PDF to configure the robot DH 15:

https://market.prorealcode.com/wp-content/uploads/2022/04/ReadMeDAX15_EN.pdf

https://market.prorealcode.com/wp-content/uploads/2022/04/ReadMeDAX15_FR.pdf

https://market.prorealcode.com/wp-content/uploads/2022/04/ReadMeDAX15_IT-2.pdf

https://market.prorealcode.com/wp-content/uploads/2022/04/ReadMeDAX15_DE-1.pdf

Performance: Normal Mode, 5% risk per trade (since we sell in MarketPlace):

|

Jan |

Feb |

Mar |

Apr |

May |

June |

July |

Aug |

Sept |

Oct |

Nov |

Dec |

Year |

|

6.66% |

17% | 18.46% | 20.20% | -28.74% | -11.91% | -1,9% | -2.15% | 39.95% | -12.97% |

5.41% |

20.22% |

2022 66.7% |

|

9.64% |

2023 9.3% |

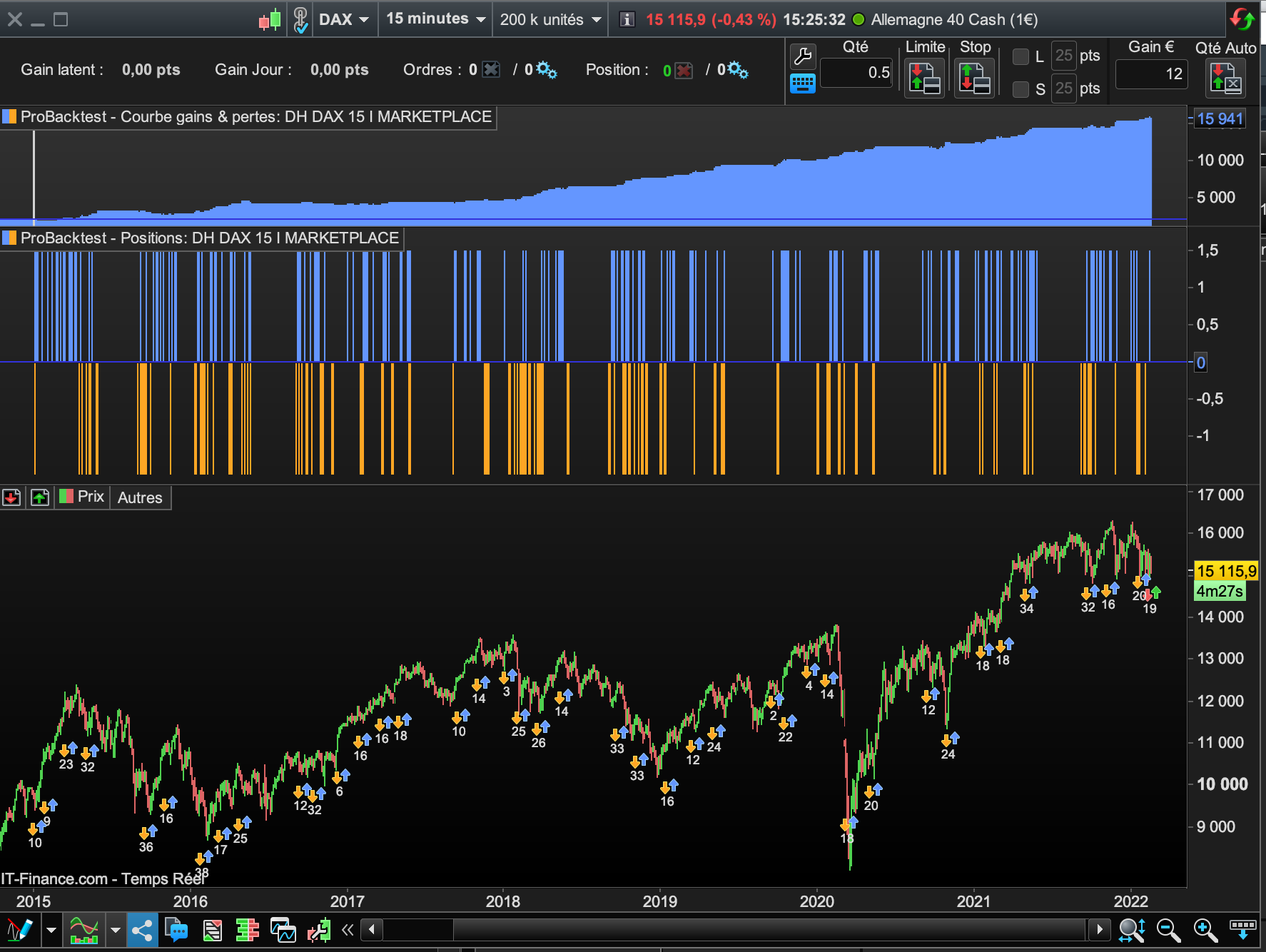

Timeframe: 15min

Take Profit: YES when position is opened and evolutive with market conditions

Stop Loss: YES when position is opened and evolutive with market conditions

Breakeven: YES for keeping your capital safe

Trailing Stop: YES against strong reversals

Risk per trade can be modified from 0% to 5% (2,5% as default)

Fixed Lots: YES from 0.5 contracts to 10 contracts

Reinvest Gains: YES reinvest proportion from 0% to 40%

3 MODES: NORMAL, REINVEST or FIXED LOTS

Version with trades full time (different from version I)

Used for my real account with IG Markets and exactly the same results as backtests

Adapted to capital less than 10 000€ (max 10 contracts with CFD “Allemagne 40 cash 1€”)

For capital superior to 10 000€ see my robot DH DAX 15 PRO

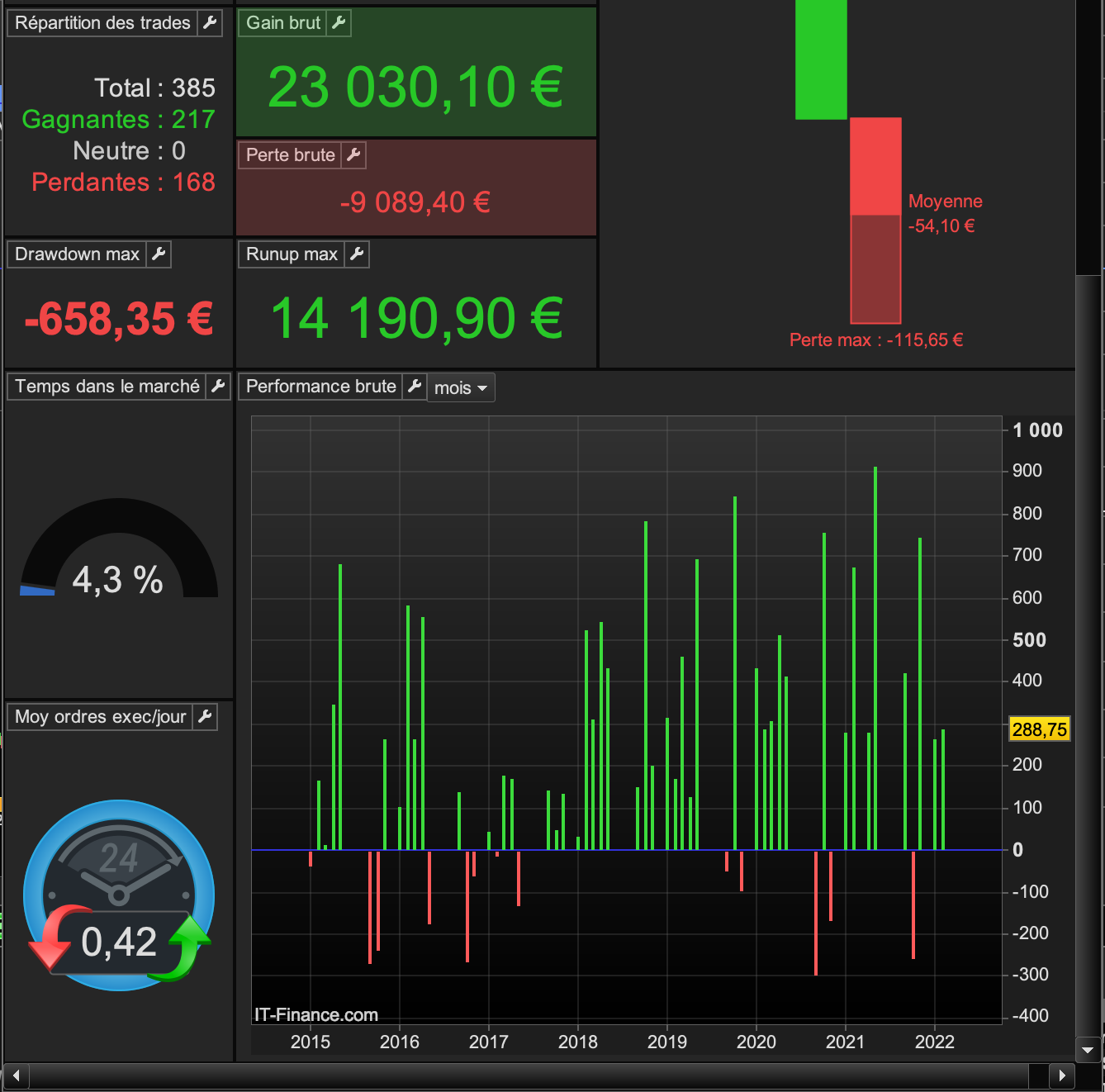

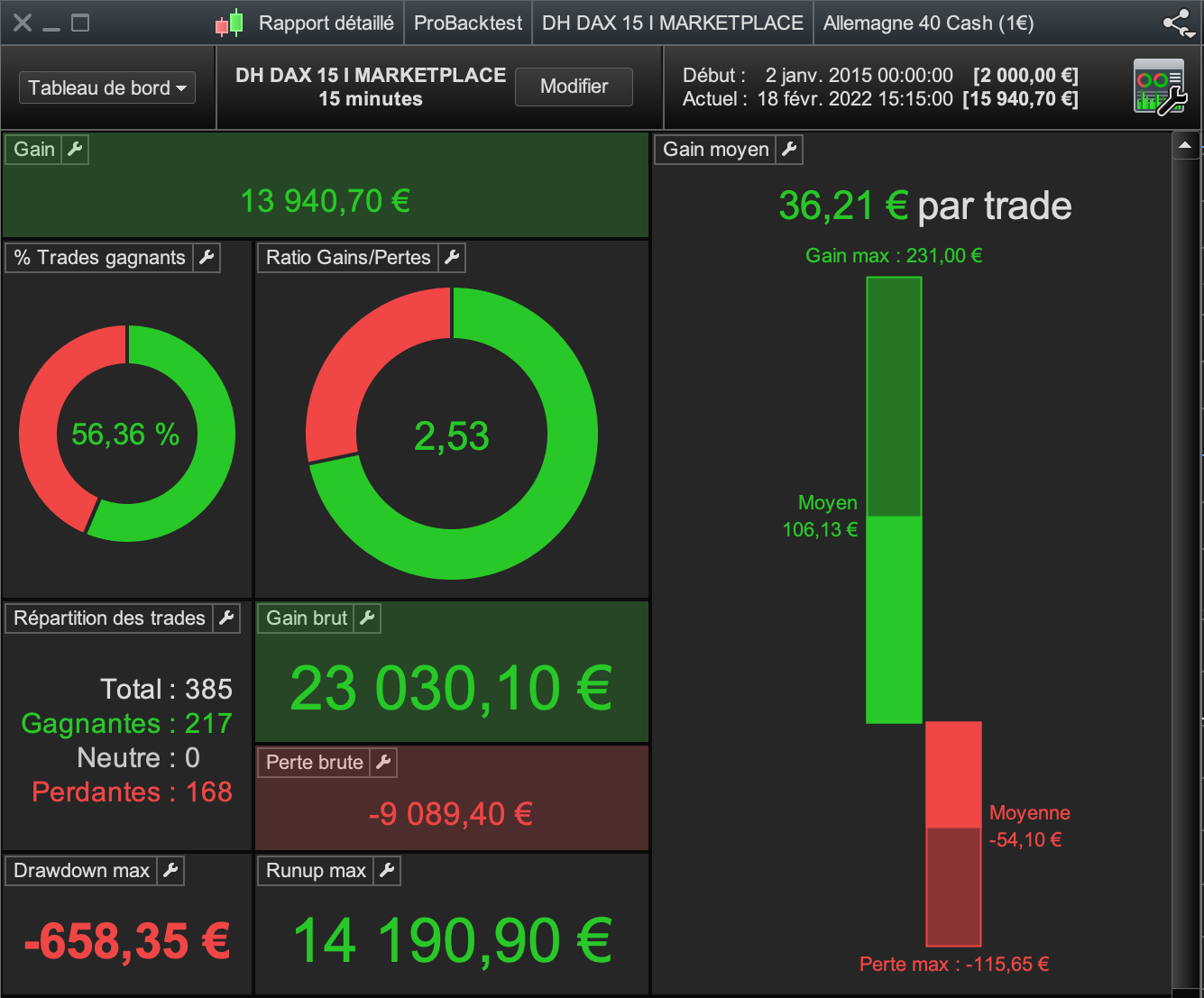

RESULTS:

Initial Capital: 2000€

Risk per Trades: 2.5%

Spread: 2.5 pts (very pessimistic situation)

Normal mode

Initial Capital: 2000€

Risk per Trades: 2.5%

Spread: 2.5 pts (very pessimistic situation)

Reinvest Mode

Reinvestment Proportion: 20%

Initial Capital: 2000€

Risk per Trades: 2.5%

Spread: 2.5 pts (very pessimistic situation)

Fixed Lots Mode

Fixed Lot: 1.5 contracts

jpfamin (verified owner) –

I run This algo since july, It was profitable until jan 2023, then huge drawdow : I lost 60% of the profit I made.

Jean Paul

pubpascal (verified owner) –

Results over 3 months are poor, especially in shorts. The robot seems to be optimized because past results are good, but those after the maj date are not. +7.74 in April, -17.2% in May, -6.1% in June, -1.3% in July … not counting the 40th/month and a drawdown of -25% over these 3 months and 1/2.