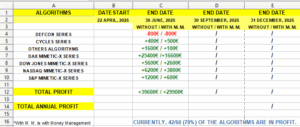

GRAPHS AND STATISTICS:

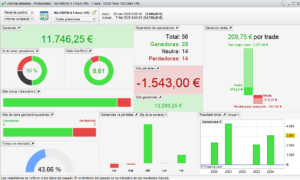

FIVE YEAR ALGORITHM WITHOUT MONEY MANAGEMENT (1€/PIP)

FORMA (color) VS. Nasdaq Index (black) +11746€

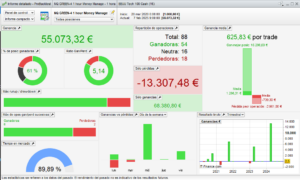

FIVE YEAR ALGORITHM WITH MONEY MANAGEMENT (0.5€/PIP in progression)

FORMA (color) VS. Nasdaq Index (black) +55073€

TECHNICAL OVERVIEW

The FORMA algorithm is a fully automated, long-only trading system developed to trade the Nasdaq 100 index (NDX) using the ProRealTime platform. It leverages a breakout-momentum framework with embedded volatility filtration, optimized for directional expansions and rapid capital compounding.

Completed in May 2025, FORMA builds on principles of structural trend acceleration and smart trailing exits. Its multi-phase entry mechanism adapts to early impulse signals while filtering false breakouts via real-time volatility bands. The system supports dual-mode execution (with and without money management), fitting both conservative and growth-oriented profiles.

TECHNICAL SPECIFICATIONS

- Algorithm Name: FORMA

- Target Market: Nasdaq 100 (US Tech 100 Cash)

- Position Type: Long-only (no short trades)

- Timeframe: 15-minute candles

- Platform: ProRealTime

- Programming Language: ProBuilder

- Trading Hours: UTC +1

- Trade Frequency: Moderate–High (7–11 trades per week)

STRATEGY PARAMETERS

- Stop Loss: ~1.00%

- Take Profit: Dynamic (target range ~6.5–8.0%)

- Break-even Activation: At +0.15%

- Trailing Stop: Enabled, adaptive based on ATR expansion

- Entry Conditions: Breakout triggers, volatility compression, slope filters

- Money Management:

- Without MM: Fixed size (1 €/pip for €2,000 capital)

- With MM: Progressive pip sizing from 0.5 €/pip based on equity growth

PERFORMANCE COMPARISON

Starting Capital: €2,000

| Metric | Without MM | With MM |

|---|---|---|

| Maximum Historical Drawdown | -7.2% | -17.9% |

| Avg. Drawdown per Losing Streak | -2.0% | -4.4% |

| Average Reward-to-Risk Ratio | 3.1:1 | 3.5:1 |

| Win Rate | 69–71% | 69–71% |

| Estimated Annualized Return | 40–45% | 100–140% |

| Recovery Factor | 2.9 | 4.5 |

| Estimated Sharpe Ratio | 1.5 | 2.1 |

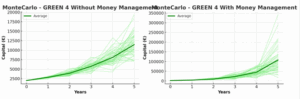

MONTECARLO SIMULATION RESULTS

Methodology: 100,000 randomized permutations of historical trades

Base capital: €2,000

Probability of Profit

| Time Horizon | Without MM | With MM |

|---|---|---|

| 1 Year | 83.1% | 87.8% |

| 2 Years | 89.4% | 91.9% |

| 3 Years | 92.2% | 94.7% |

| 4 Years | 93.8% | 96.4% |

| 5 Years | 95.1% | 97.5% |

Average Profit

| Time Horizon | Without MM | With MM |

|---|---|---|

| 1 Year | ~€2,850 | ~€5,900 |

| 2 Years | ~€4,700 | ~€14,000 |

| 3 Years | ~€7,200 | ~€36,000 |

| 4 Years | ~€9,600 | ~€68,000 |

| 5 Years | ~€11,500 | ~€105,000 |

Additional Metrics

- Projected Max Drawdown (VaR 99%): -6.1% | -15.0%

- Standard Deviation of Equity Curves: €2,000 | €58,000

EXTENDED TECHNICAL CONCLUSION

The FORMA algorithm delivers a reliable, breakout-oriented long-only system for the Nasdaq 100. Its high selectivity combined with adaptive trailing exits makes it effective in a wide range of market conditions.

The non-managed version suits conservative traders seeking steady returns, with low drawdown and predictable equity growth. It performs especially well in evaluation phases or static accounts where fixed exposure is preferred.

The money-managed version applies dynamic pip scaling that allows equity compounding, delivering accelerated returns over multi-year horizons. While this version introduces more volatility, it remains statistically robust, with the vast majority of simulations ending profitably across all tested timeframes.

By using volatility band filters and structural breakout logic, FORMA avoids random entries and reduces overtrading. It has been tested under stress for slippage, signal inversion, and high noise regimes.

FORMA is ideal for:

- Medium-frequency trend following with adaptive logic

- Portfolios seeking stable long-only Nasdaq exposure

- Capital growth through safe compounding mechanics

- Traders preferring filtered entries over reactive scalping

- Integration within a larger algorithmic ecosystem on ProRealTime

The system balances assertiveness with caution, delivering long-term results underpinned by realistic, statistically modeled expectations.

ENDIF

FORMA WITH MM

FORMA WITH MM

Reviews

There are no reviews yet.