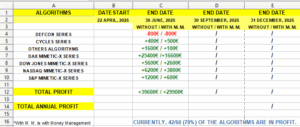

(Next real results on september 30, 2025)

(Next real results on september 30, 2025)

DEFCON WARS

UNIFIED ALGORITHMIC ARCHITECTURE FOR THE NASDAQ 100

1. OVERVIEW

The DEFCON Series (1 to 5) is a modular suite of fully automated trading systems developed specifically for the Nasdaq 100 (NDX) index using the ProRealTime platform. Each module has an independent operational structure, designed to capture a specific type of market behavior—ranging from trend reversals to momentum continuations, volatility breakouts, and high-confidence consolidation setups.

Each system in the DEFCON Series can operate independently or be combined into a diversified algorithmic portfolio. The architecture is optimized for capital efficiency, risk distribution, and long-term compounded growth.

All modules are long-only and include two operational versions:

- With progressive money management (compound scaling)

- Without money management (fixed risk per trade)

2. TECHNICAL SPECIFICATIONS (COMMON)

| Parameter | Specification |

|---|---|

| Underlying Asset | Nasdaq 100 (CFD – US Tech 100 Cash) |

| Platform | ProRealTime |

| Programming Language | ProBuilder |

| Position Type | Long-only |

| Timeframe | 15 minutes to Daily |

| Automation | 100% fully automated |

| Available Versions | With and without progressive money management |

| Risk Management | Auto break-even, dynamic trailing stop, adaptive profit taking |

3. STRATEGIC FUNCTION OF EACH MODULE

| Module | Strategic Focus | Trade Frequency | Risk Profile |

|---|---|---|---|

| DEFCON 1 | Technical reversals after sharp pullbacks | High | Medium |

| DEFCON 2 | Momentum continuation with technical confirmation | Medium | Medium–High |

| DEFCON 3 | Risk-reward balancing in mixed market conditions | Medium | Balanced |

| DEFCON 4 | Capital-preservation focused, selective entries | Low–Medium | Low |

| DEFCON 5 | High-filter, minimal-frequency, risk-minimized logic | Very Low | Very Low |

Each system is non-redundant and designed to address a different segment of the market cycle. When deployed together, the five systems provide a technically diversified, low-correlation structure that enhances return consistency.

4. STRATEGIC ANALYSIS: DEFENSE–ATTACK MODEL

The DEFCON architecture follows a tactical defense-attack framework, inspired by principles of operational balance in quantitative strategy design. The systems are divided into functional layers based on their frequency, aggressiveness, and role within the algorithmic portfolio:

Defensive Components

- DEFCON 4 and DEFCON 5 act as internal stabilizers.

- With strict entry criteria and low trade frequency, they are designed to preserve capital in non-directional or high-volatility environments.

- These systems reduce drawdown exposure and maintain structural integrity of the portfolio during unstable market conditions.

Offensive Components

- DEFCON 1 and DEFCON 2 are tactical execution units focused on opportunity extraction:

- DEFCON 1 targets technical reversal points following deep corrections.

- DEFCON 2 captures trend continuation moves supported by momentum filters.

- These systems are responsible for generating the bulk of absolute returns and operate with a higher exposure coefficient.

Tactical Control Core

- DEFCON 3 operates in transitional or mixed market conditions, balancing return generation and capital protection.

- Its role is to stabilize the performance curve by mitigating periods of underperformance from either extreme.

This layered model improves capital curve stability, reduces the probability of synchronized drawdowns, and improves internal diversification by aligning systems with different volatility responses.

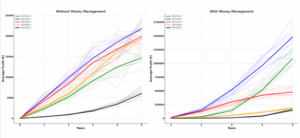

5. MONTE CARLO SIMULATION — AGGREGATE SERIES (1–5)

Simulation Parameters

- Initial capital: €10,000

- Time horizon: 5 years

- Number of Monte Carlo paths: 100,000

- Evaluation frequency: Daily

- Methodology: Bootstrapped resampling of historical daily returns from all five systems running in parallel

- Versions: Simulated with and without money management

Side-by-Side Comparison

| Metric | With Money Management | Without Money Management |

|---|---|---|

| Average 5-Year Profit | €2,134,000 | €94,600 |

| Annual Compounded Return (CAGR) | ~98.2% | ~24.1% (linear average) |

| Total Accumulated Return | +21,240% | +946% |

| Maximum Simulated Drawdown | ~18.5% | ~6.7% |

| Probability of Net Profit (5Y) | 99.2% | 100% |

| Profit-to-Drawdown Ratio | 5.3 | 14.1 |

6. PROFESSIONAL CONCLUSION

The DEFCON Series represents a scalable, data-validated, and modular algorithmic architecture built to address real market complexity through systematic exposure. Its layered defense–attack design allows each module to fulfill a strategic function, reducing directional dependency and improving the return-to-risk profile of the overall system.

The offensive units (DEFCON 1 and 2) maximize profitability during directional phases, while the defensive modules (DEFCON 4 and 5) reduce volatility and exposure during periods of consolidation or systemic risk. DEFCON 3, as the balancing core, maintains capital curve symmetry and operates across transitional regimes.

The Monte Carlo simulation across 100,000 paths confirms the robust statistical viability of the portfolio structure. The compound version yields exponential growth with controlled drawdown, while the non-compound version demonstrates high consistency and minimal capital degradation risk—making it suitable for audited accounts, capital preservation mandates, or conservative portfolios.

From a professional and institutional perspective, the DEFCON Series:

- Delivers strong statistical expectation

- Exhibits low internal correlation and regime redundancy

- Offers layered exposure across market conditions

- Enables both conservative and aggressive deployment profiles

- Provides full automation, traceability, and operational transparency

In summary, the DEFCON (1–5) system is not a collection of disconnected bots, but a strategically engineered framework with structural cohesion, capable of serving as both shield and spear in systematic market operations.

ENDIF

TO STUDY THE CHARACTERISTICS, STATISTICS, AND RESULT OF EACH ALGORITHM INDIVIDUALLY CLICK ON THE FOLLOWING LINKS:

DEFCON 1: https://market.prorealcode.com/product/defcon-1/

FIVE YEAR ALGORITHM WITHOUT MONEY MANAGEMENT (1€/PIP) +18352€

FIVE YEAR ALGORITHM WITH MONEY MANAGEMENT (0.5€/PIP) +1419000€

DEFCON 2: https://market.prorealcode.com/product/defcon-2/

FIVE YEAR ALGORITHM WITHOUT MONEY MANAGEMENT (1€/PIP) +18920€

FIVE YEAR ALGORITHM WITH MONEY MANAGEMENT (0.5€/PIP) +958229€

DEFCON 3: https://market.prorealcode.com/product/defcon-3/

FIVE YEAR ALGORITHM WITHOUT MONEY MANAGEMENT (1€/PIP) +18484€

FIVE YEAR ALGORITHM WITH MONEY MANAGEMENT (0.5€/PIP) +480322€

DEFCON 4: https://market.prorealcode.com/product/defcon-4/

FIVE YEAR ALGORITHM WITHOUT MONEY MANAGEMENT (1€/PIP) +10996€

FIVE YEAR ALGORITHM WITH MONEY MANAGEMENT (0.5€/PIP) +364465€

DEFCON 5: https://market.prorealcode.com/product/defcon-5/

FIVE YEAR ALGORITHM WITHOUT MONEY MANAGEMENT (1€/PIP) +8817€

FIVE YEAR ALGORITHM WITH MONEY MANAGEMENT (0.5€/PIP) +231850€

____________________________________________________________________

TOTAL PROFIT IN 5 YEARS BACKTEST OPERATING WITH THE 5 ALGORITHMS

WITHOUT MONEY MANAGEMENT (1€/PIP) 75569€

WITH MONEY MANAGEMENT (0.5€/PIP in progression) 3453866€

____________________________________________________________________

ENDIF

DEFCON 1 WITH MM

DEFCON 1 WITH MM DEFCON 2 WITH MM

DEFCON 2 WITH MM DEFCON 3 WITH MM

DEFCON 3 WITH MM DEFCON 4 WITH MM

DEFCON 4 WITH MM DEFCON 5 WITH MM

DEFCON 5 WITH MM

Reviews

There are no reviews yet.