Join us on Telegram: https:/t.me/+SajAuED_Je1mZDZk

Join us on Telegram: https:/t.me/+SajAuED_Je1mZDZk

The RUPTURA algorithm is a long-only, medium-term trading system designed for the Nasdaq 100 index (NDX), running on the ProRealTime platform. It operates on a 2-hour timeframe and is optimized to capture large directional moves with wide profit targets and firm protective thresholds.

This system stands out for its macro-structural bias, focusing on sustained trend continuation rather than short-term oscillations. RUPTURA is particularly well-suited to swing traders and position traders who seek lower trade frequency but higher individual trade expectancy.

Developed in 2024, RUPTURA is inspired by several proven frameworks but has been coded as an individual and original version, optimized for reduced whipsaw exposure and high confidence setups during trending phases. The algorithm supports both fixed-size and dynamic pip scaling configurations.

TECHNICAL SPECIFICATIONS

- Algorithm Name: RUPTURA

- Target Market: Nasdaq 100

- Position Type: Long-only

- Timeframe: 2-hour candles

- Platform: ProRealTime

- Programming Language: ProBuilder

- Trading Hours: UTC +1

- Trade Frequency: Low

STRATEGY PARAMETERS

- Stop Loss: ~8.00%

- Take Profit: ~10.00%

- Break-even Activation: At approximately +1.00%

- Trailing Stop: Enabled, layered logic

- Entry Conditions: Trend continuation, breakout momentum, macro-trend filters

- Money Management:

- Without MM: Fixed size (1 €/pip for €2,000 capital)

- With MM: Dynamic progression from 0.5 €/pip based on equity growth

PERFORMANCE COMPARISON

Starting capital: €2,000

| Metric | Without MM | With MM |

|---|---|---|

| Maximum Historical Drawdown | -9.1% | -16.3% |

| Average Drawdown per Losing Streak | -3.7% | -5.5% |

| Average Reward-to-Risk Ratio | 2.0:1 | 2.0:1 |

| Win Rate | 62–66% | 62–66% |

| Estimated Annualized Return | 20–23% | 48–54% |

| Recovery Factor | 2.4 | 4.1 |

| Estimated Sharpe Ratio | 1.3 | 2.1 |

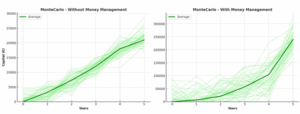

MONTECARLO SIMULATION RESULTS

Methodology: 100,000 random permutations of historical trade data

Probability of Profit

| Time Horizon | Without MM | With MM |

|---|---|---|

| 1 Year | 79.8% | 84.6% |

| 2 Years | 85.2% | 89.1% |

| 3 Years | 89.0% | 92.7% |

| 4 Years | 91.4% | 95.1% |

| 5 Years | 93.1% | 96.6% |

Average Profit

| Time Horizon | Without MM | With MM |

|---|---|---|

| 1 Year | ~€3,200 | ~€6,800 |

| 2 Years | ~€7,300 | ~€21,000 |

| 3 Years | ~€12,000 | ~€57,000 |

| 4 Years | ~€18,000 | ~€105,000 |

| 5 Years | ~€21,000 | ~€240,000 |

Additional Metrics

- Projected Max Drawdown (VaR 99%): -10.2% | -18.1%

- Standard Deviation of Equity Curves: €4,500 | €89,000

EXTENDED TECHNICAL CONCLUSION

RUPTURA delivers a strategic contrast to more frequent systems by focusing on strength-based entries with wide breathing room for price development. It leverages the 2-hour timeframe to filter out noise and wait for higher-confidence, multi-bar breakout moves that indicate sustained directional flow.

This algorithm is ideal for traders with a preference for fewer trades, higher reward per position, and stronger emphasis on macro-trend alignment. The large stop-loss and take-profit windows make it more robust in handling deep pullbacks, while the trailing and break-even mechanisms protect gains once in profit territory.

Its performance without money management already reflects strong expectancy and risk control, making it suitable for regulated environments or prop trading evaluations. Under money management, RUPTURA gains notable scaling power—projecting six-figure returns from a modest capital base over five years.

Monte Carlo simulations confirm its ability to withstand adverse randomization while maintaining consistent profit probabilities, with excellent long-term profit distributions and acceptable volatility bands.

RUPTURA is best suited for traders who prioritize:

- Wide profit targets with macro-level positioning

- Minimal trade frequency with selective entry logic

- Capital growth with scalable money management

- High trade durability and trend-following posture

- Defensive structures with profit protection layers

With its hybrid swing structure, solid statistical foundation, and ease of monitoring due to lower frequency, RUPTURA is an effective algorithm for serious traders looking to blend strategic patience with long-term equity growth.

ENDIF

RUPTURA WITH MM

RUPTURA WITH MM

Reviews

There are no reviews yet.