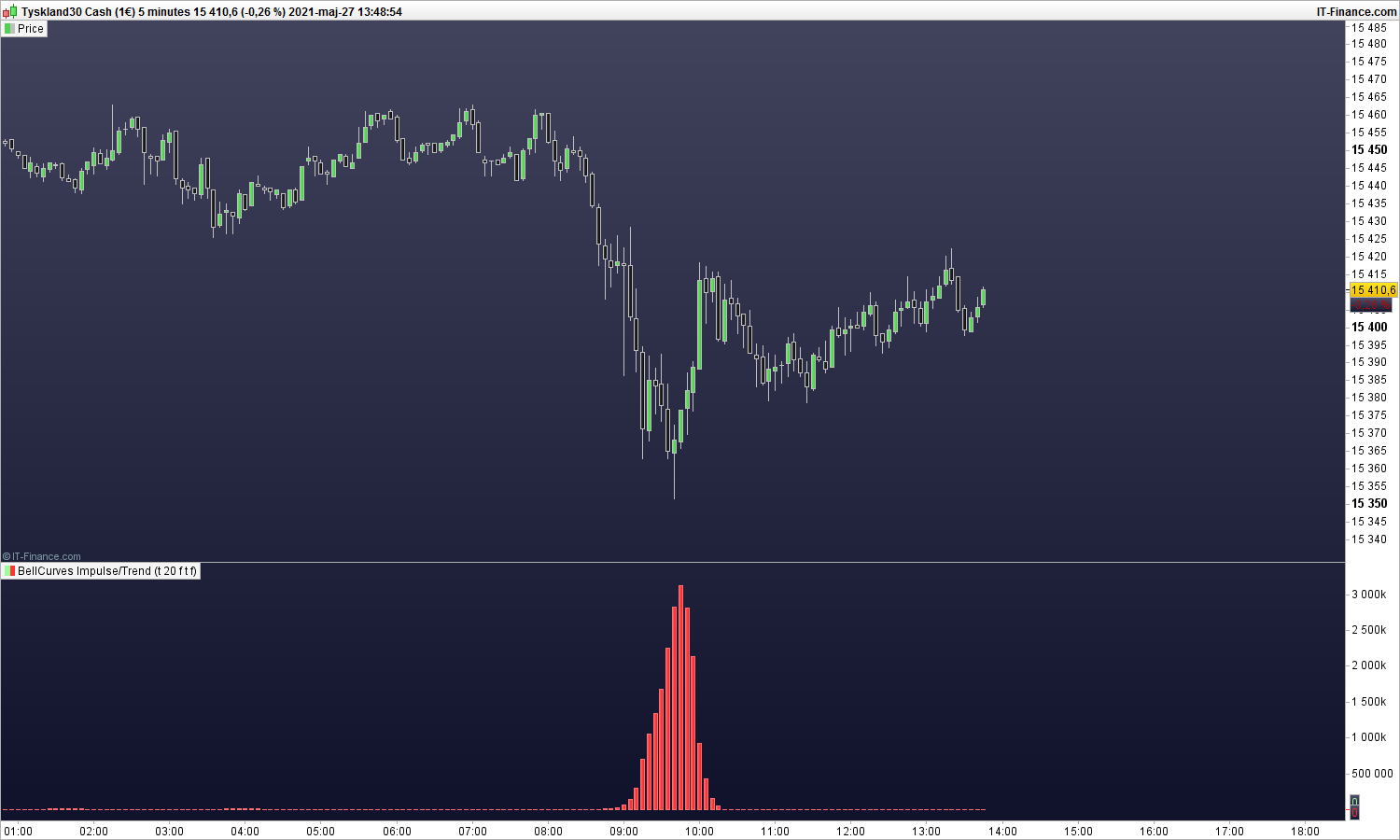

If you want to have a great intraday setup follow these rules

- Step 1: Map out key levels in the 1-hour chart!

- Step 2: Look for BellCurves in 15 min, 5 min, or 1 min Chart around these Key Levels.

Long:

1. Once the Red Bellcurve starts to form we know that we’re in a negative impulse and we want to find our Low. The Low is confirmed when the Bellcurve starts to decline. When you see that the BellCurve declines you can draw a line at the lowest low on the chart.

2. Our Long Aggressive Entry is when the price breaks down the previous low and we can enter long at the very first Green Candle.

3. Our Confirmed Entry can be when the 2B Bottom Reversal Pattern occurs.

Short:

Once you have mapped the Key Levels in a higher timeframe you look for the following in lower timeframes:

1. Once the Green Bellcurve starts to form we know that we’re in a positive impulse and we want to find our High. The High is confirmed when the Bellcurve starts to decline. When you see that the BellCurve declines you can draw a line at the highest high on the chart.

2. Our Short Aggressive Entry is when the price breaks up the previous high and we can enter short at the very first Red Candle. This didn’t happen in the example below! So we are flexible and see that a potential double top occurs and we want to enter short when this structure breaks.

3. Enter Short when the Double Top Structure breaks.

This example illustrates that if we don’t get our ideal Entry Condition we can still use other methods to confirm our entry. As a trader you won’t be able to find the perfect setup all the time, we have to have a flexible mind and adapt to the current market characteristics.

Setting Panel

Impulse (True/False) – Set to True and you only get the Significant market impulses. Set to False and the Trend Feature is activated.

Quick (True/False) – Set to True and the Bellcurves react quicker to price moves.

Length (Value) – Sets the underlying trend. A low value returns quick impulses and the short-term trend. A High value returns significant impulses and the long-term trend.

PositiveBellCurve (True/False) – Enable the Positive BellCurve

NegativeBellCurve (True/False) – Enable the Negative BellCurve

Real Trades Using the Negative BellCurves

Bewertungen

Es gibt noch keine Bewertungen.