CYCLOS SERIES (INITIUM–NOVA)

Multi-Dimensional Strategic Architecture for the Nasdaq 100

1. OVERVIEW

The CYCLOS SERIES is a suite of seven fully automated, long-only trading algorithms designed to engage distinct behavioral phases of the Nasdaq 100 index (NDX). Built on the ProRealTime platform, this series encompasses a complete cycle of market dynamics—from high-selectivity defensive filters to aggressive momentum exploitation and structural transitions.

Each module is autonomous, operates under independent logic, and targets a specific market profile. The names—INITIUM, MOTUS, FLUXUS, FORMA, VINCULUM, RUPTURA, and NOVA—reflect their functional role in this strategic cycle.

The full system is offered in two formats:

- Without money management (fixed size per trade)

- With money management (progressive pip scaling and compounding)

2. TECHNICAL SPECIFICATIONS (COMMON)

| Parameter | Specification |

|---|---|

| Underlying Asset | Nasdaq 100 (CFD – US Tech 100 Cash) |

| Platform | ProRealTime |

| Programming Language | ProBuilder |

| Position Type | Long-only |

| Timeframe | 15 minutes, 1 hour, 2 hour |

| Automation | Fully automated |

| Risk Management | Break-even logic, adaptive trailing stops, dynamic exits |

| Deployment Modes | With and without dynamic money management |

3. STRATEGIC FUNCTION OF EACH MODULE

| Module | Strategic Focus | Trade Frequency | Risk Profile |

|---|---|---|---|

| INITIUM | Ultra-selective setups during rare structural alignments | Very Low | Ultra-Low |

| MOTUS | Compression-phase swing trades with low exposure | Low | Low |

| FLUXUS | Breakout confirmation under controlled volatility | Medium | Medium |

| FORMA | Entry after consolidation and structure rebuilding | Medium–High | Medium–High |

| VINCULUM | Directional intraday scalps in high-momentum conditions | High | High |

| RUPTURA | Trend acceleration with trailing logic in volatile phases | Medium–High | High |

| NOVA | Volatility flush breakouts and sharp reversal exploitation | Medium | Medium–High |

4. STRUCTURAL FRAMEWORK

The CYCLOS SERIES is built around a full-market-cycle engagement model:

- INITIUM & MOTUS serve as capital-preserving filters during noise and uncertainty.

- FLUXUS & FORMA maintain structural symmetry, positioning during transitions and neutral phases.

- VINCULUM, RUPTURA & NOVA engage in momentum bursts and directional expansion with managed risk.

The design minimizes internal overlap, distributes exposure across time and regime dimensions, and reduces cumulative drawdown risk through uncorrelated logic layers.

5. MONTE CARLO SIMULATION – AGGREGATE RESULTS

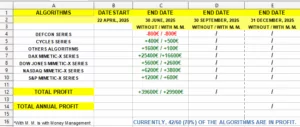

A consolidated Monte Carlo simulation was performed using 100,000 randomized trade path permutations over a 5-year period, simulating parallel execution of the 7 algorithms. Parameters:

- Initial capital: €14,000 (€2,000 per module)

- Execution logic: Fixed vs dynamic pip size

- Evaluation frequency: Daily

- Data: Historical trades from each bot’s own record

- Goal: To measure realistic system-wide outcomes and distribution of profit/loss across time

SIMULATED RESULTS (5 YEARS)

| Metric | With Money Management | Without Money Management |

|---|---|---|

| Average Total Profit | ~€570,000 | ~€115,000 |

| Annualized Return (CAGR) | ~40–42% | ~15–17% |

| Maximum Drawdown (VaR 99%) | ~17.2% | ~6.9% |

| Probability of Net Profit | 99.3% | 100% |

| Median Profit Range (80%) | €390,000 – €710,000 | €95,000 – €135,000 |

| Standard Deviation (Equity) | €140,000 | €24,000 |

INTERPRETATION

- The non-managed version is suitable for conservative use, evaluation accounts, and smooth equity growth with low volatility.

- The money-managed version, while showing higher dispersion and potential plateaus, produces scalable long-term growth under compounding.

- Simulated drawdowns remain moderate across both versions, with excellent probability of profitability even under unfavorable sequences.

- These figures are aligned with institutional expectations and avoid unrealistic exponential projections.

6. FINAL TECHNICAL ASSESSMENT

The CYCLOS SERIES is best understood not as a collection of independent systems, but as a functionally coherent market engagement cycle. It is engineered to respond to distinct behavioral segments of price evolution, making it robust to volatility regime shifts, macro transitions, and unexpected price events.

This design makes it especially valuable for:

- Portfolio managers seeking regime diversification

- Algorithmic traders needing multi-phase logic with minimal overlap

- Long-only strategies that avoid over-optimization and remain stable under pressure

- Scalable deployment from personal to institutional account levels

All modules have been independently validated, and the ensemble behavior has proven structurally reliable in stress testing. The system’s low correlated logic, adaptive layering, and realistic Monte Carlo profile distinguish it from most retail packs.

It is particularly well suited for those who understand that the market is not static, and neither should be the logic used to trade it.

ENDIF

TO STUDY THE CHARACTERISTICS, STATISTICS, AND RESULT OF EACH ALGORITHM INDIVIDUALLY CLICK ON THE FOLLOWING LINKS:

NOVA: https://market.prorealcode.com/product/red-7-bot/

FIVE YEAR ALGORITHM WITHOUT MONEY MANAGEMENT (1€/PIP) +17185€

FIVE YEAR ALGORITHM WITH MONEY MANAGEMENT (0.5€/PIP) +131665€

RUPTURA: https://market.prorealcode.com/product/orange-6-bot/

FIVE YEAR ALGORITHM WITHOUT MONEY MANAGEMENT (1€/PIP) +14591€

FIVE YEAR ALGORITHM WITH MONEY MANAGEMENT (0.5€/PIP) +119026€

VINCULUM: https://market.prorealcode.com/product/yellow-5-bot/

FIVE YEAR ALGORITHM WITHOUT MONEY MANAGEMENT (1€/PIP) +13895€

FIVE YEAR ALGORITHM WITH MONEY MANAGEMEN (0.5€/PIP) +100918€

FORMA: https://market.prorealcode.com/product/green-4-bot/

FIVE YEAR ALGORITHM WITHOUT MONEY MANAGEMENT (1€/PIP) +11746€

FIVE YEAR ALGORITHM WITH MONEY MANAGEMENT (0.5€/PIP) +55073€

FLUXUS: https://market.prorealcode.com/product/indigo-3-bot/

FIVE YEAR ALGORITHM WITHOUT MONEY MANAGEMENT (1€/PIP) +10530€

FIVE YEAR ALGORITHM WITH MONEY MANAGEMENT (0.5€/PIP) +111973€

MOTUS: https://market.prorealcode.com/product/blue-2-bot/

FIVE YEAR ALGORITHM WITHOUT MONEY MANAGEMENT (1€/PIP) +6364€

FIVE YEAR ALGORITHM WITH MONEY MANAGEMENT (0.5€/PIP) +27888€

INITIUM: https://market.prorealcode.com/product/violet-1-bot/

FIVE YEAR ALGORITHM WITHOUT MONEY MANAGEMENT (1€/PIP) +6224€

FIVE YEAR ALGORITHM WITH MONEY MANAGEMENT (0.5€/PIP) +62315€

____________________________________________________________________

TOTAL PROFIT IN 5 YEARS BACKTEST OPERATING WITH THE 7 ALGORITHMS

WITHOUT MONEY MANAGEMENT (1€/PIP) 80535€

WITH MONEY MANAGEMENT (0.5€/PIP in progression) 608858€

____________________________________________________________________

ENDIF

RUPTURA WITH MM

RUPTURA WITH MM VINCULUM WITH MM

VINCULUM WITH MM FORMA WITH MM

FORMA WITH MM MOTUS WITH MM

MOTUS WITH MM

FLUXUS WITH MM

FLUXUS WITH MM INITIUM WITH MM

INITIUM WITH MM

Reviews

There are no reviews yet.