—————– DATASHEET ———————————

Strategy type: Vectorial (specialized in trend changes)

Input signals: Calculates the angle between moving averages to locate trend changes. Filters are applied to improve the inputs, as well as other mechanisms.

Stop Loss: Always. Maximum of 2%. It can be different for long and short.

Profit handling: Trailing Stop by blocks based on ATR and exit with profits in case of a strong trend change. Maximum target profit configured.

General comments: Strategy specialised in trend changes. You have a good ratio of winning positions, but your goal is the highest possible win/loss ratio. In the latest version, we focus on long positions. Short positions are not their strong suit according to the backtests, but we have tried to prepare them for the scenarios to come.

Don’t be fooled: Results are shown for 1 contract at € 1 per point. Only 1 position at a time. Without martingales or partial closures (MM available, but not shown in results). Different configurations are available, and visible and non-obfuscated code. Visible headers in ProRealTime screenshots are shown here, distinguishing between backtest, real and demo in each case (avoid screens without headers and quick photoshops 🏴☠️). Available versioning and results full information in our website and groups, with full tracking.

Extras: Delivered to be used out-of-the-box, but configurable for experienced users. Money Management and Drawdown control modules are available.

ADVISE: For CFD, if you recently opened your trading account, you may get an error “trailing stop is not compatible with your account” when launching any system. That’s because you have a “limited risk” account. Please contact your broker’s support, preferably by phone, requesting to unblock your account. The problem will disappear after unblock your account and restart ProRealTime.

————————————————————————

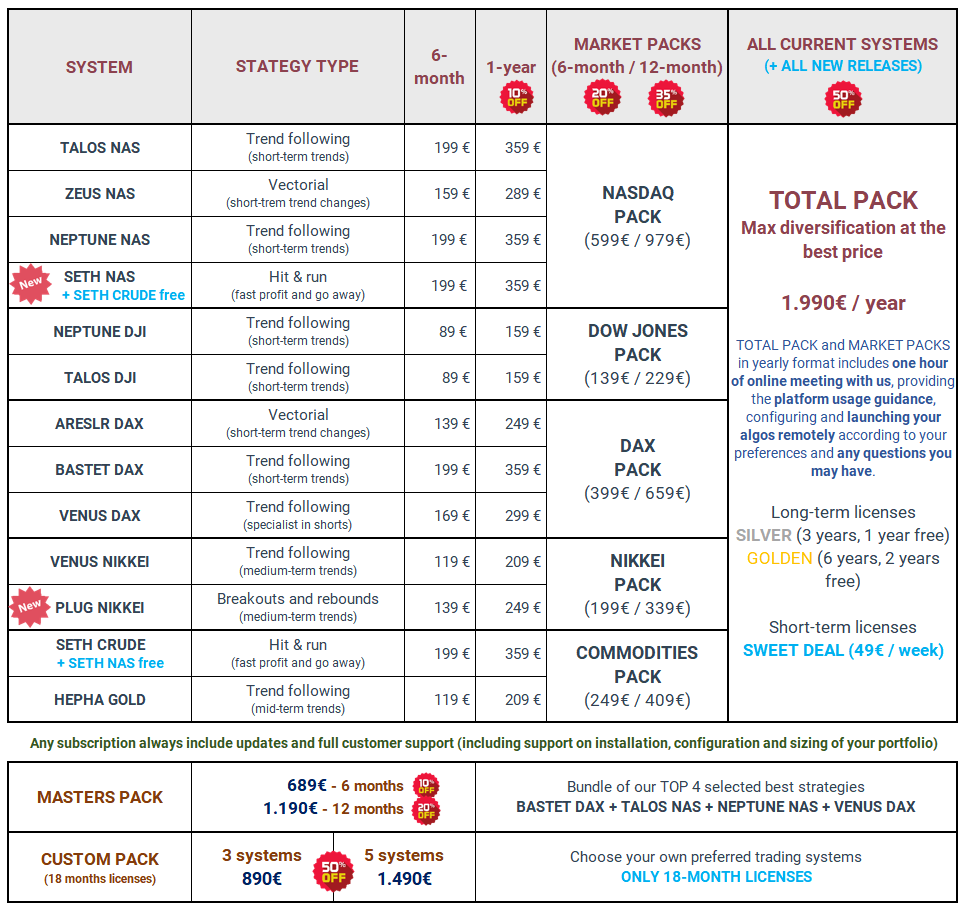

To reduce the risk even in the same market, combine it too with our other NASDAQ different strategies, reducing the possible drawdowns too. Take advantage and a high discount by subscribing to the NASDAQ PACK.

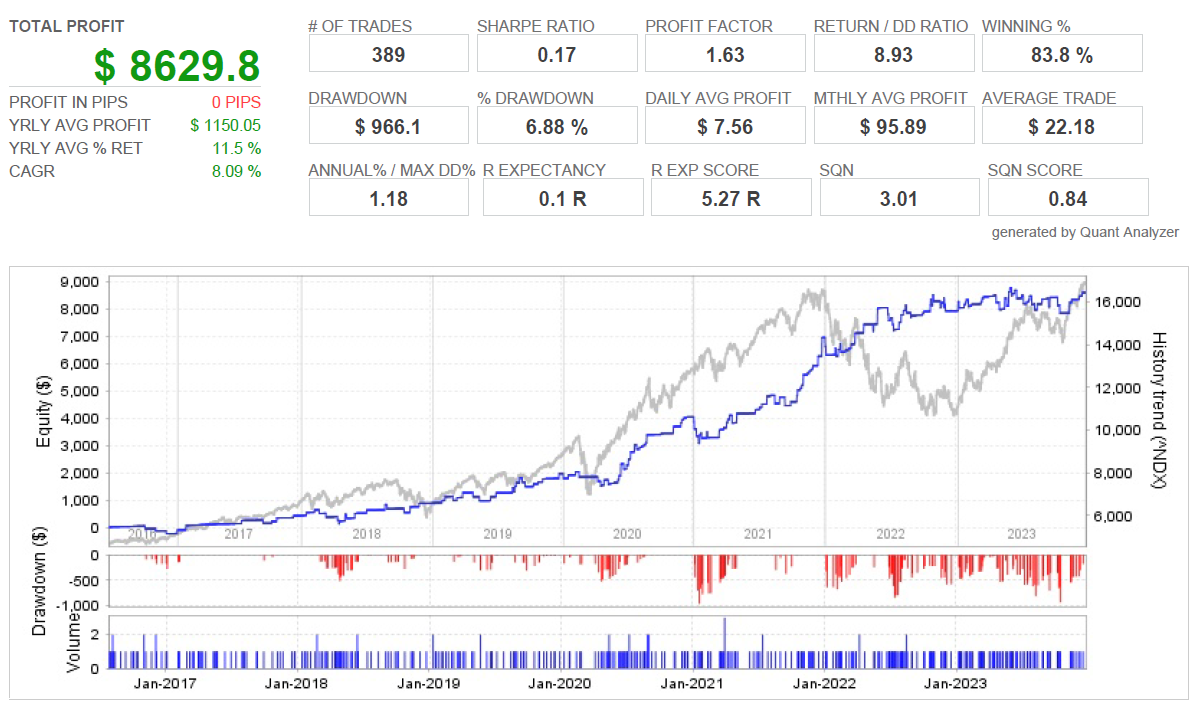

THIS VERSION BACKTEST

CURRENT VERSION ANALYSIS FOR FULL PERIOD –> Download the full report here

Note the different scale between profit and the market price. The software matches the last value, but the left scale is profit, and the right one is the market price.

We do not make-up drawdowns; big gains need drawdowns. Avoid magic systems and ratios, don’t be fooled. Our results always show results in Out Of Sample, always considering the publication date of each version. Some studies or comparisons could use the last version, but we do not make-up past results with the new versions or optimizations; our official results tables and publications always show the real results)

All our algos have a max 2% Stop Loss (or less), a money management system and a configurable drawdown limit to protect capital in the worst of cases. All images show results with 1 contract configuration.

This algo is delivered to be used “out-of-the-box”, not recommended any change even in changing circumstances. Let us do the best for you, if the strategy has to be updated, we will do it after the corresponding study and period in real in our accounts before distributing it

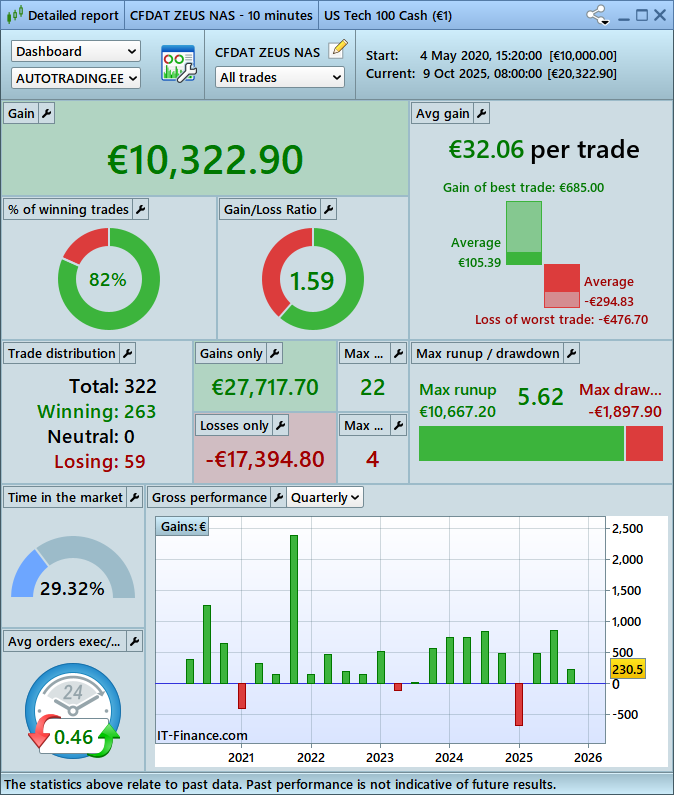

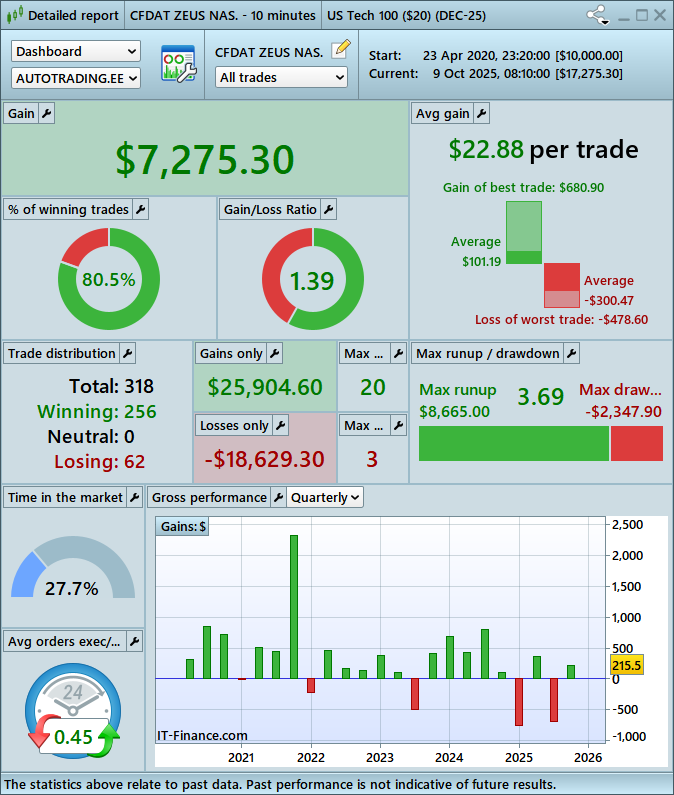

OTHER RESULTS AND SAMPLE PERIODS

Note that the instance starts with 0.5 contracts and has a high money reinvestment (it makes the results and ratios less smooth, and less linear)

V3 version in demo account. 1 fixed contract (instead of the results shown in real with variable sizing)

Previous version V2.2 in demo. Note the stability of the old version too (is a good signal of non-overfitting)

With this product license, we offer access to all updates of this strategy and customer support during the license period. You can participate in our support groups, and we can offer to you recommendations about configuration and reinvestment modules, system selection, drawdown and recommended equity…. even portfolio suggestions and coexistence with other systems.

New 2024 Prices! We have significantly reduced prices in 2024, so don’t expect further offers as we will not be reducing prices further this year.

–> Update as of March 2024: The SETH NAS and PLUG NIKKEI systems have been included, leading to an increase in the price of the TOTAL PACK. (Previous owners of the TOTAL PACK received these systems at no additional cost)

Take a look at our complete portfolio. Stable and reliable systems for all kinds of market circumstances. You can backtest and verify the latest results by yourself using our free and public demo: https://cfdautotrading.com/demo

Not CFD account? Looking for an algo for ProRealTime + Interactive Brokers?

Let’s take a look at our specific vendor IBKR AutoTrading

We distribute our systems as CFD AutoTrading for CFD accounts, and as IBKR AutoTrading for ProRealTime + Interactive Brokers

Laurent Nonclercq (verified owner) –

This algorithm was very good in 2021, then bottomed out in 2022. The creators made a nice update in November 2022 that looks promising in both long and short. The team is very serious. Very good complement to TALOS NAS

ebous64 (verified owner) –

Algorithm used to complement TALOS NAS. Easily a winning strategy over the 2021 period, and one that didn’t give me any trouble with the volatility of September/October. Algorithm appreciated for spending less time in the market (lower costs and less exposure) than the tracking strategy. In addition, an excellent success rate of over 90% and a high profit/loss ratio of over 4, an above-average sharpe ratio and a reassuring performance distribution. Used “long only”, hence limited appreciation to good…