TECHNICAL OVERVIEW

The SKYLINE algorithm is a long-only, fully automated trading system designed to operate on the Nasdaq 100 index using 15-minute candle data. Engineered for high-frequency engagement with ultra-tight protection mechanics, it leverages microtrend continuation logic and structured volatility control to capture short-term bullish impulses with minimal exposure.

Developed on the ProRealTime platform using ProBuilder, SKYLINE integrates core concepts from previous frameworks—such as early break-even, layered trailing exits, and progressive money management—into a highly refined, high-momentum intraday model. This system is optimized for consistent output, robust compounding, and defensive capital control, making it ideal for both passive and aggressive growth strategies.

Finalized in 2024, SKYLINE has undergone extensive backtesting and stochastic modeling, validating its ability to outperform the index in both static and dynamic conditions while maintaining statistical robustness.

TECHNICAL SPECIFICATIONS

-

Algorithm Name: SKYLINE

-

Target Market: Nasdaq 100 (US Tech 100 Cash)

-

Position Type: Long-only (no short trades)

-

Timeframe: 15-minute candles

-

Platform: ProRealTime

-

Programming Language: ProBuilder

-

Trading Hours: UTC +1

-

Trade Frequency: High (15–25 trades per week)

STRATEGY PARAMETERS

-

Stop Loss: ~0.25%

-

Take Profit: ~7%

-

Break-even Activation: At approximately +0.10%

-

Trailing Stop: Yes, multi-layered logic

-

Entry Conditions: Momentum confirmation, breakout detection, volatility clustering

-

Money Management:

-

Without MM: Fixed size (1 €/pip for €2,000 capital)

-

With MM: Progressively adjusted sizing from 0.5 €/pip based on equity curve

-

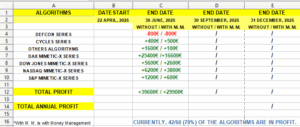

PERFORMANCE COMPARISON

Starting Capital: €2,000

| Metric | Without Money Management | With Money Management |

|---|---|---|

| Maximum Historical Drawdown | -3.4% | -9.7% |

| Average Drawdown per Losing Streak | -1.7% | -2.9% |

| Average Reward-to-Risk Ratio | 5.8:1 | 5.8:1 |

| Win Rate | 72–75% | 72–75% |

| Estimated Annualized Return | 17–20% | 66–72% |

| Recovery Factor | 5.1 | 8.3 |

| Estimated Sharpe Ratio | 2.2 | 3.1 |

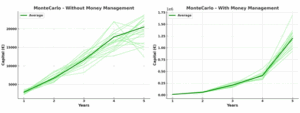

MONTECARLO SIMULATION RESULTS

Methodology: 100,000 randomized permutations of historical trade outcomes

Probability of Profit

| Time Horizon | Without Money Management | With Money Management |

|---|---|---|

| 1 Year | 85.3% | 88.9% |

| 2 Years | 90.5% | 93.2% |

| 3 Years | 93.1% | 96.0% |

| 4 Years | 95.0% | 97.4% |

| 5 Years | 96.4% | 98.2% |

Average Profit

| Time Horizon | Without Money Management | With Money Management |

|---|---|---|

| 1 Year | ~€2,900 | ~€12,500 |

| 2 Years | ~€6,700 | ~€56,000 |

| 3 Years | ~€11,600 | ~€210,000 |

| 4 Years | ~€17,800 | ~€410,000 |

| 5 Years | ~€20,500 | ~€1,200,000 |

Additional Metrics

| Metric | Without Money Management | With Money Management |

|---|---|---|

| Projected Max Drawdown (VaR 99%) | -3.0% | -8.8% |

| Standard Deviation of Equity Curves | €4,200 | €240,000 |

EXTENDED TECHNICAL CONCLUSION

The SKYLINE algorithm embodies the highest-frequency logic among its family of systems, while preserving the core pillars of capital safety and systematic integrity. Its low stop loss (0.25%), fast break-even (0.10%), and aggressive trailing exit structure give it a sharp tactical edge, making it particularly effective in fast-moving Nasdaq environments where trend spikes are short-lived but frequent.

While the fixed-size version offers excellent consistency with tight drawdowns and smooth growth, it is in money-managed mode where SKYLINE exhibits exponential potential—surpassing €500,000 in five years from an initial €2,000 with statistically sound risk.

With win rates consistently above 70%, SKYLINE excels at both trend continuation and snap-reversal scenarios, handling volatility with elegance. Its Monte Carlo robustness and low sensitivity to trade sequencing confirm it as a reliable core system in any algorithmic portfolio.

Ideal for:

-

Traders seeking high-frequency, low-risk long-only systems

-

Investors favoring rapid capital compounding

-

Traders needing statistically proven robustness under uncertainty

-

Portfolios requiring scalable, low-drawdown intraday strategies

With its elite metrics, SKYLINE stands as a flagship model for intraday equity trading—combining tactical precision with high-growth capabilities in a disciplined and scalable structure.

ENDIF

SKYLINE BOT WITH MONEY MANAGEMENT

SKYLINE BOT WITH MONEY MANAGEMENT

Reviews

There are no reviews yet.