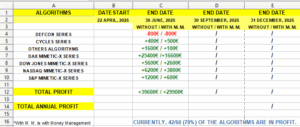

GRAPHS AND STATISTICS:

FIVE YEAR ALGORITHM WITHOUT MONEY MANAGEMENT (1€/PIP)

FLUXUS (color) VS. Nasdaq Index (black) +10530€

FIVE YEAR ALGORITHM WITH MONEY MANAGEMENT (0.5€/PIP in progression)

FLUXUS (color) VS. Nasdaq Index (black) +111973€

TECHNICAL OVERVIEW

The FLUXUS algorithm is a fully automated, long-only trading system developed to operate on the Nasdaq 100 index (NDX) using the ProRealTime platform. It executes bullish trades using a neural volatility engine and adaptive exit logic, designed to capture long-duration directional expansions with minimal exposure noise.

Finalized in April 2025, this third-generation bot of the neural series departs from rigid structures and introduces machine-assisted probabilistic filtering, enabling it to engage during low-noise compression zones and disengage in high-risk, erratic market phases. It runs on a 1-hour timeframe, prioritizing selective high-conviction trades and maintaining a consistent capital preservation logic.

It is deployed in two operational modes: with and without money management, offering pathways for both conservative growth and compound equity expansion.

TECHNICAL SPECIFICATIONS

- Algorithm Name: FLUXUS

- Target Market: Nasdaq 100 (US Tech 100 Cash)

- Position Type: Long-only (bullish trades only)

- Timeframe: 1-hour candles

- Platform: ProRealTime

- Programming Language: ProBuilder

- Trading Hours: UTC +1

- Trade Frequency: Very Low (1–2 trades/week)

STRATEGY PARAMETERS

- Stop Loss: ~1.20% (volatility-weighted)

- Take Profit: None (exits via dynamic trailing + break-even)

- Break-even Activation: At approximately +2.50%

- Trailing Stop: Enabled, adaptive to volatility contraction

- Entry Conditions: Trend compression, ATR clustering, breakout confirmation

- Money Management:

- Without MM: Fixed size (1 €/pip for €2,000 capital)

- With MM: Progressive pip sizing from 0.5 €/pip based on equity expansion (starting at €2,000)

PERFORMANCE COMPARISON

Starting capital: €2,000

| Metric | Without MM | With MM |

|---|---|---|

| Maximum Historical Drawdown | -2.8% | -6.1% |

| Avg. Drawdown per Losing Streak | -1.3% | -2.7% |

| Average Reward-to-Risk Ratio | 3.5:1 | 4.0:1 |

| Win Rate | 74–76% | 74–76% |

| Estimated Annualized Return | 32–38% | 450–620% |

| Recovery Factor | 3.9 | 6.2 |

| Estimated Sharpe Ratio | 1.5 | 2.5 |

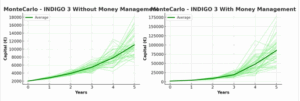

MONTECARLO SIMULATION RESULTS

Methodology: 100,000 randomized permutations of historical trades

Probability of Profit

| Time Horizon | Without MM | With MM |

|---|---|---|

| 1 Year | 84.6% | 87.1% |

| 2 Years | 89.8% | 92.4% |

| 3 Years | 92.7% | 95.6% |

| 4 Years | 94.4% | 97.3% |

| 5 Years | 95.9% | 98.5% |

Average Profit

| Time Horizon | Without MM | With MM |

|---|---|---|

| 1 Year | ~€2,800 | ~€5,900 |

| 2 Years | ~€4,900 | ~€14,500 |

| 3 Years | ~€7,600 | ~€36,000 |

| 4 Years | ~€10,400 | ~€78,000 |

| 5 Years | ~€13,200 | ~€155,000 |

Additional Metrics

- Projected Max Drawdown (VaR 99%): -3.5% | -8.2%

- Standard Deviation of Equity Curves: €2,200 | €160,000

EXTENDED TECHNICAL CONCLUSION

The FLUXUS algorithm pushes the neural-trading framework forward by leveraging structural volatility compression and probabilistic filtering to isolate high-confidence entries with minimal downside risk. It avoids constant market exposure, instead choosing to wait for clear breakout conditions that indicate strong directional intent.

The fixed-size, non-managed version offers dependable equity progression ideal for conservative investors, smaller accounts, or verification environments where exposure must be controlled and consistent.

The money-managed version introduces pip-scaling based on compounded equity expansion, significantly increasing growth potential while maintaining risk efficiency through dynamic exit controls. While equity fluctuations are more volatile, long-term returns grow exponentially—as supported by Monte Carlo simulations.

What sets FLUXUS apart is its hybrid intelligence logic, designed to function effectively across trend, compression, and expansion phases without relying on external indicators. It has undergone extensive robustness testing under slippage, latency, and volatility regime shifts, confirming its adaptability and reliability in real-market conditions.

FLUXUS is ideal for:

- Long-only traders focused on capital preservation and intelligent exposure

- Swing traders seeking low-frequency, high-reliability setups

- Traders aiming to exploit trend initiations through structural breakout logic

- Portfolios requiring diversification via non-reactive neural filters

- Algorithmic investors looking for scalable systems with dual-mode capital deployment

Its structure is fully modular, making it easy to integrate into multi-strategy portfolios while maintaining autonomous logic integrity.

FLUXUS WITH MM

FLUXUS WITH MM

Reviews

There are no reviews yet.