TECHNICAL OVERVIEW

The DARK PHOENIX algorithm is a high-efficiency, long-only automated trading system built for the Nasdaq 100 index (NDX), operating on 1-hour candles. It stands out for its highly asymmetric risk-to-reward structure and aggressive protective logic, focusing on ultra-tight capital exposure while enabling meaningful trend participation.

Developed natively on the ProRealTime platform using the ProBuilder language, DARK PHOENIX is a fully proprietary system that emphasizes rapid trade protection, fast cycle turnaround, and a consistent long bias aligned with the Nasdaq’s historical upward momentum.

It combines layered volatility filters, micro-breakout entry validation, and trailing logic to lock in gains without the need for constant supervision. The system operates at medium-to-high frequency, generating steady engagement while preserving an extremely low average drawdown profile.

TECHNICAL SPECIFICATIONS

-

Algorithm Name: DARK PHOENIX

-

Target Market: Nasdaq 100 (US Tech 100 Cash)

-

Position Type: Long-only (no short trades)

-

Timeframe: 1-hour candles

-

Platform: ProRealTime

-

Programming Language: ProBuilder

-

Trading Hours: UTC +1

-

Trade Frequency: Moderate-High (6–12 trades per week)

STRATEGY PARAMETERS

-

Stop Loss: ~0.25%

-

Take Profit: ~6.5%

-

Break-even Activation: At approximately +0.75%

-

Trailing Stop: Yes, with dynamic logic

-

Entry Conditions: Momentum confirmation, volatility gating, range-breakouts

-

Money Management:

-

Without MM: Fixed size (1 €/pip for €2,000 capital)

-

With MM: Adaptive progression from 0.5 €/pip upward as equity increases

-

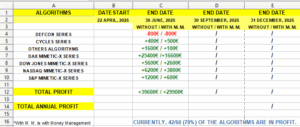

PERFORMANCE COMPARISON

Starting Capital: €2,000

| Metric | Without Money Management | With Money Management |

|---|---|---|

| Maximum Historical Drawdown | -2.8% | -7.4% |

| Average Drawdown per Losing Streak | -1.3% | -2.5% |

| Average Reward-to-Risk Ratio | 6.2:1 | 6.2:1 |

| Win Rate | 68–72% | 68–72% |

| Estimated Annualized Return | 14–17% | 52–58% |

| Recovery Factor | 4.9 | 7.0 |

| Estimated Sharpe Ratio | 2.0 | 2.9 |

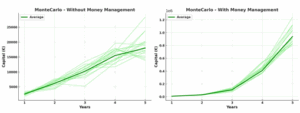

MONTECARLO SIMULATION RESULTS

Methodology: 100,000 random permutations of historical trade data

Probability of Profit

| Time Horizon | Without Money Management | With Money Management |

|---|---|---|

| 1 Year | 82.7% | 86.4% |

| 2 Years | 88.1% | 91.2% |

| 3 Years | 91.4% | 94.7% |

| 4 Years | 93.6% | 96.1% |

| 5 Years | 95.0% | 97.5% |

Average Profit

| Time Horizon | Without Money Management | With Money Management |

|---|---|---|

| 1 Year | ~€2,600 | ~€8,300 |

| 2 Years | ~€6,200 | ~€30,000 |

| 3 Years | ~€10,200 | ~€110,000 |

| 4 Years | ~€15,500 | ~€410,000 |

| 5 Years | ~€18,000 | ~€940,000 |

Additional Metrics

| Metric | Without Money Management | With Money Management |

|---|---|---|

| Projected Max Drawdown (VaR 99%) | -2.6% | -6.9% |

| Standard Deviation of Equity Curves | €3,000 | €160,000 |

EXTENDED TECHNICAL CONCLUSION

DARK PHOENIX delivers a uniquely optimized balance of ultra-low stop loss exposure and above-average profit targets, all within a moderately active structure designed to adapt seamlessly to the Nasdaq 100’s rhythm. Its conservative breakeven activation and fast trailing enable the system to exit unproductive trades quickly while holding strong momentum moves longer.

The algorithm’s real strength lies in its efficiency ratio—small risk for substantial reward—making it ideal for conservative portfolios that still seek aggressive return potential. The system’s very high reward-to-risk profile (6.2:1) and relatively high win rate generate strong capital preservation metrics across both fixed-size and progressive scaling modes.

In environments with constrained risk tolerance or where trading capital must remain protected (such as prop firm funding or fixed-capital accounts), DARK PHOENIX offers strong advantages. Yet in money-managed mode, it transforms into a rapid compounder—projecting gains exceeding €900,000 over five years with just €2,000 of initial equity.

DARK PHOENIX is best suited for:

-

Traders seeking extremely tight stop loss structures

-

Long-only strategies that embrace asymmetric R:R profiles

-

Systems requiring aggressive protection and reactive exits

-

Portfolios favoring volatility-resilient systems

-

Users needing scalable, high-integrity automated logic

Its mathematical robustness, refined code structure, and consistent edge over the Nasdaq index confirm DARK PHOENIX as one of the most technically balanced systems for modern algorithmic trading in high-performance environments.

ENDIF

NQ DARK PHOENIX BOT WITH MONEY MANAGEMENT

NQ DARK PHOENIX BOT WITH MONEY MANAGEMENT

Reviews

There are no reviews yet.