Overview

The AQR Targets (Quarterly) indicator is designed for position traders who need precise medium-term price projections. By leveraging the Average Quarterly Range (AQR), this tool dynamically calculates and plots key price levels, allowing traders to identify strategic entry, exits, and stop-loss zones. With its focus on quarterly timeframes, the indicator provides a structured approach to managing trades over extended periods.

How it works

The AQR Targets (Quarterly) indicator calculates:

- Scaling Target (50% AQR) : A conservative target with high probability (>90% accuracy).

- Primary Target (75% AQR) : A slightly more ambitious target with strong probability (>80% accuracy).

- Secondary Target (100% AQR) : Represents the full Average Daily Range with moderate probability (>50% accuracy).

- Extended Target (125% AQR) : An aggressive target for volatile market conditions (<50% accuracy).

The targets are derived from the AQR, which is calculated as the average f the (H-L) range over the past 10 quarters, by default. These levels provide traders with clear benchmarks for price movement, helping to optimize entry, exit, and risk management strategies.

The targets are realtime calculated from current quarter’s low and high and projected above and below current price.

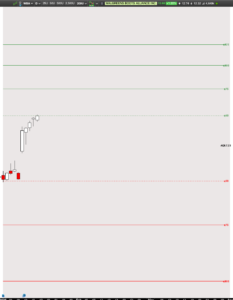

Example

With an average of 7.23$ range / quarter over the last 10 quarter, WBA reaches the 50% scaling target on January 16th. The move has developed from the lows at 9,07$ and 12,68$.

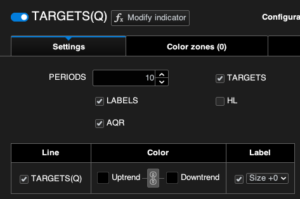

Settings

- PERIODS: Define the number of quarters for calculating the quarterly range. Default is 10 but can be expanded to analyze broader price ranges.

- TARGETS: Plots the target levels on the chart, as defined above

- HL: Plots the current high and low of the quarter

- AQR: Calculate and shows on chart the AQR value calculated on the PERIODS defined (i.e. the Average Quarterly Range on X Periods)

Benefits for traders

- Set realistic quarterly goals: Use precise levels to manage trades and set profit-taking levels

- Enhance risk management: Plan stop-loss levels based on key AQR targets to minimize risk

- Improve decision-making: Trade with confidence using probability-based target levels

- Adapt to market volatility: React to changing market conditions with self-adjusting targets

Who can use it?

- Position traders: Identify long-term price objectives and optimize multi-quarter trading strategies

- Investors: Use quarterly AQR targets to optimize long-term portfolio decisions

- Swing traders: Leverage quarterly AQR targets to align with mid-term strategies

- Market Analysts: Gain insights into quarterly price behavior and volatility trends.

- Portfolio Managers: Use AQR-based levels to optimize long-term asset allocation

Reference

The methodology behind the AQR Targets (Quarterly) Indicator is inspired by established principles of volatility-based analysis, including insights from Frank Ochoa’s teachings. This indicator has been independently developed and optimized for ProRealTime to provide traders with an efficient and reliablke tool for intraday target forecasting.

Bewertungen

Es gibt noch keine Bewertungen.