🦎 Nasdaq Alpha Seeker

Automated Trading System – US TECH 100 (1€) – 30-Minute Timeframe

🎯 Objective

Nasdaq Alpha Seeker is an intelligent breakout strategy designed to capture moderate-tension phases on the NASDAQ (US TECH 100 on IG) using a 30-minute timeframe.

It aims to seize both bullish and bearish impulses triggered by breakouts from tightened Bollinger Bands, while integrating dynamic risk management and an adaptive trailing stop.

⚙️ Operating Principle

The strategy identifies controlled volatility breakouts using a combination of technical indicators:

-

Bollinger Bands to detect compression zones,

-

A filtered RSI to avoid overbought or oversold extremes,

-

Candle structure analysis (body, wick, and size) to ensure signal quality,

-

And a volume filter to validate only those breakouts supported by significant order flow.

The system enters Long or Short positions depending on the detected breakout, remaining inactive in the absence of a clean configuration.

A trailing stop automatically follows the movement, locking in profits during trends while limiting losses when momentum fades.

📊 Main Features

| Element | Detail |

|---|---|

| Market | NASDAQ (US TECH 100) |

| Timeframe | 30 minutes |

| Strategy Type | Bollinger Breakout + Volume & Momentum Filters |

| Positioning | Long & Short |

| Lot Size | 0.5 contract (adjustable) |

| Take Profit | 303 points |

| Trailing Stop | 80 points |

| Position Accumulation | Disabled (one position at a time) |

| Automatic Closure | Friday evening (no open positions over the weekend) |

💡 System Philosophy

“Follow the Gekko” — the system climbs the market slowly but steadily, just like its namesake.

It doesn’t seek overactivity, but rather signal quality, blending algorithmic discipline with strict risk control.

📈 Usage Recommendations

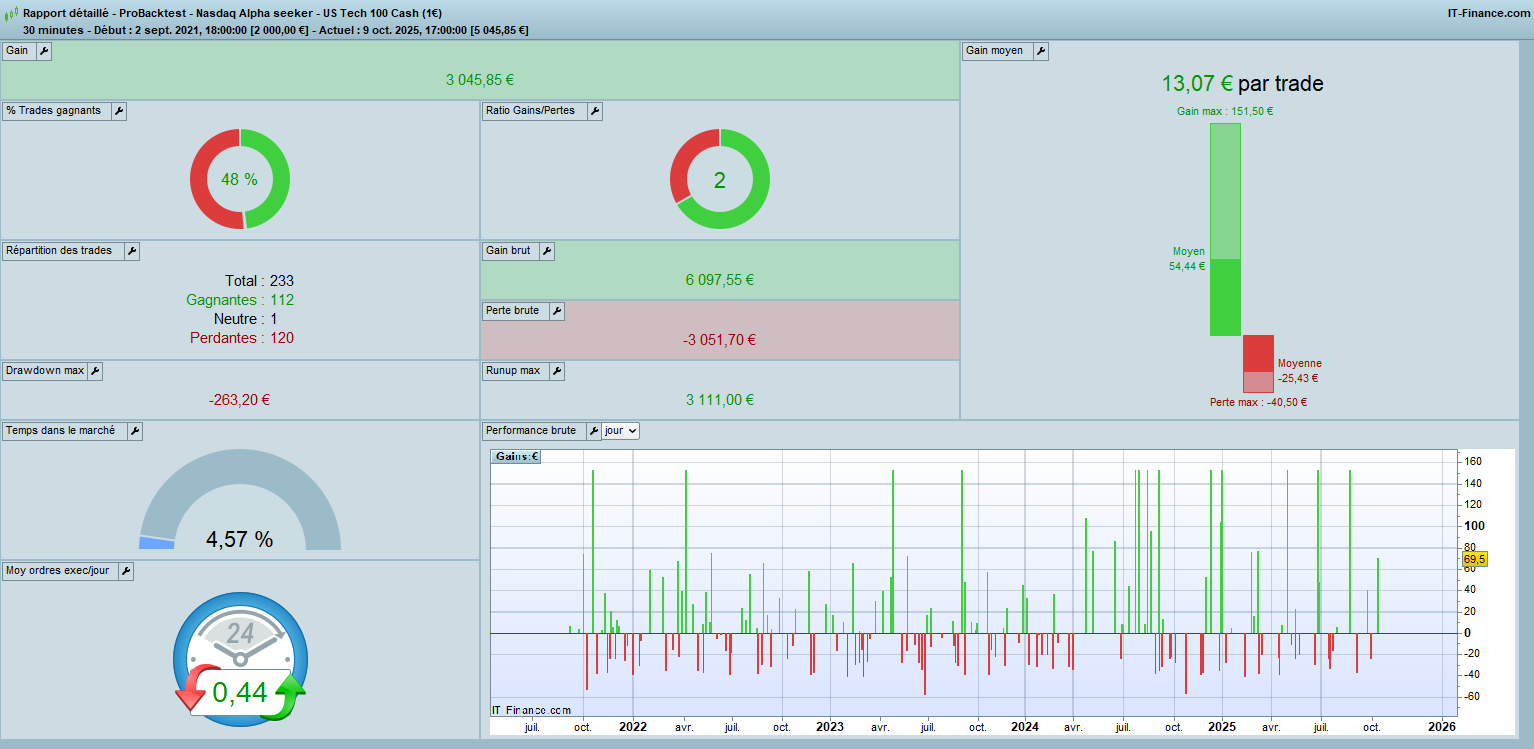

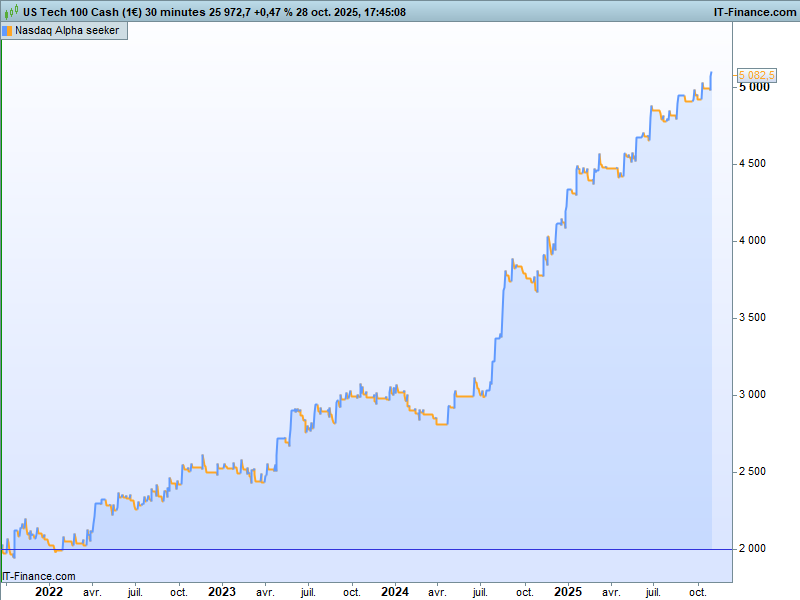

Tested and optimized for NASDAQ 100 CFDs (ProRealTime / IG).

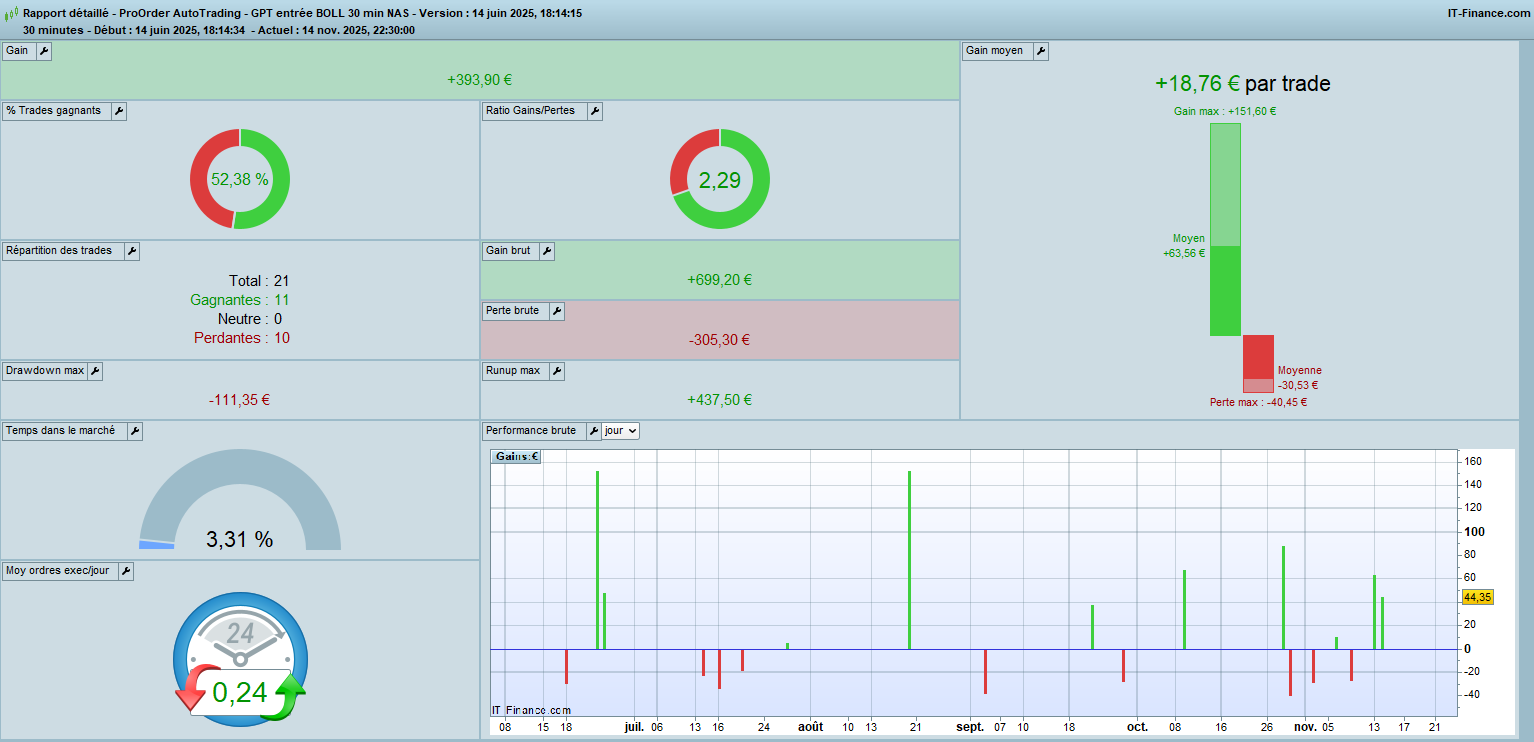

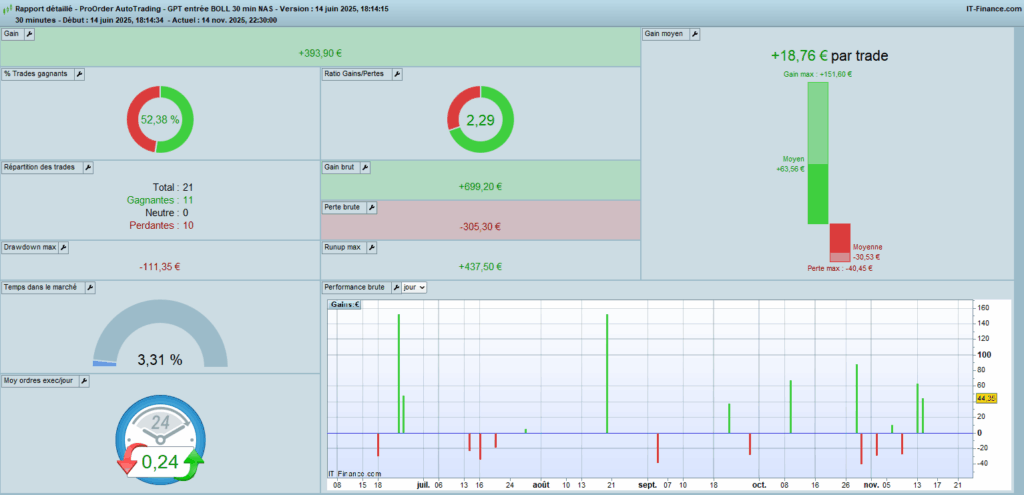

Validated both in backtesting and over 4 months of live trading.

Designed for short- to medium-term swing trading (approximately 2 to 5 trades per month).

Should be used without excessive leverage, with capital adapted to the product and NASDAQ volatility.

Given the very low maximum drawdown observed in backtests, a capital of €2,000 may be sufficient for a 0.5-lot position size.

⚠️ Disclaimer

This system is a technical, automated tool.

It does not constitute investment advice or a personalized recommendation.

Past performance is not indicative of future results.

Each user remains responsible for the risk parameters applied to their trading account.

Reviews

There are no reviews yet.