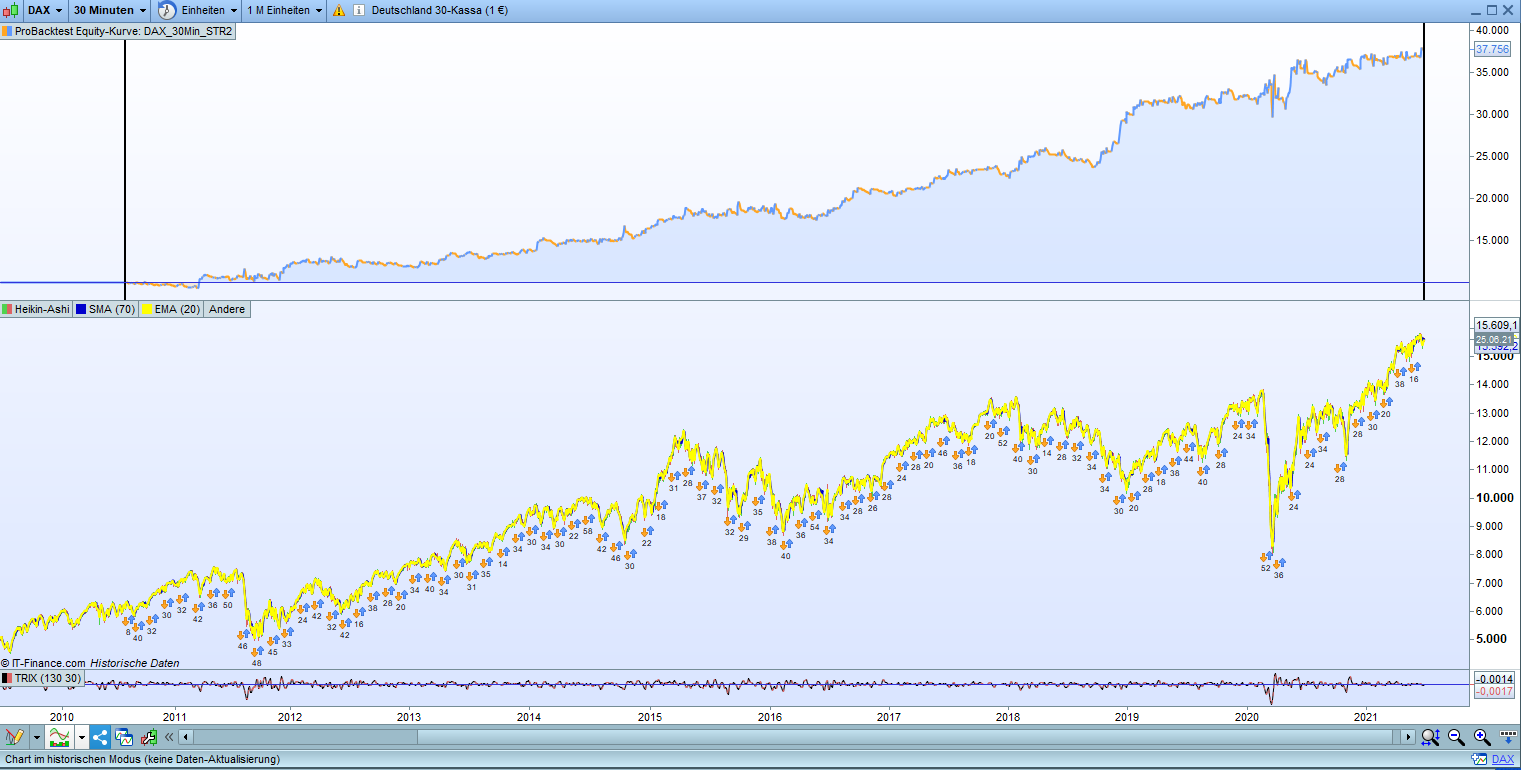

The strategy goes long or short when a strong signal is detected. Using the above strategy, I have developed an optimized algorithm over the last 6 years that adapts according to market conditions. The algorithm contains the most optimal market indicators and ossilations for the DOW. It is not a simple strategy that adjusts depending on the day of the week and time of the day.

The position size adjusts according to the preset capital size. It is automatically calculated before each position opening according to the preset starting capital and the profit/loss of the strategy. Currently, the position size is set with a starting capital of 10,000 EUR and with a fixed risk percentage (0,05% by default) – this corresponds to 5% of the starting capital plus strategy profit/loss. This variable can be adjusted by users as they wish. Of course, the position size can also be set by users with a fixed position size.

When the profit reaches 400 points/points the trailing stop is activated for 90 points/points. In addition, a stop loss is available, this is at 3000 points / points.

So if 1 contract is traded, the trailing stop is activated with a profit of 400 EUR, if the price falls, a profit of 310EUR is realized. However, if the stock market crashes, the position is closed with a loss of 3000 EUR. These values can be changed by the users.

Certainly, the historical performance in backtesting is not a guarantee of success in the future. Since I have achieved a positive effect with this trading system in my trading account, I offer it here. As described above, this algorithm has been further optimized in recent years. Meanwhile, I exclusively use the offered trading system in my private trading account. I maintain this trading system as needed to integrate the current market events (occasionally in each quarter) into the system, so that the system can better react to the future market developments. Of course, I will also make the improvements to my products in the Marketplace.

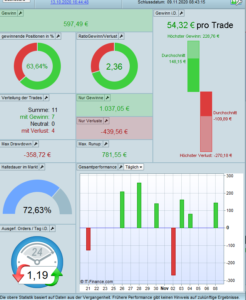

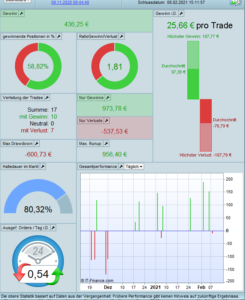

The automatic trading strategy “AlphaTrade_DOW_M30_STR1” refers to the DOW in M30 and has been fine-tuned to increase the profit. This is an alternative for those who want to achieve a strategy with higher profit than that of STR2, but accept additional risk.

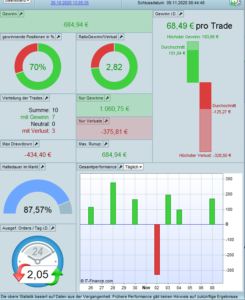

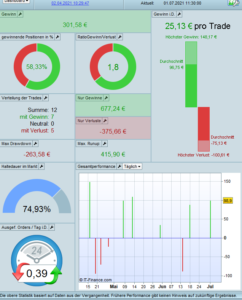

The automatic trading strategy “AlphaTrade_DOW_M30_STR2” refers to the DOW in M30 and was created based on “AlphaTrade_DOW_M30_STR1”. The STR2 was fine-tuned to reduce the drawdown. This is an alternative for those who want a strategy with lower risk than that of STR1, but accept a lower profit.

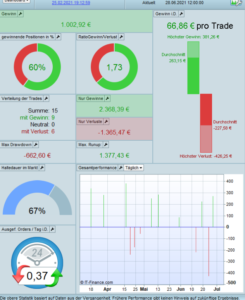

Update 12.01.2021: AlphaTrade_DOW_M30_STR19 (3th. Strategie) was developed on the basis of strategies 1 and 2. In the new strategy, VPOC were additionally implemented. This reduced the maximum drawdown.

In any case wish you all a successful trading.

PAQUETE DE PRODUCTOS

Al realizar la compra, obtendrá también una licencia para cada uno de los productos enumerados a continuación:

Result for the period 02.04.2021 untill now: (With update for the better performence)

Result for the period 02.04.2021 untill now: (With update for the better performence)

Valoraciones

No hay valoraciones aún.