ALL TIME FRAME

///////////////////////////////////////////////////////////////////

SCROLLING BELOW YOU WILL FIND ALL THE LIVE SHOWN AND NOT ONLY AND EXCLUSIVELY BACKTEST OR EXCEL NUMBERS

////////////////////////////////////////////////////////////////////////

BELOW IN THE ATTACHMENT YOU WILL FIND ALL THE PERFORMANCES OF THE BOTS IN MY PORTFOLIO

/////////////////////////////////////////////////////////////////////

From January 1st to December 31th 2025

/////////////////////////////////////////////////////////////////////////////

Evolution of the trading system

ALL TIMES – All times, or the possibility of using the algorithm in different time intervals and different indices.

All time intervals, or the possibility of using the algorithm in different time intervals, can be used in 30 seconds or in 1-3-5-15 minutes…..1 hour or in the way one wishes based on the risk and the index used.

Yes also to the index used, because it is a universal algorithm that has excellent performances on the NASDAQ, DAX and DOW J.

This is possible because the Bot is totally configurable in a very simple way (perfect even for beginners).

You can decide whether to use it for Long and Short operations, or alternatively use only Long or only Short, you can decide to activate or deactivate money management based on what you want to obtain from the trading system (both weekly and daily), based on your risk you can decide whether to use it with a single operation per day, or with multiple operations…… above all you have 4 filters (they are proprietary indicators that I use in many of my trading systems), where you have the possibility of activating or deactivating them separately, this gives the possibility of using it with different time frames and with different indices.

Profit Management: the Trailing Stop based on the ATR was used, in this way it adapts easily and with excellent results there are variations in the volatility of the index

The results: all the results shown both in Backtest and LIVE are without “reinvestment of profits”

Capital Management:

the trading system includes capital management to keep the Max Drawdown under control, but as described above it can be deactivated.

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

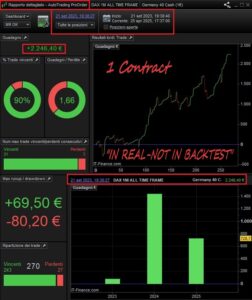

This algorithm was used on a “LIVE ACCOUNT”

ALL TIME FRAME

Algorithm details

Entry time: 1pm – 10pm

Stoploss for long trades: 1.30%

Stoploss for Short trades: 1.05%

Trailing stop: yes

Weekend: If the business is open, it will be closed strictly by 10pm on Friday

Free choice on the number of contracts to use

///////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

“ALL TIME FRAME”

Used for two years in LIVE with the NASADQ and with the DAX

Below you will find the Live performances of the NASDAQ with a 5-minute time frame and the DAX with a 1-minute time frame.

“LIVE ACCOUNT”

Nasdaq 5 Minutes

The algorithm was updated on July 28, 2023

The algorithm was updated on June 15, 2024

Dax 1 Minute

The algorithm was updated on September 21, 2023

////////////////////////////////////////////////////////////////

From May 2025, the algorithm is not changed at all, but its use in LIVE is changed.

THIS IS THE DEMONSTRATION THAT IT CAN BE USED IN AN ABSOLUTELY AUTONOMOUS WAY USING THE VARIABLES IN A VERY SIMPLE WAY.

Below you can see the new use of ALL TIME FRAME

“ BACKTEST – DAX 15M ”

The DAX with a 15-minute time frame can make both Long and Short transactions

Forward walk performed 70/30 without anchoring Annually

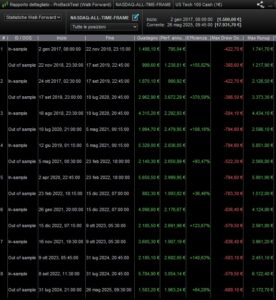

“ BACKTEST – NASDAQ 15M ”

NASDAQ with 15 minute time frame only for Long transactions, this allows you to take advantage of market increases and obtain profits when the indices are rising

Forward walk performed 70/30 without anchoring Annually

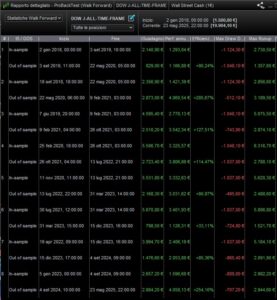

“ BACKTEST – DOW J. 1H ”

DOW J. with 1 hour time frame only for Short transactions, this allows you to take advantage of market crashes and obtain profits even when the indices are falling

Forward walk performed 70/30 without anchoring Annually

alorenzini1985 (verified owner) –

Second strategy bought from Mauro. Working perfectly with great money management and regular profits.

This strategy also allows you to diversify on different index if you want to.

What I suggest to any new user of automatic trading, give youself time.

The strategy might have some down phases but in the long term you will be profitable.

On top of that, Mauro is always responding in the short term with extremely clear explanations of what is going on.

If you want to minimize risks, just start with 2.000€ on the trading account and by entering on the market with 0,5 contracts (not one).

The price of the strategy it absolutely worth it and you can contact me if you need any proof of profitable trades, i’ll share them.

Alessandro

Christoffer Andersson (verified owner) –

I can’t stress this enough but this is a fantastic algo and it works just as I think an algo should work.

Great riskmanagement and the algo rakes in many “base hits” due to the trailing S/L and that adds up.

As for Mauro, great support, if you need him, he’ll be there for you.

Cheers.

dewitage (verified owner) –

Excellent algorithm, currently only used on the NASDAQ.

After three weeks of use it performs very well with all positive transactions closed and a good profit.

It can be configured in a simple and intuitive way by having seven variables that can be activated or deactivated based on the index and time frame used.

Risk controlled by having a tight stop loss.

The seller’s responsiveness to questions or doubts in configuring the algorithm was greatly appreciated.